Discussion

I follow Rightmove for a few areas out of interest and I have been surprised by how much prices are dropping in some areas. Although I appreciate it is not easy to get a full picture due to other factors such as renovation.

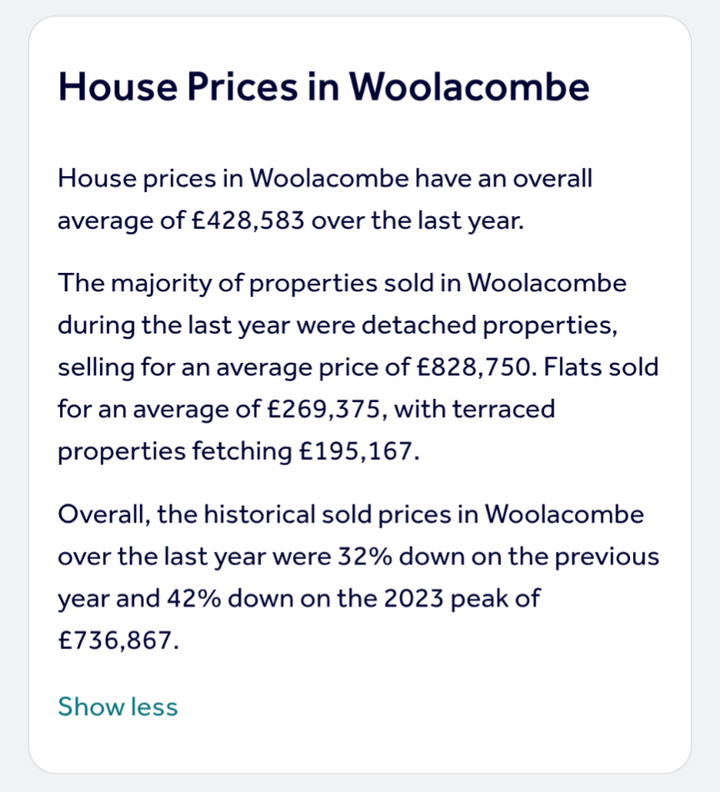

Woolacombe in North Devon seems to have tanked recently and property is taking time to sell.

How are property prices doing in your area. Is this just a correction following the boom years or are we going to see a return of negative equity?

Woolacombe in North Devon seems to have tanked recently and property is taking time to sell.

How are property prices doing in your area. Is this just a correction following the boom years or are we going to see a return of negative equity?

WH16 said:

I'm guessing places with a high proportion of second or holiday homes are going to be hit hardest, given it is becoming harder and more expensive to maintain multiple with each subsequent government.

Agreed. It feels like the Isle of wight has dropped over the last year, post COVID. The prices and availability went a little ballistic a few years ago so needed a correction IMO. But I haven't moved house for the last 19 years, so what do I know?

I know people who have had properties on the market for six months without a huge amount of interest.

greygoose said:

That area is full of second homes and holiday rentals so may not be that representative.

True. It's an area I visit often and the locals are worried. They have got what they wanted with an exodus of the second home owners, but not happy with losing equity in their homes.

ChocolateFrog said:

Average price of £730k probably has a lot to do with that.

Prices seem to be going crazy in Yorkshire. It feels like cheap houses have more than doubled since Covid. Anything that was £40-50k is now £100k+.

My house is likely up around 80% since 2019.

Similar to North Cumbria, we have been looking for 4 years and low to middle prices have really jumped quite a lot, in the past 12 months it feels like 20k added. Prices seem to be going crazy in Yorkshire. It feels like cheap houses have more than doubled since Covid. Anything that was £40-50k is now £100k+.

My house is likely up around 80% since 2019.

There's not a lot of stock here and also few estate agents so they can try a higher price first I guess

ChocolateFrog said:

Average price of £730k probably has a lot to do with that.

Prices seem to be going crazy in Yorkshire. It feels like cheap houses have more than doubled since Covid. Anything that was £40-50k is now £100k+.

My house is likely up around 80% since 2019.

