Another Bank of England warning on debt- Are we doomed?

Discussion

towser44 said:

menousername said:

Oakey said:

I work, my partner stays at home and looks after our son. She opened a Next account, they promptly gave her £4k of credit. f king bonkers.

king bonkers.

Im using "you" here in the third person sense, not at you directly.... king bonkers.

king bonkers. if you can pay they win.

If you cannot - they either come after your house or they sell the debt to someone who will come after your house - they win.

House price growth = equity over mortgage = means of recourse probably 99% of the time thanks to low interest rates.

Any interest accruing could make it quite catastrophic for the account holder

Secured Debt: Directly secured on your house

Unsecured: Lender applies for CCJ, second that passes or even before they can then submit an application for a Charging Order on your home. If you can't work it out and debt is over £1k, they apply for an Order of Sale and force a sale.

It is a longer process, but they can do it. The laws were recently changed to make is easier: http://researchbriefings.parliament.uk/ResearchBri...

Edited by hyphen on Tuesday 25th July 14:18

crankedup said:

Personal question which you may choose to tell me to * off. Your one million investment, would that be invested into buy to let?

I wouldn't dream of telling you to * off; the money is predominantly invested in property refurbishment followed by BTL.In the near to medium future I intend to diversify into whatever else I can find.

My point stands that sensible use of money is to take advantage of financial conditions.

crankedup said:

Personal question which you may choose to tell me to * off. Your one million investment, would that be invested into buy to let?

Personal opinion, but I can't think of a worse investment than BTL at this moment in time. S24, Brexit and overall debt saturation means that the magical 7% yeld (gross) is utopia (though some people with long term skin in the game surely do better than that).

crankedup said:

Wait Here Until Green Light Shows said:

I really hope interest rates start climbing soon - it's about time those of us who have been sensible with money start seeing some benefit.

5% would be nice please.

That would be nice, make a change from seeing cash savings devalue.5% would be nice please.

king overdue

king overdue

Rovinghawk said:

crankedup said:

Personal question which you may choose to tell me to * off. Your one million investment, would that be invested into buy to let?

I wouldn't dream of telling you to * off; the money is predominantly invested in property refurbishment followed by BTL.In the near to medium future I intend to diversify into whatever else I can find.

My point stands that sensible use of money is to take advantage of financial conditions.

Our lad has done the same, BTL although on a lesser scale to yourself. And yes I agree sensible money investments can still provide a decent return, although it's a matter of how much risk the investor is comfortable with, as we know.

edh said:

The increase in personal debt was all part of the plan and the only thing keeping the economy moving. If you withdraw govt spending you need another means of increasing GDP. As increasing inflows via growing exports is much harder, why not just let people borrow more? Cynical?

Which government are you talking about?

edh said:

Ultra low rates and easy credit (plus ridiculous incentives to boost house prices) have kept the UK economy moving. It was all part of Osborne's plan.

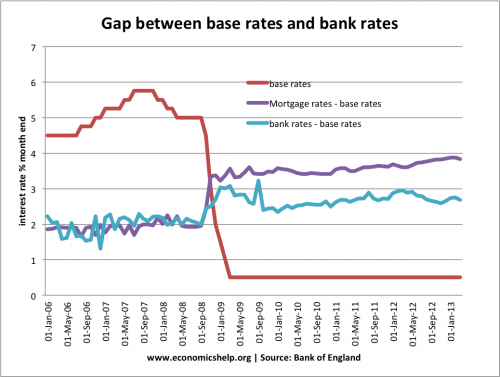

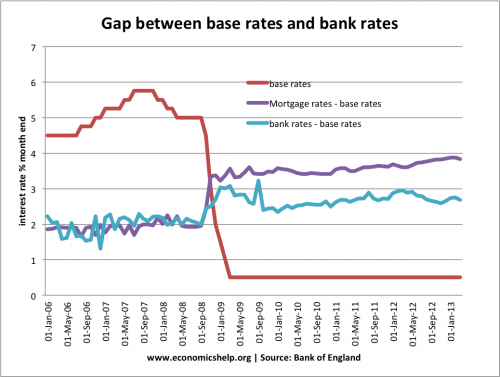

Whose plan? I'll give you a clue; the chancellor does not set base rates, or retail lending rates and Osborne wasn't even chancellor in 2009!

I don't know why you make this stuff up, the only person you're fooling is yourself.

tannhauser said:

crankedup said:

Wait Here Until Green Light Shows said:

I really hope interest rates start climbing soon - it's about time those of us who have been sensible with money start seeing some benefit.

5% would be nice please.

That would be nice, make a change from seeing cash savings devalue.5% would be nice please.

king overdue

king overdue

fblm said:

edh said:

The increase in personal debt was all part of the plan and the only thing keeping the economy moving. If you withdraw govt spending you need another means of increasing GDP. As increasing inflows via growing exports is much harder, why not just let people borrow more? Cynical?

edh said:

Ultra low rates and easy credit (plus ridiculous incentives to boost house prices) have kept the UK economy moving. It was all part of Osborne's plan.

Whose plan? I'll give you a clue; the chancellor does not set base rates, or retail lending rates and Osborne wasn't even chancellor in 2009!

I don't know why you make this stuff up, the only person you're fooling is yourself.

They have been in charge for 7 years you know.. Their treasury forecasts have incorporated a steady rise in personal indebtedness, which helps keep the economy afloat absent any other sources of cash.

Blair/Brown are culpable, sure. They bought the nonsense promulgated by the masters of the universe who were the authors of the GFC. They presided over a ridiculous house price boom.

How far back do you want to go? Thatcher's deregulation of lending and abolition of domestic rates were a massive driver of house price inflation & therefore personal borrowing.

Murph7355 said:

fblm said:

Why should cash savings produce you any kind of return?

Amusingly from people who bemoan the FS sector

2. Possibility, however unlikely we may believe it is, of account holder haircuts should another crash happen

3. Bank giving 0.05% or whatever tiny rate for your cash for you taking the above risks, then lending it out at 3,4,6% etc

This combination alone has changed the role of the bank. If anything it begs the question should savings rates be tied to interest rates or should banks have to offer competitive rates for cash deposits and compete for them.

No doubt someone will be along to say that will see mortgage rates rocket and society collapse

menousername said:

1. Reduction of guaranteed saftey net should bank go bust.... hopefully it will not be reduced any further

2. Possibility, however unlikely we may believe it is, of account holder haircuts should another crash happen

3. Bank giving 0.05% or whatever tiny rate for your cash for you taking the above risks, then lending it out at 3,4,6% etc

This combination alone has changed the role of the bank. If anything it begs the question should savings rates be tied to interest rates or should banks have to offer competitive rates for cash deposits and compete for them.

No doubt someone will be along to say that will see mortgage rates rocket and society collapse

The reduction in the protection level is nothing to do with banks per se and everything to do with the fall in sterling vs the euro. The rate of protection was set by EU legislation and re-sets every so often. Brexit vote cause and effect.2. Possibility, however unlikely we may believe it is, of account holder haircuts should another crash happen

3. Bank giving 0.05% or whatever tiny rate for your cash for you taking the above risks, then lending it out at 3,4,6% etc

This combination alone has changed the role of the bank. If anything it begs the question should savings rates be tied to interest rates or should banks have to offer competitive rates for cash deposits and compete for them.

No doubt someone will be along to say that will see mortgage rates rocket and society collapse

The banks cannot lend any funds on same day, less than 30 days in fact if I recall correctly, deposit. Another bit of legislation, protecting your deposits after the crash, Basle III?. This coupled to low base rate and the enhanced capital requirements mean rates are low, will stay low and its largely not the high street bank's doing.

fblm said:

tannhauser said:

crankedup said:

Wait Here Until Green Light Shows said:

I really hope interest rates start climbing soon - it's about time those of us who have been sensible with money start seeing some benefit.

5% would be nice please.

That would be nice, make a change from seeing cash savings devalue.5% would be nice please.

king overdue

king overdue

andy43 said:

£4000 with no income

Early noughties all over again. 125% mortgage anybody?

I don't see the link?

Early noughties all over again. 125% mortgage anybody?

Surely a store card is only valid in the store issuing it, therefore the risk to the issuer is the cost to produce the stock sold for a potential £4k not the full £4k. I would also think the chances of getting up to £4k without paying anything off would be quite slim!

