Discussion

At the age of 53 I have finally decided to open a S&S ISA. I've always been cautious and have stuck with cash ISA and traditional savings accounts up to now believing the stock market was witchcraft and beyond my understanding. Not sure why as I do have a SIPP which of course is invested, but its in a fund with Aviva and as it seems to be doing fairly well I just leave it alone.

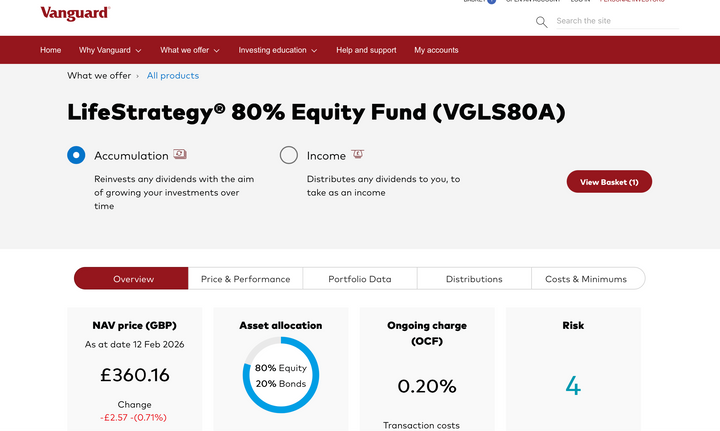

My dad passed away recently and has left me a bit of money and as I haven't used any ISA allowance this year I've decided to just do it. So I have opened an account with Vanguard after much research as it seems fairly simple and its a well known platform. To begin with I've put 5k in the new Global LS80. I plan to put another 5k in before April then a further 20k in the next tax year. Reason I'm not using all of this years allowance is that I haven't actually got the money yet.

My question is about choosing funds. Not expecting free financial advice here but I have two choices and I'm not sure if there's much difference.

1. Put the whole amount (30k) into the same Global LS80 fund.

2. Choose a variety of ETFs with 5k in each.

Does option 2 spread risk, offer potential for more gain, or does it really make little difference? Seems the LS fund is already spread across the market anyway so as a beginner am I better off just letting it do its thing?

My dad passed away recently and has left me a bit of money and as I haven't used any ISA allowance this year I've decided to just do it. So I have opened an account with Vanguard after much research as it seems fairly simple and its a well known platform. To begin with I've put 5k in the new Global LS80. I plan to put another 5k in before April then a further 20k in the next tax year. Reason I'm not using all of this years allowance is that I haven't actually got the money yet.

My question is about choosing funds. Not expecting free financial advice here but I have two choices and I'm not sure if there's much difference.

1. Put the whole amount (30k) into the same Global LS80 fund.

2. Choose a variety of ETFs with 5k in each.

Does option 2 spread risk, offer potential for more gain, or does it really make little difference? Seems the LS fund is already spread across the market anyway so as a beginner am I better off just letting it do its thing?

The simplest crude answer, is which ETFs you have matters less, than the percent of your wealth that's invested in equity.

I used to be 50 but I'm grown more optimistic in general for various reasons, so I'm up to 60%

I would include the SIPP in the totals unless you are investing for some other reason than retirement

I used to be 50 but I'm grown more optimistic in general for various reasons, so I'm up to 60%

I would include the SIPP in the totals unless you are investing for some other reason than retirement

By equities do you mean stocks and shares rather than bonds/cash?

I'm not sure exactly what the split will be. The lifestrategy fund is 80% equities and I 'think' my Sipp is about the same. The two of them together account for about 50% of my wealth with the other half being cash isa, savings and premium bonds. Also own property outright.

I guess that still makes me on the cautious side which I'm okay with. The 30k S&S isa money is money I can afford to lose (but would rather not!). As I've never had one it feels like a bit of a gamble but a calculated one. I'm looking at 10 year investment at which point I'll use it to supplement income while I semi retire.

I'd like the ISA to be diverse. It looks like the lifestrategy is designed to do that so maybe best to just put everything into that. If I choose a variety of ETFs might I just be duplicating things? Thinking thigs like market trackers like s&p500 and ftse100 for a start. But I think the LS fund already invests in those anyway?

I'm not sure exactly what the split will be. The lifestrategy fund is 80% equities and I 'think' my Sipp is about the same. The two of them together account for about 50% of my wealth with the other half being cash isa, savings and premium bonds. Also own property outright.

I guess that still makes me on the cautious side which I'm okay with. The 30k S&S isa money is money I can afford to lose (but would rather not!). As I've never had one it feels like a bit of a gamble but a calculated one. I'm looking at 10 year investment at which point I'll use it to supplement income while I semi retire.

I'd like the ISA to be diverse. It looks like the lifestrategy is designed to do that so maybe best to just put everything into that. If I choose a variety of ETFs might I just be duplicating things? Thinking thigs like market trackers like s&p500 and ftse100 for a start. But I think the LS fund already invests in those anyway?

LS80 is a solid choice IMO.

Chances are your Aviva pension will be somewhere around 75/25 and probably has a bit of a UK bias and some property to it but assuming the 80% equity option is something you can tolerate I wouldn't complicate it.

It's a nice solid fund you should be able to just keep putting money into without second guessing yourself too much.

Chances are your Aviva pension will be somewhere around 75/25 and probably has a bit of a UK bias and some property to it but assuming the 80% equity option is something you can tolerate I wouldn't complicate it.

It's a nice solid fund you should be able to just keep putting money into without second guessing yourself too much.

Thanks for that. I am leaning towards simply using the LS80 fund. I've taken the new Global one with less home bias for now but may go half and half with the traditional LS80 overall. I feel like I'm more set and forget. But having said that I've really enjoyed researching investments over the past few weeks so that might change in the future. Not really looking for massive gains TBH but interest rates on the cash ISAs are slowly falling. Meanwhile I've noticed my Sipp has done much better over the last 5 years and I plan to dump a bit more cash into that too.

I have a few Vanguard accounts albeit not ISA. It's maybe worth considering HSBC. They have 5 global pre-defined ISA stock portfolio's you can choose from for ease. They are cautious, conservative, balanced, dynamic and adventurous. The difference is the amount of equities in each one. You can also split your £20K across more than one if you wish. Last April I plumped for Dynamic and it's up 23.5% thus far. Nice and easy and I've been very impressed. Fees are good too.

When opening a Vanguard account and selecting say an LS80 product, at what stage of the application does their website allow you to have this in an ISA?

I've just tried a dummy run by adding an LS80 to my Vanguard basket, but to progress further I need to set up an account (i'm not ready yet), so I assume one of their next questions would be whether I want this in an ISA?

I've just tried a dummy run by adding an LS80 to my Vanguard basket, but to progress further I need to set up an account (i'm not ready yet), so I assume one of their next questions would be whether I want this in an ISA?

I set up the account first. Then to get started and test it out I picked the ls80 fund and paid £500 by debit card. When that went through fine I did the same with a further £4500 a few days later.

I can't remember at what point it asks if you want an ISA. The choice was Sipp or ISA but it was very straightforward when setting up the account.

I can't remember at what point it asks if you want an ISA. The choice was Sipp or ISA but it was very straightforward when setting up the account.

Vanguard not the most intuitive for this as I recall but I'm sure you'll figure it out. If I did it...

Global 80 a completely appropriate choice for the whole sum IMHO.

It says 'ISA ready' under key facts so it will be possible to hold it in an ISA.

Note that you don't have to use Vanguard, it is available on other platforms. VG is gonna cost you £4/month if you care.

Global 80 a completely appropriate choice for the whole sum IMHO.

It says 'ISA ready' under key facts so it will be possible to hold it in an ISA.

Note that you don't have to use Vanguard, it is available on other platforms. VG is gonna cost you £4/month if you care.

Edited by Hustle_ on Friday 13th February 09:40

ChrisH72 said:

I set up the account first. Then to get started and test it out I picked the ls80 fund and paid £500 by debit card. When that went through fine I did the same with a further £4500 a few days later.

I can't remember at what point it asks if you want an ISA. The choice was Sipp or ISA but it was very straightforward when setting up the account.

Thanks, I;; have a go when the time is rightI can't remember at what point it asks if you want an ISA. The choice was Sipp or ISA but it was very straightforward when setting up the account.

okgo said:

The first port of call is to set up the ISA and then when you add money it ll ask where you want to put it.

Don t lose this years allowance by dithering would be my advice.

I'm going to get it all set up by the middle of March, then do another later in the new financial year when funds allow.Don t lose this years allowance by dithering would be my advice.

Hustle_ said:

Vanguard not the most intuitive for this as I recall but I'm sure you'll figure it out. If I did it...

Global 80 a completely appropriate choice for the whole sum IMHO.

It says 'ISA ready' under key facts so it will be possible to hold it in an ISA.

Note that you don't have to use Vanguard, it is available on other platforms. VG is gonna cost you £4/month if you care.

I think the Vanguard app is a bit of a waste of time. Seems easier to log in through the website and there's more you can do that way. I haven't used any other platforms to comment on their ease of use but Vanguard is okay for now and their customer service appears good.Global 80 a completely appropriate choice for the whole sum IMHO.

It says 'ISA ready' under key facts so it will be possible to hold it in an ISA.

Note that you don't have to use Vanguard, it is available on other platforms. VG is gonna cost you £4/month if you care.

Edited by Hustle_ on Friday 13th February 09:40

When I looked into fees Vanguard is okay up to about 50k after which things like interactive investor may work out cheaper. I'll be a while before I hit that but can always change later on if necessary.

ChrisH72 said:

By equities do you mean stocks and shares rather than bonds/cash?

I'm not sure exactly what the split will be. The lifestrategy fund is 80% equities and I 'think' my Sipp is about the same. The two of them together account for about 50% of my wealth with the other half being cash isa, savings and premium bonds. Also own property outright.

I guess that still makes me on the cautious side which I'm okay with. The 30k S&S isa money is money I can afford to lose (but would rather not!). As I've never had one it feels like a bit of a gamble but a calculated one. I'm looking at 10 year investment at which point I'll use it to supplement income while I semi retire.

I'd like the ISA to be diverse. It looks like the lifestrategy is designed to do that so maybe best to just put everything into that. If I choose a variety of ETFs might I just be duplicating things? Thinking thigs like market trackers like s&p500 and ftse100 for a start. But I think the LS fund already invests in those anyway?

It sounds very similar to me. half in cash, half 80/20 equity /bonds. which translates to about forty percent in equities and ten percent in bonds, overall. I'm not sure exactly what the split will be. The lifestrategy fund is 80% equities and I 'think' my Sipp is about the same. The two of them together account for about 50% of my wealth with the other half being cash isa, savings and premium bonds. Also own property outright.

I guess that still makes me on the cautious side which I'm okay with. The 30k S&S isa money is money I can afford to lose (but would rather not!). As I've never had one it feels like a bit of a gamble but a calculated one. I'm looking at 10 year investment at which point I'll use it to supplement income while I semi retire.

I'd like the ISA to be diverse. It looks like the lifestrategy is designed to do that so maybe best to just put everything into that. If I choose a variety of ETFs might I just be duplicating things? Thinking thigs like market trackers like s&p500 and ftse100 for a start. But I think the LS fund already invests in those anyway?

It's already diversified in the sense you are mostly cash. Rebalancing 30k is not gambling. It's just tweaking the percentage slightly.

Nor is it new. You've been exposed to the stock market for years.

Edited by lizardbrain on Friday 13th February 15:26

ziggy328 said:

I have a few Vanguard accounts albeit not ISA. It's maybe worth considering HSBC. They have 5 global pre-defined ISA stock portfolio's you can choose from for ease. They are cautious, conservative, balanced, dynamic and adventurous. The difference is the amount of equities in each one. You can also split your £20K across more than one if you wish. Last April I plumped for Dynamic and it's up 23.5% thus far. Nice and easy and I've been very impressed. Fees are good too.

HSBC? Sounds interesting as the easier it is to set up, pick, leave it alone the better. I'm off to investigate.I want to cash in some premium bonds to utilise this years ISA allowance, and I'll hopefully be in a position later this year to open another ISA and buy back those premium bonds.......

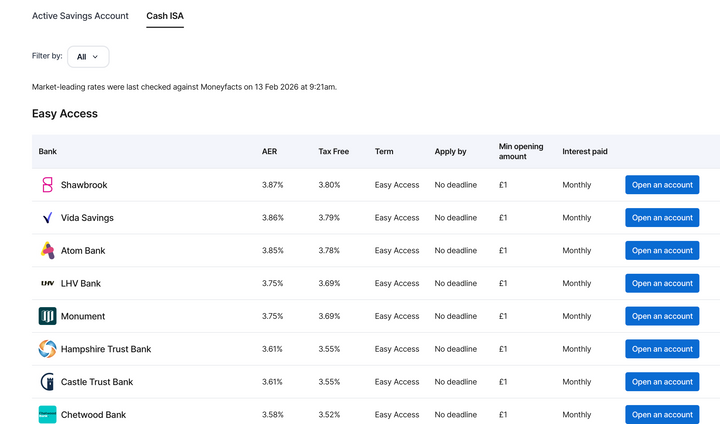

Not sure how Vanguard compare... but I have a Hargreave Lansdown account and I've just had a look at which easy access ISA's they are offering.

Not sure how Vanguard compare... but I have a Hargreave Lansdown account and I've just had a look at which easy access ISA's they are offering.

Edited by The Gauge on Saturday 14th February 09:52

Gassing Station | Finance | Top of Page | What's New | My Stuff