How much disposable income are you comfortable investing?

Discussion

Initially I was going to phrase this as "How much of my disposable income should I invest into Vanguard LS100?"

But I've been around here long enough now to know that it'll only be met by the usual (rightly so) responses...

So, I'm 24, a higher rate tax payer who is already maximising company pension contributions (5% employee / 10% employer - I don't have the option to up my personal contributions), recently become a home owner, no finance/debts and ~6 months expenditure saved for the worst case scenario. So, as far as I'm concerned, I have nothing left to save for other than later in life and a manual M2

I saved for my house deposit via a S&S LISA so I'm familiar with investments and the risk they carry... So, I've just opened a S&S ISA with Vanguard directly with the intention to invest £250 per month in their LS100 offering. Great. But, after bills, travel expenses and some frivolity I have £1.2k to play with, so £250 feels is feeble, or is it?

For some reason, I think due to being a new home owner and the increased bills/responsibility has made me slightly risk averse, or at least makes me want to be able to see/access my money readily... But on the flip side, I know that I can easily sell my funds and withdraw from the S&S ISA wrapper whenever I want to, of course it may be subject to market volatility but still... It's definitely a psychological thing. Not to mention all of my money is sat in a Santander 123 account paying a measly 1.5%, soon to be 1% when I know from experience funds can provide multiples of that.

Basically, how much of your disposable income are you comfortable investing?

But I've been around here long enough now to know that it'll only be met by the usual (rightly so) responses...

So, I'm 24, a higher rate tax payer who is already maximising company pension contributions (5% employee / 10% employer - I don't have the option to up my personal contributions), recently become a home owner, no finance/debts and ~6 months expenditure saved for the worst case scenario. So, as far as I'm concerned, I have nothing left to save for other than later in life and a manual M2

I saved for my house deposit via a S&S LISA so I'm familiar with investments and the risk they carry... So, I've just opened a S&S ISA with Vanguard directly with the intention to invest £250 per month in their LS100 offering. Great. But, after bills, travel expenses and some frivolity I have £1.2k to play with, so £250 feels is feeble, or is it?

For some reason, I think due to being a new home owner and the increased bills/responsibility has made me slightly risk averse, or at least makes me want to be able to see/access my money readily... But on the flip side, I know that I can easily sell my funds and withdraw from the S&S ISA wrapper whenever I want to, of course it may be subject to market volatility but still... It's definitely a psychological thing. Not to mention all of my money is sat in a Santander 123 account paying a measly 1.5%, soon to be 1% when I know from experience funds can provide multiples of that.

Basically, how much of your disposable income are you comfortable investing?

Edited by 95JO on Monday 20th January 15:52

I'm also 24, low rate (20%) tax payer and I have a mortgage of £600p/m. I invest £300 pm into S&S ISA, 5% pension. my take home is probably about 1700 net. I drive a s tty old 2007 diesel Skoda and spend about £25 a week on food/ drink so hardly living the high life but still managing to save a decent wedge.

tty old 2007 diesel Skoda and spend about £25 a week on food/ drink so hardly living the high life but still managing to save a decent wedge.

tty old 2007 diesel Skoda and spend about £25 a week on food/ drink so hardly living the high life but still managing to save a decent wedge.

tty old 2007 diesel Skoda and spend about £25 a week on food/ drink so hardly living the high life but still managing to save a decent wedge. Drezza said:

I'm also 24, low rate (20%) tax payer and I have a mortgage of £600p/m. I invest £300 pm into S&S ISA, 5% pension. my take home is probably about 1700 net. I drive a s tty old 2007 diesel Skoda and spend about £25 a week on food/ drink so hardly living the high life but still managing to save a decent wedge.

tty old 2007 diesel Skoda and spend about £25 a week on food/ drink so hardly living the high life but still managing to save a decent wedge.

Nice, just to be clear, the £250 isn't all I'm saving - The remaining £1k or so just gets lumped in to the Santander 123, doing nothing! tty old 2007 diesel Skoda and spend about £25 a week on food/ drink so hardly living the high life but still managing to save a decent wedge.

tty old 2007 diesel Skoda and spend about £25 a week on food/ drink so hardly living the high life but still managing to save a decent wedge. 95JO said:

I enquired about it and was told that this is not something they can offer currently - I don't know why.

Is this something I could do myself via a tax return or similar?

Fair enough. Yeah why not, start a SIPP and get the 40% relief. Of course that money wouldn’t be accessible for over 3 decades so that might not be an attractive prospect to someone as young as you.Is this something I could do myself via a tax return or similar?

djc206 said:

Fair enough. Yeah why not, start a SIPP and get the 40% relief. Of course that money wouldn’t be accessible for over 3 decades so that might not be an attractive prospect to someone as young as you.

Probably the best thing I could do in terms of return, but like you said, I don't want to wait 30+ years really!95JO said:

So, I'm 24, a higher rate tax payer who is already maximising company pension contributions (5% employee / 10% employer - I don't have the option to up my personal contributions)

Are you saying you have maxed out your pension contributions? Have you any allowance left over you could put in a SIPP/PP? Any allowance left over from the past three years?95JO said:

I saved for my house deposit via a S&S LISA so I'm familiar with investments and the risk they carry... So, I've just opened a S&S ISA with Vanguard directly with the intention to invest £250 per month in their LS100 offering. Great. But, after bills, travel expenses and some frivolity I have £1.2k to play with, so £250 feels is feeble, or is it?

Yes it might well be as you're only putting in £3000 out of the £20,000 annual allowance. As you say it's not locked away so I'd at least double or triple it. You've still got money to play with but if you've invested it you won't waste it.95JO said:

For some reason, I think due to being a new home owner and the increased bills/responsibility has made me slightly risk averse, or at least makes me want to be able to see/access my money readily... But on the flip side, I can easily sell my funds and withdraw from the S&S ISA wrapper whenever I want to, of course it may be subject to market volatility but still... It's definitely a psychological thing. Not to mention my brain is telling me to stop storing all of my money in a Santander 123 account paying a measly 1.5%, soon to be 1% when I know from experience funds can provide multiples of that.

Keep an amount (£10k) in cash & shove the rest into your ISA. Even Vanguard LS40 (lowish risk level) was up by 13% over the last 12 months.Time is the key; you need to have it invested so the magic of compound interest can take place. Save really hard now & you can retire early.

95JO said:

djc206 said:

Fair enough. Yeah why not, start a SIPP and get the 40% relief. Of course that money wouldn’t be accessible for over 3 decades so that might not be an attractive prospect to someone as young as you.

Probably the best thing I could do in terms of return, but like you said, I don't want to wait 30+ years really!Have a look through the IM sticky at the top of this forum.

I tend to try to "ladder" things a little.

So:

So:

- Cash

- Savings

- NS&I Bonds

- Cautious and "wealth preservation" funds where I'm happy storing a lot as it's not going to tank overnight

- 100% normal equities

- 100% racier equities

b hstewie said:

hstewie said:

hstewie said:

hstewie said: I tend to try to "ladder" things a little.

So:

What's the difference between 'Cash' & 'Savings'?So:

- Cash

- Savings

- NS&I Bonds

- Cautious and "wealth preservation" funds where I'm happy storing a lot as it's not going to tank overnight

- 100% normal equities

- 100% racier equities

Mr Pointy said:

Are you saying you have maxed out your pension contributions? Have you any allowance left over you could put in a SIPP/PP? Any allowance left over from the past three years?

No, I’m paying in the maximum my employer allows me to, as mentioned above, I could utilise a SIPP and reclaim the Government bonus. But if I’m being honest, I don’t fancy locking away more money that I can’t access for 30+ years. However, I appreciate this is almost definitely the best thing to do (financially).Mr Pointy said:

Yes it might well be as you're only putting in £3000 out of the £20,000 annual allowance. As you say it's not locked away so I'd at least double or triple it. You've still got money to play with but if you've invested it you won't waste it.

That’s what I thought - I definitely won’t be able to max out my annual allowance any time soon but after some more thought on the commute home, I think £500 per month is definitely a step in the right direction.Mr Pointy said:

Keep an amount (£10k) in cash & shove the rest into your ISA. Even Vanguard LS40 (lowish risk level) was up by 13% over the last 12 months.

Time is the key; you need to have it invested so the magic of compound interest can take place. Save really hard now & you can retire early.

I’ve got £8k in cash, so I’ll allow that to build over a few months and start the process of lumping into the LS100. Time is the key; you need to have it invested so the magic of compound interest can take place. Save really hard now & you can retire early.

re: LS40 - Indeed, I was shocked by that when browsing earlier. My Dad is looking to do similar, however he’s closer to taking his pension so I’ll be pointing him in that direction!

I’ve already had a glimpse of what that S&S investments can return after seeing a 30% gain over 2 years of holding a couple of funds... Maybe that was beginners luck though

But yes, that’s the plan, I’d like to retire/semi-retire in my early 50’s - We’ll see!

Thanks for the reply,

b hstewie said:

hstewie said:

hstewie said:

hstewie said: I tend to try to "ladder" things a little.

So:

Makes sense, I’d like to diversify in the future. However, at the minute I don’t have much to diversify since putting down the deposit for my house. So:

- Cash

- Savings

- NS&I Bonds

- Cautious and "wealth preservation" funds where I'm happy storing a lot as it's not going to tank overnight

- 100% normal equities

- 100% racier equities

As mentioned above, £8k in cash, decent pensions (mix of Civil Service and Aviva managed fund) and roughly £17k in my car. However, now the big ticket item is done (house deposit), I want to put that ~£1.2kpm to the best possible use, without locking it away until I’m 55+

So, I think I’ll diversify once I have north of £50k in cash/investments. I’ve read elsewhere to not bother until north of £100k!

But thanks for the reply, definitely an approach I will adopt in due course.

Trust me on this, at 24 if you are able to invest that kind of money (>£1k a month) then go for it.

Most people at 24 who have >£1k/mo disposable income are trying to work out how best (or not) to spend it, not save it.

The next 20 years are going to be gone in a blink.

So pick a decent ISA fund (seems like you already found VLS) and just fire and forget.

If something changes in your circs then you can always stop the payments, or decrease or of course increase.

As for SIPP, that's a decision only you can make. Personally for me a SIPP was not the right vehicle, but that's the route I went down. So I ended up mid 30s realising I had spent 15 years paying into a pension I probably couldn't access when I wanted too. It was 50 when I started my pension, then went to 55 and now it looks like it will be 58 or maybe even more.

It shows life changes, and the rules change. Back then I was naïve and thought that these things were set in stone but they are not. You need to be able to adapt and change course quickly and for me at least the SIPP was no good for that.

I still have a SIPP and pay into it each month, but at a much reduced rate, surplus going into my ISA.

Most people at 24 who have >£1k/mo disposable income are trying to work out how best (or not) to spend it, not save it.

The next 20 years are going to be gone in a blink.

So pick a decent ISA fund (seems like you already found VLS) and just fire and forget.

If something changes in your circs then you can always stop the payments, or decrease or of course increase.

As for SIPP, that's a decision only you can make. Personally for me a SIPP was not the right vehicle, but that's the route I went down. So I ended up mid 30s realising I had spent 15 years paying into a pension I probably couldn't access when I wanted too. It was 50 when I started my pension, then went to 55 and now it looks like it will be 58 or maybe even more.

It shows life changes, and the rules change. Back then I was naïve and thought that these things were set in stone but they are not. You need to be able to adapt and change course quickly and for me at least the SIPP was no good for that.

I still have a SIPP and pay into it each month, but at a much reduced rate, surplus going into my ISA.

95JO said:

Makes sense, I’d like to diversify in the future. However, at the minute I don’t have much to diversify since putting down the deposit for my house.

As mentioned above, £8k in cash, decent pensions (mix of Civil Service and Aviva managed fund) and roughly £17k in my car. However, now the big ticket item is done (house deposit), I want to put that ~£1.2kpm to the best possible use, without locking it away until I’m 55+

So, I think I’ll diversify once I have north of £50k in cash/investments. I’ve read elsewhere to not bother until north of £100k!

But thanks for the reply, definitely an approach I will adopt in due course.

I'd also add try and make sure you understand your own psychology As mentioned above, £8k in cash, decent pensions (mix of Civil Service and Aviva managed fund) and roughly £17k in my car. However, now the big ticket item is done (house deposit), I want to put that ~£1.2kpm to the best possible use, without locking it away until I’m 55+

So, I think I’ll diversify once I have north of £50k in cash/investments. I’ve read elsewhere to not bother until north of £100k!

But thanks for the reply, definitely an approach I will adopt in due course.

You've mentioned a few times about making money.

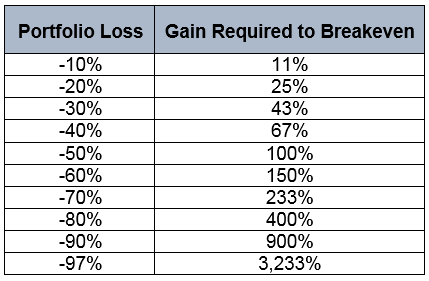

Make sure you understand how you'd react when your investments lose money.

You feel losses more than gains and the last decade hasn't been normal compared to historical stock markets.

That probably sounds doom and gloom when I think it's just something to keep in mind but with the caveat that I bloody wish I'd started investing when I was 24.

mike9009 said:

All good advice above.

I would also look at overpaying the mortgage too. As you probably know, the compound interest payments get quite large over the mortgage term.......

It is cheap money at the moment but over the lifetime of the mortgage things might well change.

Mike

I’m surprised this didn’t come up sooner as I failed to mention that I’ve considered it.I would also look at overpaying the mortgage too. As you probably know, the compound interest payments get quite large over the mortgage term.......

It is cheap money at the moment but over the lifetime of the mortgage things might well change.

Mike

I’ve discussed with my OH and we’ve agreed to look in to it come remortgage time (4.5 years)... As you mention, interest rates are very low so we’re taking advantage of it currently.

Gassing Station | Finance | Top of Page | What's New | My Stuff