Platform costs for SIPP that is in drawdown

Discussion

I appreciate I need to do some legwork here....& am having interesting chats now with https://www.perplexity.ai, which is giving me some food for thought, in particular whether I should consider platforms that only offer ETFs.

Still not sure whether that is a better way for me to move forward or to stick with the sort of funds I have today, but on a different platform.

So: having had a bloody awful experience with Aviva since they started buggering around with things last year, I have reached the point where I *will* be moving away from them at some point this year.

Obviously need my current official complaint to be resolved first

So.

Imagine a DC pot north of £500K where I am simply doing regular monthly withdrawals around £3-4K pcm.

Current funds are:

20% BNY Mellon Multi-Asset Balanced

20% North American

60% Global Equity

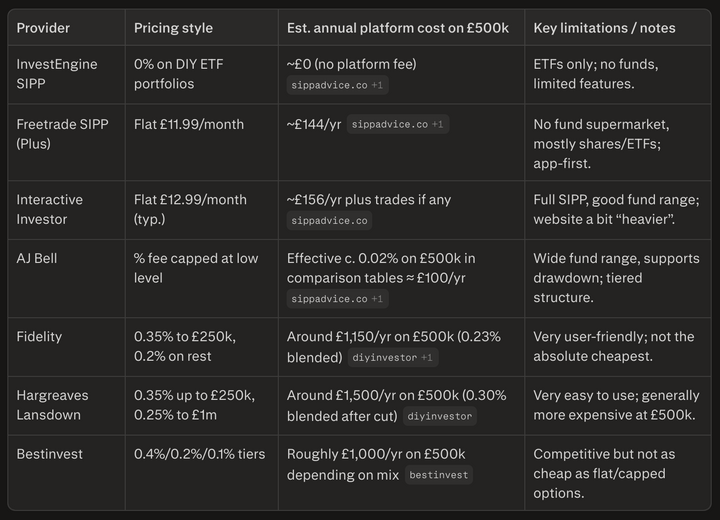

AI gave this suggestion of costs:

Has me leaning towards II.

Anyone got any experience of a 'simple drawdown with any of those platforms?

All I want is for things to work, and IF I want to make a change, for that to be simple for me to control. Tasks like adjusting the amount up, down or pausing the draw, then restarting it, or tweaking the funds or ETFs a little.

Still not sure whether that is a better way for me to move forward or to stick with the sort of funds I have today, but on a different platform.

So: having had a bloody awful experience with Aviva since they started buggering around with things last year, I have reached the point where I *will* be moving away from them at some point this year.

Obviously need my current official complaint to be resolved first

So.

Imagine a DC pot north of £500K where I am simply doing regular monthly withdrawals around £3-4K pcm.

Current funds are:

20% BNY Mellon Multi-Asset Balanced

20% North American

60% Global Equity

AI gave this suggestion of costs:

Has me leaning towards II.

Anyone got any experience of a 'simple drawdown with any of those platforms?

All I want is for things to work, and IF I want to make a change, for that to be simple for me to control. Tasks like adjusting the amount up, down or pausing the draw, then restarting it, or tweaking the funds or ETFs a little.

I think with that size pot and what sounds like a pretty standard set of requirements and importantly (IMO) wanting to be sure you're choosing a provider that should be around for the long term if you're dependent on them for paying out a good chunk of your income my start point these days would start with II and try and find a good reason not to use them.

With c. £500k I think you'd struggle to beat ii's fee structure (plus you'd be able to hold funds and / or ETFs via that platform).

The only slight downside is ii doesn't offer its own annuity, so you'd have to transfer your pot to another provider if you wanted to go down that drawdown route. Not a factor if you're not considering an annuity, of course.

PS: when comparing SIPP platforms, you should check the small print to see if they charge any additional annual drawdown fees. Thankfully this seems to be rarer nowadays.

The only slight downside is ii doesn't offer its own annuity, so you'd have to transfer your pot to another provider if you wanted to go down that drawdown route. Not a factor if you're not considering an annuity, of course.

PS: when comparing SIPP platforms, you should check the small print to see if they charge any additional annual drawdown fees. Thankfully this seems to be rarer nowadays.

butchstewie said:

I think with that size pot and what sounds like a pretty standard set of requirements and importantly (IMO) wanting to be sure you're choosing a provider that should be around for the long term if you're dependent on them for paying out a good chunk of your income my start point these days would start with II and try and find a good reason not to use them.

Mmm....definitely leaning that way.It will be more work for me: Aviva currently do the selling down each month to "pay me", so I would need to sell to cash within II to then fund the next few months or year. Not beyond me, just a change.

Looks like only Vanguard & Fidelity might avoid that. I am interested in some Vanguard funds, but a pal told me he was moving his whole Vanguard pension to II as it was cheaper (with the same funds!). Mind you, last we spoke it was taking a long time to sort

C69 said:

With c. £500k I think you'd struggle to beat ii's fee structure (plus you'd be able to hold funds and / or ETFs via that platform).

The only slight downside is ii doesn't offer its own annuity, so you'd have to transfer your pot to another provider if you wanted to go down that drawdown route. Not a factor if you're not considering an annuity, of course.

PS: when comparing SIPP platforms, you should check the small print to see if they charge any additional annual drawdown fees. Thankfully this seems to be rarer nowadays.

Thanks. Yup, I know I will need to do my own research.The only slight downside is ii doesn't offer its own annuity, so you'd have to transfer your pot to another provider if you wanted to go down that drawdown route. Not a factor if you're not considering an annuity, of course.

PS: when comparing SIPP platforms, you should check the small print to see if they charge any additional annual drawdown fees. Thankfully this seems to be rarer nowadays.

Not overly worried about annuity links right now - I imagine it might be 10-15 years before I might want to stop managing and consider that option.

Huzzah said:

I moved away from Aviva a couple of yrs ago, pleased I did too.

I can imagine. They are an absolute dinosaur to deal with, but when they started removing features without telling me, alarm bells started ringing. Having requested a modest change to payout on 9th Jan, I'm still not yet convinced they will make it this month. Just awful to deal with.Out of interest, where did you move to, if you don't mind sharing?

Interactive Investor have changed their fee structure this month - https://www.ii.co.uk/our-charges

Chris Type R said:

Interactive Investor have changed their fee structure this month - https://www.ii.co.uk/our-charges

Cheeky monkeys!So a couple of quid a month more?

It also says in "other trading costs" UK shares & funds (over £500,000) £40

Not clear what that means - an annual/monthly extra?

I'm disappointed to hear bad reviews of Aviva. I have my Sipp with them and over the last few years it's performed really well. But I'm only 53 so I haven't started drawing anything, in fact other than changing the risk level a while back I haven't had any need to do anything with it.

So is the problem just when you start to drawdown?

So is the problem just when you start to drawdown?

mikeiow said:

Chris Type R said:

Interactive Investor have changed their fee structure this month - https://www.ii.co.uk/our-charges

Cheeky monkeys!So a couple of quid a month more?

It also says in "other trading costs" UK shares & funds (over £500,000) £40

Not clear what that means - an annual/monthly extra?

In terms of your question you'd have to ask ii, but I interpret it to mean individual trades > 500k.

ChrisH72 said:

I'm disappointed to hear bad reviews of Aviva. I have my Sipp with them and over the last few years it's performed really well. But I'm only 53 so I haven't started drawing anything, in fact other than changing the risk level a while back I haven't had any need to do anything with it.

So is the problem just when you start to drawdown?

TL/DR: Not really. So is the problem just when you start to drawdown?

Yours may well be fine, although I gather from another fiscal forum that Aviva are not, shall we say, on the list of favourite platforms of choice for at least one helpful IFA on that board!

Detail:

Remember Aviva bought up many providers over the years: mine started life as Scandia, then Friends Life, then Friends before bcoming Aviva as a "New Generation Personal Pension Plan".

So yours may very likely not be the same as mine!

I like you, I've been happy with the performance of mine

Starting drawdown wasn't *too* painful. A bit paper-based, a bit of pain, but "okay".

Even taking the TFLS elements was okay..

I paused it for 18 months quite early on as the value had dropped quite a bit (blame BG American

), & that lasted over a year (good to have cash to live on - I was trying to avoid the "sequencing of returns risk" challenge).

), & that lasted over a year (good to have cash to live on - I was trying to avoid the "sequencing of returns risk" challenge).Kick starting it again was "okay" - more paperwork, but not too tough.

However.

I have always 'managed' my funds, making some tweaks along the years.....but last summer they removed that ability.

They didn't communicate this, even tried to pretend it could never do it, then when I presented clear evidence I actually *did* it, they decided the back end team had removed it. Took my complaint and essentially said "tough luck, that's how it is". b

ds!

ds!Then this year (briefly), they appeared to remove the ability to see transactions. An odd one.

I used to be able to look at funds from within the app, which was easy: now I have to go via their "fund centre", which is simply not as easy to use as the old way.

Finally...having asked for a tweak to the drawdown amount on 9th Jan this year, they have yet to confirm it WILL happen, actually telling me my bank had rejected it.

Very odd, since they already pay into that account, & all I was asking was for a small change.

That, for me, is the final straw - dealing with people there who appear to be utterly clueless when I speak with them.

I suspect the key problem for me is that their back end is old tech, & they have probably "let go" the people who understand it, leaving it a bit cranky.

The 'front end" support people I speak with don't really sound like they understand what is going on, & have been unable to explain why the back end people said my bank rejected the payment. Nor could they tell me when they tried to pay it. Or why they said it was when they "added my account". FFS - they already pay into it!!

My bank (First Direct) were very clear to me they have no way to reject a credit of that amount. Go figure!

So. a bit of a long ramble, but hopefully explains why I won't be with Aviva much longer!

I wish you luck: this might just be me, wanting that little more control than they now allow. & getting unlucky with my changed amount....

Thanks for the heads up.

I think mine was Norwich Union before it changed to Aviva. Can't be sure though as it was a long time ago. Until recently, when the money became 6 figures, I hadn't given it much thought. The pension was just an amount that came out every month. I imagine it'll be at least 12 years before I think about touching it. Hopefully they'll get themselves sorted by then but if not I wouldn't think twice about moving to another provider.

I think mine was Norwich Union before it changed to Aviva. Can't be sure though as it was a long time ago. Until recently, when the money became 6 figures, I hadn't given it much thought. The pension was just an amount that came out every month. I imagine it'll be at least 12 years before I think about touching it. Hopefully they'll get themselves sorted by then but if not I wouldn't think twice about moving to another provider.

Mazinbrum said:

I’m happy with II.

Are you just investing with them, or drawing down from a SIPP?

Just curious about the mechanics: sounds like I will need to keep churning the funds into cash to enable the monthly payments. Hopefully that task is simple to achieve: I did find a Fidelity ISA fiddly having to cash in, wait several days then draw money out: felt like that should have been a simpler one step task!

@ChrisTypeR - thx for link, I doubt I will proactively do much before April-May, but will take a look at that.

@ChrisH2 - yeah, do it worry about it, something will have changed by the time you draw against yours, no doubt

Depending on what you invest in, transaction fees can be extremely minimal.

Latest Vanguard charges info -

https://www.vanguardinvestor.co.uk/content/dam/int...

Latest Vanguard charges info -

https://www.vanguardinvestor.co.uk/content/dam/int...

Gassing Station | Finance | Top of Page | What's New | My Stuff