PH Investigates: black box insurance

'The price of freedom' says one provider of telematics insurance - one we're willing to pay though?

Autosaint, a provider of telematics insurance, boasts somewhat ominously on its homepage that this is 'the price of freedom' and for many younger drivers this may well be the reality. But before those of us with years of no-claims and affordable cover on whatever car we fancy get too smug, we need to consider how long it'll be before such policies become more widespread.

Telematics insurance was launched into the mainstream in 2006 by Aviva, again aimed at lowering costs for younger drivers by offering a PAYD (Pay As You Drive) scheme based on how much and when you drove. But it didn't last long. "Lower than expected take up, high technology costs and a market with much cheaper premiums than today significantly weakened the commercial viability of the previous product," an Aviva spokesperson told us. "The PAYD product allowed us to really understand driving behaviour and identify very accurately the risk profiling at an individual customer level. In addition we also learned why the product was not appealing to the 'mass market'."

Aviva has learned from the experience and is now looking at launching a more limited app-based policy that records your driving for a fixed period, from which your premium is then calculated. "Technology has developed significantly since then," said our spokesperson, "as well as consumer awareness and acceptance of usage based insurance offerings."

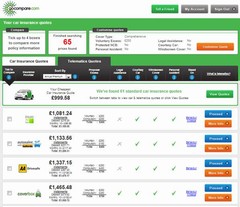

This app-based system is clearly less intrusive and takes some of the sting out of the Big Brother concerns many have about telematics insurance. But this hasn't stopped others. Go Compare is now putting its weight behind telematics insurance, including eight providers in a new telematics-specific comparison screen that lets you weigh up prices against 'regular' policies. Go Compare's head of motor services Scott Kelly says nearly a third of drivers are currently unaware of telematics insurance and the potential savings, but reckons a fifth could switch to such policies in the next five years.

"The tipping point, where telematics policies gain real mass market appeal, is yet to come," he says. "But as the technology matures and becomes more readily available and as understanding grows, telematics-based policies could prove to be one of the most important developments in the car insurance industry."

Our story on the C1's black box offering attracted over 300 comments, many with serious concerns about the system's ability to 'mark' your driving and penalise you on future premiums on the basis of harsh acceleration, cornering or braking; the latter, in particular, a cause of much concern among PHers. Does that mean, for instance, if you brake suddenly when a child runs out from behind a parked car you'll be penalised for 'bad' driving?

"Everyone has incidents where they have to brake sharply," a spokesperson for Citroen told us. "The scoring mechanism is looking at how often you do this per thousand miles of driving as compared to other drivers so no one incident of this type is going to be that influential."

And what if someone else - parent, sibling, mechanic on a 'test drive' or similar - rags your car without your knowledge? "The Safety Score is calculated over a two-week period where the driver has driven more than 150 miles," we were told. "These isolated incidents are unlikely to have a big impact on the Safety Score as they will be diluted by the other miles the policy holder(s) complete. In any event, the vehicle owner should make any technician/garage aware of the black box in the car which would act as a deterrent." Your black box, your problem in other words. The full Q&A makes for interesting - and occasionally scary - reading too, especially given reports of data upload errors from some early adopters. See here for the full transcript.

Citroen's offer is, of course, opt-in and, for some perhaps, that necessary evil if it means affordable insurance. But what if you want to retrofit a black box to your car? Companies like Autosaint, a subsidiary of Fresh! Insurance, offer just that. Given that these companies are amassing a huge amount of data about you and your driving habits you'd like to think they're accountable, right?

Well, we tried phoning them to find out. First time we nearly got sold a policy. Second time the receptionist wouldn't put us through to anyone, eventually giving us an email address to an office manager who turned out to be on holiday. And on the third attempt we got put through to a very confused lady working in HR. And we're asked to trust these firms with huge amounts of personal data about our every journey? Testimonials on their website predictably paint a rosier picture, not least from someone by the name of 'Ian Skidmore'. With a name like that, who can blame him for trying anything to reduce his premium...

Many on the original thread commented 'thin end of the wedge', and the fact Go Compare's Scott Kelly sees huge potential for older 'Sunday drivers' who don't travel during busy peak periods or late at night to make big savings indicates that it's not just aimed at young drivers. And, therefore, likely to become ever-more prevalent in your future insurance ring-around. You have been warned.

One issue is that, although it may save some drivers money, it will obviously cost others more. It has to, to maintain the insurance company's average income from policies. At the momentit is voluntary, which means you get a heavy weighting towards drivers who choose it to reduce their premiums, but this model won't work unless most drivers are forced onto the scheme.

Besides, I am shopping for insurance at the moment, the telematics quotes are so much more expensive than the rest it was comical!

Give it a few years and insurance even with these black boxes will sky rocket due to "data received and analysed".

Its Big brother helping the nanny state. Not for me. Not ever (well as long as i have a say in it).

It will move from voluntary to compulsory and then once the police get hold of the data, using the safety card again, it really will be a case of Big Brother watching.

It won't happen today or tomorrow but it's coming.

Sincerely hope I'm wrong about this!

But the alternative of black box free insurance will still be available as long as there is demand - that's the beauty of market economics. I can see it costing a hell of a lot more though as the 'low risk' drivers will all be on monitored insurance.

The question I would like to be answered though is whether slower actually means safer. Old men in hats will perform superbly when judged by a satellite, never breaking speed limits or pushing their cars on country roads. Are they really safer in the real world though?

Ps. I did 150 miles at Brands Hatch a few weeks ago; I wonder what the box would make of that????

some 2nd cars do most of their summer mileage on track. So, whereas i'm chilled (low risk) travelling to/from track, maybe over 50% of miles would be 'aggressive'. Maybe GPS would see tracks as private land?

The idea that a myopic monospeeding moron with the awareness and skill of fresh road kill could possibly be safer than a smooth, fast and alert driver is fundamentally flawed and frankly offensive.

Let's face it, this is not about rewarding safe drivers and penalising unsafe drivers. This is about lowering peoples peak speeds. Scare the masses into driving slower and as a result, insurance payouts are likely to decrease.

It's probably worthwhile ofr the Ins. Co.s to offer discounted policies to the early adopters, but anyone who can't see that this will be a short term effect is a myopic moron.

Oh.

i find small, slow cars that are mostly driven by older people are the biggest pain on our roads. they're always doing well under the speed limit, pulling slowly out of junctions, not getting up to speed when joining dual carriage ways, not using indicators etc.

driving past farnborough airport last night at 6pm there was a small (blue?) car in the dark doing 25mph in a 40 with NO lights on. he had loads of cars behind him unable to pass on the single carriageway, but i expect he pays bugger all insurance...

Gassing Station | General Gassing | Top of Page | What's New | My Stuff