Inheritance - investing for income

Discussion

xeny said:

Personally I'd stick it in a global equity tracker, and sell ~30K worth each year.

Think of investing for return, and then make your income from that.

If professionals can have a 'mare with property, I'm stuffed if I'm going to try and do it on my own.

You wouldn't need to sell that much each year. Dividend yield on e.g. VWRL is 1.5-2%.Think of investing for return, and then make your income from that.

If professionals can have a 'mare with property, I'm stuffed if I'm going to try and do it on my own.

Greenmantle said:

stick it all in guilts

choose coupon rate to suit your annual income

choose the maturity

leave it till maturity

anything from 1 to 30 years.

may not be inflation busting but safe with a decent annual income.

Gilts may be safe but they can be massively volatile and you're liable for tax on the coupon.choose coupon rate to suit your annual income

choose the maturity

leave it till maturity

anything from 1 to 30 years.

may not be inflation busting but safe with a decent annual income.

Depending what it is you can see your capital value crater temporarily.

Being given £1M and not knowing what to do with there's a really strong argument for getting proper advice.

Just be careful as if you "only" need £20-30K in income you could end up paying half that in fees with the traditional percentage of assets under management model.

Countdown said:

Thanks all

To narrow it down further can she get anything like an annuity at the age of 44? or maybe a long--dated bond?

ETA I might be overthinking this. I've just stuck the figures into an excel sheet and assuming a 2% yield and 3% inflation she will be able to draw down £24k per annum for about 35 years. She has a pension income on top of this so it should be OK.

Yes, it's kinda pointless doing anything bonkers if she doesn't need to and all she's doing is generating a hefty IHT bill for her beneficiaries when she croaks. Someone should take a look at her overall financial situation, what she wants to achieve (ie retire at 50 with a chunky annual income etc) and then she can get some advice.To narrow it down further can she get anything like an annuity at the age of 44? or maybe a long--dated bond?

ETA I might be overthinking this. I've just stuck the figures into an excel sheet and assuming a 2% yield and 3% inflation she will be able to draw down £24k per annum for about 35 years. She has a pension income on top of this so it should be OK.

If she doesn't have a clue (and clearly doesn't) then get her to speak with an IFA or an accountant.

For that sort of sum even the hard core experts on MSE would advise the same.

https://forums.moneysavingexpert.com/categories/sa...

For that sort of sum even the hard core experts on MSE would advise the same.

https://forums.moneysavingexpert.com/categories/sa...

Phooey said:

Yeah, an IFA would love to help a clueless lass with a million quid

An accountant might not be a bad idea though

See the post above yours ref an IFA.

An accountant might not be a bad idea though

The good thing is nowadays you can literally see live online anything either they or an accountant choose to invest in based on your risk category.

My father in law had an IFA / Accountant combo - local firm, all investments visible through Quilter and Charles Stanley online.

Edited by DT1975 on Friday 3rd May 22:21

b hstewie said:

hstewie said:

hstewie said:

hstewie said: £1M is a life changing sum.

If I was your friend I'd be giving a lot of thought to risk/reward as generally there is no such thing as reward without taking some risk.

Right now you could park the lot in NS&I and it will be completely safe and you'll get 3% with absolutely zero risk.

But it isn't inflation linked.

The most traditional route is stocks and shares where there's a whole spectrum of risk/reward but your friend has to accept that to make anything other than a "savings" interest rate she will have to take some risk.

Ask you friend to imagine a scenario where she's invested the £1M and in six months time she goes to look at what it's worth.

What would she be comfortable seeing and what would make her absolutely freak out?

Personal view is don't listen to anything about property or products where if you decide you want a new car you can't quickly and easily get your hands on the money to do it.

Sorry Stewie, I usually agree with most things you write, but I disagree with some of the things you say here.If I was your friend I'd be giving a lot of thought to risk/reward as generally there is no such thing as reward without taking some risk.

Right now you could park the lot in NS&I and it will be completely safe and you'll get 3% with absolutely zero risk.

But it isn't inflation linked.

The most traditional route is stocks and shares where there's a whole spectrum of risk/reward but your friend has to accept that to make anything other than a "savings" interest rate she will have to take some risk.

Ask you friend to imagine a scenario where she's invested the £1M and in six months time she goes to look at what it's worth.

What would she be comfortable seeing and what would make her absolutely freak out?

Personal view is don't listen to anything about property or products where if you decide you want a new car you can't quickly and easily get your hands on the money to do it.

£1m is absolutely not a life changing sum if you don't treat it with extreme prudence. Getting your hands on it 'quickly and easily' whenever you feel like it is probably the worst thing you can let someone do. Plenty of people have won £1m on the lottery and been skint again in a few years by treating themselves to a few nice cars, holidays, and maybe moving house. £1m doesn't even buy you a decent detached house in many parts of the country.

At least if you put it into property then the most damage you can do is blowing the £50k or so you'll get each year as an income, and you'll always have the asset sat there appreciating as well. £50k a year, rising generally with inflation, would be more than enough for most people to add a bit of extra fun to their lives, or just retire on if they were reasonably careful.