That must be a desirable part of Yorkshire? But then what on earth was available for £50k in 2019, it would have been an absolute hole for that price near me?! Around us (still Yorkshire) I’d say they’re up about 25% for a terrace in ten years. Prices seem to be going crazy in Yorkshire. It feels like cheap houses have more than doubled since Covid. Anything that was £40-50k is now £100k+.

My house is likely up around 80% since 2019.

Stuff at £5-700k with work required sells quickly but nothing seems to be moving at the higher end.

Slow.Patrol said:

greygoose said:

That area is full of second homes and holiday rentals so may not be that representative.

True. It's an area I visit often and the locals are worried. They have got what they wanted with an exodus of the second home owners, but not happy with losing equity in their homes.

Crumpet said:

ChocolateFrog said:

Average price of £730k probably has a lot to do with that.

Prices seem to be going crazy in Yorkshire. It feels like cheap houses have more than doubled since Covid. Anything that was £40-50k is now £100k+.

My house is likely up around 80% since 2019.

That must be a desirable part of Yorkshire? But then what on earth was available for £50k in 2019, it would have been an absolute hole for that price near me?! Around us (still Yorkshire) I d say they re up about 25% for a terrace in ten years. Prices seem to be going crazy in Yorkshire. It feels like cheap houses have more than doubled since Covid. Anything that was £40-50k is now £100k+.

My house is likely up around 80% since 2019.

Stuff at £5-700k with work required sells quickly but nothing seems to be moving at the higher end.

My 12 year old town house with garage, garden and 2 car drive was £130k in 2018 and it was only a couple of years ago that my neighbour sold an identical house for £155k, another 30% or so seems to gone on since then.

From my perspective it's the rest of the country that has gone really nuts.

Edited by ChocolateFrog on Sunday 25th January 10:26

Edited by ChocolateFrog on Sunday 25th January 10:28

I don't follow property prices, but my sister told of his son's recent purchase last year.

My nephew started looking in late 2024 for a first timer 2 bed flat in Kilburn/ London for £500k, but the choice was dire (some with really dodgy conversion on the 2nd bedroom). He liked one particular flat but it was £700k, and outside his budget. He was tracking this flat throughout 2025 which was reducing all the time, and when it reached £600k, he made his move and completed in November '25 (albeit with a little assistance from Bank of Parents to bridge the increasing budget).

Only a small sample, but it does highlight price softening even for central London over the last year.

My nephew started looking in late 2024 for a first timer 2 bed flat in Kilburn/ London for £500k, but the choice was dire (some with really dodgy conversion on the 2nd bedroom). He liked one particular flat but it was £700k, and outside his budget. He was tracking this flat throughout 2025 which was reducing all the time, and when it reached £600k, he made his move and completed in November '25 (albeit with a little assistance from Bank of Parents to bridge the increasing budget).

Only a small sample, but it does highlight price softening even for central London over the last year.

chip* said:

I don't follow property prices, but my sister told of his son's recent purchase last year.

My nephew started looking in late 2024 for a first timer 2 bed flat in Kilburn/ London for £500k, but the choice was dire (some with really dodgy conversion on the 2nd bedroom). He liked one particular flat but it was £700k, and outside his budget. He was tracking this flat throughout 2025 which was reducing all the time, and when it reached £600k, he made his move and completed in November '25 (albeit with a little assistance from Bank of Parents to bridge the increasing budget).

Only a small sample, but it does highlight price softening even for central London over the last year.

London flat prices have certainly disproportionately softened. My nephew started looking in late 2024 for a first timer 2 bed flat in Kilburn/ London for £500k, but the choice was dire (some with really dodgy conversion on the 2nd bedroom). He liked one particular flat but it was £700k, and outside his budget. He was tracking this flat throughout 2025 which was reducing all the time, and when it reached £600k, he made his move and completed in November '25 (albeit with a little assistance from Bank of Parents to bridge the increasing budget).

Only a small sample, but it does highlight price softening even for central London over the last year.

In the areas of the country I have an interest in, prices seem pretty flat generally. Haven’t seen much movement up or down in 2 years.

Had ours valued in 2022 and again 5 months ago. Value in 2022 was 10% higher than today. In 2022 it would have been an easy sell probably selling for over asking price the agent said. Today would be a tougher, slower sale and probably have to knock some off the asking price. Desirable property in a desirable location.

There's no such thing as a house that won't sell but there is a 'right' price, and today I think a lot of (mainly non-standard) houses are richly priced. An example of one of many is a house I was interested in but I believe the price is wrong. It was built by a local builder in 2022 and sold for 790k. It's been on the market in the past 6 months with 2 different agents for 900k. If house prices have dropped (they have) it feels like 750k max. Part of the distortion comes from the cost to build - you couldn't build it today for 750k. Sellers are optimistic and buyers are pessimistic.

There's no such thing as a house that won't sell but there is a 'right' price, and today I think a lot of (mainly non-standard) houses are richly priced. An example of one of many is a house I was interested in but I believe the price is wrong. It was built by a local builder in 2022 and sold for 790k. It's been on the market in the past 6 months with 2 different agents for 900k. If house prices have dropped (they have) it feels like 750k max. Part of the distortion comes from the cost to build - you couldn't build it today for 750k. Sellers are optimistic and buyers are pessimistic.

Woolacombe beach\saunton sands also is going to be ripped up for wind farm power transfer with a ton of building work as part of it. Add that to second homes tax and you only really have people that need to sell on the market everyone else would just wait.

Edited by ez64 on Sunday 25th January 11:18

chip* said:

I don't follow property prices, but my sister told of his son's recent purchase last year.

My nephew started looking in late 2024 for a first timer 2 bed flat in Kilburn/ London for £500k, but the choice was dire (some with really dodgy conversion on the 2nd bedroom). He liked one particular flat but it was £700k, and outside his budget. He was tracking this flat throughout 2025 which was reducing all the time, and when it reached £600k, he made his move and completed in November '25 (albeit with a little assistance from Bank of Parents to bridge the increasing budget).

Only a small sample, but it does highlight price softening even for central London over the last year.

Quite similar in Central London (Mostly City and 1mile surrounding boroughs at least), 1 bed flat average prices quite beyond softening actually. Between 2015 and 2025, Cumulative annual price change -27.3%. Extremely unlucky for someone who bought in 2015 and trying to upgrade to a house today, they will see massive loss as house prices in ideal locations are actually still strong (against inflation at least)My nephew started looking in late 2024 for a first timer 2 bed flat in Kilburn/ London for £500k, but the choice was dire (some with really dodgy conversion on the 2nd bedroom). He liked one particular flat but it was £700k, and outside his budget. He was tracking this flat throughout 2025 which was reducing all the time, and when it reached £600k, he made his move and completed in November '25 (albeit with a little assistance from Bank of Parents to bridge the increasing budget).

Only a small sample, but it does highlight price softening even for central London over the last year.

Press keeps going on about affordability is better but the reality it seems in most purchases is the lending has just become easier, hence storing up issues later down the line if house prices falter or the economy does... Or inflation rises and discount rates offered recently for 2 years become a big issue.

For sure there are areas that are actually dropping a bit after mega growth... But imho In general , house prices are not aligning with pay increases or economic situation in general.

I do feel though that because household income issues are such a big factor in political popularity, a house price crash will always end up with government intervention to steady the market

For sure there are areas that are actually dropping a bit after mega growth... But imho In general , house prices are not aligning with pay increases or economic situation in general.

I do feel though that because household income issues are such a big factor in political popularity, a house price crash will always end up with government intervention to steady the market

Slow.Patrol said:

I follow Rightmove for a few areas out of interest and I have been surprised by how much prices are dropping in some areas. Although I appreciate it is not easy to get a full picture due to other factors such as renovation.

Woolacombe in North Devon seems to have tanked recently and property is taking time to sell.

How are property prices doing in your area. Is this just a correction following the boom years or are we going to see a return of negative equity?

You cannot infer from those numbers that the value of houses has decreased. Woolacombe in North Devon seems to have tanked recently and property is taking time to sell.

How are property prices doing in your area. Is this just a correction following the boom years or are we going to see a return of negative equity?

What the figures presented show is that the average price of the houses sold in that period was lower.

That does not mean that the value ofthose houses last year was the same as the ones that were actually sold last year.

Edited by LooneyTunes on Sunday 25th January 13:54

Gassing Station | Finance | Top of Page | What's New | My Stuff