Dear University lecturers - get back to work

Discussion

sidicks said:

Is it not revalued career average?

Is that average then not revalued to retirement date (I’m sure that’s a legal requirement).

So the ‘loss’ is just the gap between the revaluation rate and the actual salary increase?

Yes but that gap is very substantial if you're talking about early career academic to prof, say.Is that average then not revalued to retirement date (I’m sure that’s a legal requirement).

So the ‘loss’ is just the gap between the revaluation rate and the actual salary increase?

Just reading this:

https://www.uss.co.uk/how-uss-is-run/valuation/201...

https://www.uss.co.uk/how-uss-is-run/valuation/201...

travel is dangerous said:

25 % of our salary is contributed towards making the defined benefit pension. I contribute to my own DB pension. It does not come (entirely) from taxpayers (e.g. it's a private pension scheme)

Members would continue to contribute 8% of payJamp said:

Yes but that gap is very substantial if you're talking about early career academic to prof, say.

That’s certainly not what you claimed previously:Jamp said:

Your "final salary" was your salary on the date the scheme switched, not actually your final salary in your university career as was promised. So if you were an early career academic and planned to stay in academia for a whole career (and make senior lecturer/prof/HoD), your existing contributions' value was halved or more.

What is the revaluation rate and what have pay increases been in the past?The front page from the website also claims:

USS said:

Benefits already earned by both active and deferred members are protected by law and in the scheme rules.

Edited by sidicks on Thursday 22 February 21:37

The Crack Fox said:

Career pathway? They chose it! No-one forced them. My point still stands - if the employment contract has been illegally changed - challenge it in court. If you don't like the current terms of your employment - work somewhere else. I'm not commenting on how fair/unfair the deal on offer might be, by the way, but like it or lump it, that's the real world.

Define real world .Many unions strike they then go back to the negotiating table and come out with a better deal for there members , so for those union members that is the real world.

egor110 said:

Define real world .

Many unions strike they then go back to the negotiating table and come out with a better deal for there members , so for those union members that is the real world.

The ‘real world’ takes into account demographic changes and the economic environment (or at least it should do)...Many unions strike they then go back to the negotiating table and come out with a better deal for there members , so for those union members that is the real world.

sidicks said:

What is the revaluation rate and what have pay increases been in the past?

I think you're misunderstanding me, but to answer your questions I think the reversion rate is of the order of 3%. Pay increases are typically 1% if you stay in the same job and at the same point on your band, but my point is that academics are typically promoted several times in their careers and at least climb the points on their salary band as they gain experience. e.g. my department pays fresh grads £25k, but profs go up to £115k. If the scheme ends, someone who's done 10 years of junior service has average contributions at that junior level only and not their career average as was promised. Fair enough if they left the scheme of their own accord, but they are being forced to 'leave'. sidicks said:

egor110 said:

Define real world .

Many unions strike they then go back to the negotiating table and come out with a better deal for there members , so for those union members that is the real world.

The ‘real world’ takes into account demographic changes and the economic environment (or at least it should do)...Many unions strike they then go back to the negotiating table and come out with a better deal for there members , so for those union members that is the real world.

The Crack Fox said:

egor110 said:

Define real world

The civilised world, post c.1980. Yipper said:

Looks like a bunch of militant reds trying to shake the magic money tree.

The UK uni pension scheme is a whopping £6b in debt and completely unsustainable. Profs need to cut back and suck it up.

Welcome to the real world.

it has zero debt and it has assets of £60 billion. It has a deficit (which is based on. inevitably uncertain, assumptions) of about 10 % of it's investments.The UK uni pension scheme is a whopping £6b in debt and completely unsustainable. Profs need to cut back and suck it up.

Welcome to the real world.