Dg504 said:

Wacky Racer said:

£1M is three weeks wages to a top premiership footballer in their early twenties.

I wonder what they do with it?

Well the best part of 50% goes in tax/NI and then what’s left I’d bet goes on their chintzy house, car(s) and lifestyle(s)…I wonder what they do with it?

R.

If you go globally diversified equities or gilts, IFAs will love to advise.

They will ask for about 1-1.5% of assets under management to look clever by putting your money in actively managed funds that will probably take another 1% management fee, from which they’ll also get a kickback. Ie 2-2.5% of your return every year is taken by fees.

If you just put the funds in VWRL or similar you’ll be paying around 0.2% fees with a typical return of say, 6-8% averaged over a 5 year period (equities need to be thought of over a 5 year period as it removes any near term price fluctuations).

IFA advised funds tend to do no different/better than simple global trackers and often chase a bit more risk to try and beat the global tracker return and pay off the ifa and manager. 2% drain on 6% income is 1/3 of your money every year lost in fees / it’s HUGE.

That said, IM are definitely worth a call as they aren’t lazy idiots like most IFAs I’ve heard about. They seem to offer balanced advice vs just trying to get as many assets under management as possible to enrich themselves. But a lot of people advise keeping things simple, global equities low fee, and leave it to cook.

They will ask for about 1-1.5% of assets under management to look clever by putting your money in actively managed funds that will probably take another 1% management fee, from which they’ll also get a kickback. Ie 2-2.5% of your return every year is taken by fees.

If you just put the funds in VWRL or similar you’ll be paying around 0.2% fees with a typical return of say, 6-8% averaged over a 5 year period (equities need to be thought of over a 5 year period as it removes any near term price fluctuations).

IFA advised funds tend to do no different/better than simple global trackers and often chase a bit more risk to try and beat the global tracker return and pay off the ifa and manager. 2% drain on 6% income is 1/3 of your money every year lost in fees / it’s HUGE.

That said, IM are definitely worth a call as they aren’t lazy idiots like most IFAs I’ve heard about. They seem to offer balanced advice vs just trying to get as many assets under management as possible to enrich themselves. But a lot of people advise keeping things simple, global equities low fee, and leave it to cook.

Does anyone have the numbers for last 5yrs in VWRL or whatever, vs GBP and GBP inflation?

I assume it’s pretty much dividend as income and growth covering inflation?

In any case it’s a fairly solid safe bet IF you can optimise it with tax wrapper allowances over time as it shelters from CGT etc.

My issue with property is CGT and income will always be fully exposed to tax.

And CGT could be near 30% of gains… so if you buy at £100k and wait 20yrs inflation might be say £180k at 3%, but they’ll charge you 30% of that ‘gain’ as a capital gain with no way to avoid it.

Even in a trust it’ll be at least 20% currently aiui.

In 20yrs with VWRL you can get £400k into ISA wrappers. Or near half. There is CGT but only at 20pc… and you can sell up a bit at a time (increasingly almost zero as CGT allowance drops to zero, who knows how long that’ll last?) to optimise things.

Property seems great on the surface but wrapping it up back to liquid at the end is never seemingly accounted for but really does eat into the apparently decent income/yield/asset growth.

I assume it’s pretty much dividend as income and growth covering inflation?

In any case it’s a fairly solid safe bet IF you can optimise it with tax wrapper allowances over time as it shelters from CGT etc.

My issue with property is CGT and income will always be fully exposed to tax.

And CGT could be near 30% of gains… so if you buy at £100k and wait 20yrs inflation might be say £180k at 3%, but they’ll charge you 30% of that ‘gain’ as a capital gain with no way to avoid it.

Even in a trust it’ll be at least 20% currently aiui.

In 20yrs with VWRL you can get £400k into ISA wrappers. Or near half. There is CGT but only at 20pc… and you can sell up a bit at a time (increasingly almost zero as CGT allowance drops to zero, who knows how long that’ll last?) to optimise things.

Property seems great on the surface but wrapping it up back to liquid at the end is never seemingly accounted for but really does eat into the apparently decent income/yield/asset growth.

Edited by Mr Whippy on Saturday 4th May 09:01

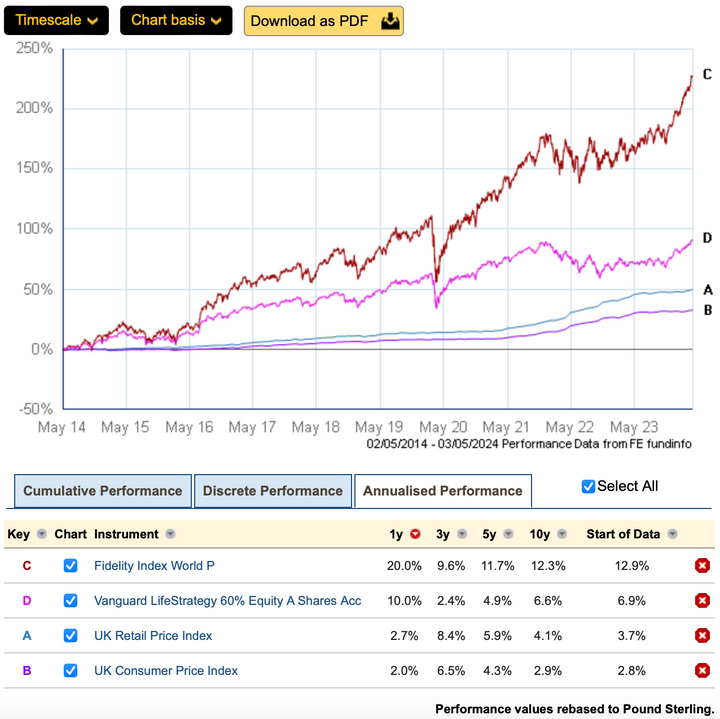

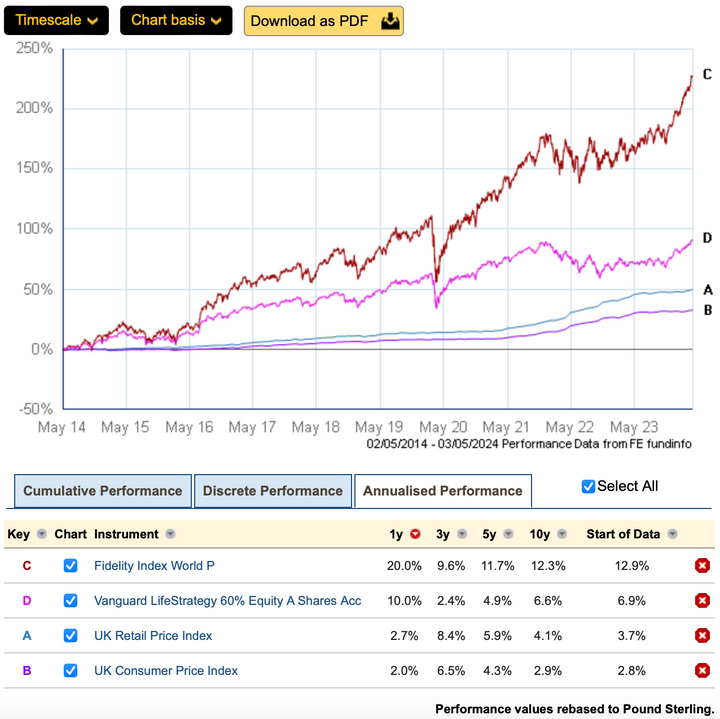

This is ten years.

Remember what look like reasonably small little dips on a graph can be seeing your million quid go down to £600K.

I don't know many people who are fine with that if all they've been used to is cash savings.

LifeStrategy 60 included as a slightly more realistic benchmark for where I expect most peoples appetite for risk to be.

Remember what look like reasonably small little dips on a graph can be seeing your million quid go down to £600K.

I don't know many people who are fine with that if all they've been used to is cash savings.

LifeStrategy 60 included as a slightly more realistic benchmark for where I expect most peoples appetite for risk to be.

The Leaper said:

Dg504 said:

Wacky Racer said:

£1M is three weeks wages to a top premiership footballer in their early twenties.

I wonder what they do with it?

Well the best part of 50% goes in tax/NI and then what’s left I’d bet goes on their chintzy house, car(s) and lifestyle(s)…I wonder what they do with it?

R.

The rules regarding pensions are different for footballers, as they often retire around 35, so the PFA pension scheme is able to take far more than a normal mere mortal, about 35% contribution I think, before tax. The rest is taxable just like the rest of us. Car sponsorship deals are done on an individual basis so all bets are off in guessing a hard and fast rule for those.

Sometimes the club have a car sponsorship deal, which gives cars to all first teamers, but only senior players tend to get the good models. I know Man U had a deal with Cheverolet but you had to be over 35 to get a Corvette. Ryan Giggs had one.

b hstewie said:

hstewie said:

hstewie said:

hstewie said: This is ten years.

Remember what look like reasonably small little dips on a graph can be seeing your million quid go down to £600K.

I don't know many people who are fine with that if all they've been used to is cash savings.

LifeStrategy 60 included as a slightly more realistic benchmark for where I expect most peoples appetite for risk to be.

Where is inflation?Remember what look like reasonably small little dips on a graph can be seeing your million quid go down to £600K.

I don't know many people who are fine with that if all they've been used to is cash savings.

LifeStrategy 60 included as a slightly more realistic benchmark for where I expect most peoples appetite for risk to be.

And how can it start at 0%?

I get 5yrs is the 100% point but then 5yrs earlier it was worthless?

Hideous presentation of info (not blaming you)

All you want to see is % return after inflation on capital appreciation, and then another with dividend income?

Gassing Station | Finance | Top of Page | What's New | My Stuff