Brexit - 35% House Prices Crash

Discussion

kambites said:

captain_cynic said:

If you think the NHS is expensive, you should see how much a private system costs.

The US taxpayer pays nearly twice as much for their private health system as the UK taxpayer does for the NHS... And the US taxpayer then needs health insurance above that.

The US taxpayer pays nearly twice as much for their private health system as the UK taxpayer does for the NHS... And the US taxpayer then needs health insurance above that.

Healthcare is expensive, especially if you want it to work. The UK's overall expenditure on healthcare per capita is about average for Europe (which makes it on the low side for western Europe) and massively lower than the USA.

Healthcare is expensive, especially if you want it to work. The UK's overall expenditure on healthcare per capita is about average for Europe (which makes it on the low side for western Europe) and massively lower than the USA. People love to claim the NHS is poor value for money but the figures don't really back that up.

Edited by kambites on Monday 17th September 11:48

It's such a b

ks argument to suggest that if we change the NHS we have to have the US system instead. There are loads of countries paying similar money for a better service, why don't we talk about how they do healthcare instead?

ks argument to suggest that if we change the NHS we have to have the US system instead. There are loads of countries paying similar money for a better service, why don't we talk about how they do healthcare instead?captain_cynic said:

Rising rent will drive renters to cheaper accommodation

The suggestion is that rents would pretty much all rise. As for 'cheaper accommodation' bear in mind that mandatory minimum standards will lead to minimum prices. Note that when 'bedroom tax' was introduced many folks found it difficult to find smaller homes.captain_cynic said:

They're already struggling to get what they're already charging.

I have a long waiting list willing to pay what I charge, so have to disagree with you there.captain_cynic said:

A glut of supply will often have the effect of lowering prices

Know you of such an oversupply? Speaking for the market overall, I don't.Atomic12C said:

Didn't it 'bounce' more or less back to an increasing trend fairly quickly though?

I remember some house prices dropping a little and other basically only seeing a slow down of increase.

Enough to put a number of developers out of business who were relying on paying off large debt levels based on the future trend of properties, but other than that it resulted in interest rate drops which allowed many people to get on the mortgage ladder.

Only problem now is that too many people are living/relying on that incredibly low interest rate level.

Too many still with large debts and totally ignorant (or even arrogant) of the nature that interest rates must rise in order to give the UK some financial levers to pull to control the economy.

I think it was very much region based...I remember some house prices dropping a little and other basically only seeing a slow down of increase.

Enough to put a number of developers out of business who were relying on paying off large debt levels based on the future trend of properties, but other than that it resulted in interest rate drops which allowed many people to get on the mortgage ladder.

Only problem now is that too many people are living/relying on that incredibly low interest rate level.

Too many still with large debts and totally ignorant (or even arrogant) of the nature that interest rates must rise in order to give the UK some financial levers to pull to control the economy.

Semi interesting article - https://www.bbc.co.uk/news/business-41582755

'In 58% of wards, residential properties are selling for less now, after accounting for inflation, than they were in 2007.'

I was working in the repossessions dept at YBS/CBS in 2007-2010. The vast majority of people losing their homes were 'trapped' because they couldn't get off the SVR (7-8%) due to their LTV.

But you are right, a lot of people have maxed out their monthly spend on the basis of low interest rates - will be interesting to see what happens if the interests rates start going up to the 5-6% as they were pre 2007.

For example, 150k at 3% is £711, if their product ends and the interest rates have increased to 6% then their payment will be £256 extra a month. To the average PH powerfully built director, that is pocket money, but to the average person it could well be make or break.

Iddz said:

Hi guys,

As you would have heard or seen, as its all over the news; apparently with the event of a no-brexit deal we are likely to see a 35% drop in house prices.

Would you say this is likely to happen? I am a first time buyer and have finally saved up enough deposit to buy by dream house but do not want to be stuck in negative equality.

Any information welcome.

Buy a place you want to live in. As you would have heard or seen, as its all over the news; apparently with the event of a no-brexit deal we are likely to see a 35% drop in house prices.

Would you say this is likely to happen? I am a first time buyer and have finally saved up enough deposit to buy by dream house but do not want to be stuck in negative equality.

Any information welcome.

If you're buying with cash; then you're only worry is coming out with less than you put in; and you can always stay put until prices recover. And they will. Look at house prices since 2005.

If you're buying with a mortgage, then you may want to consider affordability if interest rates rise... perhaps a long term fixed rate would be beneficial, a mortage advisor or an IFA could give you better advice here.

If you're looking to make money... that's a different ball game.

Rovinghawk said:

Sky, Netflix & off-licences could take a significant hit in that event.

People see those as essential expenditure. They'll just eat and drink out less as they watch 'made to binge' s te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.

te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.Iddz said:

Hi guys,

As you would have heard or seen, as its all over the news; apparently with the event of a no-brexit deal we are likely to see a 35% drop in house prices.

Would you say this is likely to happen? I am a first time buyer and have finally saved up enough deposit to buy by dream house but do not want to be stuck in negative equality.

Any information welcome.

