Currency collapse, debt bubble and hyperinflation - worried?

Discussion

Anyone worried about the impending collapse of the dollar and the worldwide domino effect that will have? The markets are melting up and the debt bubble is likely to eventually burst.

Have you started hedging against this possibility? Time to sell tech stocks and buy more gold, silver and bitcoin?

Have you started hedging against this possibility? Time to sell tech stocks and buy more gold, silver and bitcoin?

I’d be interested to know what people’s 5 yr performance is when they trade individual stocks and assets.

What research they do to pick them etc...

Fundsmiths 5yr cumulative return is 128%. A simple buy hold forget strategy.

If you enjoy researching and trading then fair enough but I’m more than happy with those returns for near to zero effort on my side.

What research they do to pick them etc...

Fundsmiths 5yr cumulative return is 128%. A simple buy hold forget strategy.

If you enjoy researching and trading then fair enough but I’m more than happy with those returns for near to zero effort on my side.

btdk5 said:

I’d be interested to know what people’s 5 yr performance is when they trade individual stocks and assets.

What research they do to pick them etc...

Fundsmiths 5yr cumulative return is 128%. A simple buy hold forget strategy.

If you enjoy researching and trading then fair enough but I’m more than happy with those returns for near to zero effort on my side.

Aren't most of Fundsmith's holdings US based though? I believe they only have 30 odd, so lots of eggs in the same basket.What research they do to pick them etc...

Fundsmiths 5yr cumulative return is 128%. A simple buy hold forget strategy.

If you enjoy researching and trading then fair enough but I’m more than happy with those returns for near to zero effort on my side.

p_k_n said:

Anyone worried about the impending collapse of the dollar and the worldwide domino effect that will have? The markets are melting up and the debt bubble is likely to eventually burst.

Have you started hedging against this possibility? Time to sell tech stocks and buy more gold, silver and bitcoin?

I see this view as a continuum i.e. at one end, Modern Money Theory [MMT] adherents that the US - reserve currency status - can continue to print money and increase debt with little ill effects, whilst at the other end lies the Weimer Republic / Venezuela basket case hyperinflation.Have you started hedging against this possibility? Time to sell tech stocks and buy more gold, silver and bitcoin?

I've anchored my investments (exposure to PMs namely gold and silver through iShares physically backed ETFs) on probable outcomes based upon history: debt defaults and/or devaluation.

My thoughts are very much influenced by Ray Dalio. Lyn Alden, a FinTwit [Twitter] darling, is very much of the opinion that the current economic situation is more like the 1940s than the 1970s due to debt levels. We're reaching the limits of the Triffin dilemma re: dollar cannot survive as the World's reserve currency without requiring larger deficits. The key is the different ways that we can get out of the current situation, but more importantly, the choices that different actors will pursue.

I do not believe that the dollar will imminently collapse; however, the debt bubble will force some hard conversations and some hard choices. We can discuss a Bretton Woods 2.0, whether crypto e.g. BTC, will form part of that conversation; more important is what paths various countries / leaders are likely to pursue [probable outcomes].

At the back of my mind are the other issues could potentially blow up: whether a potential insolvency crisis will arise from the steepening US 10 - 30 year rates; China's speculative housing bubble; and Italexit [Italy leaving the EU].

I'm still a believer in secular deflation, however it looks like short-medium term inflation due to supply shortages, and reversing globalisation due to a mixture of geopolitical risks [China and Russia], and growing populism (and the resultant political consequences) due to the hollowing out of working and middle class. That's without considering AI in the next decade or so!

As I stated in the Gold thread, if the World goes to hell in a hand-basket, I'm going down with the ship as I am entrenched in the financial system (work, mortgage, investments, etc); I've attempted to hedge as best I can against a less extreme scenario re: long-term devaluation, which I believe if the most likely probable outcome.

Edited by putonghua73 on Thursday 25th February 13:20

Stig said:

btdk5 said:

I’d be interested to know what people’s 5 yr performance is when they trade individual stocks and assets.

What research they do to pick them etc...

Fundsmiths 5yr cumulative return is 128%. A simple buy hold forget strategy.

If you enjoy researching and trading then fair enough but I’m more than happy with those returns for near to zero effort on my side.

Aren't most of Fundsmith's holdings US based though? I believe they only have 30 odd, so lots of eggs in the same basket.What research they do to pick them etc...

Fundsmiths 5yr cumulative return is 128%. A simple buy hold forget strategy.

If you enjoy researching and trading then fair enough but I’m more than happy with those returns for near to zero effort on my side.

The team behind a fund are sitting there everyday analysing corporate accounts, building economic models and monitoring favoured sectors. If you can do that in your spare time and outperform then fair enough.

If you don’t like the concentration risk then a truly global equities etf or multi asset fund like life strategy is also an option.

I’m just trying to understand why people make it more complicated than that and if they do what are their returns?

halo34 said:

Muzzer79 said:

Benbay001 said:

Isnt there always a next impending doom?

This.After all this did actually happen......

"Before the crash, which wiped out both corporate and individual wealth, the stock market peaked on Sept. 3, 1929, with the Dow at 381.17. The ultimate bottom was reached on July 8, 1932, where the Dow stood at 41.22. From peak to trough, the Dow experienced a staggering loss of 89.2%"

"The crash followed a speculative boom that had taken hold in the late 1920s. During the latter half of the 1920s, steel production, building construction, retail turnover, automobiles registered, and even railway receipts advanced from record to record. The combined net profits of 536 manufacturing and trading companies showed an increase, in the first six months of 1929, of 36.6% over 1928, itself a record half-year. Iron and steel led the way with doubled gains.[31] Such figures set up a crescendo of stock-exchange speculation that led hundreds of thousands of Americans to invest heavily in the stock market. A significant number of them were borrowing money to buy more stocks. By August 1929, brokers were routinely lending small investors more than two-thirds of the face value of the stocks they were buying. Over $8.5 billion was out on loan,[32] more than the entire amount of currency circulating in the U.S. at the time.[33][34]"

Joey Deacon said:

Nah, they can always just print some more money.

yep and they dont even have to spend money printing these days ....just add some zeros on a computer screen

or even better, invent a new currency out of thin air and get people to exchange their real money for it ...who would have thought of that 50 years ago ?!

Fittster said:

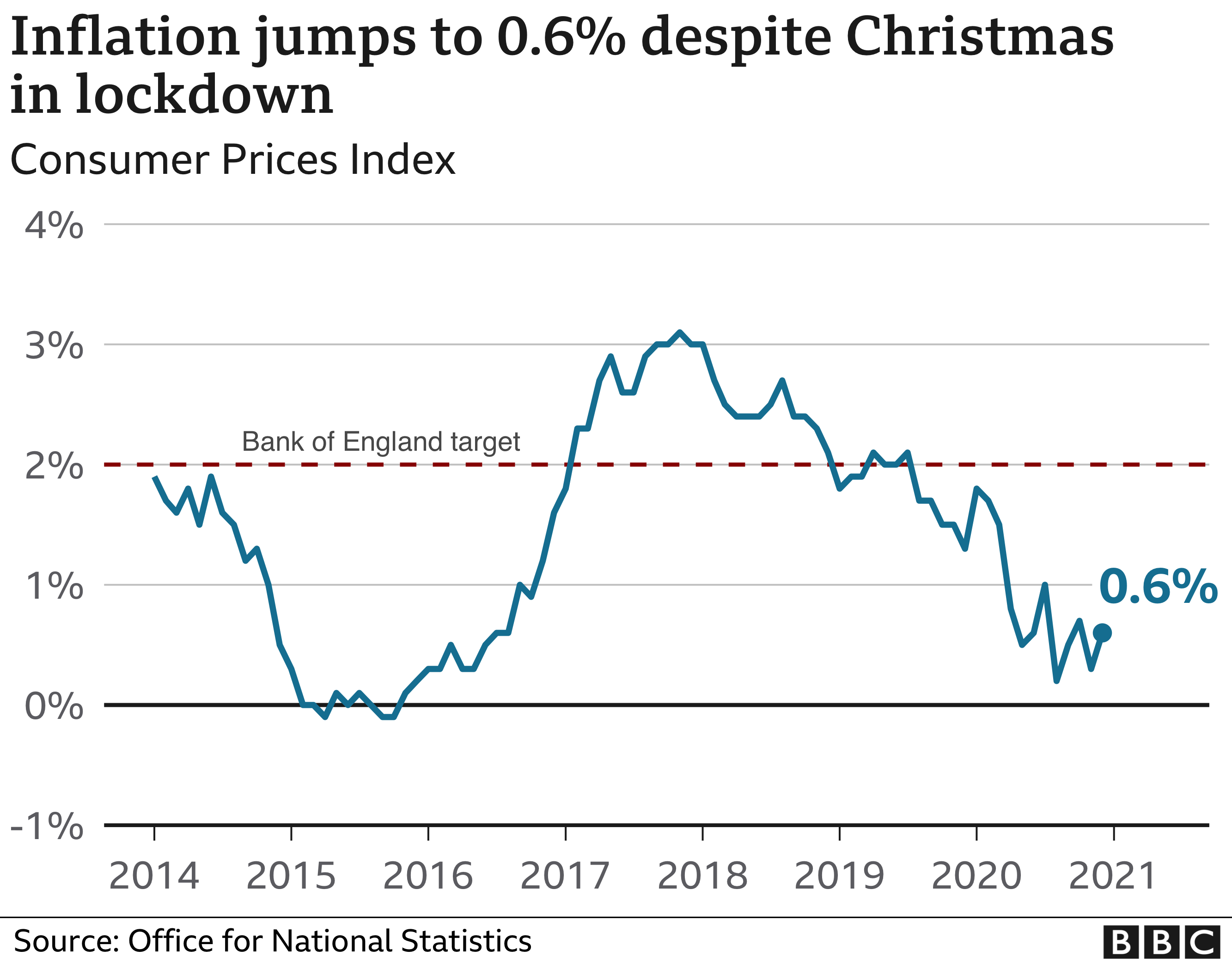

Idiots who post this sort of nonsense should have to explain why with all the horrors they foresee there is not a flicker of inflation.

Are the finance professional who trade / invest in bonds all thicker than the OP?

It just seems odd pre pandemic, we can fight over police budgets the NHS funding etc etc when we could have just come up with the money like we have furlough? Why didn't we do it then? because it would have adverse effects? Will we avoid these adverse effects (whatever they are) because it's been done because it's a pandemic? (and globally?)Are the finance professional who trade / invest in bonds all thicker than the OP?

Aren't a lot of bonds bought by the Fed or Bank of England? So if bond take up is poor then these institutions take up the slack? (knowledge patchy on this)

https://www.independent.co.uk/news/business/commen...

Fittster what do you see as a likely consequence of what's happening? None of us are thick are we, if what's going on benefits us all then why not carry on and create money to directly give to the poorer/jobless and also money in the system to create a perpetual stock market that increase to the benefit of all.

If we could all just refresh our bank balances each time we spent, life would be good wouldn't it but where does that all end?

Fittster said:

Idiots who post this sort of nonsense should have to explain why with all the horrors they foresee there is not a flicker of inflation.

Are the finance professional who trade / invest in bonds all thicker than the OP?

Can't say I'm surprised with a reply like this from someone who has their occupation title as "Dullness" - I think that probably sums up everything about you and your life. Are the finance professional who trade / invest in bonds all thicker than the OP?

p_k_n said:

Fittster said:

Idiots who post this sort of nonsense should have to explain why with all the horrors they foresee there is not a flicker of inflation.

Are the finance professional who trade / invest in bonds all thicker than the OP?

Can't say I'm surprised with a reply like this from someone who has their occupation title as "Dullness" - I think that probably sums up everything about you and your life. Are the finance professional who trade / invest in bonds all thicker than the OP?

Gassing Station | Finance | Top of Page | What's New | My Stuff