Will understanding

Discussion

Trying to understand one, i'll do my best to keep it short, if thats possible,

My dad died when i was young (9) in 1987, my mother remarried in 2008 and in 2018 she was diagnosed with dementia

her husband (horrible piece) put her in a carehome and has been abscent ever since,

6 years later and my mother passsed away 2 weeks back, on trying to get the will to see if there are any funeral requests its seems

me, my brother and her husband are exucuters, the solicotors have struggled to get hold of him for a week but finally have and his feedback is 'he needs time to think about things'

This is not about money as the carehome has swallowed up any estate mother had over the years.

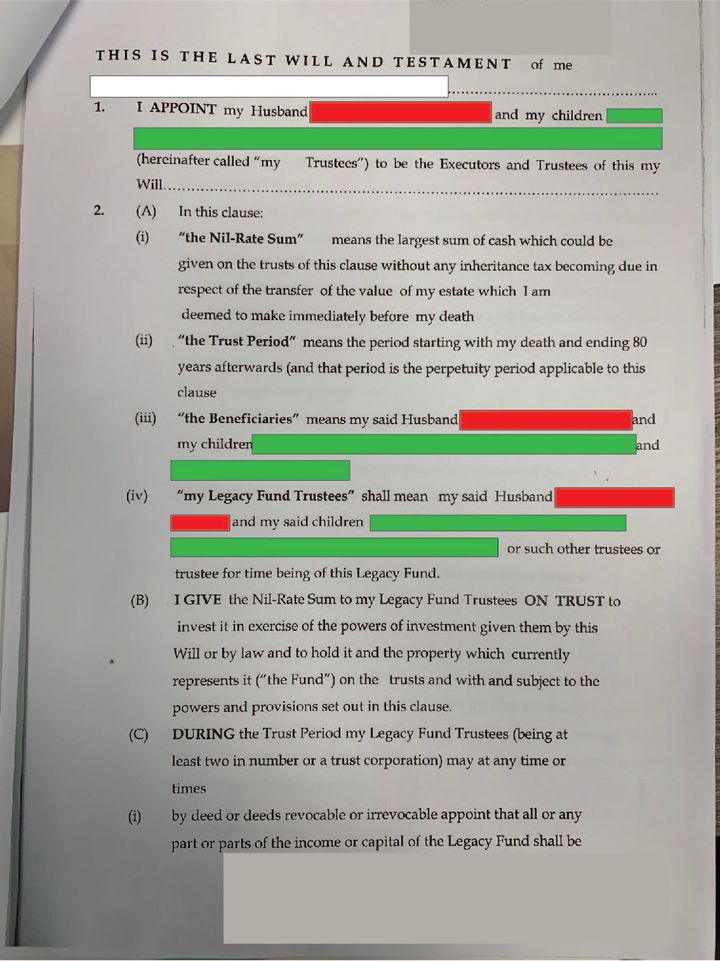

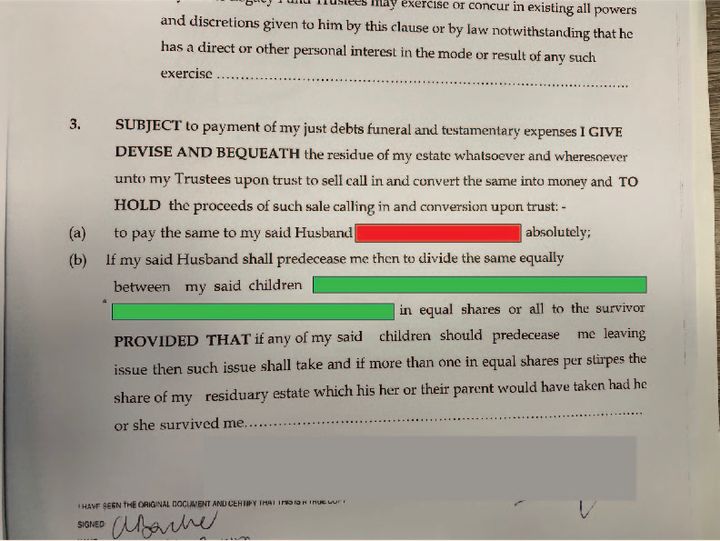

Anyway, below is the will blanked out names, Red = Husband Green = Me & Brother, im confused on section 3 as to what the wording means,

worth an ask before i try another solicitor,

My dad died when i was young (9) in 1987, my mother remarried in 2008 and in 2018 she was diagnosed with dementia

her husband (horrible piece) put her in a carehome and has been abscent ever since,

6 years later and my mother passsed away 2 weeks back, on trying to get the will to see if there are any funeral requests its seems

me, my brother and her husband are exucuters, the solicotors have struggled to get hold of him for a week but finally have and his feedback is 'he needs time to think about things'

This is not about money as the carehome has swallowed up any estate mother had over the years.

Anyway, below is the will blanked out names, Red = Husband Green = Me & Brother, im confused on section 3 as to what the wording means,

worth an ask before i try another solicitor,

Not an expert by any means, but I've had experience of a similar will.

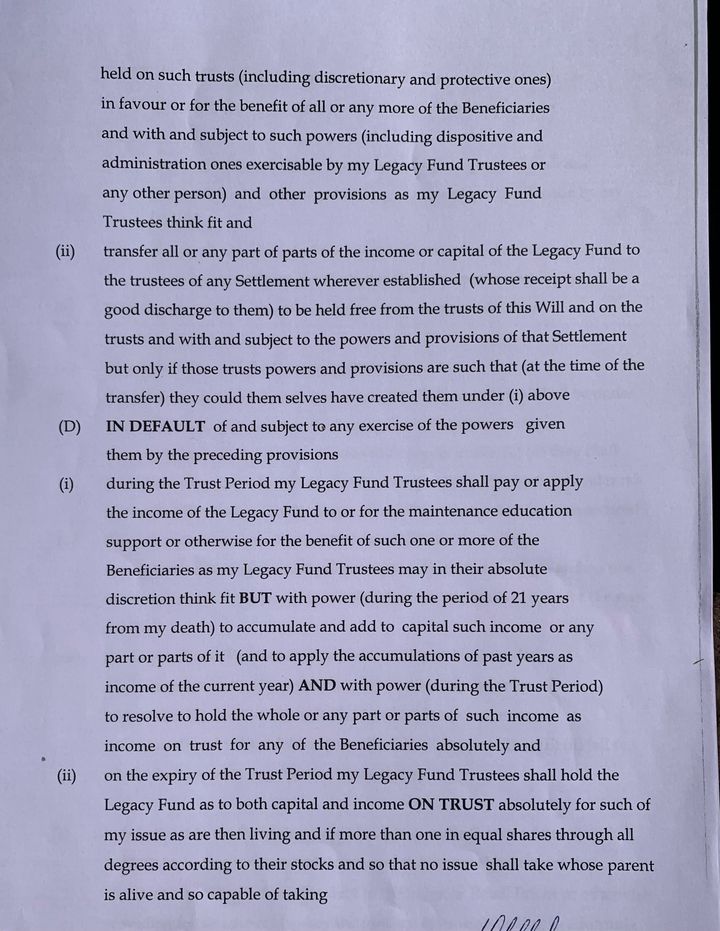

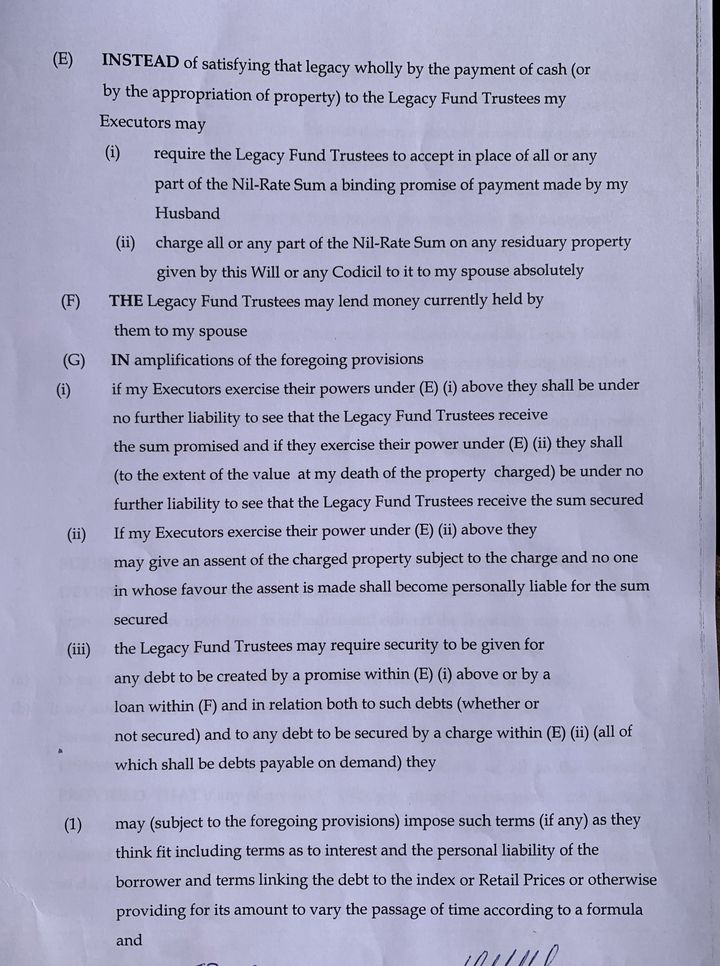

Clause 2 looks like it's setting up a Will Trust using the deceased's inheritance tax nil rate band (currently £325k). Later in this clause there are probably instructions regarding how the WT trustees should then distribute income and / or capital to beneficiaries.

Clause 3 appears to say anything left over goes to the husband, but if he's already dead then it goes to the children.

So, if the deceased left an estate worth £400k, then £325k would go into the Will Trust (per Clause 2), then £75k would be bequeathed to either the husband or children (per Clause 3).

Both clauses are irrelevant if the estate's value is £0.

If you're in any doubt, getting proper legal advice is strongly recommended.

Clause 2 looks like it's setting up a Will Trust using the deceased's inheritance tax nil rate band (currently £325k). Later in this clause there are probably instructions regarding how the WT trustees should then distribute income and / or capital to beneficiaries.

Clause 3 appears to say anything left over goes to the husband, but if he's already dead then it goes to the children.

So, if the deceased left an estate worth £400k, then £325k would go into the Will Trust (per Clause 2), then £75k would be bequeathed to either the husband or children (per Clause 3).

Both clauses are irrelevant if the estate's value is £0.

If you're in any doubt, getting proper legal advice is strongly recommended.

Edited by C69 on Thursday 10th April 19:47

Thanks for the comments.

Sorry I missed the middle 2 pages of the will from my post as I’m not sure if these pages are relevent although I’m unsure on the legacy fund section.

There is some money left in her estate but only a small amount around £30k, we aren’t chasing for any of it but would like to understand if this all goes to the husband.

Sorry I missed the middle 2 pages of the will from my post as I’m not sure if these pages are relevent although I’m unsure on the legacy fund section.

There is some money left in her estate but only a small amount around £30k, we aren’t chasing for any of it but would like to understand if this all goes to the husband.

BertyFish said:

Thanks for the comments.

Sorry I missed the middle 2 pages of the will from my post as I’m not sure if these pages are relevent although I’m unsure on the legacy fund section.

There is some money left in her estate but only a small amount around £30k, we aren’t chasing for any of it but would like to understand if this all goes to the husband.

My understanding is that it should all go to the Will Trust (the 'Legacy Fund') as per clause 2. Unfortunately, it looks like the will has ended up being overly complex for the situation that you're now in.Sorry I missed the middle 2 pages of the will from my post as I’m not sure if these pages are relevent although I’m unsure on the legacy fund section.

There is some money left in her estate but only a small amount around £30k, we aren’t chasing for any of it but would like to understand if this all goes to the husband.

I would suggest paying a solicitor who knows about estate administration to explain to you how things might work in practice. Setting up a trust for £30k seems nonsensical, so is there any way to avoid doing it? You shouldn't be out of pocket for this (hence the mention of 'testamentary expenses'), because it'll come out of the £30k.

Thanks again, the solictors who put the will together are now no longer trading as i think that would have been my first contact.

Ive rang a couple of local solicitors with one saying they dont offer a service and another saying the charge would be £295+vat to look at it but may not be able to help.

We were given my mothers bank details yesterday so atleast we can arrange a funeral and look at the will after if needed.

Ive rang a couple of local solicitors with one saying they dont offer a service and another saying the charge would be £295+vat to look at it but may not be able to help.

We were given my mothers bank details yesterday so atleast we can arrange a funeral and look at the will after if needed.

C69 said:

Clause 2 looks like it's setting up a Will Trust using the deceased's inheritance tax nil rate band (currently £325k). Later in this clause there are probably instructions regarding how the WT trustees should then distribute income and / or capital to beneficiaries.

Clause 3 appears to say anything left over goes to the husband, but if he's already dead then it goes to the children.

Both clauses are irrelevant if the estate's value is £0.

^^^ This.Clause 3 appears to say anything left over goes to the husband, but if he's already dead then it goes to the children.

Both clauses are irrelevant if the estate's value is £0.

I can't see any point spending money on solicitors unless you believe there's some "value" remaining in her estate.

IANAL. But it looks like this will might specify a Nil Rate Band Trust, that was previously used as a way of avoiding inheritance tax. The law changed a few years ago and such trusts aren't usually required any more.

In my Dad's case, we needed to use a solicitor to do some legal thing that avoided the Trust having to be used.

I think you (or more likely the estate) probably need to pay for advice.

In my Dad's case, we needed to use a solicitor to do some legal thing that avoided the Trust having to be used.

I think you (or more likely the estate) probably need to pay for advice.

outnumbered said:

IANAL. But it looks like this will might specify a Nil Rate Band Trust, that was previously used as a way of avoiding inheritance tax. The law changed a few years ago and such trusts aren't usually required any more.

In my Dad's case, we needed to use a solicitor to do some legal thing that avoided the Trust having to be used.

I think you (or more likely the estate) probably need to pay for advice.

Deed of variation that the executor(s) can sign to retrospectively change the will. Surprised me that you can do so retrospectively after the deceased has died but that’s what we did for my mums will. She also had a similar trust set up which, as you say, was then an irrelevance after the n introduction of the nil rate tax band as all assets were simply passing to my father anyway. In my Dad's case, we needed to use a solicitor to do some legal thing that avoided the Trust having to be used.

I think you (or more likely the estate) probably need to pay for advice.

Shnozz said:

Deed of variation that the executor(s) can sign to retrospectively change the will. Surprised me that you can do so retrospectively after the deceased has died but that’s what we did for my mums will.

The executors can't change a Will on their own. Any beneficiaries must agree and sign because it's their rights that are being varied.Panamax said:

Shnozz said:

Deed of variation that the executor(s) can sign to retrospectively change the will. Surprised me that you can do so retrospectively after the deceased has died but that’s what we did for my mums will.

The executors can't change a Will on their own. Any beneficiaries must agree and sign because it's their rights that are being varied.Gassing Station | Finance | Top of Page | What's New | My Stuff