Should You Save or Spend?

Discussion

DonkeyApple said:

EddieSteadyGo said:

What antics?

Groak was the biggest proponent of the free money, nothing can go wrong BTL debt pyramid back before the crunch. He argued all day long that it was easy money and everyone was a fool for not copying him. Then he got his debt called in.

Today, despite being a saver and investor and having created his own nice little unleveraged property pension for his current retirement he is off arguing that it’s wrong to save and invest etc etc. And general ranting against the ‘system’.

The fact is that what he is now doing to secure his retirement income is a superb practice. He has the advantage of being at home at that end of the market but he’s running a nice yielding, unleveraged property fund but likes to deny that you should save and invest for the future despite that being exactly what he has done.

He gets triggered by the term ‘pension’ and gets terribly confused thinking this must mean giving all your money to the ‘man’ when in reality it can be anything that delivers an amount of money that can replicate employment income.

It just gets a bit boring once he’s been ‘triggered’.

Welshbeef said:

They don’t tell you  .

.

But let’s work it out

1 you work for 45 years

2. You earn £27k for that whole time

3. Using one of my recent pension statements for defined contribution it worked out to be when I retire that pension would pay out 2% of the pension pots total value.

Therefore £11,250 divided by 2% = £562,500 pension pot required.

Given I’ve asimed £27lk for the whole term that means no inflation and let’s also assume zero growth and zero loss of he pension pot.

Therefore £562,500/45 = £12,500 needed to be saved into a pension a year. Which is 46.2% of your annual salary.

Let’s do it the other way 5% paid in and matched so 10% total paid in, zero returns zero inflation.

The pension pot after 45 years would be £121,500.

So using the same 2% of pension fund value as the annual pension it will give you an annual pension of £2,430

Add in state pension and your looking at £11,180 per year pension if you’ve paid in 10% of a £27k a year pension.

The tax incentives are a huge difference though, and for a matched pension, even just 2% employee, 2% employer - it only costs you £680 in net pay to get £2000 in your pension pot. When we look at what we can 'afford' to put away from our pay for example, we need to look at what net pay we give up versus what we get in return, rather than just what % of pay we are giving up. .

. But let’s work it out

1 you work for 45 years

2. You earn £27k for that whole time

3. Using one of my recent pension statements for defined contribution it worked out to be when I retire that pension would pay out 2% of the pension pots total value.

Therefore £11,250 divided by 2% = £562,500 pension pot required.

Given I’ve asimed £27lk for the whole term that means no inflation and let’s also assume zero growth and zero loss of he pension pot.

Therefore £562,500/45 = £12,500 needed to be saved into a pension a year. Which is 46.2% of your annual salary.

Let’s do it the other way 5% paid in and matched so 10% total paid in, zero returns zero inflation.

The pension pot after 45 years would be £121,500.

So using the same 2% of pension fund value as the annual pension it will give you an annual pension of £2,430

Add in state pension and your looking at £11,180 per year pension if you’ve paid in 10% of a £27k a year pension.

I would also add that 'annuity' pensions (aka, the £2,430 per annum until you die pension you mention above) are quite old school now, and people are looking at building up a cash pot and drawing down off that instead.

When you are 65 years old, you'll probably want/need to have more money than at 85 years old for example. Flatlining a fixed amount per annum is a bit old school for me - I much prefer the idea of a total pot of money, drawing down when need be. It also means when you die, whatever is left in your pension pot goes to family, rather than just disappearing like an annuity pension can. Anyone trading their pension pot for a fixed annual annuity pension (especially at current rates) really need to see a financial advisor to see if that's a good route for them. I'm not a big fan of annuities and they don't represent good value for money in todays current market (in my opinion of course).

Welshbeef said:

Do that seem correct ? Or am I missing something as those numbers look really poor. Imagine someone on half the U.K. average salary and they can only pay in 5% combined it will barely be £60pcm private pension.... honestly what is that really worth?

Apologies if I'm missing a point, but the obvious thing your missing is compounding... 5% increase compounded over that long would get you £17,656 including state pension.

(But your money would be worth less due to inflation)

Greshamst said:

Apologies if I'm missing a point, but the obvious thing your missing is compounding...

5% increase compounded over that long would get you £17,656 including state pension.

(But your money would be worth less due to inflation)

That’s why I stated assumed zero growth and zero inflation. 5% increase compounded over that long would get you £17,656 including state pension.

(But your money would be worth less due to inflation)

Welshbeef said:

Greshamst said:

Apologies if I'm missing a point, but the obvious thing your missing is compounding...

5% increase compounded over that long would get you £17,656 including state pension.

(But your money would be worth less due to inflation)

That’s why I stated assumed zero growth and zero inflation. 5% increase compounded over that long would get you £17,656 including state pension.

(But your money would be worth less due to inflation)

Growth rarely really surpasses inflation with any significance. You need luck.

He tax break is great and the matched contribution is great and the current 25% lump sum tax free is very good.

These 3 things goes in gross matched contributions and 25% tax free lump sum are what makes defined contribution pensions worth while. Growth surpassing real inflation is nigh on impossible.

My own situation

Council tax increased 4.99%

Utilities I go for fixed term well I’ve just renewed after searching the market place long and hard is 23% higher than before

Sky is up 5%

Mobile up too

Passport costs up

Derv has gone from £1.139 to £1.329 per ltr

Beers have rocketed

Food in general has gone up a lot.

So CPI is 3% is an utter fallicy for most people and as such the inflation you suffer is vastly more than “inflation busting growth”.

He tax break is great and the matched contribution is great and the current 25% lump sum tax free is very good.

These 3 things goes in gross matched contributions and 25% tax free lump sum are what makes defined contribution pensions worth while. Growth surpassing real inflation is nigh on impossible.

My own situation

Council tax increased 4.99%

Utilities I go for fixed term well I’ve just renewed after searching the market place long and hard is 23% higher than before

Sky is up 5%

Mobile up too

Passport costs up

Derv has gone from £1.139 to £1.329 per ltr

Beers have rocketed

Food in general has gone up a lot.

So CPI is 3% is an utter fallicy for most people and as such the inflation you suffer is vastly more than “inflation busting growth”.

Welshbeef said:

Growth rarely really surpasses inflation with any significance. You need luck.

He tax break is great and the matched contribution is great and the current 25% lump sum tax free is very good.

These 3 things goes in gross matched contributions and 25% tax free lump sum are what makes defined contribution pensions worth while. Growth surpassing real inflation is nigh on impossible.

My own situation

Council tax increased 4.99%

Utilities I go for fixed term well I’ve just renewed after searching the market place long and hard is 23% higher than before

Sky is up 5%

Mobile up too

Passport costs up

Derv has gone from £1.139 to £1.329 per ltr

Beers have rocketed

Food in general has gone up a lot.

So CPI is 3% is an utter fallicy for most people and as such the inflation you suffer is vastly more than “inflation busting growth”.

Ok, so your 2% gets instantly boosted by getting your income tax back, then another 2% on top from someone else meaning that your £1 has instantly become about £2.20. That doesn’t seem too bad does it. A risk free more than doubling of your money in an instant. Then for most of the time it is invested it will be beating the CPI etc. He tax break is great and the matched contribution is great and the current 25% lump sum tax free is very good.

These 3 things goes in gross matched contributions and 25% tax free lump sum are what makes defined contribution pensions worth while. Growth surpassing real inflation is nigh on impossible.

My own situation

Council tax increased 4.99%

Utilities I go for fixed term well I’ve just renewed after searching the market place long and hard is 23% higher than before

Sky is up 5%

Mobile up too

Passport costs up

Derv has gone from £1.139 to £1.329 per ltr

Beers have rocketed

Food in general has gone up a lot.

So CPI is 3% is an utter fallicy for most people and as such the inflation you suffer is vastly more than “inflation busting growth”.

Now, you talk about your costs going up horribly but you’re a home owner are you not?

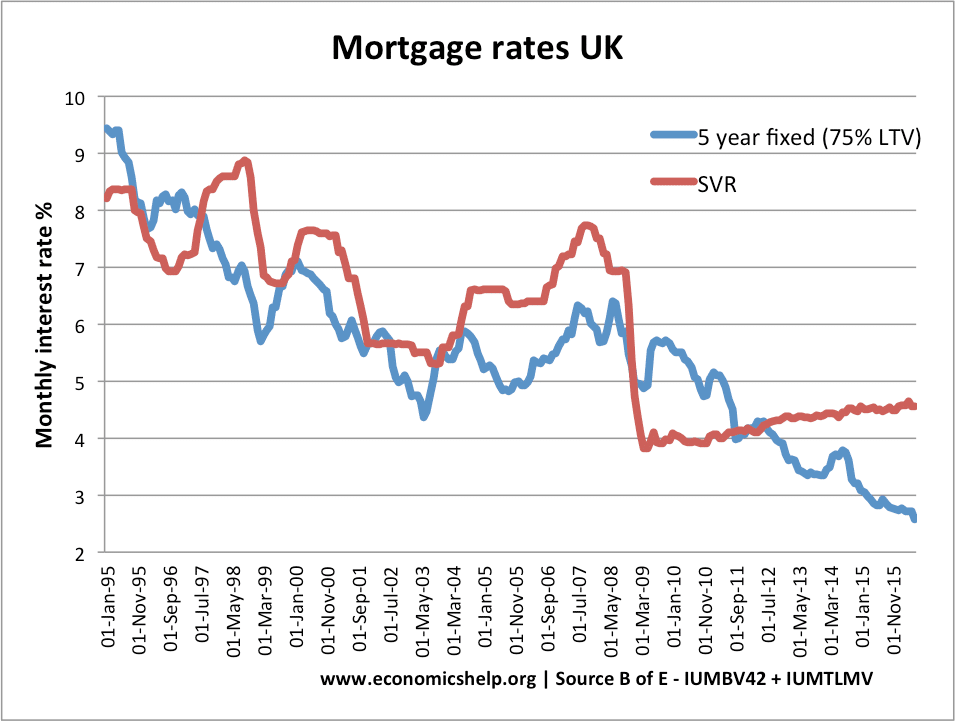

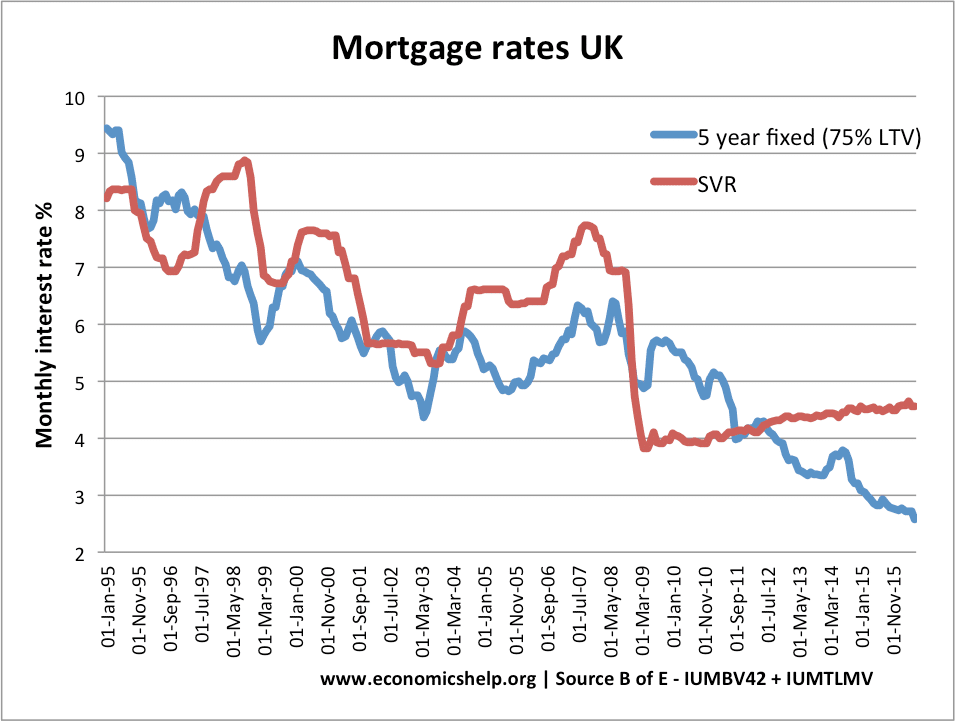

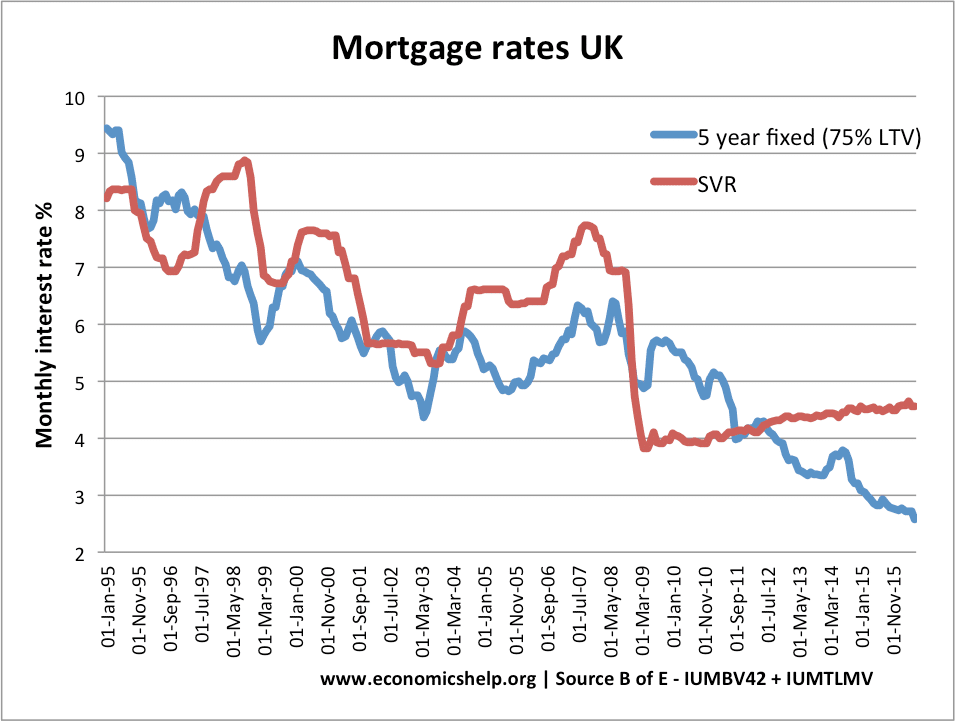

Many people saw the monthly cost of buying their home drop quite dramatically about ten years ago. Pretty deflationary considering the weighting of that cost on your monthly expenditure versus the cost of milk?

And things like Sky, passports and beer are pretty optional as is fuel in many ways as we do ultimately make choice on how much of it our chosen car burns.

The average Briton is immensely wasteful and profligate but does like to complain about the cost of things going up all the time. I’m pretty confident that you could walk into almost any household in the U.K. and show them how to make immense savings on their day to day expenditure.

CPI ignores rent or mortgage

Consumer Price index ie the stuff you buy.

I’ve been on a variable offset from 2009 to date (we moved here in 2009). So it’s dropped and gone up the same value so to me mortgage has been indifferent.

Yes when I bought houses in the 1990’s and 2000’s I was paying 3-7% from memory BUT the key thing was the value of the property was vastly lower so in £ terms I’m actually paying less now on a house worth multiples of my first house (ignoring my aggressive overpayment position).

Note I’m playing devils advocate.

I’ve had a pension from the day I turned 18yo.

I’ve tried to max out peps tessas and ISAs every year

I’ve done well out of buy to let’s over a period of 25 years and counting

I’d like to pay more into the pension but the last few years I’ve been draining he cash hard on stuff (investing in our home and. Having 3 kids mean costs escalate notably).

Consumer Price index ie the stuff you buy.

I’ve been on a variable offset from 2009 to date (we moved here in 2009). So it’s dropped and gone up the same value so to me mortgage has been indifferent.

Yes when I bought houses in the 1990’s and 2000’s I was paying 3-7% from memory BUT the key thing was the value of the property was vastly lower so in £ terms I’m actually paying less now on a house worth multiples of my first house (ignoring my aggressive overpayment position).

Note I’m playing devils advocate.

I’ve had a pension from the day I turned 18yo.

I’ve tried to max out peps tessas and ISAs every year

I’ve done well out of buy to let’s over a period of 25 years and counting

I’d like to pay more into the pension but the last few years I’ve been draining he cash hard on stuff (investing in our home and. Having 3 kids mean costs escalate notably).

Welshbeef said:

CPI ignores rent or mortgage

Consumer Price index ie the stuff you buy.

Correct. And how much of the stuff in the CPI do you need to buy? What’s essential? Consumer Price index ie the stuff you buy.

The point is that one of the largest monthly costs for the average Briton whonis a home owner has fallen dramatically in the last decade. An awful lot of other things have to go up an awful lot for your actual cost of living to have risen. Inflation, within reason is quite a personal number.

I don’t really buy much, when I do, I usually buy used. Old cars, old furniture etc. I work quite hard to not pay VAT. As a household, the majority of things that we buy will hold their value. We don’t own many of the goods that comprise either the RPI or the CPI, certainly no new. Neither are really indicative of my household.

The fact is that an awful lot of people have gotten into the habit of buying things they just don’t need with money they haven’t earned yet and also a lot of excess tax but then claim they don’t earn enough to save anything for the time when they can’t earn income from work. In reality they do earn more than enough to save more than enough for the future but they are making the personal choice not to do so. Which is fine but they don’t have the right to complain that they haven’t enough money afterwards.

L

DonkeyApple said:

Ok, so your 2% gets instantly boosted by getting your income tax back, then another 2% on top from someone else meaning that your £1 has instantly become about £2.20. That doesn’t seem too bad does it. A risk free more than doubling of your money in an instant. Then for most of the time it is invested it will be beating the CPI etc.

Now, you talk about your costs going up horribly but you’re a home owner are you not?

Many people saw the monthly cost of buying their home drop quite dramatically about ten years ago. Pretty deflationary considering the weighting of that cost on your monthly expenditure versus the cost of milk?

And things like Sky, passports and beer are pretty optional as is fuel in many ways as we do ultimately make choice on how much of it our chosen car burns.

The average Briton is immensely wasteful and profligate but does like to complain about the cost of things going up all the time. I’m pretty confident that you could walk into almost any household in the U.K. and show them how to make immense savings on their day to day expenditure.

When the cost of mortgages dropped people used this as a time to pay down their dept and we now after a decade we have a country with almost no personal debt! Now, you talk about your costs going up horribly but you’re a home owner are you not?

Many people saw the monthly cost of buying their home drop quite dramatically about ten years ago. Pretty deflationary considering the weighting of that cost on your monthly expenditure versus the cost of milk?

And things like Sky, passports and beer are pretty optional as is fuel in many ways as we do ultimately make choice on how much of it our chosen car burns.

The average Briton is immensely wasteful and profligate but does like to complain about the cost of things going up all the time. I’m pretty confident that you could walk into almost any household in the U.K. and show them how to make immense savings on their day to day expenditure.

DonkeyApple said:

Camelot1971 said:

DonkeyApple said:

Savers aren’t people who want to be buried in a gold lined coffin but people who don’t want to spend 20 years sitting in urine being beaten by their State carers.

What makes you think that someone who doesn't like or want to spend money during the working part of their life would suddenly want to spend money when they are retired?

My grandparents had money - not loads but enough to leave £100k each to their 4 daughters. They didn't want to spend any of it "just in case" and while it was nice my mum had some money I really wish they would have travelled or just done something with it while they were alive.

Having a pension that gives you the life that you want when you retire is sensible. Having 6 months or a years salary in savings is sensible. Having 10's of thousands in the bank with no desire to spend and a great desire to have more is, to me, just a complete waste.

But you’re still not quite getting the point. You need to save a proportion of the money that your employers give you if you wish to synthesise a similar lifestyle laternon when employers cease to need or want your services. It sounds like you are thinking that this would be the same amount of money but obviously to maintain the standard of living it is less. You won’t have a mortgage to pay, you won’t have children to feed and clothe and you won’t be co tributing to your pension or savings.

What you are also forgetting is that you do not know when or how you or your partner are going to die. What a saver will do is naturally cover that uncertainty. What spenders will do is just hope that someone else will pay for any of life’s uncertainties. One is self sufficient while the other is reliant ultimately on charity and welfare.

If you don’t know when you are going to die or whether it will be a nice death collapsing in the roses or a horrible lingering death where you will spend every penny that you have trying to make it as humane as possible for your life partner then you cannot time it that you will have died the same moment as you spent your last pound.

Now, if someone is a saver then why on earth would you expect someone with that mentality to every plan or gamble to run out of income before dying? Not ever going to happen. That’s a soender’s Thought process, the whole ‘Gay Disco’ thing of spend fast die young. No, the saver will obviously inevitably die leaving excess wealth by the very nature of being a saver and the fact that your end date and end style is an unknown. And what’s the actual downside? Your excess money becomes a little freebie to the people you love the most and will do anything to help along.

I'm not sure that they received much joy from having that money though. They were more worried about the "just in case" for them (which is fine) rather than saving every penny to hand to their children. My mum was always telling them to spend it on themselves - live a little, travel, do things! Live is about experiences as much as tangible objects.

I agree, in the end, there is no downside of leaving money, as such. But there is a downside for the person leaving it if they get to later in life and wished they had done things they now can't do.

I don't agree with live fast, die young. I do agree with live your life to the full. You only get one.

DonkeyApple said:

Correct. And how much of the stuff in the CPI do you need to buy? What’s essential?

The point is that one of the largest monthly costs for the average Briton whonis a home owner has fallen dramatically in the last decade. An awful lot of other things have to go up an awful lot for your actual cost of living to have risen. Inflation, within reason is quite a personal number.

I don’t really buy much, when I do, I usually buy used. Old cars, old furniture etc. I work quite hard to not pay VAT. As a household, the majority of things that we buy will hold their value. We don’t own many of the goods that comprise either the RPI or the CPI, certainly no new. Neither are really indicative of my household.

The fact is that an awful lot of people have gotten into the habit of buying things they just don’t need with money they haven’t earned yet and also a lot of excess tax but then claim they don’t earn enough to save anything for the time when they can’t earn income from work. In reality they do earn more than enough to save more than enough for the future but they are making the personal choice not to do so. Which is fine but they don’t have the right to complain that they haven’t enough money afterwards.

L

I don’t work for the fun of it I work to enable me to do the basics and then some nice things on top. The point is that one of the largest monthly costs for the average Briton whonis a home owner has fallen dramatically in the last decade. An awful lot of other things have to go up an awful lot for your actual cost of living to have risen. Inflation, within reason is quite a personal number.

I don’t really buy much, when I do, I usually buy used. Old cars, old furniture etc. I work quite hard to not pay VAT. As a household, the majority of things that we buy will hold their value. We don’t own many of the goods that comprise either the RPI or the CPI, certainly no new. Neither are really indicative of my household.

The fact is that an awful lot of people have gotten into the habit of buying things they just don’t need with money they haven’t earned yet and also a lot of excess tax but then claim they don’t earn enough to save anything for the time when they can’t earn income from work. In reality they do earn more than enough to save more than enough for the future but they are making the personal choice not to do so. Which is fine but they don’t have the right to complain that they haven’t enough money afterwards.

L

I’ve wanted a new snazzy TV for ages but guess what our 2x TVs are 9 years and counting neither are smart TVs.

We run an 11 year old S Max and a 8 year old F10 535d - I could go out and buy a lovely M5 should I wish but I don’t as I’m compromising.

We go on 3 holidays a year one in the U.K. for a week one in the end for 2 weeks in Aug and skiing for a week as that’s what we love to do plus you cannot elect to do that at an older age as frankly it’s not an old persons sport so only x more years skiing and were done.

I run a 18 year old second hand mower and limp it along I want a new Honda but don’t pull the trigger.

As we’ve 3 kids going out for meals doesn’t happen that often as it’s painful so we have “date nights” at home and go to town on top infredients and a nice bottle of wine or two.

Never go to the cinema - last time I went was Lord of the rings return of the king as such we have sky movies and use it so much it’s really cracking value.

Benefit of 3 kids is you can reuse some clothes where possible.

So we don’t live extravagantly when we could we take sensible choices which were both happy with the compromise (or not) that is offers.

So no Donkey our doscretional spend isn’t crazy and easy to slash. There is a bit otherwise you’d simply be in the house or the office - yes we go for walks but zoo visits air shows fireworks rugby games ballet swimming and other kids hobbies are not free.

Welcome for your input on these specific points

EddieSteadyGo said:

Ah... I found a different article which referred to business relationships of a darker kind. Anyway, it's none of my business. From the newspaper reports though he is a millionaire , which actually is great for him. But is does mean that his retirement income is probably a little more comfortable than the average Joe might expect.

Come now! "MULTI-millionaire" is, I believe, the term the article uses..... let's at least get things accurate! joyless lobotomised parrot said:

EddieSteadyGo said:

Ah... I found a different article which referred to business relationships of a darker kind. Anyway, it's none of my business. From the newspaper reports though he is a millionaire , which actually is great for him. But is does mean that his retirement income is probably a little more comfortable than the average Joe might expect.

Come now! "MULTI-millionaire" is, I believe, the term the article uses..... let's at least get things accurate!

swerni said:

red_slr said:

Venturist said:

I just don’t see that day ever coming in the sense that the generation before me seem to be obsessed with.

Wait till you have been working 30 years and come back to me LOL.I've had the last three months off and while it's be enjoyable, I'm now looking forward to going back to work.

Note 'my current manager'... he was bored stupid within 3 months, persevered for another 3 trying out various hobbies (Some rather expensive) but nothing provided him with anywhere near as much satisfaction and fulfillment than running a sales organization for a software company (his history).

Camelot1971 said:

I appreciate your thoughts.

I'm not sure that they received much joy from having that money though. They were more worried about the "just in case" for them (which is fine) rather than saving every penny to hand to their children. My mum was always telling them to spend it on themselves - live a little, travel, do things! Live is about experiences as much as tangible objects.

I agree, in the end, there is no downside of leaving money, as such. But there is a downside for the person leaving it if they get to later in life and wished they had done things they now can't do.

I don't agree with live fast, die young. I do agree with live your life to the full. You only get one.

I won't quote all the exchange but I am enjoying the views on this thread. Nicely balanced and as always DonkeyApple's views mirror my own, only far more reasoned and interjected with some side issues I hadn't even considered to further enforce my views. Either way, a good read on all sides.I'm not sure that they received much joy from having that money though. They were more worried about the "just in case" for them (which is fine) rather than saving every penny to hand to their children. My mum was always telling them to spend it on themselves - live a little, travel, do things! Live is about experiences as much as tangible objects.

I agree, in the end, there is no downside of leaving money, as such. But there is a downside for the person leaving it if they get to later in life and wished they had done things they now can't do.

I don't agree with live fast, die young. I do agree with live your life to the full. You only get one.

As to the points you raise in your repost above, I am minded to agree with you about what a shame such a situation is. I agree about finding the balance and the other thing that has struck me about my own parents is just how hard it is to "live" properly when you start creeping along in age.

It's all well and good in avoiding urine infested care homes and enjoying a better view at a mature age, but what I have witnessed as my dad closes on his mid-80s is just how little he can in fact do. He is thankfully in good health, but there are many things beyond his reach for various reasons. Health insurance for those far flung holidays is now nearly impossible unless he does it as part of a cruise. Forget the USA and Canada for that reason.

Even car insurance is obstructively expensive. His dream car was an Aston Martin and back in his 70's he considered one but the insurance cost was prohibitive. You could argue that if you can afford an Aston you can throw £3k+ on insurance, but there was no chance he would have done so even if he could have afforded it.

It is unclear how long he will even have his licence, in which case any desire of a dream car are gone for good. His dream home, quiet and rural, becomes impossible on the back of an inability to get about independently. His desire to play golf every day of the week is thwarted by his tiredness. Yes, he will be able to have a luxurious flat/care home with a wonderful view, but he delayed gratification too long IMO.

Same as most things in life, it is a matter of balance. We see the extremities and they often form examples one can point to at either end of the spectrum as they present the most valid point. The one thing I try and do now is weigh up where I am aiming and what I want from my life and how to plan for that almost daily, rather than let myself drift along a path spending without thinking or with the view of living each day as though it were my last. Time will tell if I have got the equation right (or at least broadly right).

EddieSteadyGo said:

joyless lobotomised parrot said:

EddieSteadyGo said:

Ah... I found a different article which referred to business relationships of a darker kind. Anyway, it's none of my business. From the newspaper reports though he is a millionaire , which actually is great for him. But is does mean that his retirement income is probably a little more comfortable than the average Joe might expect.

Come now! "MULTI-millionaire" is, I believe, the term the article uses..... let's at least get things accurate!

Croutons said:

EddieSteadyGo said:

joyless lobotomised parrot said:

EddieSteadyGo said:

Ah... I found a different article which referred to business relationships of a darker kind. Anyway, it's none of my business. From the newspaper reports though he is a millionaire , which actually is great for him. But is does mean that his retirement income is probably a little more comfortable than the average Joe might expect.

Come now! "MULTI-millionaire" is, I believe, the term the article uses..... let's at least get things accurate!

There are also complicated issues of defamation which can reach to people spreading or encouraging the spread of defamatory articles. Got a feeling you don't have the cojones for that.

But if you really do have a genuine interest in the matter I'll be happy to give you the gist, 'tho' I can't think why you'd be interested in hearing that I "have links" and a good relationship (tho' not criminal association) with people who are (allegedly) prominent local gangsters ? Who doesn't?

Gassing Station | Finance | Top of Page | What's New | My Stuff