Wait Here Until Green Light Shows said:

I really hope interest rates start climbing soon - it's about time those of us who have been sensible with money start seeing some benefit.

5% would be nice please.

I don't get this, why on earth should you expect 5% return for cash invested in a bank? 5% would be nice please.

To me reward is the flip side of risk, you take very little risk you should expect very little reward.

You want the lazy, safe, put money in a savings account fine, you should get very little in return for it, if you want a reward for your money you should put that money to active use.

kingston12 said:

Elroy Blue said:

Where's the incentive to save. I have no personal debt other than a small mortgage. I saved money, but I watch it decrease in value each year thanks to pitiful savings rates.

Those with no savings get elderly care for free, while those with assets have to hand it over.

I'm not surprised people think 'to hell with it' and borrow within a inch of their financial lives

Totally agree. The Government/BoE have presided over an extended period of low interest rates leading to a house price bubble and little or no wage increases. Large unsecured borrowing is available to anyone with not much more than one click of a mouse and mortgages are very easy to come by.Those with no savings get elderly care for free, while those with assets have to hand it over.

I'm not surprised people think 'to hell with it' and borrow within a inch of their financial lives

Now inflation is starting to come back strongly in the rest of the economy as well, are they really surprised that borrowing has gone up?

i bought my car for 400 quid yes its thirsty but runs well and so far reliable. my mate me laugh he is looking for a new car and said he didn't want a banger. happy to put 2k down and pay 150+ per month. the thing is he has had an iva in the past, o.k he has a small child, but happy to take on 5k debt.

i had debt taken me a few years but nearly there, feels so enlightening, i still have a bit but wouldn't get a car on it.

i had debt taken me a few years but nearly there, feels so enlightening, i still have a bit but wouldn't get a car on it.

markcoznottz said:

Rewarding useful/prudent behaviour.

Ignoring just how prudent keeping savings in cash has been for the last decade; are you saying that you want rewarding for effectively making banks and the economy safer by keeping the money in the bank in cash and not going out and spending your money on a classic car?Debt is the new normal.

There is today an enormous oversupply of spare cash floating around the world. Somewhere around ~$70 trillion. There will always be some sucker around the corner willing to lend you more cash.

Fill yer boots. Borrow as much as you can and live it up.

There will be no major debt crash. And if there is, the UK government will print some more cash and bail you out.

Doomsayers have been warning about debt since the 15th century... And every decade sees ever more debt demand and supply.

There is today an enormous oversupply of spare cash floating around the world. Somewhere around ~$70 trillion. There will always be some sucker around the corner willing to lend you more cash.

Fill yer boots. Borrow as much as you can and live it up.

There will be no major debt crash. And if there is, the UK government will print some more cash and bail you out.

Doomsayers have been warning about debt since the 15th century... And every decade sees ever more debt demand and supply.

ellroy said:

The reduction in the protection level is nothing to do with banks per se and everything to do with the fall in sterling vs the euro. The rate of protection was set by EU legislation and re-sets every so often. Brexit vote cause and effect.

The govt backstop of 75k came down due to brexit related fx fluctuations? stuckmojo said:

Personal opinion, but I can't think of a worse investment than BTL at this moment in time.

S24, Brexit and overall debt saturation means that the magical 7% yeld (gross) is utopia (though some people with long term skin in the game surely do better than that).

It's not great to start off now (remember the extra 3%SDLT too) but if you've been in for a while then it's still good business.S24, Brexit and overall debt saturation means that the magical 7% yeld (gross) is utopia (though some people with long term skin in the game surely do better than that).

In my particular case I got the houses as cheap fixer-uppers and used friends/contacts to help me do the work at mates rates. This changes things compared to buying new shiny properties.

S24 is a nuisance but rents rise to cover situations like that. I find Brexit an irrelevance, especially as my tenants have been with me for years & will probably stay a lot longer. Debt saturation means many can't buy houses so need to rent.

My yield on current valuations is probably about 6%- it's certainly greater than that on historic costs. Leveraged yields can be up to 16% with a few smarts & some luck. As I keep saying, low interest rates can be good if used well.

ETA- yes, I'm aware of your website. Could you please advise me of some better investments?

Edited by Rovinghawk on Tuesday 25th July 22:03

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff