Dubai / Abu Dhabi Property

Discussion

Has anyone here invested into any property in the UAE?

I'm very much considering investing into some property.

Seems like the potential for appreciation is huge, when exiting no capital gains and a quick process with selling lots less red tape than here.

I know of a few people who have renovated houses there and also seen big increases. Just wondered if anyone had done it.

I'm very much considering investing into some property.

Seems like the potential for appreciation is huge, when exiting no capital gains and a quick process with selling lots less red tape than here.

I know of a few people who have renovated houses there and also seen big increases. Just wondered if anyone had done it.

I've been on the fence for nearly 12 years now and am still renting ( )

)

Yes there are stories of people making big money but the market is very volatile in comparison to the UK...

My biggest issue is the deposits that are required for expats, we're talking 26-27% required once all fees are taken into account. I'm not comfortable with putting all my eggs in one basket leaving no money left as a contingency should anything happen with work.

Off plan has the potential for big profits, but, with so many projects not materialising, and it not solving the immediate issue of having to rent, I've never finalised a deal.

)

)Yes there are stories of people making big money but the market is very volatile in comparison to the UK...

My biggest issue is the deposits that are required for expats, we're talking 26-27% required once all fees are taken into account. I'm not comfortable with putting all my eggs in one basket leaving no money left as a contingency should anything happen with work.

Off plan has the potential for big profits, but, with so many projects not materialising, and it not solving the immediate issue of having to rent, I've never finalised a deal.

Marshall878 said:

I've been on the fence for nearly 12 years now and am still renting ( )

)

Yes there are stories of people making big money but the market is very volatile in comparison to the UK...

My biggest issue is the deposits that are required for expats, we're talking 26-27% required once all fees are taken into account. I'm not comfortable with putting all my eggs in one basket leaving no money left as a contingency should anything happen with work.

Off plan has the potential for big profits, but, with so many projects not materialising, and it not solving the immediate issue of having to rent, I've never finalised a deal.

Don’t you have to have residency to buy?  )

)Yes there are stories of people making big money but the market is very volatile in comparison to the UK...

My biggest issue is the deposits that are required for expats, we're talking 26-27% required once all fees are taken into account. I'm not comfortable with putting all my eggs in one basket leaving no money left as a contingency should anything happen with work.

Off plan has the potential for big profits, but, with so many projects not materialising, and it not solving the immediate issue of having to rent, I've never finalised a deal.

JimmyConwayNW said:

Has anyone here invested into any property in the UAE?

I'm very much considering investing into some property.

Seems like the potential for appreciation is huge, when exiting no capital gains and a quick process with selling lots less red tape than here.

I know of a few people who have renovated houses there and also seen big increases. Just wondered if anyone had done it.

It isn’t CGT free if you are a UK tax resident…I'm very much considering investing into some property.

Seems like the potential for appreciation is huge, when exiting no capital gains and a quick process with selling lots less red tape than here.

I know of a few people who have renovated houses there and also seen big increases. Just wondered if anyone had done it.

Marshall878 said:

I've been on the fence for nearly 12 years now and am still renting ( )

)

Yes there are stories of people making big money but the market is very volatile in comparison to the UK...

My biggest issue is the deposits that are required for expats, we're talking 26-27% required once all fees are taken into account. I'm not comfortable with putting all my eggs in one basket leaving no money left as a contingency should anything happen with work.

Off plan has the potential for big profits, but, with so many projects not materialising, and it not solving the immediate issue of having to rent, I've never finalised a deal.

I've probably been quite actively looking into it for the past 3 months or so. The more I look it into it the more confused I become. )

)Yes there are stories of people making big money but the market is very volatile in comparison to the UK...

My biggest issue is the deposits that are required for expats, we're talking 26-27% required once all fees are taken into account. I'm not comfortable with putting all my eggs in one basket leaving no money left as a contingency should anything happen with work.

Off plan has the potential for big profits, but, with so many projects not materialising, and it not solving the immediate issue of having to rent, I've never finalised a deal.

I assume estate agents are going to say whatever to get you to buy and promise the world.

But I think due to the huge number of people who have moved their and the abundance of studio and apartments buying something semi affordable and 4/5 bed houses would make a lot of sense for the families to move to. Especially if you can sell on handover.

Within the next 3-5 years I don't think I will be a UK tax resident, I'm looking at a few options. That aspect doesn't phase me.

I've done it and about to start a renovation on a 3 bed house in Dubai.

I also briefly ran an off-plan advisory service.

It's a complex market with a lot of sharks, but if you pick the right property in the right development and take a long term view you can do well. As someone else said, the market is volatile so you have to have a strong stomach, but there are a lot of positive tailwinds right now.

I would stay well away from any 1 bed apartments and studios at the moment. A LOT were sold off-plan during the covid boom and are now about to come online in the next 1 -3 years. There will be a huge glut. Also avoid any apartments in the desert/away from built-up areas.

Townhouses and villas in good locations (Arabian Ranches, Dubai Hills, Meadows, Springs, Lakes, etc) are in massive demand. Larger (2 bed+) apartments in established communities like the Marina can be solid (in the right building).

If looking at apartments, my long term money would be in Dubai South (near new airport area) or Dubai Hills (already expensive).

If looking at houses, I'd be interested in Springs and Meadows, and some of the larger villas (e.g. Sidra) in Dubai Hills but these are all going to be £££.

They've just announced they're going to develop the land around Jebel Ali Racecourse (which weirdly isn't in Jebel Ali). That is the last big patch of really central land that is undeveloped and will likely be a good buy.

All in my opinion of course.

If you have specific questions happy to answer if I can...

I also briefly ran an off-plan advisory service.

It's a complex market with a lot of sharks, but if you pick the right property in the right development and take a long term view you can do well. As someone else said, the market is volatile so you have to have a strong stomach, but there are a lot of positive tailwinds right now.

I would stay well away from any 1 bed apartments and studios at the moment. A LOT were sold off-plan during the covid boom and are now about to come online in the next 1 -3 years. There will be a huge glut. Also avoid any apartments in the desert/away from built-up areas.

Townhouses and villas in good locations (Arabian Ranches, Dubai Hills, Meadows, Springs, Lakes, etc) are in massive demand. Larger (2 bed+) apartments in established communities like the Marina can be solid (in the right building).

If looking at apartments, my long term money would be in Dubai South (near new airport area) or Dubai Hills (already expensive).

If looking at houses, I'd be interested in Springs and Meadows, and some of the larger villas (e.g. Sidra) in Dubai Hills but these are all going to be £££.

They've just announced they're going to develop the land around Jebel Ali Racecourse (which weirdly isn't in Jebel Ali). That is the last big patch of really central land that is undeveloped and will likely be a good buy.

All in my opinion of course.

If you have specific questions happy to answer if I can...

22s said:

I've done it and about to start a renovation on a 3 bed house in Dubai.

I also briefly ran an off-plan advisory service.

It's a complex market with a lot of sharks, but if you pick the right property in the right development and take a long term view you can do well. As someone else said, the market is volatile so you have to have a strong stomach, but there are a lot of positive tailwinds right now.

I would stay well away from any 1 bed apartments and studios at the moment. A LOT were sold off-plan during the covid boom and are now about to come online in the next 1 -3 years. There will be a huge glut. Also avoid any apartments in the desert/away from built-up areas.

Townhouses and villas in good locations (Arabian Ranches, Dubai Hills, Meadows, Springs, Lakes, etc) are in massive demand. Larger (2 bed+) apartments in established communities like the Marina can be solid (in the right building).

If looking at apartments, my long term money would be in Dubai South (near new airport area) or Dubai Hills (already expensive).

If looking at houses, I'd be interested in Springs and Meadows, and some of the larger villas (e.g. Sidra) in Dubai Hills but these are all going to be £££.

They've just announced they're going to develop the land around Jebel Ali Racecourse (which weirdly isn't in Jebel Ali). That is the last big patch of really central land that is undeveloped and will likely be a good buy.

All in my opinion of course.

If you have specific questions happy to answer if I can...

Thank you and thats really really helpful info.I also briefly ran an off-plan advisory service.

It's a complex market with a lot of sharks, but if you pick the right property in the right development and take a long term view you can do well. As someone else said, the market is volatile so you have to have a strong stomach, but there are a lot of positive tailwinds right now.

I would stay well away from any 1 bed apartments and studios at the moment. A LOT were sold off-plan during the covid boom and are now about to come online in the next 1 -3 years. There will be a huge glut. Also avoid any apartments in the desert/away from built-up areas.

Townhouses and villas in good locations (Arabian Ranches, Dubai Hills, Meadows, Springs, Lakes, etc) are in massive demand. Larger (2 bed+) apartments in established communities like the Marina can be solid (in the right building).

If looking at apartments, my long term money would be in Dubai South (near new airport area) or Dubai Hills (already expensive).

If looking at houses, I'd be interested in Springs and Meadows, and some of the larger villas (e.g. Sidra) in Dubai Hills but these are all going to be £££.

They've just announced they're going to develop the land around Jebel Ali Racecourse (which weirdly isn't in Jebel Ali). That is the last big patch of really central land that is undeveloped and will likely be a good buy.

All in my opinion of course.

If you have specific questions happy to answer if I can...

I can see so many 1 bed and studio being built so I did think a house/villa would make more sense as far less of them and far more families.

A lot of the areas you mention as being a good / safe choice are the areas I had looked into which means I can't be a million miles off something sensible.

Abu Dhabi seems to have big potential for growth and increases aswell. I don't know how much tales of doubling up from offplan to handover are just estate agents hot air.

I do just have this horrific feeling the moment I buy something in the UAE WW3 or a global property crash is triggered by my purchase.

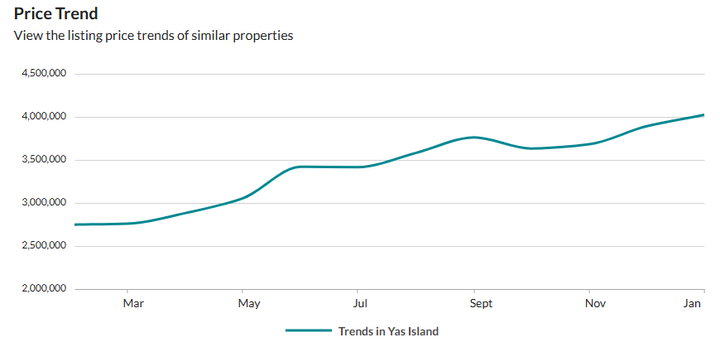

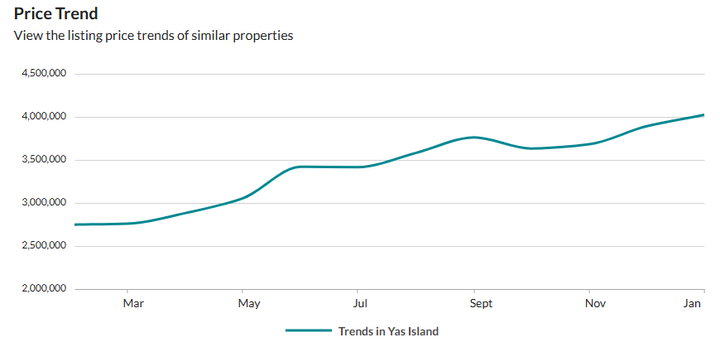

Abu Dhabi is a strange one. Since the announcement of DisneyLand (which isn't for another 10-15yrs!) prices have climbed considerably.

Where we are, beginning of last year we were in the process of buying a 4 bedroom villa for 2,000,000AED, things went wrong with work and the deal fell through. Those villas are now 2.6-2.9Mil. That's and increase of over £100,000.

With the deposits required, that's an additional £20-30k required.

As the poster above mentioned, Dubai South has increased substantially since the announcement of DXB moving operations to DWC. When we were in Al Ghadeer, house prices were affordable, but the 100km commute to work each way made me stick to renting. However, friends that did buy, have doubled their investment.

On the flip side, we personally know someone who had bought into an off plan development on Yas Island, 6 months into the payments, the developer reached out following the annoucnement of DisneyLand claiming that they were reviewing their pricing and the contract was cancelled.

In hindsight, after 11 years of renting, buying would have been the smarter move, but with residency tied to your work, with limited job security I just couldn't commit.

Where we are, beginning of last year we were in the process of buying a 4 bedroom villa for 2,000,000AED, things went wrong with work and the deal fell through. Those villas are now 2.6-2.9Mil. That's and increase of over £100,000.

With the deposits required, that's an additional £20-30k required.

As the poster above mentioned, Dubai South has increased substantially since the announcement of DXB moving operations to DWC. When we were in Al Ghadeer, house prices were affordable, but the 100km commute to work each way made me stick to renting. However, friends that did buy, have doubled their investment.

On the flip side, we personally know someone who had bought into an off plan development on Yas Island, 6 months into the payments, the developer reached out following the annoucnement of DisneyLand claiming that they were reviewing their pricing and the contract was cancelled.

In hindsight, after 11 years of renting, buying would have been the smarter move, but with residency tied to your work, with limited job security I just couldn't commit.

Marshall878 said:

Abu Dhabi is a strange one. Since the announcement of DisneyLand (which isn't for another 10-15yrs!) prices have climbed considerably.

Where we are, beginning of last year we were in the process of buying a 4 bedroom villa for 2,000,000AED, things went wrong with work and the deal fell through. Those villas are now 2.6-2.9Mil. That's and increase of over £100,000.

With the deposits required, that's an additional £20-30k required.

As the poster above mentioned, Dubai South has increased substantially since the announcement of DXB moving operations to DWC. When we were in Al Ghadeer, house prices were affordable, but the 100km commute to work each way made me stick to renting. However, friends that did buy, have doubled their investment.

On the flip side, we personally know someone who had bought into an off plan development on Yas Island, 6 months into the payments, the developer reached out following the annoucnement of DisneyLand claiming that they were reviewing their pricing and the contract was cancelled.

In hindsight, after 11 years of renting, buying would have been the smarter move, but with residency tied to your work, with limited job security I just couldn't commit.

Its the 100k potential in a year that is proving attractive. Where we are, beginning of last year we were in the process of buying a 4 bedroom villa for 2,000,000AED, things went wrong with work and the deal fell through. Those villas are now 2.6-2.9Mil. That's and increase of over £100,000.

With the deposits required, that's an additional £20-30k required.

As the poster above mentioned, Dubai South has increased substantially since the announcement of DXB moving operations to DWC. When we were in Al Ghadeer, house prices were affordable, but the 100km commute to work each way made me stick to renting. However, friends that did buy, have doubled their investment.

On the flip side, we personally know someone who had bought into an off plan development on Yas Island, 6 months into the payments, the developer reached out following the annoucnement of DisneyLand claiming that they were reviewing their pricing and the contract was cancelled.

In hindsight, after 11 years of renting, buying would have been the smarter move, but with residency tied to your work, with limited job security I just couldn't commit.

I'm going to go for 2/3 weeks at the beginning of April and instead of a holiday on the palm in a hotel going to air bnb in dubai hills - which is where I would want to live (I think) and rent a car for duration and aim to get something done. I'll get stuff lined up beforehand.

JimmyConwayNW said:

Thank you and thats really really helpful info.

I can see so many 1 bed and studio being built so I did think a house/villa would make more sense as far less of them and far more families.

A lot of the areas you mention as being a good / safe choice are the areas I had looked into which means I can't be a million miles off something sensible.

Abu Dhabi seems to have big potential for growth and increases aswell. I don't know how much tales of doubling up from offplan to handover are just estate agents hot air.

I do just have this horrific feeling the moment I buy something in the UAE WW3 or a global property crash is triggered by my purchase.

You're welcome.I can see so many 1 bed and studio being built so I did think a house/villa would make more sense as far less of them and far more families.

A lot of the areas you mention as being a good / safe choice are the areas I had looked into which means I can't be a million miles off something sensible.

Abu Dhabi seems to have big potential for growth and increases aswell. I don't know how much tales of doubling up from offplan to handover are just estate agents hot air.

I do just have this horrific feeling the moment I buy something in the UAE WW3 or a global property crash is triggered by my purchase.

Villas/townhouses are in short supply. You can build a tower with 200 apartments on a very small patch of land in a great central location. For a community of 200 townhouses, you need a big patch of desert which is why the prices of centrally located family houses are going ga ga.

Emaar (Dubai's biggest developer) is focused on Dubai Hills as the new 'centre of Dubai' along with building out Dubai South so they're good bets. Bear in mind (much like UK) the 'new build' houses in Dubai Hills are going to be noticeably smaller than the equivalent in Springs/Meadows/Ranches 1 etc.

AD I don't know much about to be honest - I do know a lot of people are looking (/dreaming) to move that way since it's much quieter and traffic in dxb is crazy atm. But Dubai and Abu Dhabi are far away from each other, so as usual it's about whether you can stomach a commute or find a job in the place you want to move to.

I can only comment on Dubai, no experience of Abu Dhabi.

There are huge rewards in Dubai currently but in my experience, you need to avoid new builds and off plan unless you get lucky and / or have the patience of a saint.

I’ve focused on established and older buildings in prime locations with great views. Apartments that need modernising have been best for me. Often the kitchens will need to be opened up and bathrooms and kitchens will be dire. The view is key - plenty of homes with great views are one new tower away from having none so do your research.

You will need the right team - the wrong one will derail your plans and be prepared to be very frustrated along the way as you will be lied to and taken for a fool daily. Supervising small children comes to mind …

Many owners have made 5 to 10x their money in 10/15 years and don’t need to renovate / can’t be bothered as they have rent coming in which might be a 20% yield on their original purchase price.

My goal is 7% yield (rent it) or 30% capital growth (sell it). I’ve made over £1m in the last year - just my experience, many have made far, far more.

There are huge rewards in Dubai currently but in my experience, you need to avoid new builds and off plan unless you get lucky and / or have the patience of a saint.

I’ve focused on established and older buildings in prime locations with great views. Apartments that need modernising have been best for me. Often the kitchens will need to be opened up and bathrooms and kitchens will be dire. The view is key - plenty of homes with great views are one new tower away from having none so do your research.

You will need the right team - the wrong one will derail your plans and be prepared to be very frustrated along the way as you will be lied to and taken for a fool daily. Supervising small children comes to mind …

Many owners have made 5 to 10x their money in 10/15 years and don’t need to renovate / can’t be bothered as they have rent coming in which might be a 20% yield on their original purchase price.

My goal is 7% yield (rent it) or 30% capital growth (sell it). I’ve made over £1m in the last year - just my experience, many have made far, far more.

Gassing Station | Business | Top of Page | What's New | My Stuff