Brexit - was it worth it? (Vol. 2)

Discussion

Bandit said:

Goldman Sach’s, Remain tubthumpers seem to have added over 600 jobs in the U.K. since the Brexit vote. In fact just last week they announced they were opening a brand new office for an additional 400 finance workers. That location would surely be in the EU right?

Ummmm no, Birmingham actually.

Just seen Bloomberg coverage, apparently the city’s universities, technology sector and relative proximity to London were reasons behind the decision. Ummmm no, Birmingham actually.

In general all three of the above - universities, technology and London - are UK strengths other locations struggle to match. In particular the UK is a 'global centre for socially responsible technology innovation'.

Iminquarantine said:

Meanwhile, I haven't posted any stories of winning for a while, but here is one.

Welsh bicycle manufacturer just over the moon at £250,000 worth of sovereignty

https://www.walesonline.co.uk/news/wales-news/brex...

'Brexit cost my bicycle business £250,000 extra in just two months, and I can't see any positives'

Down our way there's a UKIP bunch that try to be very visible. Considering how much investment south wales and especially our area has had from the EU funds I was quite surprised to see how many votes went to Brexit.Welsh bicycle manufacturer just over the moon at £250,000 worth of sovereignty

https://www.walesonline.co.uk/news/wales-news/brex...

'Brexit cost my bicycle business £250,000 extra in just two months, and I can't see any positives'

Did we have this one?

Caller: "I voted to leave.... but I do a lot of ebay to Europe, now noone's buying anything off me in Europe. I've been lied to... did anyone say when we leave the EU everything is going to be taxed?"

https://twitter.com/i/status/1381886557477556224

Latest from the Morgan McKinley Quarterly London Employment Monitor: the finance sector has returned to hiring growth and has retained its GFCI position. Which harks back to this, from last month...according to PWC’s annual survey of global chief executives, the UK is a more attractive investment proposition than it was before Brexit:

Global CEOs say UK market is more attractive after Brexit

"Britain is a more attractive investment proposition than it was before Brexit according to a survey of 5,000 business leaders across the globe."

https://www.cityam.com/global-chief-executives-say...

Global CEOs say UK market is more attractive after Brexit

"Britain is a more attractive investment proposition than it was before Brexit according to a survey of 5,000 business leaders across the globe."

https://www.cityam.com/global-chief-executives-say...

crankedup said:

Mrr T said:

crankedup said:

Meanwhile an industry area which caused so much angst and consternation earlier this year, shellfish. The waters from which these fish are taken were Grade ‘B’ and thus the shellfish were deemed to be requiring the washing before transportation into the EU areas. Even though the EU had agreed before brexit that those shellfish could be exported live into EU zones.

Happily the waters in question have now been inspected and upgraded to Grade ‘A’ therefore catches from these waters are perfectly good ready for live export. Just waiting now for the EU rubber stamp.

Like many obstacles arising from brexit trade can be resolved for the benefit of everbody.

So for many years British fishermen have been forced to purify muscles and oysters fished in the much of the UK, which costs money, because the UK decided they were caught in class B waters. Happily the waters in question have now been inspected and upgraded to Grade ‘A’ therefore catches from these waters are perfectly good ready for live export. Just waiting now for the EU rubber stamp.

Like many obstacles arising from brexit trade can be resolved for the benefit of everbody.

It now seem the UK government was wrong and they are really class A waters so no purification is required.

That a real win for UK government incompetence.

All the sad faced lamenting week after week about shellfish fishermen thrown to the wolves, another industry doomed thanks to brexit. Another load of daft commentary debunked.

EU customs can test them on import. If the change is found to be unreasonable they would warn the UK who would have to reverse the upgrade. It good to know the UK is taking back control.

Mrr T said:

crankedup said:

Mrr T said:

crankedup said:

Meanwhile an industry area which caused so much angst and consternation earlier this year, shellfish. The waters from which these fish are taken were Grade ‘B’ and thus the shellfish were deemed to be requiring the washing before transportation into the EU areas. Even though the EU had agreed before brexit that those shellfish could be exported live into EU zones.

Happily the waters in question have now been inspected and upgraded to Grade ‘A’ therefore catches from these waters are perfectly good ready for live export. Just waiting now for the EU rubber stamp.

Like many obstacles arising from brexit trade can be resolved for the benefit of everbody.

So for many years British fishermen have been forced to purify muscles and oysters fished in the much of the UK, which costs money, because the UK decided they were caught in class B waters. Happily the waters in question have now been inspected and upgraded to Grade ‘A’ therefore catches from these waters are perfectly good ready for live export. Just waiting now for the EU rubber stamp.

Like many obstacles arising from brexit trade can be resolved for the benefit of everbody.

It now seem the UK government was wrong and they are really class A waters so no purification is required.

That a real win for UK government incompetence.

All the sad faced lamenting week after week about shellfish fishermen thrown to the wolves, another industry doomed thanks to brexit. Another load of daft commentary debunked.

EU customs can test them on import. If the change is found to be unreasonable they would warn the UK who would have to reverse the upgrade. It good to know the UK is taking back control.

Link?

crankedup said:

IF, WARN, IT SEEMS. A bit flimsy that.

Link?

Let's let Mr North explain it.Link?

http://www.eureferendum.com/blogview.aspx?blogno=8...

Mrr T said:

crankedup said:

IF, WARN, IT SEEMS. A bit flimsy that.

Link?

Let's let Mr North explain it.Link?

http://www.eureferendum.com/blogview.aspx?blogno=8...

Seems that the industry has until September to resolve the issue with exports to the EU zone. Some will survive but it seems Mr North is not at all confident that the majority will survive . Casualty of the new trading regulations.

Mrr T said:

So for many years British fishermen have been forced to purify muscles and oysters fished in the much of the UK, which costs money, because the UK decided they were caught in class B waters.

It now seem the UK government was wrong and they are really class A waters so no purification is required.

That a real win for UK government incompetence.

Agree with you...It now seem the UK government was wrong and they are really class A waters so no purification is required.

That a real win for UK government incompetence.

But who grades the waters? The UK govt? The EU?

If this is true, isn't an improvement in bureaucracy (revised grading of waters) a win? Prompted by Brexit

(Yes, yes, could have been done before. But wasn't - laziness, incompetence, protectionism or whatever was causing it sorted).

(Yes, yes, could have been done before. But wasn't - laziness, incompetence, protectionism or whatever was causing it sorted).Murph7355 said:

Mrr T said:

So for many years British fishermen have been forced to purify muscles and oysters fished in the much of the UK, which costs money, because the UK decided they were caught in class B waters.

It now seem the UK government was wrong and they are really class A waters so no purification is required.

That a real win for UK government incompetence.

Agree with you...It now seem the UK government was wrong and they are really class A waters so no purification is required.

That a real win for UK government incompetence.

But who grades the waters? The UK govt? The EU?

If this is true, isn't an improvement in bureaucracy (revised grading of waters) a win? Prompted by Brexit

(Yes, yes, could have been done before. But wasn't - laziness, incompetence, protectionism or whatever was causing it sorted).

(Yes, yes, could have been done before. But wasn't - laziness, incompetence, protectionism or whatever was causing it sorted).Standards are fairly simple to understand. Test to see E. Coli levels, grade accordingly.

Just seems that the impacts weren't examined in advance, nor plans put in place to deal with it. PPPPPPP

M.

turbobloke said:

Latest from the Morgan McKinley Quarterly London Employment Monitor: the finance sector has returned to hiring growth and has retained its GFCI position. Which harks back to this, from last month...according to PWC’s annual survey of global chief executives, the UK is a more attractive investment proposition than it was before Brexit:

Global CEOs say UK market is more attractive after Brexit

"Britain is a more attractive investment proposition than it was before Brexit according to a survey of 5,000 business leaders across the globe."

https://www.cityam.com/global-chief-executives-say...

The PwC link (which you don't bother to find) is here https://www.pwc.co.uk/press-room/press-releases/po...Global CEOs say UK market is more attractive after Brexit

"Britain is a more attractive investment proposition than it was before Brexit according to a survey of 5,000 business leaders across the globe."

https://www.cityam.com/global-chief-executives-say...

This is an annual survey. The "before Brexit" which you quote is after the Brexit referendum, but before the departure of the UK from the EU and before the end of the transition arrangement. It is also before the UK-EU relationship was determined, at Christmas 2020. Infact the PwC survey was last conducted in Autumn 2019, so figures quoted are in comparison to the position in late 2019.

Therefore, Global CEOs say UK market is more attractive after Brexit is only a comparison to 1.5 years ago, where they was the certainty of an impending Brexit, combined with no clarity on the future relationship. It is hardly surprising that the UK is more attractive now than it was then.

Bandit said:

Goldman Sach’s, Remain tubthumpers seem to have added over 600 jobs in the U.K. since the Brexit vote. In fact just last week they announced they were opening a brand new office for an additional 400 finance workers. That location would surely be in the EU right?

Ummmm no, Birmingham actually.

The Goldman Sachs office in Birmingham office is a engineering-technology support office. There are similar GS technology offices in other lower cost cities, including Warsaw and Bangalore. The office is described here as well as on the GS website: https://www.efinancialcareers.co.uk/news/2021/04/g... The staff in Birmingham appear to be a mix of new hires and moves from staff reductions in London. Ummmm no, Birmingham actually.

The big Goldman Sachs moves, with big salaries, appear to be to the European Union, as you can read here:

https://www.efinancialcareers.co.uk/news/2021/01/b...

"It's happening: major U.S banks appear to be strengthening their teams in the European Union after Brexit. Following last week's appointment of Sebastian Mentzen from BNP Paribas as a VP in Morgan Stanley's Frankfurt syndicate desk, it seems other U.S. banks are also strenghtening their presence in the German financial centre. Goldman Sachs hired Tilman Anger from DWS Group as a Frankfurt-based executive director in asset management institutional sales. JPMorgan hired Tanja Moral Santiago from UBS as an executive director in corporate client solutions, and Christine Schmitz from ING as an executive director in corporate client solutions. "

Or if you want a summary of the financial services sector, try this:

https://www.efinancialcareers.co.uk/news/finance/b...

Bank of America moved around 125 staff to Dublin. Its new markets hub in Paris now has around 400 staff.

Barclays has moved 250+ people out of London.

BNP Paribas has moved 250+ people out of London.

Citi is moving 250 people, of whom 150 are going to Frankfurt.

Credit Suisse planned to move its EU-focused investment bankers to Frankfurt post-Brexit, and its salespeople and traders to Madrid.

Deutche Bank, 250 or so people are being moved.

HSBC is moving up to 1,000 people.

JPMorgan is moving 400 to 500 people.

I'm getting bored with writing now, just open up the link for numbers of UK jobs going to the EU.

Meanwhile, a summary of the current winning:

https://edition.cnn.com/2021/04/12/business/brexit...

"We are calling on both the UK and EU to get back around the table and produce solutions that reduce trade barriers and give exporters a fighting chance," British Chambers of Commerce co-executive director Hannah Essex said in a statement on Monday.

"The difficulties exporters are facing are not just 'teething problems.' They are structural issues that, if they continue to go unaddressed, could lead to long term, potentially irreversible weakness in the UK export sector," she added.

Or some design firms moving operations from the UK to the EU

https://www.dezeen.com/2021/04/14/brexit-design-bu...

"Furniture designer Lara Bohinc has set up a business in the Netherlands due to the "untenable costs and hassle" of exporting to the continent.

"The UK is no longer a viable distribution hub," Bohinc told Dezeen.

Designer Peter Marigold is moving the production of his meltable bioplastic FORMcards to Germany, saying that keeping the small-scale business in the UK is "just not viable".

"Best to not have anything even touching the UK"

https://edition.cnn.com/2021/04/12/business/brexit...

"We are calling on both the UK and EU to get back around the table and produce solutions that reduce trade barriers and give exporters a fighting chance," British Chambers of Commerce co-executive director Hannah Essex said in a statement on Monday.

"The difficulties exporters are facing are not just 'teething problems.' They are structural issues that, if they continue to go unaddressed, could lead to long term, potentially irreversible weakness in the UK export sector," she added.

Or some design firms moving operations from the UK to the EU

https://www.dezeen.com/2021/04/14/brexit-design-bu...

"Furniture designer Lara Bohinc has set up a business in the Netherlands due to the "untenable costs and hassle" of exporting to the continent.

"The UK is no longer a viable distribution hub," Bohinc told Dezeen.

Designer Peter Marigold is moving the production of his meltable bioplastic FORMcards to Germany, saying that keeping the small-scale business in the UK is "just not viable".

"Best to not have anything even touching the UK"

sisu said:

Without being inside the EU it is just an island off France.

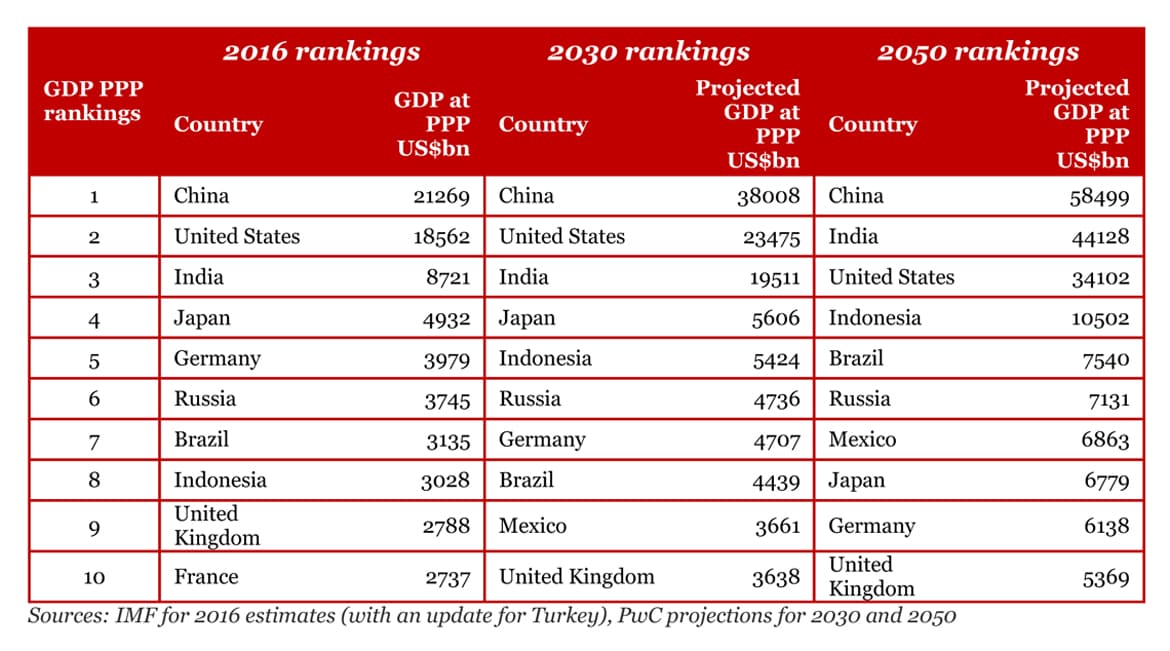

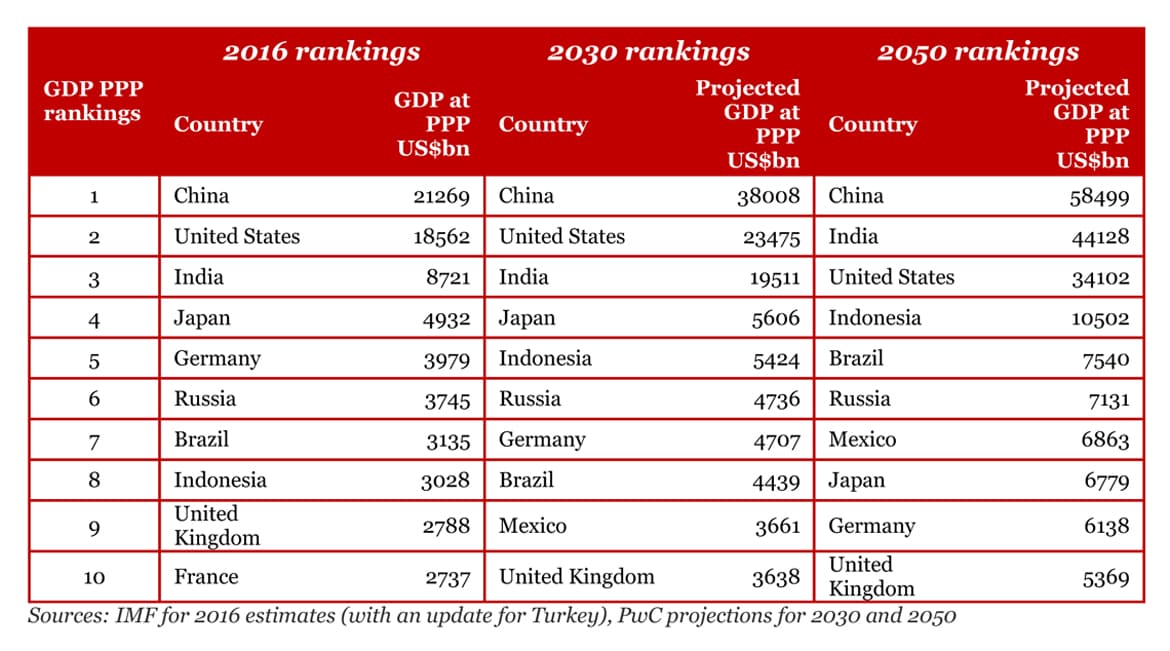

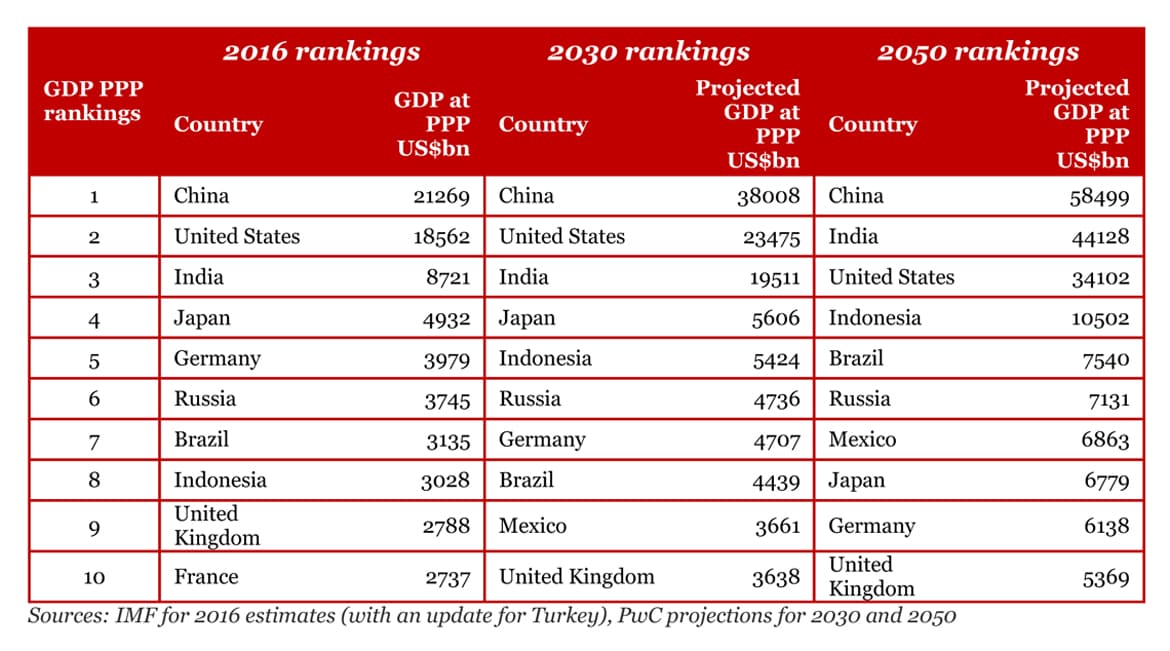

The view according to IMF/PwC rather than sisu has UK looking to be the fastest growing economy in the G7 to 2050, with average annual growth of 1.9%. While the UK is projected to retain its place in the top ten, France isn't, with Italy out of the top 20. The EU27’s share of world GDP is set to decline to below 10% by 2050, down from (iirc) 16% now. Good ol' EU. Forecasts are what they are..it's good to be seen as not in such marked decline.

turbobloke said:

sisu said:

Without being inside the EU it is just an island off France.

The view according to IMF/PwC rather than sisu has UK looking to be the fastest growing economy in the G7 to 2050, with average annual growth of 1.9%. While the UK is projected to retain its place in the top ten, France isn't, with Italy out of the top 20. The EU27’s share of world GDP is set to decline to below 10% by 2050, down from (iirc) 16% now. Good ol' EU. Forecasts are what they are..it's good to be seen as not in such marked decline.

Iminquarantine said:

Bandit said:

Goldman Sach’s, Remain tubthumpers seem to have added over 600 jobs in the U.K. since the Brexit vote. In fact just last week they announced they were opening a brand new office for an additional 400 finance workers. That location would surely be in the EU right?

Ummmm no, Birmingham actually.

The Goldman Sachs office in Birmingham office is a engineering-technology support office. There are similar GS technology offices in other lower cost cities, including Warsaw and Bangalore. The office is described here as well as on the GS website: https://www.efinancialcareers.co.uk/news/2021/04/g... The staff in Birmingham appear to be a mix of new hires and moves from staff reductions in London. Ummmm no, Birmingham actually.

The big Goldman Sachs moves, with big salaries, appear to be to the European Union, as you can read here:

https://www.efinancialcareers.co.uk/news/2021/01/b...

"It's happening: major U.S banks appear to be strengthening their teams in the European Union after Brexit. Following last week's appointment of Sebastian Mentzen from BNP Paribas as a VP in Morgan Stanley's Frankfurt syndicate desk, it seems other U.S. banks are also strenghtening their presence in the German financial centre. Goldman Sachs hired Tilman Anger from DWS Group as a Frankfurt-based executive director in asset management institutional sales. JPMorgan hired Tanja Moral Santiago from UBS as an executive director in corporate client solutions, and Christine Schmitz from ING as an executive director in corporate client solutions. "

Or if you want a summary of the financial services sector, try this:

https://www.efinancialcareers.co.uk/news/finance/b...

Bank of America moved around 125 staff to Dublin. Its new markets hub in Paris now has around 400 staff.

Barclays has moved 250+ people out of London.

BNP Paribas has moved 250+ people out of London.

Citi is moving 250 people, of whom 150 are going to Frankfurt.

Credit Suisse planned to move its EU-focused investment bankers to Frankfurt post-Brexit, and its salespeople and traders to Madrid.

Deutche Bank, 250 or so people are being moved.

HSBC is moving up to 1,000 people.

JPMorgan is moving 400 to 500 people.

I'm getting bored with writing now, just open up the link for numbers of UK jobs going to the EU.

We will shift jobs away from London while bulking up its European presence by “hundreds of people” as it executes on Brexit contingency plans, the chief executive officer of Goldman Sachs International told CNBC on Tuesday.

What actually happened was that they added 600 more U.K. jobs since then and have announced a further 400 new jobs In Birmingham. Call the jobs what you like, they are to support the financial company that is GS.

I remember talk of 100,000’s of financial jobs leaving the U.K. after Brexit. What have you found? Less than 1000 on your list.... lots of “is moving” type statements (I.e. yet to happen).

Face facts, it’s not happening. Small numbers of roles have shifted, other new roles have been created. Your remoan doom mongering hasn’t come to pass, nor will it.

Anyway, I’m bored writing too. Just look at the % of financial jobs moving. It’s all but insignificant and nothing like the end of the world picture painted by hysterical remain types.

TEKNOPUG said:

Only 130 people involved with the ‘discussion workshops’ and they managed to squeeze out an article from it. Hardly authoritive.sisu said:

That just illustrated how fast the emerging markets are predicted to grow. No question about that and the aging and decline of G7 countries which the UK is a part of. If you were Turkish you would be buoyant over the 3.5% predicted growth.

To be fair, given the size of our country and population, I am delighted that we remain top 10 under those forecasts.

If anything it shows how effective we are as an economy.

I also think that China will substantially undershoot in the long term - did you hear that their house prices are twice the income multiple ours are? Scary stuff.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff