How much disposable income are you comfortable investing?

Discussion

red_slr said:

Trust me on this, at 24 if you are able to invest that kind of money (>£1k a month) then go for it.

Most people at 24 who have >£1k/mo disposable income are trying to work out how best (or not) to spend it, not save it.

The next 20 years are going to be gone in a blink.

So pick a decent ISA fund (seems like you already found VLS) and just fire and forget.

If something changes in your circs then you can always stop the payments, or decrease or of course increase.

As for SIPP, that's a decision only you can make. Personally for me a SIPP was not the right vehicle, but that's the route I went down. So I ended up mid 30s realising I had spent 15 years paying into a pension I probably couldn't access when I wanted too. It was 50 when I started my pension, then went to 55 and now it looks like it will be 58 or maybe even more.

It shows life changes, and the rules change. Back then I was naïve and thought that these things were set in stone but they are not. You need to be able to adapt and change course quickly and for me at least the SIPP was no good for that.

I still have a SIPP and pay into it each month, but at a much reduced rate, surplus going into my ISA.

Thanks for the reply red_slrMost people at 24 who have >£1k/mo disposable income are trying to work out how best (or not) to spend it, not save it.

The next 20 years are going to be gone in a blink.

So pick a decent ISA fund (seems like you already found VLS) and just fire and forget.

If something changes in your circs then you can always stop the payments, or decrease or of course increase.

As for SIPP, that's a decision only you can make. Personally for me a SIPP was not the right vehicle, but that's the route I went down. So I ended up mid 30s realising I had spent 15 years paying into a pension I probably couldn't access when I wanted too. It was 50 when I started my pension, then went to 55 and now it looks like it will be 58 or maybe even more.

It shows life changes, and the rules change. Back then I was naïve and thought that these things were set in stone but they are not. You need to be able to adapt and change course quickly and for me at least the SIPP was no good for that.

I still have a SIPP and pay into it each month, but at a much reduced rate, surplus going into my ISA.

I’m very conscious that I’m in a fortunate position at my age and I’m always actively trying to be conservative with my money, rather than financing an M2 or similar, despite my friends/family’s encouragement

You make a good point in regards to the pension age rising further, one that I hadn’t really given much thought. I was more concerned with not being able to access it for 30+ years, never mind any more!

I think a SIPP is something I’ll look in to if ever I’m in a position where I can max my ISA contributions.

b hstewie said:

hstewie said:

hstewie said:

hstewie said: I'd also add try and make sure you understand your own psychology

You've mentioned a few times about making money.

Make sure you understand how you'd react when your investments lose money.

You feel losses more than gains and the last decade hasn't been normal compared to historical stock markets.

That probably sounds doom and gloom when I think it's just something to keep in mind but with the caveat that I bloody wish I'd started investing when I was 24.

Of course, I appreciate that my investments may decrease in value over the coming years and I’d like to think I’m prepared for that. However, in my short exposure (~2 years), I have been fortunate enough not to experience a down turn...

You've mentioned a few times about making money.

Make sure you understand how you'd react when your investments lose money.

You feel losses more than gains and the last decade hasn't been normal compared to historical stock markets.

That probably sounds doom and gloom when I think it's just something to keep in mind but with the caveat that I bloody wish I'd started investing when I was 24.

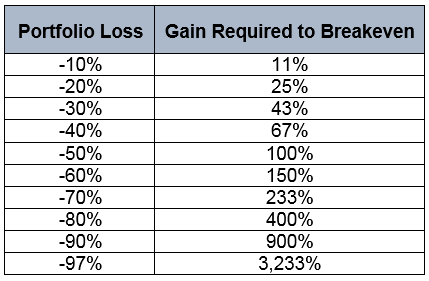

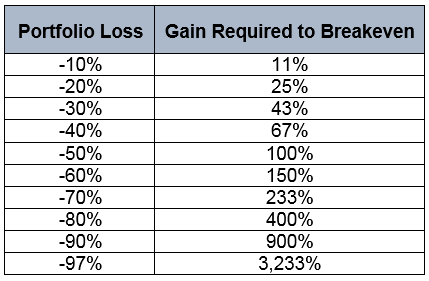

So that visual representation is hard viewing! Hopefully my circumstances don’t drastically change for the worse and I can ride out any down turns.

Out of curiosity, if you were saving for a car - Would you build those savings in a current/savings account or within your investment? (Assuming the new car purchase isn’t essential, meaning some exposure to risk is available - Have I answered my own question?)

b hstewie said:

hstewie said:

I remember trying to tell that to various ex-IFAs, but if they understood it they never showed it. But then, they sell the spades while the clients prospect. hstewie said:

hstewie said:95JO said:

Out of curiosity, if you were saving for a car - Would you build those savings in a current/savings account or within your investment? (Assuming the new car purchase isn’t essential, meaning some exposure to risk is available - Have I answered my own question?)

'Saving for a new car' is a financial oxymoron to me - if you really mean 'new' car. If you get to the point where you can afford it you may be too sensible to buy it!Edited by Simpo Two on Monday 20th January 20:55

Simpo Two said:

'Saving for a new car' is a financial oxymoron to me - if you really mean 'new' car. If you get to the point where you can afford it you may be too sensible to buy it!

By new car, I mean new to me - I always tend to by lightly used (1-3 years old) Edited by Simpo Two on Monday 20th January 20:55

But alas, this is PH after all!

MiseryStreak said:

Would anyone recommend buying gold

Start a thread asking how to invest £n and I promise you that gold will be far, far down the list.The usual train of thought is, in order of importance :

Cash EF

SIPP (esp if HRT)

ISA

Property

NS&I

Taxed investments

Magic beans

Cars / coke / hookers

Gold

HTH!

95JO said:

Thanks for the reply red_slr

I’m very conscious that I’m in a fortunate position at my age and I’m always actively trying to be conservative with my money, rather than financing an M2 or similar, despite my friends/family’s encouragement

You make a good point in regards to the pension age rising further, one that I hadn’t really given much thought. I was more concerned with not being able to access it for 30+ years, never mind any more!

I think a SIPP is something I’ll look in to if ever I’m in a position where I can max my ISA contributions.

Don’t be too conservative with your money lest you become one of those dullards that has never done anything but accumulate wealth and then once they’ve got it all have no idea how to enjoy it because it’s the figures that give them the joy not the world of opportunities that having a few quid brings. I have colleagues like this sitting on millions but miserable as sin except when counting their money. That or end up losing half of it in a divorce, one former colleague had 3 of those under his belt, we didn’t see him smile very often! I’m very conscious that I’m in a fortunate position at my age and I’m always actively trying to be conservative with my money, rather than financing an M2 or similar, despite my friends/family’s encouragement

You make a good point in regards to the pension age rising further, one that I hadn’t really given much thought. I was more concerned with not being able to access it for 30+ years, never mind any more!

I think a SIPP is something I’ll look in to if ever I’m in a position where I can max my ISA contributions.

There’s a middle ground where being fiscally responsible and still enjoying your relative youth can sit comfortably together. I struck a pretty good balance through my 20’s I think. Nice cars, nice holidays, a lot of experiences in the prime of my life but also a very good pension going and a house with a decent amount of equity in it. A mixture of head and heart.

Apart from self managing it, what's the difference between contributing to a deferred employers pension and a SIPP? I currently drip feed a small amount into an old company pension (and claim back the tax as HRT via self assessment), I also contribute to my current employers pension (as do they). Possibly save on charges?

djc206 said:

Don’t be too conservative with your money lest you become one of those dullards that has never done anything but accumulate wealth and then once they’ve got it all have no idea how to enjoy it because it’s the figures that give them the joy not the world of opportunities that having a few quid brings. I have colleagues like this sitting on millions but miserable as sin except when counting their money. That or end up losing half of it in a divorce, one former colleague had 3 of those under his belt, we didn’t see him smile very often!

There’s a middle ground where being fiscally responsible and still enjoying your relative youth can sit comfortably together. I struck a pretty good balance through my 20’s I think. Nice cars, nice holidays, a lot of experiences in the prime of my life but also a very good pension going and a house with a decent amount of equity in it. A mixture of head and heart.

I was just about to post something very similar. Life can be full of regrets wishing it had been done sooner.There’s a middle ground where being fiscally responsible and still enjoying your relative youth can sit comfortably together. I struck a pretty good balance through my 20’s I think. Nice cars, nice holidays, a lot of experiences in the prime of my life but also a very good pension going and a house with a decent amount of equity in it. A mixture of head and heart.

Also how secure is your job, planning a family etc.? I paid my mortgage off c10yrs early as I wanted to be free of debt using the surplus to retire early.

Armitage.Shanks said:

djc206 said:

Don’t be too conservative with your money lest you become one of those dullards that has never done anything but accumulate wealth and then once they’ve got it all have no idea how to enjoy it because it’s the figures that give them the joy not the world of opportunities that having a few quid brings. I have colleagues like this sitting on millions but miserable as sin except when counting their money. That or end up losing half of it in a divorce, one former colleague had 3 of those under his belt, we didn’t see him smile very often!

There’s a middle ground where being fiscally responsible and still enjoying your relative youth can sit comfortably together. I struck a pretty good balance through my 20’s I think. Nice cars, nice holidays, a lot of experiences in the prime of my life but also a very good pension going and a house with a decent amount of equity in it. A mixture of head and heart.

I was just about to post something very similar. Life can be full of regrets wishing it had been done sooner.There’s a middle ground where being fiscally responsible and still enjoying your relative youth can sit comfortably together. I struck a pretty good balance through my 20’s I think. Nice cars, nice holidays, a lot of experiences in the prime of my life but also a very good pension going and a house with a decent amount of equity in it. A mixture of head and heart.

Also how secure is your job, planning a family etc.? I paid my mortgage off c10yrs early as I wanted to be free of debt using the surplus to retire early.

- Berlin, Amsterdam and an Italian road trip planned already for this year!

- Berlin, Amsterdam and an Italian road trip planned already for this year!It’s very secure (I think), I’ve always worked in the Civil Service, but last year I moved to a GovCo owned by the same Department. Not much has changed, except more autonomy and a big pay rise in exchange for the DB pension - I’ll likely go full circle and rejoin the CS when the right job comes up.

But no plans for a family, yet... We’ll reassess in 5 years time

I know you’ve already discounted paying more into your pension and I agree. If you’re 24 and paying in a decent amount (15% of a high salary) then you are at risk of hitting the lifetime allowance with any extra. You’re saving a decent amount into your pension so that will help towards a comfortable retirement already.

I was pretty thrifty through my 20s and 30s, always maxing my pension contributions (I.e. taking the max my employer would pay) and paying in some bonus from time to time. I’m now pushing 50 and close enough to the lifetime allowance that future pension contributions, including my current employers’ generous matching, don’t look so tax efficient any more.

Who knows what will happen over the next 30-40 years? I paid a lot of my contributions when the LTA was £1.5m and rising, before dropping like a stone to £1m - I would have made different decisions if I had had an inkling that the LTA would reduce so much.

I was pretty thrifty through my 20s and 30s, always maxing my pension contributions (I.e. taking the max my employer would pay) and paying in some bonus from time to time. I’m now pushing 50 and close enough to the lifetime allowance that future pension contributions, including my current employers’ generous matching, don’t look so tax efficient any more.

Who knows what will happen over the next 30-40 years? I paid a lot of my contributions when the LTA was £1.5m and rising, before dropping like a stone to £1m - I would have made different decisions if I had had an inkling that the LTA would reduce so much.

95JO said:

Of course, I appreciate that my investments may decrease in value over the coming years and I’d like to think I’m prepared for that. However, in my short exposure (~2 years), I have been fortunate enough not to experience a down turn...

So that visual representation is hard viewing! Hopefully my circumstances don’t drastically change for the worse and I can ride out any down turns.

Out of curiosity, if you were saving for a car - Would you build those savings in a current/savings account or within your investment? (Assuming the new car purchase isn’t essential, meaning some exposure to risk is available - Have I answered my own question?)

I guess it would depend if I needed the car.So that visual representation is hard viewing! Hopefully my circumstances don’t drastically change for the worse and I can ride out any down turns.

Out of curiosity, if you were saving for a car - Would you build those savings in a current/savings account or within your investment? (Assuming the new car purchase isn’t essential, meaning some exposure to risk is available - Have I answered my own question?)

If I had £10000 and I know that in three years I need it for a car come what may personally I'd probably go with the most appropriate savings account as I know that in three years there will be a minimum of £1000 available.

If I had £10000 and I'm thinking of buying a car but in three years time if there was only £8000 available I could simply go "meh no new car then" and wait it out then I might invest.

Personally it kind of goes back to the "ladder" thing I mentioned earlier.

We're probably in very different situations though as I had a ton of savings in the bank doing nothing whilst you're thinking of how to invest whilst you grow the pot.

anonymous said:

[redacted]

The same underlying indexes make up each LifeStrategy fund, just in different proportions. In effect you've created a LifeStrategy74 fund. For the sake of 6% difference in equities/bonds, surely just shove it all in LS80 for simplicity!?OP - this picture gets thrown around a lot and seems to be popular. It's America focused but you get the gist.

ILikeCake said:

The same underlying indexes make up each LifeStrategy fund, just in different proportions. In effect you've created a LifeStrategy74 fund. For the sake of 6% difference in equities/bonds, surely just shove it all in LS80 for simplicity!?

OP - this picture gets thrown around a lot and seems to be popular. It's America focused but you get the gist.

Yeah, I've seen this before - It makes sense and follows the theme of most replies here, which is reassuring!OP - this picture gets thrown around a lot and seems to be popular. It's America focused but you get the gist.

Thanks all for the replies, definitely cemented my decision to avoid to SIPP route (for now at least) and to double my S&S ISA contributions.

I think I just needed to voice my thoughts and ensure I'm not missing something blindingly obvious.

ILikeCake said:

The same underlying indexes make up each LifeStrategy fund, just in different proportions. In effect you've created a LifeStrategy74 fund. For the sake of 6% difference in equities/bonds, surely just shove it all in LS80 for simplicity!?

OP - this picture gets thrown around a lot and seems to be popular. It's America focused but you get the gist.

I guess the UK version is this from reddit OP - this picture gets thrown around a lot and seems to be popular. It's America focused but you get the gist.

With the LTA in mind, I’d have told my younger self to be sure to max out ISA options.

Mind you, mid-20s MikeIOW was nowhere near earning enough.....& ISAs didn’t exist

My other advice would be to focus on health.....I don’t just mean “become a gym jock” or just play squash- find a team sport you enjoy (mine was/is volleyball), it can lead to mucho fun over the years, and build lifelong friendships.

Gassing Station | Finance | Top of Page | What's New | My Stuff