Lump sum overpayment of mortgage - options

Discussion

What do people think is best?

I have recently overpaid 8% of my mortgage with cash.

Term left is 19yrs.

There is no way I will be going at it this long, I will pay it off in 10 most likely.

Should I:

a) keep term at 19 yrs and ask for reduced monthlies, put monthly money difference into something more rewarding

b) reduce the term.

Which is financially more efficient? Apparently I get to pick.

Its fixed at 3.98% for another 3yrs. (of a 5yr fix)

I pay my monthly easily each month with (fortunately) money to spare.

A) is more efficient, provided that you put the difference between your prior payment and your new payment into savings/investments that return more than your mortgage rate of interest. Without that alternative investment B is more efficient.

Of course, if you have a savings/investments option that returns more than your mortgage rate of interest, then your initial overpayment wasn t financially efficient in the first place. But no use crying over spilt milk.

(Also, there are other factors at play aside from financial efficiency, but that s what you asked about)

Of course, if you have a savings/investments option that returns more than your mortgage rate of interest, then your initial overpayment wasn t financially efficient in the first place. But no use crying over spilt milk.

(Also, there are other factors at play aside from financial efficiency, but that s what you asked about)

Jawls said:

A) is more efficient, provided that you put the difference between your prior payment and your new payment into savings/investments that return more than your mortgage rate of interest. Without that alternative investment B is more efficient.

Of course, if you have a savings/investments option that returns more than your mortgage rate of interest, then your initial overpayment wasn t financially efficient in the first place. But no use crying over spilt milk.

(Also, there are other factors at play aside from financial efficiency, but that s what you asked about)

Thanks. The cash overpayment was in the catagory "ultrasafe" and so it had to go somewhere with zero risk. I really didn't think there was anything else at 3.98% that was (so) zero risk. My thinking that paying off a debt is a zero risk investment. The mortgage isn't with Northern Rock..... Of course, if you have a savings/investments option that returns more than your mortgage rate of interest, then your initial overpayment wasn t financially efficient in the first place. But no use crying over spilt milk.

(Also, there are other factors at play aside from financial efficiency, but that s what you asked about)

My other investments are medium risk and some are medium to high risk, so I can spread some of the monthly difference there.

Putting the 8% chunk into shares or crypto was never on the table!

Overpaying your mortgage is one of the most tax efficient things you can do, alongside putting the max into your ISAs and pension.

(And with the annual allowance most NHS consultants will be using their full allowance already with or without any private addition)

I did what you’re doing, put every bit of extra cash into overpaying my mortgage and paid it off in 7 years. It was the best financial decision I made (other than buying an NSX at the absolute trough in the market as I remind my wife every time I raise the idea of buying another car )

)

(And with the annual allowance most NHS consultants will be using their full allowance already with or without any private addition)

I did what you’re doing, put every bit of extra cash into overpaying my mortgage and paid it off in 7 years. It was the best financial decision I made (other than buying an NSX at the absolute trough in the market as I remind my wife every time I raise the idea of buying another car

)

)Many years ago when I was paying off my mortgage, I kept the term and payments the same, therefore effectively over paying every month, I paid in 3 lump sums during the time I had it. I paid a 25 year mortgage off in 8 years. No idea if present terms allow that sort of thing these days. But then it was no where near the max I could borrow at the time. After that, and during the mortgage I also put a lot into ISA's, which I now live off waiting for my pensions to kick in.

Origami said:

Overpaying your mortgage is one of the most tax efficient things you can do, alongside putting the max into your ISAs and pension.

(And with the annual allowance most NHS consultants will be using their full allowance already with or without any private addition)

I did what you re doing, put every bit of extra cash into overpaying my mortgage and paid it off in 7 years. It was the best financial decision I made (other than buying an NSX at the absolute trough in the market as I remind my wife every time I raise the idea of buying another car )

)

Which aspect of mortgage overpayment is tax efficent?(And with the annual allowance most NHS consultants will be using their full allowance already with or without any private addition)

I did what you re doing, put every bit of extra cash into overpaying my mortgage and paid it off in 7 years. It was the best financial decision I made (other than buying an NSX at the absolute trough in the market as I remind my wife every time I raise the idea of buying another car

)

)I'm not aware of any tax advantage relating to overpaying?

Say you are paying 4% interest on £100,000, ie £4,000

You are paying that out of taxed income.

And you happen to have £100,000 to invest or do with as you please.

If you are a 45% tax payer you would need to be earning (1/.55)*4,000=£7,272 before tax to pay this, ie a return of 7.3% before tax.

So where can you find a better place to invest your £100,000 returning 7.3% entirely risk free?

Thats why the best use of that £100,000 is to overpay your mortgage.

You might make more than 7.3% gross on stocks but then again you might not. Long term over the past 20 years the FTSE 100 has returned around 6.3% annualised including reinvesting dividends but of course there have been periods when it returns less or even nothing.

Especially if don’t in an offset mortgage where you still have access to the capital if you decide you need it.

So DYOR but reducing your mortgage should be a high priority for any spare cash before going all in on other investments. (You can make an exception for ISAs where you lose your annual allowance if you don’t use it and building this up as a stack of tax exempt earnings is very prudent.)

And if your investment includes any type of fees then you’re very likely to be doing worse than just paying your mortgage down.

All very much DYOR of course but that’s my approach and it’s served is very well

You are paying that out of taxed income.

And you happen to have £100,000 to invest or do with as you please.

If you are a 45% tax payer you would need to be earning (1/.55)*4,000=£7,272 before tax to pay this, ie a return of 7.3% before tax.

So where can you find a better place to invest your £100,000 returning 7.3% entirely risk free?

Thats why the best use of that £100,000 is to overpay your mortgage.

You might make more than 7.3% gross on stocks but then again you might not. Long term over the past 20 years the FTSE 100 has returned around 6.3% annualised including reinvesting dividends but of course there have been periods when it returns less or even nothing.

Especially if don’t in an offset mortgage where you still have access to the capital if you decide you need it.

So DYOR but reducing your mortgage should be a high priority for any spare cash before going all in on other investments. (You can make an exception for ISAs where you lose your annual allowance if you don’t use it and building this up as a stack of tax exempt earnings is very prudent.)

And if your investment includes any type of fees then you’re very likely to be doing worse than just paying your mortgage down.

All very much DYOR of course but that’s my approach and it’s served is very well

Part of Maggie Thatcher’s legacy, which may be forgotten, was mortgage rates at 16%

As that came down after her reign, we didn’t reduce repayments

Net result was paying off the mortgage 10 years early

Being mortgage free felt great and opened up a number of opportunities, we’e never regretted it

As that came down after her reign, we didn’t reduce repayments

Net result was paying off the mortgage 10 years early

Being mortgage free felt great and opened up a number of opportunities, we’e never regretted it

The overpayment I made will save me £22,000 in interest that would have accrued over the 19 yrs.

Which is near on £40,000 before income tax. Now I've said I won't be keeping the mortgage for this long, but projecting on a 3.98% mortgage, that's a very decent long term figure if it was growth. And capital not at risk. I have to pay it. Halifax Bank isn't going anywhere.

Mortgages aren't going to 1.5% or 10% soon.

Which is near on £40,000 before income tax. Now I've said I won't be keeping the mortgage for this long, but projecting on a 3.98% mortgage, that's a very decent long term figure if it was growth. And capital not at risk. I have to pay it. Halifax Bank isn't going anywhere.

Mortgages aren't going to 1.5% or 10% soon.

The_Doc said:

The overpayment I made will save me £22,000 in interest that would have accrued over the 19 yrs.

Which is near on £40,000 before income tax.

This is exactly how I think, the issue is you stop wanting to buy things when you realise that a £20k car is actually going to cost you £40k compared to paying it off the mortgage. Which is near on £40,000 before income tax.

ThingsBehindTheSun said:

This is exactly how I think, the issue is you stop wanting to buy things when you realise that a £20k car is actually going to cost you £40k compared to paying it off the mortgage.

I am getting like this. What is the point in having a nice car or buying a nice watch. But then with this attitude I will never have anything! Apart from possibly a boring life!I do like holidays though so I can justify spending on them.

But very much in the boring camp of mortgage and isa at the minute. What has happened to me!

Edited by keo on Monday 15th September 05:30

Having said that, you can focus on planning ahead rather than enjoying life along the way a bit too much

It s all about balance.

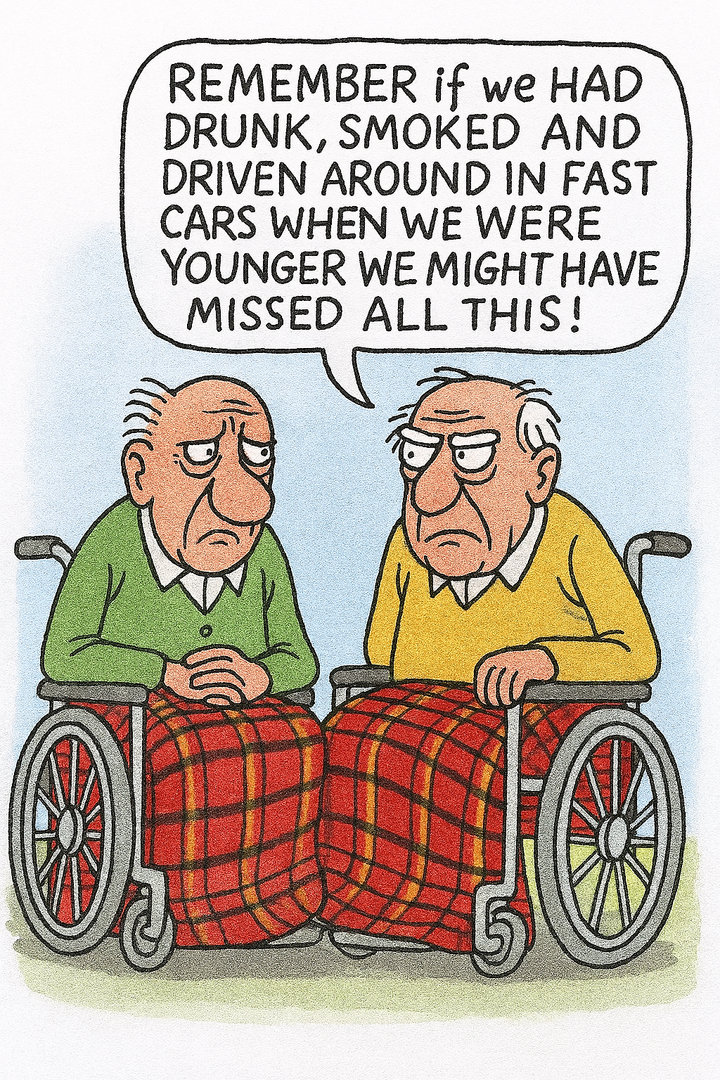

Actually copilot did a better job than Google AI in the cartoon. It even appeared to appreciate the intent - scary stuff

‘Done! The tartan blankets are now snugly draped over their knees — adding just the right touch of cozy irony to the scene. Let me know if you'd like to tweak anything else.’

It s all about balance.

Actually copilot did a better job than Google AI in the cartoon. It even appeared to appreciate the intent - scary stuff

‘Done! The tartan blankets are now snugly draped over their knees — adding just the right touch of cozy irony to the scene. Let me know if you'd like to tweak anything else.’

Edited by Origami on Monday 15th September 07:38

Oh I fully agree. I can always earn more money I can’t get time back is something I try and live by. However I have done some daft things. Cars, time off work traveling etc. I really enjoyed them and wouldn’t change it.

But just feels like I’m going a little the other way to compensate for some of my “daft” past decisions as such. I’m pretty balanced overall I think

But just feels like I’m going a little the other way to compensate for some of my “daft” past decisions as such. I’m pretty balanced overall I think

Origami said:

Say you are paying 4% interest on £100,000, ie £4,000

You are paying that out of taxed income.

And you happen to have £100,000 to invest or do with as you please.

If you are a 45% tax payer you would need to be earning (1/.55)*4,000=£7,272 before tax to pay this, ie a return of 7.3% before tax.

So where can you find a better place to invest your £100,000 returning 7.3% entirely risk free?

Thats why the best use of that £100,000 is to overpay your mortgage.

You might make more than 7.3% gross on stocks but then again you might not. Long term over the past 20 years the FTSE 100 has returned around 6.3% annualised including reinvesting dividends but of course there have been periods when it returns less or even nothing.

Especially if don t in an offset mortgage where you still have access to the capital if you decide you need it.

So DYOR but reducing your mortgage should be a high priority for any spare cash before going all in on other investments. (You can make an exception for ISAs where you lose your annual allowance if you don t use it and building this up as a stack of tax exempt earnings is very prudent.)

And if your investment includes any type of fees then you re very likely to be doing worse than just paying your mortgage down.

All very much DYOR of course but that s my approach and it s served is very well

Paying off ones mortgage faster is always a good idea, mainly due to the psychology of not having a large debt. However your logic in regards hurdle rates is totally flawed. If you can achieve a greater return than the mortgage interest elsewhere you win that argument. The reason being, you can't choose not to pay income tax, therefore an investment return can only be assessed on a like basis. You are paying that out of taxed income.

And you happen to have £100,000 to invest or do with as you please.

If you are a 45% tax payer you would need to be earning (1/.55)*4,000=£7,272 before tax to pay this, ie a return of 7.3% before tax.

So where can you find a better place to invest your £100,000 returning 7.3% entirely risk free?

Thats why the best use of that £100,000 is to overpay your mortgage.

You might make more than 7.3% gross on stocks but then again you might not. Long term over the past 20 years the FTSE 100 has returned around 6.3% annualised including reinvesting dividends but of course there have been periods when it returns less or even nothing.

Especially if don t in an offset mortgage where you still have access to the capital if you decide you need it.

So DYOR but reducing your mortgage should be a high priority for any spare cash before going all in on other investments. (You can make an exception for ISAs where you lose your annual allowance if you don t use it and building this up as a stack of tax exempt earnings is very prudent.)

And if your investment includes any type of fees then you re very likely to be doing worse than just paying your mortgage down.

All very much DYOR of course but that s my approach and it s served is very well

PeteTaylor99 said:

Paying off ones mortgage faster is always a good idea, mainly due to the psychology of not having a large debt. However your logic in regards hurdle rates is totally flawed. If you can achieve a greater return than the mortgage interest elsewhere you win that argument. The reason being, you can't choose not to pay income tax, therefore an investment return can only be assessed on a like basis.

I don t follow?If I invest £100,000 at 4% and then pay 45% tax I get 4,000*.55=£2,200 in my pocket.

If I pay it into my mortgage which is at 4%, I will have £4,000 more cash that I would have spent on the interest component of the mortgage.

And it is risk free unlike the investment.

You need a return if 7.3% before tax to match the return from paying down your mortgage and that will always involve some risk

Where is the logic in this wrong please?

I've gone with same term, scarily that's me mortgaged until i'm 70.

It allowed me to get the right house and know I could manage the lower payment a longer term gives and I'd have spare for some overpayments when suited me so I could control the loan.

As I was advised at the time, don't worry about the cost now, your income will go and you'll wonder what you were worried about. That was correct, a promotion in the months after helped things and I've since been able to put a bit more aside.

I've got plenty of margin within my ISA allowance so have gone with that vice direct overpayments. It's done quite well over the last few years and critically, It's in my account rather than theirs. It allows me to change strategy with the worst case scenario being running the full term, the best case, having the mortgage balance in cash before I'm 50.

Why shorten the term and artificially force an increase payment? Just increase the payment or invest elsewhere. The loan still effectively comes down.

I think a critical point is whether you have ability to save/invest tax free.

It allowed me to get the right house and know I could manage the lower payment a longer term gives and I'd have spare for some overpayments when suited me so I could control the loan.

As I was advised at the time, don't worry about the cost now, your income will go and you'll wonder what you were worried about. That was correct, a promotion in the months after helped things and I've since been able to put a bit more aside.

I've got plenty of margin within my ISA allowance so have gone with that vice direct overpayments. It's done quite well over the last few years and critically, It's in my account rather than theirs. It allows me to change strategy with the worst case scenario being running the full term, the best case, having the mortgage balance in cash before I'm 50.

Why shorten the term and artificially force an increase payment? Just increase the payment or invest elsewhere. The loan still effectively comes down.

I think a critical point is whether you have ability to save/invest tax free.

Edited by Rick101 on Monday 15th September 10:27

Jakey123 said:

Origami said:

Overpaying your mortgage is one of the most tax efficient things you can do, alongside putting the max into your ISAs and pension.

(And with the annual allowance most NHS consultants will be using their full allowance already with or without any private addition)

Which aspect of mortgage overpayment is tax efficent?(And with the annual allowance most NHS consultants will be using their full allowance already with or without any private addition)

I'm not aware of any tax advantage relating to overpaying?

Unless there is some kind of relief available on mortgage overpayments on your residence, I don't see what's tax efficient about it?

Gassing Station | Finance | Top of Page | What's New | My Stuff