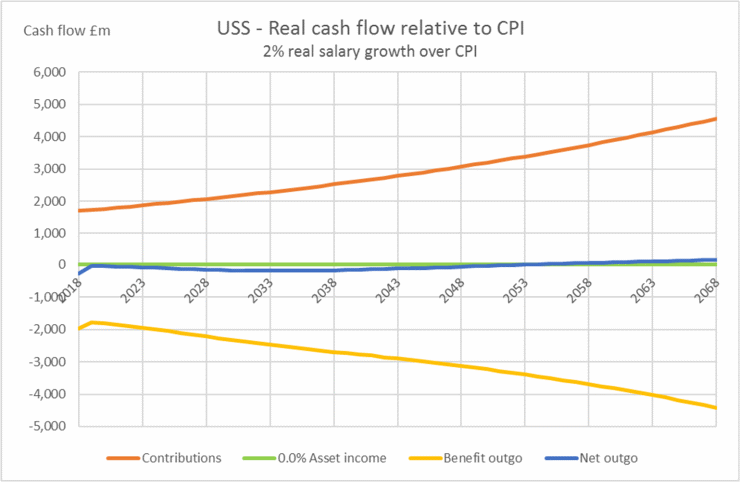

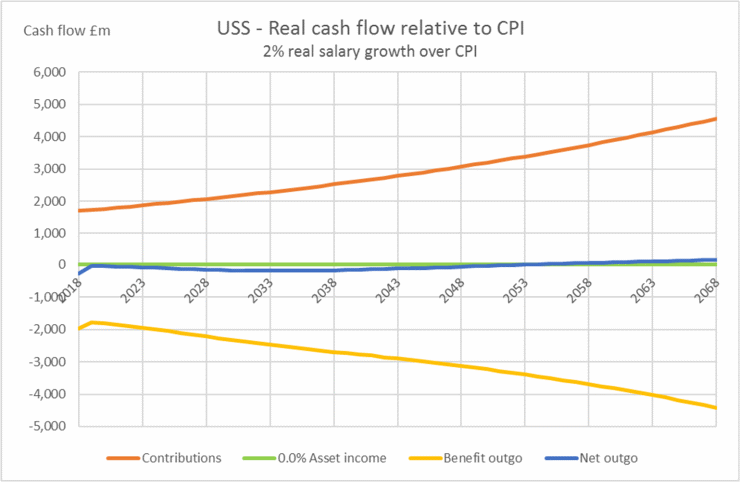

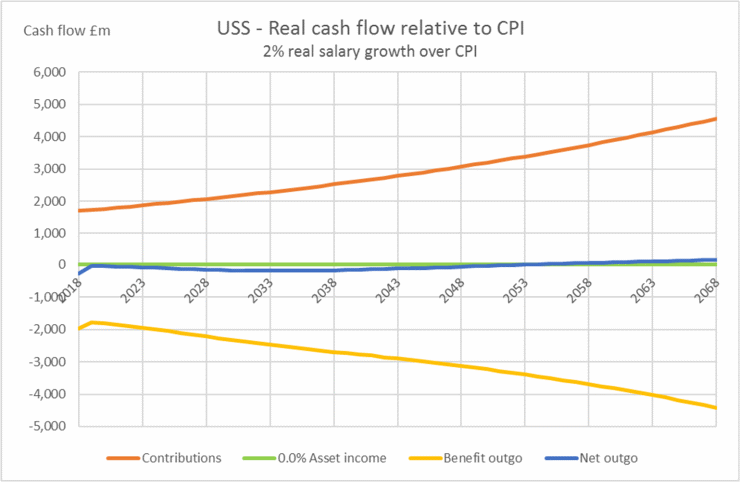

Here is the predicted cashflow of the scheme for the next four decades

Jamp said:

I think you're misunderstanding me, but to answer your questions I think the reversion rate is of the order of 3%. Pay increases are typically 1% if you stay in the same job and at the same point on your band, but my point is that academics are typically promoted several times in their careers and at least climb the points on their salary band as they gain experience. e.g. my department pays fresh grads £25k, but profs go up to £115k. If the scheme ends, someone who's done 10 years of junior service has average contributions at that junior level only and not their career average as was promised. Fair enough if they left the scheme of their own accord, but they are being forced to 'leave'.

They still receive the promised pension for the period already worked. They now have a decision as to whether to carry on the same job under the new terms or for something different. Just as every private sector member has been forced to do.The pension scheme was a promise at the time you entered that occupation is wasn’t a guarantee that nothing would ever change in the future.

travel is dangerous said:

it has zero debt and it has assets of £60 billion.

It has liabilities of £66bntravel is dangerous said:

It has a deficit (which is based on. inevitably uncertain, assumptions) of about 10 % of it's investments.

Itsvinvestments are not certain and neither is the income from them.travel is dangerous said:

Here is the predicted cashflow of the scheme for the next four decades

Based on accruing new liabilities to pay for existing members, aka a ponzi scheme. Given recent equity falls, that deficit is likely to be much bigger now.

Why did you suggest that your contribution rate is 25% rather than the true figure of 8%?

Edited by sidicks on Friday 23 February 08:29

The Crack Fox said:

travel is dangerous said:

For the record I am not striking - it's not really something that I agree with. I would prefer to persuade with logical and reasoned argument. But on this issue - this time - I have a lot sympathy. We mustn't forget that historically withdrawal of labour has been an important tactic to extract improved working conditions. We mustn't forget that employees should have the right to stand up to their employers.

You might have more sympathy if you considered the career pathway of most academics. It's a profession that typically needs 4-5 years of low- or un-paid study before you can begin work. (so you delay earning by a long time). You then typically face 3-5-10 years of temporary and uncertain contracts, moving from place-to-place almost as an itinerant scholar. Finally, after that, about 1 % of those who undertake the PhD will get a permanent job at a UK university. You will be earning substantially less, as, say, a law professor than you could as the students you educate will earn within a few years of their graduation. Your pension is therefore an important part of the remuneration package, and it's value is being cut by roughly £10,000 a year in retirement. Perhaps now you understand why so many people are so outraged.

I think that the universities (collectively) are being very shortsighted, I think it's the wrong decision for the sector, and I think they have been very disingenuous with how they have presented their proposed changes to employees. ("We're changing the pension scheme! it's going to be so much more flexible!"). It's almost as if they didn't realise that they probably couldn't bluff it to 60,000 highly educated, trained critical thinkers, many of whom have developed a lot of the accounting/actuarial methodology that pension schemes actually use...

I am not arguing that the current scheme should continue as is, by the way, but I would like to see a better offer from the employers. the post office risk-sharing DC scheme is an interesting option, perhaps.

University employees don't normally tend to strike, and when strikes do happen they tend to be small and poorly complied with. This one is very different. There is a level of outrage and determination that I have not seen before.

Career pathway? They chose it! No-one forced them. My point still stands - if the employment contract has been illegally changed - challenge it in court. If you don't like the current terms of your employment - work somewhere else. I'm not commenting on how fair/unfair the deal on offer might be, by the way, but like it or lump it, that's the real world. You might have more sympathy if you considered the career pathway of most academics. It's a profession that typically needs 4-5 years of low- or un-paid study before you can begin work. (so you delay earning by a long time). You then typically face 3-5-10 years of temporary and uncertain contracts, moving from place-to-place almost as an itinerant scholar. Finally, after that, about 1 % of those who undertake the PhD will get a permanent job at a UK university. You will be earning substantially less, as, say, a law professor than you could as the students you educate will earn within a few years of their graduation. Your pension is therefore an important part of the remuneration package, and it's value is being cut by roughly £10,000 a year in retirement. Perhaps now you understand why so many people are so outraged.

I think that the universities (collectively) are being very shortsighted, I think it's the wrong decision for the sector, and I think they have been very disingenuous with how they have presented their proposed changes to employees. ("We're changing the pension scheme! it's going to be so much more flexible!"). It's almost as if they didn't realise that they probably couldn't bluff it to 60,000 highly educated, trained critical thinkers, many of whom have developed a lot of the accounting/actuarial methodology that pension schemes actually use...

I am not arguing that the current scheme should continue as is, by the way, but I would like to see a better offer from the employers. the post office risk-sharing DC scheme is an interesting option, perhaps.

University employees don't normally tend to strike, and when strikes do happen they tend to be small and poorly complied with. This one is very different. There is a level of outrage and determination that I have not seen before.

sidicks said:

They still receive the promised pension for the period already worked. They now have a decision as to whether to carry on the same job under the new terms or for something different. Just as every private sector member has been forced to do.

The pension scheme was a promise at the time you entered that occupation is wasn’t a guarantee that nothing would ever change in the future.

