Bought 2nd hand car, have v5c, still showing as taxed

Discussion

Bought a 2nd hand car private sale a few weeks ago. As I was going away shortly after, I drove it directly from the vendor to storage and did not tax it, intending to do it on my return in march.

Very nice retired chap said he said he would cancel the direct debit the next day and complete the online new keeper process.

On my return I have had the V5C delivered a few days after I had left sometime around the 16th Feb. So fine, I will go to tax it I thought. Except, the car is still showing as taxed till Feb 26.

How is this possible? My understanding was that he should have been refunded for the remaining 11 months upon completion of the new keeper supplement. It looks like he paid for it with a yearly DD, but that should have been cancelled surely?

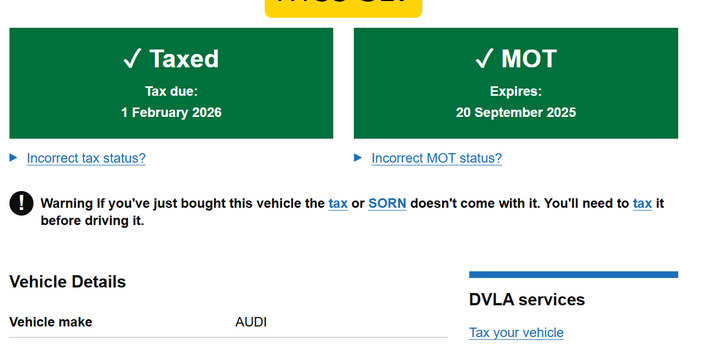

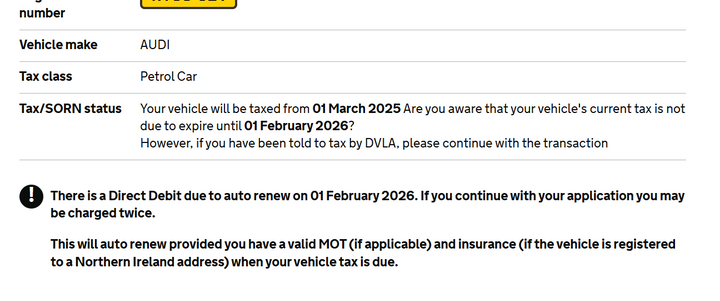

Gov Tax check

When I went to pay for the tax it says it's still taxed till feb 26

Very nice retired chap said he said he would cancel the direct debit the next day and complete the online new keeper process.

On my return I have had the V5C delivered a few days after I had left sometime around the 16th Feb. So fine, I will go to tax it I thought. Except, the car is still showing as taxed till Feb 26.

How is this possible? My understanding was that he should have been refunded for the remaining 11 months upon completion of the new keeper supplement. It looks like he paid for it with a yearly DD, but that should have been cancelled surely?

Gov Tax check

When I went to pay for the tax it says it's still taxed till feb 26

Edited by MOTK on Sunday 2nd March 23:20

MOTK said:

If it is a clerical error, I'm not much concerned about the repercussions from dvla, I'm more concerned they're still taking the old chaps money when they shouldn't be.

I will check with him tomorrow whether or not he has received his refund.

Do you know if he has actually completed the keeper change?I will check with him tomorrow whether or not he has received his refund.

MOTK said:

If it is a clerical error, I'm not much concerned about the repercussions from dvla, I'm more concerned they're still taking the old chaps money when they shouldn't be.

I will check with him tomorrow whether or not he has received his refund.

If he is paying on a monthly DD there will not be a refund.I will check with him tomorrow whether or not he has received his refund.

autopilot747 said:

Any updates on this? I m in the exact same situation. Purchased vehicle, received and new v5c in my name and still showing taxed for a whole year.

How long ago did you buy it?If the PO taxed it for the full year it will show taxed until they process his refund as a minimum.

E-bmw said:

How long ago did you buy it?

If the PO taxed it for the full year it will show taxed until they process his refund as a minimum.

PO said he would tax it for me till end of month so we could test drive. Paperwork was sent through a few days later and another week I received the v5c. This was over 2 months ago and still showing taxed for a year. I thought it was a bit strange that he said till end of month and DVLA record showed a full year.If the PO taxed it for the full year it will show taxed until they process his refund as a minimum.

autopilot747 said:

PO said he would tax it for me till end of month so we could test drive. Paperwork was sent through a few days later and another week I received the v5c. This was over 2 months ago and still showing taxed for a year. I thought it was a bit strange that he said till end of month and DVLA record showed a full year.

Which website are you checking its taxed on?ETA also to clarify, do you mean the car was on SORN and the previous owner taxed it? As soon as the registered keeper is changed, the tax under the previous owner is no longer valid. I am also assuming (but better to check) the sequence of events was 1) previous owner taxed it, 2) you test drove it, 3) you bought it (paid money), 4) you or the previous owner notified DVLA (by post or online??) of the change in registered keeper, 5) you received V5, 6) you tried to tax it but can't?

Also, what "paperwork was sent through" - was this done as a private sale? If not a private sale, why the need for the previous owner to tax it, did he not have trade plates to allow a test drive?

Edited by paul_c123 on Wednesday 30th July 12:34

paul_c123 said:

autopilot747 said:

PO said he would tax it for me till end of month so we could test drive. Paperwork was sent through a few days later and another week I received the v5c. This was over 2 months ago and still showing taxed for a year. I thought it was a bit strange that he said till end of month and DVLA record showed a full year.

Which website are you checking its taxed on?ETA also to clarify, do you mean the car was on SORN and the previous owner taxed it? As soon as the registered keeper is changed, the tax under the previous owner is no longer valid. I am also assuming (but better to check) the sequence of events was 1) previous owner taxed it, 2) you test drove it, 3) you bought it (paid money), 4) you or the previous owner notified DVLA (by post or online??) of the change in registered keeper, 5) you received V5, 6) you tried to tax it but can't?

Also, what "paperwork was sent through" - was this done as a private sale? If not a private sale, why the need for the previous owner to tax it, did he not have trade plates to allow a test drive?

Edited by paul_c123 on Wednesday 30th July 12:34

Yes the vehicle was SORN and a private sale. The sequence of events that you have listed is correct. Standard private sale the PO completed it online I believe.

I agree with the last poster.

Unless you need to have it on the road today, I would do the taxing on 1st August, as they will tax it in complete months from the day you fill out the online form. You have the proof it is currently taxed, I would screen shot that if you want to drive it today.

I bought a car, private purchase just like you, on Friday 13th June, and had to wait until the DVLA had processed the previous owner's removal of his private plate before I could tax it.

He told me the minute that had happened (on Monday 16th June), and he did the change of registered keeper 10 minutes later.

The automatic confirmation of new registered keeper came through from the DVLA within a second or two, in the correct half-year original registration (pre-private plate).

Another 10 minutes later and I had taxed it.

So my conclusion is it is a just how the DVLA system works when the previous owner paid the full year.

The previous owner has already told them you are the new registered keeper, hence you have the V5.

Calling them is a miserable waste of time, so I would just try taxing it on Friday.

The refunds do take a couple of months - I will check how long and come back to you, as we had one recently on the company fleet I manage.

They are backdated to the end of the month in which the change of registered keeper was notified.

Unless you need to have it on the road today, I would do the taxing on 1st August, as they will tax it in complete months from the day you fill out the online form. You have the proof it is currently taxed, I would screen shot that if you want to drive it today.

I bought a car, private purchase just like you, on Friday 13th June, and had to wait until the DVLA had processed the previous owner's removal of his private plate before I could tax it.

He told me the minute that had happened (on Monday 16th June), and he did the change of registered keeper 10 minutes later.

The automatic confirmation of new registered keeper came through from the DVLA within a second or two, in the correct half-year original registration (pre-private plate).

Another 10 minutes later and I had taxed it.

So my conclusion is it is a just how the DVLA system works when the previous owner paid the full year.

The previous owner has already told them you are the new registered keeper, hence you have the V5.

Calling them is a miserable waste of time, so I would just try taxing it on Friday.

The refunds do take a couple of months - I will check how long and come back to you, as we had one recently on the company fleet I manage.

They are backdated to the end of the month in which the change of registered keeper was notified.

GasEngineer said:

When you bought the car, you would had to tax it or SORN it. As you said you stored it - it should still be showing as SORNed in your name.

Vehicle was SORN until the PO taxed it himself so we could test drive it legally. He said he would only put 1 month tax on it. Now been over 2 months and still showing taxedEdited by GasEngineer on Wednesday 30th July 12:45

autopilot747 said:

GasEngineer said:

When you bought the car, you would had to tax it or SORN it. As you said you stored it - it should still be showing as SORNed in your name.

Vehicle was SORN until the PO taxed it himself so we could test drive it legally. He said he would only put 1 month tax on it. Now been over 2 months and still showing taxedEdited by GasEngineer on Wednesday 30th July 12:45

Red Devil said:

autopilot747 said:

GasEngineer said:

When you bought the car, you would had to tax it or SORN it. As you said you stored it - it should still be showing as SORNed in your name.

Vehicle was SORN until the PO taxed it himself so we could test drive it legally. He said he would only put 1 month tax on it. Now been over 2 months and still showing taxedEdited by GasEngineer on Wednesday 30th July 12:45

Red Devil said:

autopilot747 said:

GasEngineer said:

When you bought the car, you would had to tax it or SORN it. As you said you stored it - it should still be showing as SORNed in your name.

Vehicle was SORN until the PO taxed it himself so we could test drive it legally. He said he would only put 1 month tax on it. Now been over 2 months and still showing taxedEdited by GasEngineer on Wednesday 30th July 12:45

Forums | Speed, Plod & the Law | Top of Page | What's New | My Stuff