Porsche reports profit nose-dive ahead of new CEO

McLaren's former boss is accustomed to financial straits - he will find the water at Porsche warm

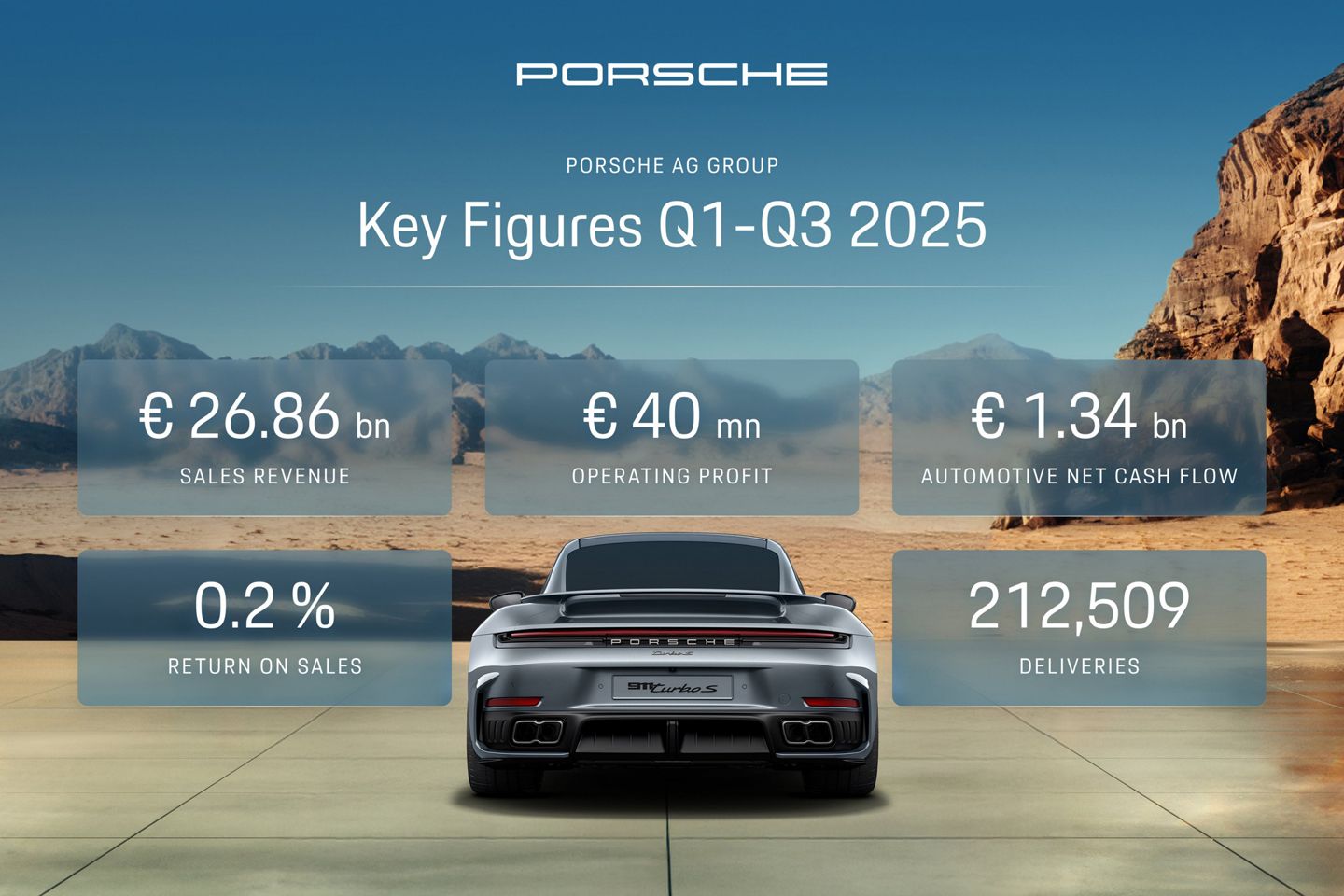

Oliver Blume’s final quarterly report as Porsche CEO was never likely to be a rosy one. His decade-long stint has seen some remarkable highs, but his departure will be remembered for the slump that the firm now finds itself in. Fitting then that he left the bringing of bad news to CFO Dr Jochen Breckner, who was at least able to point to sales revenue of more than 26 billion euros in the first nine months of 2025. Unfortunately, the manufacturer’s operating profit slumped to just 40 million euros - a 99 per cent decrease on the 4.35 billon euros it made in the same period last year.

Good news was hard to find. Its net cash flow is healthy enough (suggesting ongoing resilience, Porsche says) and it delivered a record amount of cars to the US (presumably due to buyers pre-empting tariffs earlier in the year). But its return on sales plunged from 14.1 per cent in 2024 to 0.2 per cent for the year to date, thanks to the ongoing perfect storm of the Chinese market slump, pressure on US prices since August and the ‘one-off’ effect of delaying or walking back its EV strategy. Earlier on Friday, analysts had suggested to Reuters that a third quarter operating loss of 611 million euros might be expected; in fact, it stood at 966 million.

“This year's results reflect the impact of our strategic realignment. However, these measures are essential. We are consciously accepting temporarily weaker financial figures in order to strengthen Porsche's resilience and profitability in the long term,” noted Breckner. “We expect 2025 to be the trough that precedes a noticeable improvement for Porsche from 2026 onwards. Our goal is to sharpen our brand and make our products even more individual, exclusive and desirable.

Quite some challenge for Blume’s successor, former McLaren CEO Michael Leiters, who is due to officially take charge in January. He will be expected to oversee not only a restructuring programme that requires job losses, but also (re)navigate Porsche’s eventual path to electrification - which will require a deft touch in the face of lower than expected demand. While still at McLaren, Leiters was adamant that the case for battery power was unconvincing when it came to mid-engined supercars; at Porsche, a more nuanced approach will obviously be required.

Certainly, the brand cannot afford to be left behind when it comes to EV technology in general. But its cancellation of the electric SUV intended to sit above the Cayenne is evidence enough of the pessimism that has taken root; ditto the decision to insert petrol engines (most notably in the 718 replacement) where previously no petrol engine was planned. Understandably, Porsche’s primary concern is stopping the rot in the short term - though the suggestion that things might begin to turn around from next year seems optimistic.

The appointment of Leiters has been taken by some to mean a renewed focus on the most high-end cars, based on his extensive experience at McLaren and Ferrari. This would be greeted with enthusiasm by customers with a proven record for digging deep when Porsche gets it right - and if the EU waters down its plan to end the sale of combustion engines in 2035, as seems increasingly likely, it would fit the broader direction of travel. Ultimately though, convincing buyers to make the transition from high-revving flat-sixes to hushed volume batteries will be the defining challenge of the next ten years.

In every single car review here and across social media there are a massive number of comments complaining or amazed at how expensive new cars cost now.

Increased product costs and tighter personal budgets equals fewer volumes sold.

The higher tax on new cars is also not helping

Many legacy manufacturers will struggle to produce profitable EV's.

Unless there is a serious rethink regarding mandatory EV's, many manufactures will simple go bust. Then all we are left with is Tesla and Chinese cars. China will rule the

Many legacy manufacturers will struggle to produce profitable EV's.

Unless there is a serious rethink regarding mandatory EV's, many manufactures will simple go bust. Then all we are left with is Tesla and Chinese cars. China will rule the

The German brands used to sell millions of cars in China, pretty much profiteering for decades. This is decreasing quickly.

China doesn’t want overpriced German cars now and changing the “environmental crap” in Europe isn’t changing China’s buying direction.

The German brands used to sell millions of cars in China, pretty much profiteering for decades. This is decreasing quickly.

China doesn t want overpriced German cars now and changing the environmental crap in Europe isn t changing China s buying direction.

The German brands used to sell millions of cars in China, pretty much profiteering for decades. This is decreasing quickly.

China doesn t want overpriced German cars now and changing the environmental crap in Europe isn t changing China s buying direction.

But its return on sales plungedfrom 14.1 per cent in 2024 to 0.2 per cent for the year to date, thanks to the ongoing perfect storm of the Chinese market slump

Also, quoted from here : https://www.pistonheads.com/news/ph-germancars/por...

The headline number is 212,059, the number of Porsches sold globally from January 1st this year until September 30th. If six per cent down on 2024 s equivalent (226,026), it still looks impressive for a company that only sells sports and luxury cars. Market share increased for five of the six model lines. The more interesting trends are in individual market and model fluctuations; the China situation remains tricky, for example, with 26 per cent fewer cars sold in the first three quarters of this year against 2024 (32,195 compared to 43,280).

That’s a 26% sales drop in China for Porsche

But its return on sales plungedfrom 14.1 per cent in 2024 to 0.2 per cent for the year to date, thanks to the ongoing perfect storm of the Chinese market slump

Also, quoted from here : https://www.pistonheads.com/news/ph-germancars/por...

The headline number is 212,059, the number of Porsches sold globally from January 1st this year until September 30th. If six per cent down on 2024 s equivalent (226,026), it still looks impressive for a company that only sells sports and luxury cars. Market share increased for five of the six model lines. The more interesting trends are in individual market and model fluctuations; the China situation remains tricky, for example, with 26 per cent fewer cars sold in the first three quarters of this year against 2024 (32,195 compared to 43,280).

That s a 26% sales drop in China for Porsche

Here, I will add it here seeing as you twice have deliberately left it out:

“the ‘one-off’ effect of delaying or walking back its EV strategy.”

Therefore having to write-off capitalised costs on EV projects that no longer will deliver probable economic benefit. That’s a direct whack to the P&L. Then there is also the depreciation on all EV assets that they also have not had to write off too. Again, huge whacks to your P&L. Both negative impacts to your profit directly due to EV.

But its return on sales plungedfrom 14.1 per cent in 2024 to 0.2 per cent for the year to date, thanks to the ongoing perfect storm of the Chinese market slump

Also, quoted from here : https://www.pistonheads.com/news/ph-germancars/por...

The headline number is 212,059, the number of Porsches sold globally from January 1st this year until September 30th. If six per cent down on 2024 s equivalent (226,026), it still looks impressive for a company that only sells sports and luxury cars. Market share increased for five of the six model lines. The more interesting trends are in individual market and model fluctuations; the China situation remains tricky, for example, with 26 per cent fewer cars sold in the first three quarters of this year against 2024 (32,195 compared to 43,280).

That s a 26% sales drop in China for Porsche

Here, I will add it here seeing as you twice have deliberately left it out:

the one-off effect of delaying or walking back its EV strategy.

Therefore having to write-off capitalised costs on EV projects that no longer will deliver probable economic benefit. That s a direct whack to the P&L. Then there is also the depreciation on all EV assets that they also have not had to write off too. Again, huge whacks to your P&L. Both negative impacts to your profit directly due to EV.

Here, I will add it here seeing as you twice have deliberately left it out:

the one-off effect of delaying or walking back its EV strategy.

Therefore having to write-off capitalised costs on EV projects that no longer will deliver probable economic benefit. That s a direct whack to the P&L. Then there is also the depreciation on all EV assets that they also have not had to write off too. Again, huge whacks to your P&L. Both negative impacts to your profit directly due to EV.

Many legacy manufacturers will struggle to produce profitable EV's.

Unless there is a serious rethink regarding mandatory EV's, many manufactures will simple go bust. Then all we are left with is Tesla and Chinese cars. China will rule the car world.

I’d see it as more of the start of a process of realignment to where they should be. By trading at such volume, they’ve got a certain something. It’s now affecting sales

Many legacy manufacturers will struggle to produce profitable EV's.

Unless there is a serious rethink regarding mandatory EV's, many manufactures will simple go bust. Then all we are left with is Tesla and Chinese cars. China will rule the car world.

TX.

Gassing Station | General Gassing | Top of Page | What's New | My Stuff