Yes it was. Two years ago they said they had to make a once in a generation change to the scheme to make it sustainable in the long term. Yet two years on here we are seeing a more dramatic change.The pension scheme was a promise at the time you entered that occupation is wasn’t a guarantee that nothing would ever change in the future.

Perhaps the truth is pensions are a outdated concept ?

The whole idea you worked until you were 60 then dead by the time you we're 80 meant your average pension only had to last 20 years however now people are living into the 90's even 100's now your pension somehow has to last 35-40 years .

The whole idea you worked until you were 60 then dead by the time you we're 80 meant your average pension only had to last 20 years however now people are living into the 90's even 100's now your pension somehow has to last 35-40 years .

egor110 said:

Perhaps the truth is pensions are a outdated concept ?

The whole idea you worked until you were 60 then dead by the time you we're 80 meant your average pension only had to last 20 years however now people are living into the 90's even 100's now your pension somehow has to last 35-40 years .

That’s exactly the problem. The whole idea you worked until you were 60 then dead by the time you we're 80 meant your average pension only had to last 20 years however now people are living into the 90's even 100's now your pension somehow has to last 35-40 years .

In the old days, it was pay in for 40 years, receive benefits for 10 years. Now it’s more like receive benefits for 25+ years. And the rate at which those contributions can be invested is much lower.

This was recognised in the private sector 10-20 years ago which is why there are very few DB schemes left. The public sector can’t be immune to economics and demographics.

Edited by sidicks on Thursday 22 February 23:06

egor110 said:

Perhaps the truth is pensions are a outdated concept ?

The whole idea you worked until you were 60 then dead by the time you we're 80 meant your average pension only had to last 20 years however now people are living into the 90's even 100's now your pension somehow has to last 35-40 years .

In the good old days you drew on your pension for far less than 20 years.The whole idea you worked until you were 60 then dead by the time you we're 80 meant your average pension only had to last 20 years however now people are living into the 90's even 100's now your pension somehow has to last 35-40 years .

It remains the super-exceptionally good days for some, of course.

sidicks said:

egor110 said:

Perhaps the truth is pensions are a outdated concept ?

The whole idea you worked until you were 60 then dead by the time you we're 80 meant your average pension only had to last 20 years however now people are living into the 90's even 100's now your pension somehow has to last 35-40 years .

That’s exactly the problem. The whole idea you worked until you were 60 then dead by the time you we're 80 meant your average pension only had to last 20 years however now people are living into the 90's even 100's now your pension somehow has to last 35-40 years .

In the old days, it was pay in for 40 years, receive benefits for 10 years. Now it’s more like receive benefits for 25+ years. And the rate at which those contributions can be invested is much lower.

This was recognised in the private sector 10-20 years ago which is why there are very few DB schemes left. The public sector can’t be immune to economics and demographics.

Edited by sidicks on Thursday 22 February 23:06

lauda said:

I don’t wish to seem rude but I think there are some fundamental errors in your understanding of how pension schemes are funded. The basic fact is, if the USS wanted to have a 95% chance of meeting all of its liabilities if it were to receive no further contributions from any of the participating employers, it would need another £23bn.

I don’t know about your perspective on that number but I think it indicates that costs are running out of control.

And there’s no way that you would receive a pension of double your current USS DB pension from the teacher’s scheme since the accrual rate in that scheme is nowhere near double that of the USS.

Looking at the latest valuation from 2017:I don’t know about your perspective on that number but I think it indicates that costs are running out of control.

And there’s no way that you would receive a pension of double your current USS DB pension from the teacher’s scheme since the accrual rate in that scheme is nowhere near double that of the USS.

https://www.uss.co.uk/~/media/document-libraries/u...

The deficit is £12.6bn on a technical provisions basis and £27.4bn on a buy-out basis. This with assets of just £60bn.

It also assumes that members pay increases at RPI+1%, whereas it has been claimed that, due to seniority increases, pay is expected to increase much more rapidly than that. So the real deficit is seemingly much higher than claimed above.

Not quite the picture that has been portrayed!

Edited by sidicks on Thursday 22 February 23:24

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff