Tidying up my S&S ISA

Discussion

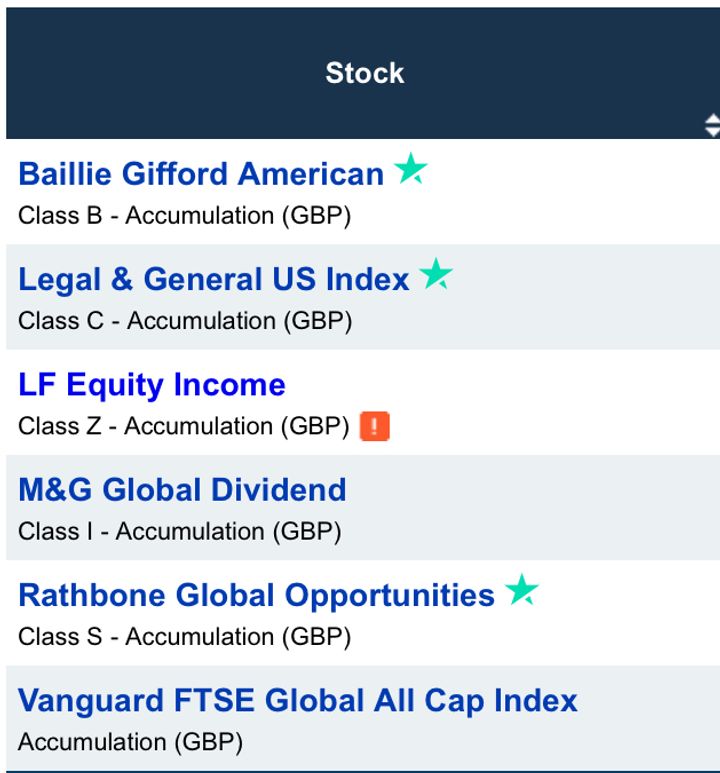

After logging into to my HL account to review my holdings, it’s clear I’ve ended up with a random set of funds that don’t provide much diversify, so questioning my reason for holding. I’ve swapped and changed at points over the last 15 years but what I really want is a couple of low cost trackers so I can continue to fire and forget each month.

I’m happy with my L&G and Vanguard funds. Both relatively low cost (0.05% & 0.23 retrospectively) but do I need to hold the others? They all share similar holdings and sectors albeit the weighting’s do differ slightly. The others do cost more with an average of 0.6% fee. The only reason I’ve kept them is so not to have all my eggs in one basket. They’ve all performed relatively well over the years.

Happy to hear thoughts and opinions?

If it helps I have no plans to touch for another 20/25 years. Top up monthly. Check it once or twice a year so have no interest in swapping and changing and only want to hold equities.

I’m happy with my L&G and Vanguard funds. Both relatively low cost (0.05% & 0.23 retrospectively) but do I need to hold the others? They all share similar holdings and sectors albeit the weighting’s do differ slightly. The others do cost more with an average of 0.6% fee. The only reason I’ve kept them is so not to have all my eggs in one basket. They’ve all performed relatively well over the years.

Happy to hear thoughts and opinions?

If it helps I have no plans to touch for another 20/25 years. Top up monthly. Check it once or twice a year so have no interest in swapping and changing and only want to hold equities.

If you re looking for an index, you ll want to chose which theme you want to track. I have stuck with international indexes for as much diversity as possible and they are available from the likes of fidelity, L&G, HSBC, Ishares etc all very low cost.

The armchair investors will be out with their devils advocate script shortly, but if you really want to go for it with an index and a great risk return ration, then you need to examine scores and quadrants in things like Lipper scores, sharpe ratios etc which all look at both the return but the volatility and risk too - these are displayed in the HL portal. And my choice for index - the one which has been a lipper leader for more quarters than any index fund on planet, the Legal & General global 100 acc. It has better growth than US index across most periods and doesn t include all of the mag7, so its volatility score is a bit more stable. It s available through HL.

Finally, the financial times fund comparison charts are brilliant; type in up to 5 charts to compare side by side and then you really can get a feel for your chosen funds performance against other options or the benchmark.

EDIT. You do arguably have good shares diversity in there with the FTSE all cap fund, so it depends on the overall ratio of this fund compared to the portfolio.

The armchair investors will be out with their devils advocate script shortly, but if you really want to go for it with an index and a great risk return ration, then you need to examine scores and quadrants in things like Lipper scores, sharpe ratios etc which all look at both the return but the volatility and risk too - these are displayed in the HL portal. And my choice for index - the one which has been a lipper leader for more quarters than any index fund on planet, the Legal & General global 100 acc. It has better growth than US index across most periods and doesn t include all of the mag7, so its volatility score is a bit more stable. It s available through HL.

Finally, the financial times fund comparison charts are brilliant; type in up to 5 charts to compare side by side and then you really can get a feel for your chosen funds performance against other options or the benchmark.

EDIT. You do arguably have good shares diversity in there with the FTSE all cap fund, so it depends on the overall ratio of this fund compared to the portfolio.

Edited by Lincolnshire on Saturday 25th October 08:49

I'd go 100% into the Vanguard fund if you are targeting 100% equity.

It holds by far the most companies (over 7,000) from around the world including emerging markets so it's the best implementation of a global market-cap weighted index but that's reflected in the relatively high fee of 0.23%.

Be careful for platform fees with normal funds like the Vanguard one. ETFs (like VWRP) gives very similar exposure for a lower fee and sometimes capped platform fees.

The L&G fund is unnecessary unless you want to increase your exposure to US companies which is already 63% in the Vanguard fund.

It holds by far the most companies (over 7,000) from around the world including emerging markets so it's the best implementation of a global market-cap weighted index but that's reflected in the relatively high fee of 0.23%.

Be careful for platform fees with normal funds like the Vanguard one. ETFs (like VWRP) gives very similar exposure for a lower fee and sometimes capped platform fees.

The L&G fund is unnecessary unless you want to increase your exposure to US companies which is already 63% in the Vanguard fund.

Resto157 said:

After logging into to my HL account to review my holdings, it s clear I ve ended up with a random set of funds that don't provide much diversify, so questioning my reason for holding. I've swapped and changed at points over the last 15 years but what I really want is a couple of low cost trackers so I can continue to fire and forget each month.

'don't provide much diversity'.

The reality is the complete opposite.

I have observed that many posters on the Finance topic, seem to have diversificationitis.

It is possible Resto, if you analyse all of your holdings, that you have investments in hundreds of businesses and very likely some of those same businesses will be held multiple times in your various funds.

Compare the other extreme, the most successful investor ever Mr Warren Buffett, who holds more than 90% of his personal wealth in just one company. His diversification is within that company, which owns many varied subsidiaries trading in countries around the world.

It is possible to have a 'hold and forget', diversified (by sector, geography and foreign exchange) portfolio, with about 25 holdings.

By having hundreds of holdings, a really good one will be so diluted, that it won't even be of help you.

With 25 holdings, having (a lucky) one or two good performers and they will noticeably power your whole portfolio.

There might be some laggards, but they will naturally become irrelevant so can be ignored. Sometimes a laggard unexpectedly springs into life, usually following a shake up by new management.

Jon39 said:

Compare the other extreme, the most successful investor ever Mr Warren Buffett

https://www.aqr.com/-/media/AQR/Documents/Journal-...

"BRK has also produced significant alpha to traditional risk factors. However, we find that this alpha becomes statistically insignificant when controlling for some of the investment styles Buffett describes in his writings"

"However, despite the plethora of factors examined here, the headline from this analysis might be thatMagellan still posted more than 8% “alpha” on average each year for 13 years"

It's worth bearing in mind that Lynch's success was decades ago, before computers took over. The chance of a fund manager repeating that today are slim.

Buffett's success according to AQR was down to buying stocks with particular factor exposure, not stock picking skill (alpha). If he can't do it, what chance does the DIY investor have?

Jon39 said:

It is possible to have a 'hold and forget', diversified (by sector, geography and foreign exchange) portfolio, with about 25 holdings.

By having hundreds of holdings, a really good one will be so diluted, that it won't even be of help you.

With 25 holdings, having (a lucky) one or two good performers and they will noticeably power your whole portfolio.

There might be some laggards, but they will naturally become irrelevant so can be ignored. Sometimes a laggard unexpectedly springs into life, usually following a shake up by new management.

https://rationalreminder.ca/podcast/346

"If you roll back to our earlier discussion, I think you'll see the answer coming. When you add more stocks, you get diversification, it reduces the volatility, it reduces the effect of skewness. The effects of skewness are still there, but not as dramatic. Single stocks only beat the market 4% of the time in the simulations. Portfolios of a 100 stocks, it's still less than 50%, but it's up to 43% portfolios of 100 stocks"

Derek Chevalier said:

"If you roll back to our earlier discussion, I think you'll see the answer coming. When you add more stocks, you get diversification, it reduces the volatility, it reduces the effect of skewness. The effects of skewness are still there, but not as dramatic. Single stocks only beat the market 4% of the time in the simulations. Portfolios of a 100 stocks, it's still less than 50%, but it's up to 43% portfolios of 100 stocks"

I believe your income might be from being a financial advisor.

Mine is from being a business investor with no clients to satisfy, therefore different motivations.

I stick to what works and have always run with about 25 holdings.

As for 'beat the market', 23 years out 37 does not seem too bad.

Annual average 11.51% vs 8.40% (both total returns, to 31 Dec 2024).

This year so far, is one of the exceptionals at +28.78%, but none of that means anything until we reach the year end.

As you know, anything can happen in this game, but I am a firm believer in very-long term, whilst it keeps working.

Jon39 said:

therefore different motivations.

Jon39 said:

I stick to what works

Jon39 said:

As for 'beat the market', 23 years out 37 does not seem too bad.

Derek Chevalier said:

Jon39 said:

I stick to what works

How do you define "works"?

Over a 37 year period, I consider an annual average of 11.51% counts as the strategy works, especially when considering at least three market crashes during that time.

Matching the market at 8.40% would also be a good result.

This is the UK market, which I have remained with. During the 1980/90s, buying US shares was not as easy as now, but with hindsight the returns may have been greater. Best to be satisfied though. Any temptation to be greedy, might also increase risk.

OP, not sure whether the squabbling up thread is helping you or not? It seems Jon39 can’t miss another chance to remind everyone again about what a successful investor he is.

No advice to offer on fund holdings from me, but have you considered holding ETFs rather than funds? HL charge 0.45% platform fee capped at £45 p.a in ISAs and £200 p.a in SIPPs.

No advice to offer on fund holdings from me, but have you considered holding ETFs rather than funds? HL charge 0.45% platform fee capped at £45 p.a in ISAs and £200 p.a in SIPPs.

If you really want to minimise costs, I'd swap out of Vanguard FTSE Global All Cap to something like HSBC FTSE All-World Index. This still has emerging market exposure, but its ongoing charges figure is 0.13%.

Regarding the actively-managed funds, I'd make sure that they're outperforming their relative indices. Also, do their higher charges offer decent value for money?

For instance, I know (from bitter experience!) that your Baillie Gifford American fund performed spectacularly until it didn't any more. It has recovered somewhat now, but your own valuation (versus an equivalent passive fund) will very much depend on when you bought (as per the graphs below). This illustrates the point that active funds can often outperform an index, but they can rarely do so consistently over longer periods.

It's a similar story for the Rathbone fund. If you bought five years ago, you'd have been better off just buying Vanguard FTSE Global All Cap instead. However, for some other time frames it has exceeded its index.

The other thing I'd say is that there's a lot of commonality with the underlying holdings (but you've already pointed this out) plus a lot of exposure to the US. This may or may not be a good thing.

PS: What's the percentage spilt between the funds in your portfolio, and the overall active / passive allocation?

Regarding the actively-managed funds, I'd make sure that they're outperforming their relative indices. Also, do their higher charges offer decent value for money?

For instance, I know (from bitter experience!) that your Baillie Gifford American fund performed spectacularly until it didn't any more. It has recovered somewhat now, but your own valuation (versus an equivalent passive fund) will very much depend on when you bought (as per the graphs below). This illustrates the point that active funds can often outperform an index, but they can rarely do so consistently over longer periods.

It's a similar story for the Rathbone fund. If you bought five years ago, you'd have been better off just buying Vanguard FTSE Global All Cap instead. However, for some other time frames it has exceeded its index.

The other thing I'd say is that there's a lot of commonality with the underlying holdings (but you've already pointed this out) plus a lot of exposure to the US. This may or may not be a good thing.

PS: What's the percentage spilt between the funds in your portfolio, and the overall active / passive allocation?

C69 said:

If you really want to minimise costs, I'd swap out of Vanguard FTSE Global All Cap to something like HSBC FTSE All-World Index. This still has emerging market exposure, but its ongoing charges figure is 0.13%.

Regarding the actively-managed funds, I'd make sure that they're outperforming their relative indices. Also, do their higher charges offer decent value for money?

For instance, I know (from bitter experience!) that your Baillie Gifford American fund performed spectacularly until it didn't any more. It has recovered somewhat now, but your own valuation (versus an equivalent passive fund) will very much depend on when you bought (as per the graphs below). This illustrates the point that active funds can often outperform an index, but they can rarely do so consistently over longer periods.

It's a similar story for the Rathbone fund. If you bought five years ago, you'd have been better off just buying Vanguard FTSE Global All Cap instead. However, for some other time frames it has exceeded its index.

The other thing I'd say is that there's a lot of commonality with the underlying holdings (but you've already pointed this out) plus a lot of exposure to the US. This may or may not be a good thing.

PS: What's the percentage spilt between the funds in your portfolio, and the overall active / passive allocation?

See below % split. The activity managed funds have been held from between 10 and 4 years. I bought in to the BG fund on its way down at the end 21 I believe. Took a bit of time to recover and is one I’d want to drop. As you can see they only make up circa 30% of my overall holdings. The reason for my original post was to get others views on if it was worth holding at all, as I’m contemplating moving out of all 3 and in to the trackers.Regarding the actively-managed funds, I'd make sure that they're outperforming their relative indices. Also, do their higher charges offer decent value for money?

For instance, I know (from bitter experience!) that your Baillie Gifford American fund performed spectacularly until it didn't any more. It has recovered somewhat now, but your own valuation (versus an equivalent passive fund) will very much depend on when you bought (as per the graphs below). This illustrates the point that active funds can often outperform an index, but they can rarely do so consistently over longer periods.

It's a similar story for the Rathbone fund. If you bought five years ago, you'd have been better off just buying Vanguard FTSE Global All Cap instead. However, for some other time frames it has exceeded its index.

The other thing I'd say is that there's a lot of commonality with the underlying holdings (but you've already pointed this out) plus a lot of exposure to the US. This may or may not be a good thing.

PS: What's the percentage spilt between the funds in your portfolio, and the overall active / passive allocation?

C69 said:

If you really want to minimise costs, I'd swap out of Vanguard FTSE Global All Cap to something like HSBC FTSE All-World Index. This still has emerging market exposure, but its ongoing charges figure is 0.13%.

It's worth bearing in mind what is and isn't included in a given index. https://www.lseg.com/content/dam/ftse-russell/en_u...

C69 said:

Regarding the actively-managed funds, I'd make sure that they're outperforming their relative indices.

Unfortunately, it's not as simple as that, given that the fund will be taking different risks than the underlying index, often not an apples-to-apples comparison. Edited by Derek Chevalier on Sunday 26th October 09:33

Assuming you are comfortable with 100% Equities I would use the minimal number of funds(or ETF's if they make more sense from a platform fee perspective) then set and forget. I find simplicity means am less likely to excessively tinker with allocations. That might not be an issue for you but it has been for myself based on past behaviour.

Cabbage Patch said:

No advice to offer on fund holdings from me, but have you considered holding ETFs rather than funds? HL charge 0.45% platform fee capped at £45 p.a in ISAs and £200 p.a in SIPPs.

OP: this is the only advice which can be relied upon to save/make you money, everything else is speculation. you say you've a 20-25 years horizon but if you pay HL charges of 0.45%? over that period you'll cry in 20 years time at the lost potential. anyone with (say) £1m in a sipp with HL right now which has steadily grown to that sum over about 20-30 years will be down £2-300k just because of thier charges.I'd seriously recommend ETFs if you're with HL - HMWO is a good core holding then add other ETFs depending upon your prefference.

Derek Chevalier said:

C69 said:

If you really want to minimise costs, I'd swap out of Vanguard FTSE Global All Cap to something like HSBC FTSE All-World Index. This still has emerging market exposure, but its ongoing charges figure is 0.13%.

It's worth bearing in mind what is and isn't included in a given index. https://www.lseg.com/content/dam/ftse-russell/en_u...

C69 said:

Regarding the actively-managed funds, I'd make sure that they're outperforming their relative indices.

Unfortunately, it's not as simple as that, given that the fund will be taking different risks than the underlying index, often not an apples-to-apples comparison. mikeiow said:

Derek Chevalier said:

C69 said:

If you really want to minimise costs, I'd swap out of Vanguard FTSE Global All Cap to something like HSBC FTSE All-World Index. This still has emerging market exposure, but its ongoing charges figure is 0.13%.

It's worth bearing in mind what is and isn't included in a given index. https://www.lseg.com/content/dam/ftse-russell/en_u...

C69 said:

Regarding the actively-managed funds, I'd make sure that they're outperforming their relative indices.

Unfortunately, it's not as simple as that, given that the fund will be taking different risks than the underlying index, often not an apples-to-apples comparison. 2. Read it

3. Post any questions related to any of the content in the book.

https://www.amazon.co.uk/Smarter-Investing-Simpler...

Derek Chevalier said:

1. Buy Hale's book.

2. Read it

3. Post any questions related to any of the content in the book.

https://www.amazon.co.uk/Smarter-Investing-Simpler...

All the book says is to buy a global index, contribute regularly and leave it. Which is advice already given in this thread, so perhaps give the poster a financial bunk up by saving them the cost of the book?2. Read it

3. Post any questions related to any of the content in the book.

https://www.amazon.co.uk/Smarter-Investing-Simpler...

Lincolnshire said:

Derek Chevalier said:

1. Buy Hale's book.

2. Read it

3. Post any questions related to any of the content in the book.

https://www.amazon.co.uk/Smarter-Investing-Simpler...

All the book says is to buy a global index, contribute regularly and leave it. Which is advice already given in this thread, so perhaps give the poster a financial bunk up by saving them the cost of the book?2. Read it

3. Post any questions related to any of the content in the book.

https://www.amazon.co.uk/Smarter-Investing-Simpler...

I'd gladly send the OP a copy.

Gassing Station | Finance | Top of Page | What's New | My Stuff