Afaik you will get an equally good response on the future of the housing market by asking here and yes that includes newspaper "experts":As you would have heard or seen, as its all over the news; apparently with the event of a no-brexit deal we are likely to see a 35% drop in house prices.

Would you say this is likely to happen? I am a first time buyer and have finally saved up enough deposit to buy by dream house but do not want to be stuck in negative equality.

Any information welcome.

TX.

Hitch said:

People see those as essential expenditure. They'll just eat and drink out less as they watch 'made to binge' s te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.

te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.

I watched a program on Channel 4 about people on the 'breadline' - food vouchers and all - They had 2 massive tv's on opposite sides of the living room. One with a sky subscription and one with a virgin subscription. te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.

te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.Atomic12C said:

Didn't it 'bounce' more or less back to an increasing trend fairly quickly though?

I remember some house prices dropping a little and other basically only seeing a slow down of increase.

Enough to put a number of developers out of business who were relying on paying off large debt levels based on the future trend of properties, but other than that it resulted in interest rate drops which allowed many people to get on the mortgage ladder.

Only problem now is that too many people are living/relying on that incredibly low interest rate level.

Too many still with large debts and totally ignorant (or even arrogant) of the nature that interest rates must rise in order to give the UK some financial levers to pull to control the economy.

Define 'quickly'.I remember some house prices dropping a little and other basically only seeing a slow down of increase.

Enough to put a number of developers out of business who were relying on paying off large debt levels based on the future trend of properties, but other than that it resulted in interest rate drops which allowed many people to get on the mortgage ladder.

Only problem now is that too many people are living/relying on that incredibly low interest rate level.

Too many still with large debts and totally ignorant (or even arrogant) of the nature that interest rates must rise in order to give the UK some financial levers to pull to control the economy.

We bought for £183k in 2007 and sold for £152k in 2014.

Terminator X said:

Afaik you will get an equally good response on the future of the housing market by asking here and yes that includes newspaper "experts":

TX.

Mystic Meg?

TX.

Didn't see that coming!

Back in the dark days of the 20th century, mortgage interest rates were an issue and it was occasionally eye-wateringly high (try 16% for size!!). I don't recall house prices falling or folks not buying but then many of us were buying houses as a 'married' couple as bizarre as that concept seems to be to the youngsters these days.

Gary29 said:

crofty1984 said:

I'm looking to move up the housing ladder, so if they caould make that happen in the next couple of years, that would be just super, thanks. 20% should do nicely.

Me too, 20% across the board would save me a few quid in the long run.oyster said:

Which people would it be brilliant for?

If you have a house you lose a ton of money.

If you have a job you might well lose it, or have your income fall or flatline.

If you have savings they'll be devalued by drops in interest rates.

Likewise if you have a pension.

If you have a house you still live in it, if your buying one you save, if your selling one it might be better to wait.If you have a house you lose a ton of money.

If you have a job you might well lose it, or have your income fall or flatline.

If you have savings they'll be devalued by drops in interest rates.

Likewise if you have a pension.

Nothing new there

When money is in short supply interest rates go up

It all comes under "Same sh*t different day"

pequod said:

Mystic Meg?

Didn't see that coming!

Back in the dark days of the 20th century, mortgage interest rates were an issue and it was occasionally eye-wateringly high (try 16% for size!!). I don't recall house prices falling or folks not buying but then many of us were buying houses as a 'married' couple as bizarre as that concept seems to be to the youngsters these days.

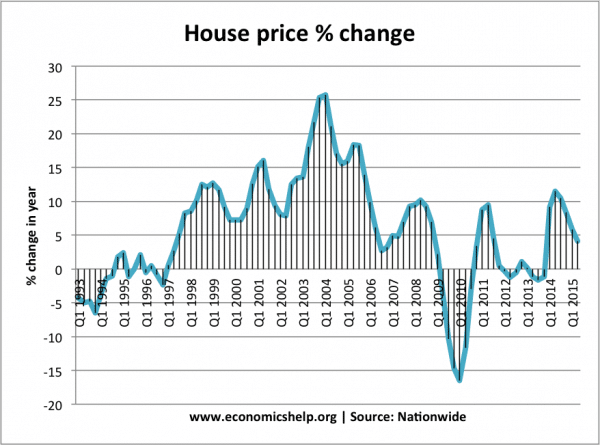

https://www.housepricecrash.co.uk/indices-nationwide-national-inflation.phpDidn't see that coming!

Back in the dark days of the 20th century, mortgage interest rates were an issue and it was occasionally eye-wateringly high (try 16% for size!!). I don't recall house prices falling or folks not buying but then many of us were buying houses as a 'married' couple as bizarre as that concept seems to be to the youngsters these days.

Late 80's/early 90's there was a crash of around 25%

2008/2009 it was around 20% crash

The difficulty around Brexit and its effects is the sheer amount of variables involved. No one knows what is going to happen. However if Jobs go, GDP falls, interest rates rise, etc then a fall of 20-25% in house prices would be deemed realistic.

Alternatively, unemployment may keep falling, interest rates might get reduced again, GDP will increase and house prices will continue to rise

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff