How far will house prices fall [volume 4]

Discussion

skwdenyer said:

The median household net income in the UK is considerably greater than the median household take-home salary.

If we think about that for a moment, we have drifted to a position where the "normal" situation is for a family to be receiving some form of benefits (over and above a little child benefit, say). Not a safety net. Normality.

Can you link to some detail for those figures - I wonder if it's skewed by a lot pensioners?If we think about that for a moment, we have drifted to a position where the "normal" situation is for a family to be receiving some form of benefits (over and above a little child benefit, say). Not a safety net. Normality.

Jobbo said:

edh said:

It's very difficult to increase the supply of land

Housebuilders have an understandable need to maximise profit per plot and to restrict the supply of new houses in order to do this.

UK house prices took off about the time mortgage lending was de-restricted - correlation or causation?

It would be very easy to increase the supply of land - relax the planning system.Housebuilders have an understandable need to maximise profit per plot and to restrict the supply of new houses in order to do this.

UK house prices took off about the time mortgage lending was de-restricted - correlation or causation?

SKWD, your house price/income graph starts in 1995 which was close to the bottom of the slump. A friend of mine bought a 2-bed flat in Balham for £65k not long after (1997ish, IIRC). If you extend the graph backwards I think the overall trend would be far less clearly upward, but that’s just supposition unless we see the graph over a longer term.

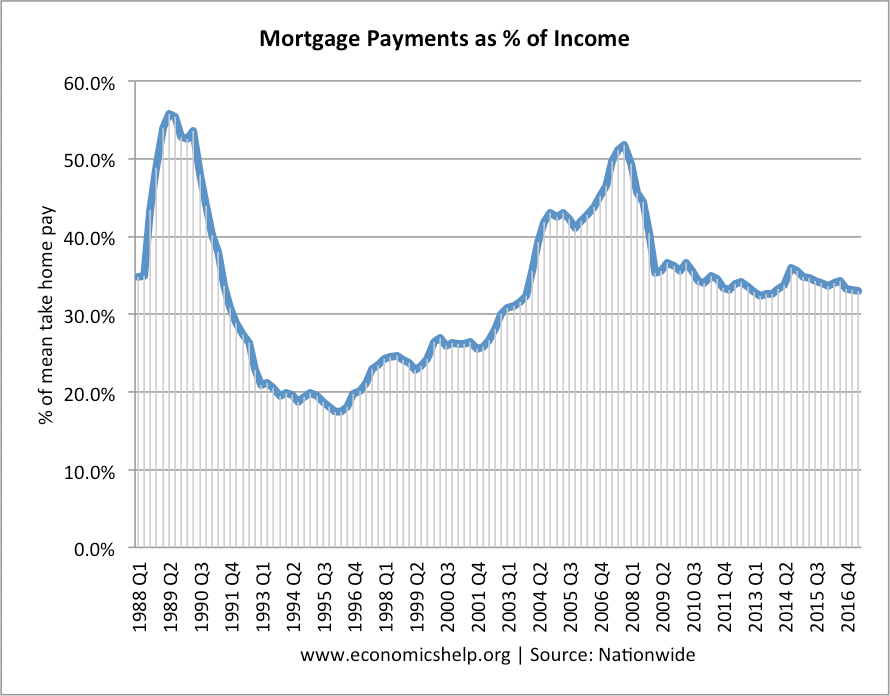

I didn't put up a graph of house prices vs incomes. I put up a graph of mortgage payments as % of take home pay for first-time buyers. Not quite the same thing. I will see if I can find data going further back.

But I don't believe the past is the best guide. We have made many changes to the "market" since pre-95. However, since you asked, here are some quick additional points:

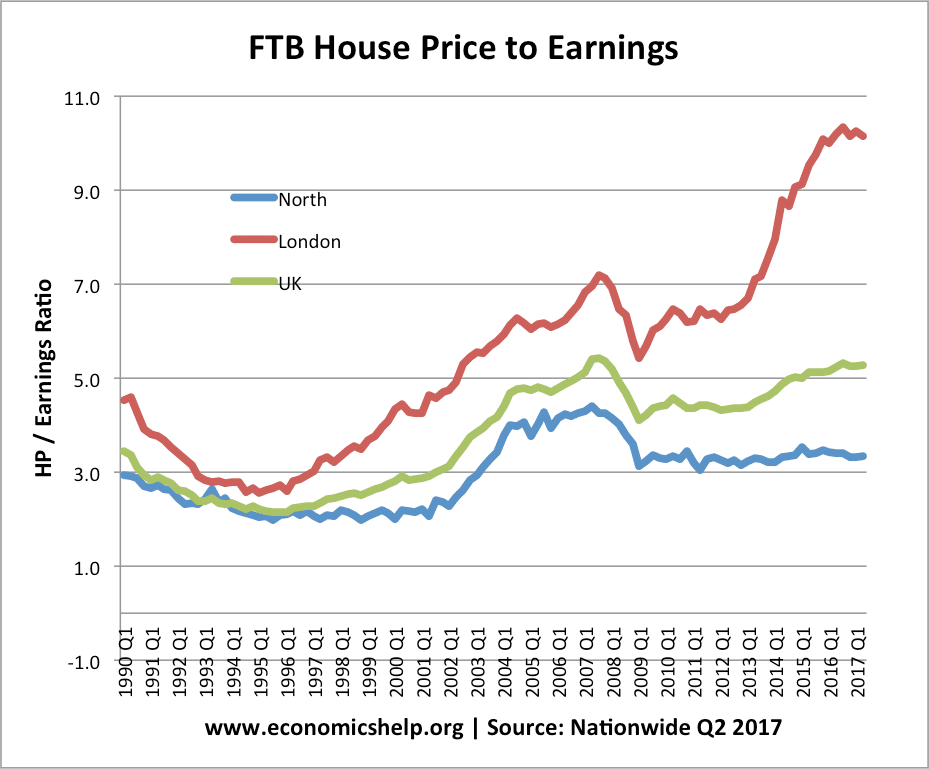

The graph you thought I'd put up (FTB house price to earnings, but of course skewed by LTV ratio changes etc.):

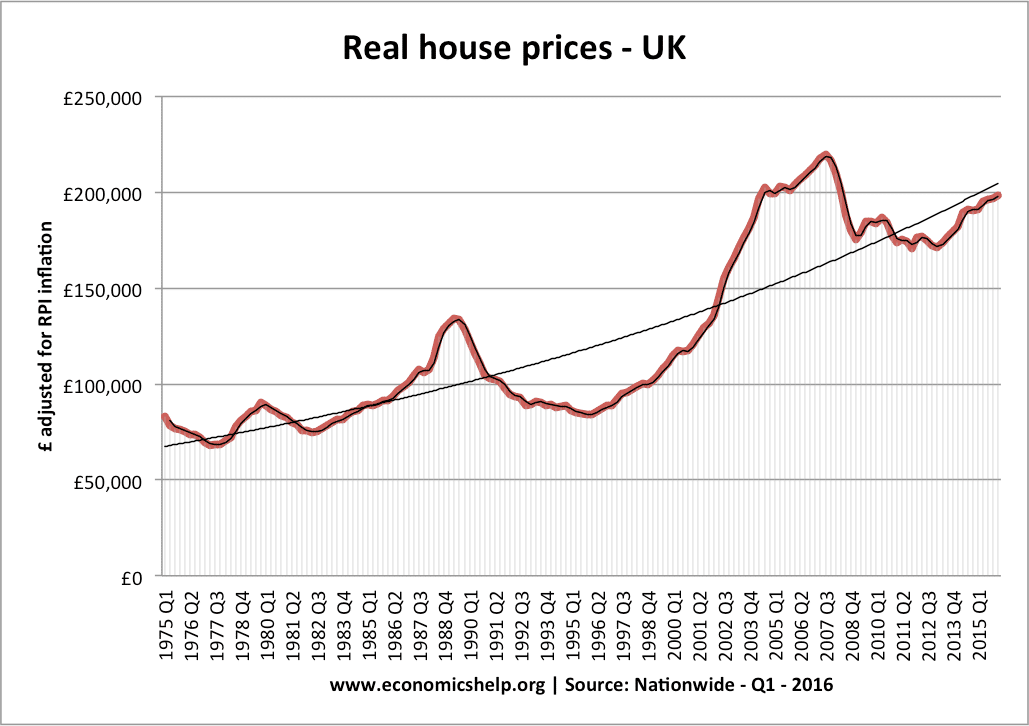

This one is inflation-adjusted, showing a near-tripling of the real-terms cost of a house:

An extension of the previous graph:

Feel free to correlate the 2 graphs above to show a slump in house prices each time mortgage payments reached a peak.

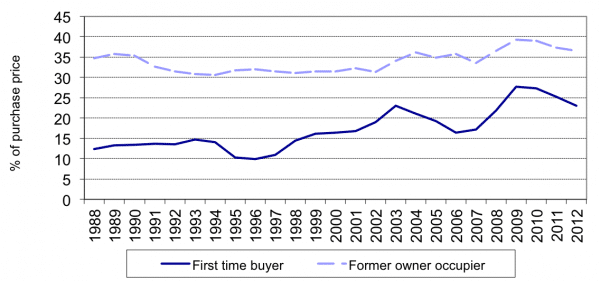

A look at deposits is also interesting:

I have to do some work

Later on, I'll see if I can run the raw data and extend some of these up to the present day.

Later on, I'll see if I can run the raw data and extend some of these up to the present day.There isn't a clear "go/no go" trend in all of this. The market doesn't operate that way. Since 2008, we've introduced very stringent new constraints on mortgages, which have clearly had an impact. Every few years there is some "fiddling" in the "market" by government. I don't believe it is possible to strip all of those things out with ease, nor is it possible to predict what politicians will do next.

The deposit curve is possibly the most startling, however, and graphically illustrates the problems at the bottom of the market.

skwdenyer said:

[

This one is inflation-adjusted, showing a near-tripling of the real-terms cost of a house:

A typical 2018 house is of a significantly higher standard than a typical 1975 house- better electrics, plumbing, insulation, fixtures, etc. I put it to you that a basic house now is significantly better than an above-average house back then.This one is inflation-adjusted, showing a near-tripling of the real-terms cost of a house:

It's not unrealistic for it to be more expensive based on this; if people want higher standards they must be willing/able to pay for them.

Do you have a graph adjusted to reflect a like-for-like comparison?

skwdenyer said:

I didn't put up a graph of house prices vs incomes. I put up a graph of mortgage payments as % of take home pay for first-time buyers. Not quite the same thing. I will see if I can find data going further back.

[...]

The graph you thought I'd put up (FTB house price to earnings, but of course skewed by LTV ratio changes etc.)

I have too much work on to read your post just yet, but to be clear I was typing on my phone and couldn't get back to see the precise graph you posted (and I did acknowledge its content when I read it, but this forum software doesn't allow you to look back at the thread when replying, unhelpfully). It was the date range I was commenting on.[...]

The graph you thought I'd put up (FTB house price to earnings, but of course skewed by LTV ratio changes etc.)

Rovinghawk said:

NickCQ said:

it's about making the wealth distribution more equal,

I paid tax on my earned income to invest.I paid tax on the materials & tools I bought to use.

I paid tax when buying the properties (SDLT).

I pay tax on the rental income- not only on the profit but on the turnover.

I pay tax on any CG when I sell the properties.

I'd say that society has had a decent share already.

I'd suggest that certain parts of this society go out & earn some wealth rather than have some of mine distributed to them. If that makes me a bad person IYO then so be it.

I've grabbed the Nationwide data which fed into the first time buyer mortgage payments as percentage of mean take home pay and extended the graph back to the start of the data (1983). 1995 was indeed the lowest point. Clearly the late 80s were silly but the current (post 2008) percentage has stayed fairly consistent. However, the chart may well remain steady due to people buying later in life.

Jobbo said:

I've grabbed the Nationwide data which fed into the first time buyer mortgage payments as percentage of mean take home pay and extended the graph back to the start of the data (1983). 1995 was indeed the lowest point. Clearly the late 80s were silly but the current (post 2008) percentage has stayed fairly consistent. However, the chart may well remain steady due to people buying later in life.

Jobbo said:

I've grabbed the Nationwide data which fed into the first time buyer mortgage payments as percentage of mean take home pay and extended the graph back to the start of the data (1983). 1995 was indeed the lowest point. Clearly the late 80s were silly but the current (post 2008) percentage has stayed fairly consistent. However, the chart may well remain steady due to people buying later in life.

These graphs are a few years old now, and I suspect the deposit/LTV would be higher now than it would have been in 2014 (although a number of the mid to prime areas of London have now dropped back to 2014 values.)

Found a 2017 graph house price/income ratio graph.

Edited by V6Alfisti on Wednesday 9th May 10:38

oyster said:

Given the vast majority of unearned wealth from property is tied up in principal private residencies, your reply is merely scratching the surface.

If that is the case, what's your opinion for a deeper analysis?Leaving aside the anomaly that is London, should prices stagnate or reduce? Will they do so naturally or should it be forced? What are the unintended consequences of either natural or forced price reductions?

Should London be treated the same or as a special case?

Who benefits, who loses and why should one side lose for the other's gain?

ben5575 said:

edh said:

Housebuilders have an understandable need to maximise profit per plot and to restrict the supply of new houses in order to do this.

That's a common misunderstanding of the market. Housing is governed by sales rates, not build rates (which does rather fly in the face of the simplistic black/white, supply/demand view). Trust me (I'm a property developer  ), I would rather make 20% on 100 houses sold in a month and move on to my next 100, than squeeze 22% from 100 over 2.5 years.

), I would rather make 20% on 100 houses sold in a month and move on to my next 100, than squeeze 22% from 100 over 2.5 years. Other constraints on supply like labour and materials mean we are not going to see massive increases in new build unless we radically change our building methods.

Land is too expensive. That's at the heart of it.

edh said:

Almost anything will sell in a flash at the right price... You can restrict supply by your pricing, which affects sales rates. (Btw a drop of 2% gross margin ain't really going to cut it...).

As it's his business he probably knows this already.edh said:

Other constraints on supply like labour and materials mean we are not going to see massive increases in new build unless we radically change our building methods.

And what radical changes do you propose? Bear in mind that the reason methods have become traditional is that they've been found to work. Some of the scariest words to come from construction management are "I've had a really good idea- we're going to do this in an unconventional manner".edh said:

Land is too expensive. That's at the heart of it.

Land is too expensive in the area that you & every other bugger want to develop it. A possible solution is to develop somewhere else. Too much emphasis is on one tiny little section of the country. Electric light now exists north of the Watford Gap and God still exists west of Reading.Rovinghawk said:

edh said:

Almost anything will sell in a flash at the right price... You can restrict supply by your pricing, which affects sales rates. (Btw a drop of 2% gross margin ain't really going to cut it...).

As it's his business he probably knows this already.Rovinghawk said:

edh said:

Other constraints on supply like labour and materials mean we are not going to see massive increases in new build unless we radically change our building methods.

And what radical changes do you propose? Bear in mind that the reason methods have become traditional is that they've been found to work. Some of the scariest words to come from construction management are "I've had a really good idea- we're going to do this in an unconventional manner".Rovinghawk said:

edh said:

Land is too expensive. That's at the heart of it.

Land is too expensive in the area that you & every other bugger want to develop it. A possible solution is to develop somewhere else. Too much emphasis is on one tiny little section of the country. Electric light now exists north of the Watford Gap and God still exists west of Reading.LVT doesn't tax people for improving their land, unlike business rates, so stimulates business and the local economy in poorer areas.

LVT also promotes optimal use of existing housing stock and land (gets v expensive to hold vacant lots in city centres), reducing the need for new build.

Timmy40 said:

edh said:

Land is too expensive. That's at the heart of it.

Which comes back to our planning laws. Interesting that Tories are buying into the idea of capturing planning gain though... That could make land cheaper.

edh said:

I don't. I abhor the focus on London. LVT will help rebalance as it makes land in less "desirable" areas cheaper, free even.

LVT doesn't tax people for improving their land, unlike business rates, so stimulates business and the local economy in poorer areas.

LVT also promotes optimal use of existing housing stock and land (gets v expensive to hold vacant lots in city centres), reducing the need for new build.

Surely LVT would tax people for improving their land, since the value of the land goes up (compare the land value of agricultural land with the same land which has received planning consent to build).LVT doesn't tax people for improving their land, unlike business rates, so stimulates business and the local economy in poorer areas.

LVT also promotes optimal use of existing housing stock and land (gets v expensive to hold vacant lots in city centres), reducing the need for new build.

'Promoting optimal use of the existing housing stock' sounds like the opposite of what we need to do, which is build more housing to meet demand. Vacant lots in city centres tend not to be housing estates.

Jobbo said:

edh said:

I don't. I abhor the focus on London. LVT will help rebalance as it makes land in less "desirable" areas cheaper, free even.

LVT doesn't tax people for improving their land, unlike business rates, so stimulates business and the local economy in poorer areas.

LVT also promotes optimal use of existing housing stock and land (gets v expensive to hold vacant lots in city centres), reducing the need for new build.

Surely LVT would tax people for improving their land, since the value of the land goes up (compare the land value of agricultural land with the same land which has received planning consent to build).LVT doesn't tax people for improving their land, unlike business rates, so stimulates business and the local economy in poorer areas.

LVT also promotes optimal use of existing housing stock and land (gets v expensive to hold vacant lots in city centres), reducing the need for new build.

'Promoting optimal use of the existing housing stock' sounds like the opposite of what we need to do, which is build more housing to meet demand. Vacant lots in city centres tend not to be housing estates.

You can build lots of homes on vacant lots & it's certainly better than leaving them idle (which currently costs the land owner / speculator nothing). there's always huge opposition to greenfield developments, but less on renovating & building on city centre eyesores..

Optimal use also means using empty homes to house people instead of as a store of wealth, also encouraging people to downsize. TBH I don't understand why old people don't move out of their big family homes - we're already planning to do just that & build ourselves a place for the two of us now our kids have moved out.

Jobbo said:

Surely LVT would tax people for improving their land.

LVT is the Holy Grail which will solve everything from overpriced housing to adult social care. It has no downsides.You risk your immortal soul burning in the fieriest pits of Hell for daring to question it, you heretic!

edh is a true believer.

Planning/councils do play a huge part. There are 10s if thousands of acres if farmland in Surrey which are doing nothing, not even seen from the roadside. Who will build all of these extra houses? You say land is too expensive. What is a sensible price. Here’s a thought, crazy as it is. Why not get reliable super fast bandwidth and mobile almost everywhere. Then a significant number could work from somewhere other than central London.

edh said:

No, by definition it is a tax on the unimproved value of land, separate from any structures on that land. By gaining planning consent you have not "improved" the land as you haven't built anything, but you have changed the value by changing its permitted use.

You and I have different definitions of 'improved' then. By definition, it will tax land which has been improved in value, whether because the area as a whole has gone up or because planning consent has been granted (for the land itself, or a development nearby) or whatever other sentiment affects it.The effect of this is to force people out of property where they did nothing to increase the value of the land. That is iniquitous.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff