Leasehold Maisonette Insurance

Discussion

I own a ground floor maisonette. There is no service charge (lease just says split repair costs with the upper maisonette), and ground rent is £5 a year.

The owner of the upper maisonette is having problems with the freeholder demanding 2k for insurance (I pay a couple of hundred). The lease says the tenant/lessor needed to insure it but if they don't the freeholder can, and recover the money. They are also being difficult over the wording of the lease, trying to rejecting her insurance certificate so thay can charge her much more.

I'm now concerned they may try it on with the me, and the other residents in similar maisonettes on the estate.

The lease clause is as follows...

"3. THE Tenant hereby COVENANTS with the Lessors as follows:-

<snip>

10) To insure and keep insured the Demised Premises in the joint names of the Lessor and the Tenant against loss or damage by fire and such other risks as are covered by a comprehensive flat owners policy in the full reinstatement cost in of one the public insurance offices in London and..."

The Freeholder is rejecting her insurance as they say it must be in joint names and a London based insurance company. Thats proving hard to do. Shes changed her insurer to one registered in London but getting one that also allows joint names with the Freeholder is proving harder.

My question is can the Freeholder reject the insurance on those grounds, and where does the leaseholder stand when the Freeholder is taking the piss with costs.

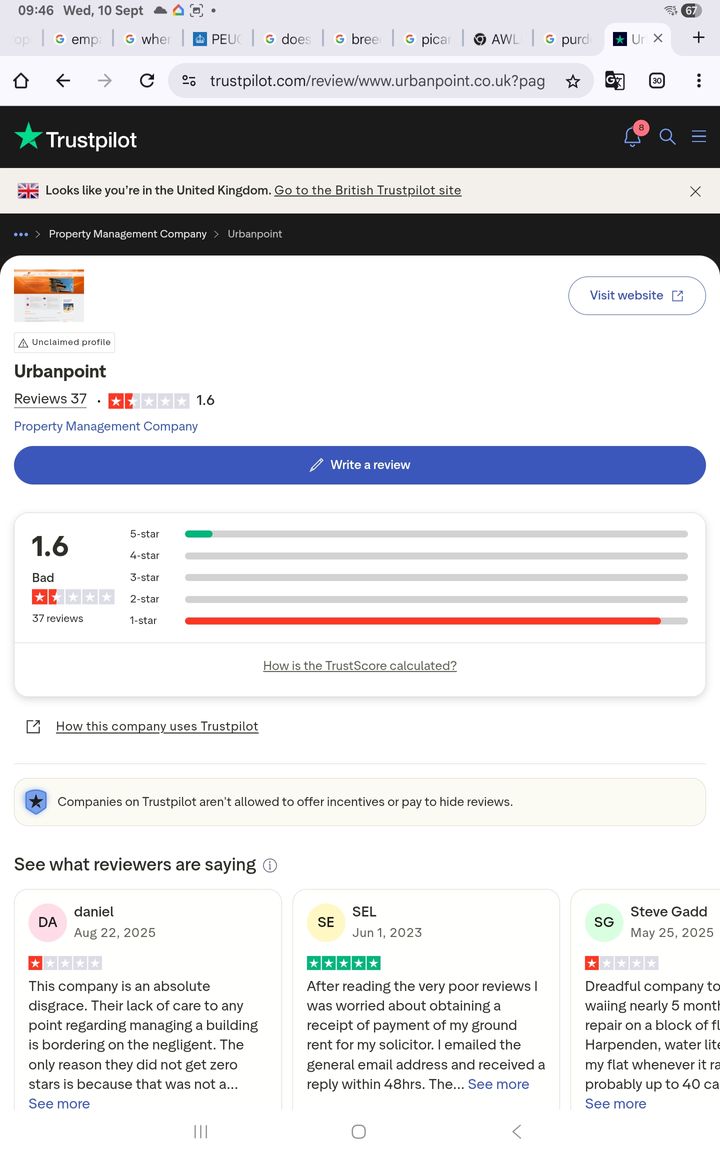

Looking at reviews for the Freeholder/management company (one and the same) they are terrible.

The owner of the upper maisonette is having problems with the freeholder demanding 2k for insurance (I pay a couple of hundred). The lease says the tenant/lessor needed to insure it but if they don't the freeholder can, and recover the money. They are also being difficult over the wording of the lease, trying to rejecting her insurance certificate so thay can charge her much more.

I'm now concerned they may try it on with the me, and the other residents in similar maisonettes on the estate.

The lease clause is as follows...

"3. THE Tenant hereby COVENANTS with the Lessors as follows:-

<snip>

10) To insure and keep insured the Demised Premises in the joint names of the Lessor and the Tenant against loss or damage by fire and such other risks as are covered by a comprehensive flat owners policy in the full reinstatement cost in of one the public insurance offices in London and..."

The Freeholder is rejecting her insurance as they say it must be in joint names and a London based insurance company. Thats proving hard to do. Shes changed her insurer to one registered in London but getting one that also allows joint names with the Freeholder is proving harder.

My question is can the Freeholder reject the insurance on those grounds, and where does the leaseholder stand when the Freeholder is taking the piss with costs.

Looking at reviews for the Freeholder/management company (one and the same) they are terrible.

Forums | Homes, Gardens and DIY | Top of Page | What's New | My Stuff