Child support demand far greater than salary

Discussion

Appreciate anyone with knowledge of how to address the following urgent need. Apologies, I only know bits of the story....

Friend other than 1 year (15 mths ago) doesn't earn much.

Child Suuport Ageny have calculated an award based on that 1 single year.

They appear to have taken no account of the last full year onwards (and more) that is much lower.

The kicker is that the calculated amount is (loads) more than his recent/current salary. As in 150% of this.

He doesn't seem to be able to get anyone to look at the curent facts.

He is very happy (and has done in the past) to make fair or even stretch contributions. But way more than he even earns is just not do-able or fair.

Questions please:

1. Is there some angle/right/route/words to force them to look at the recent/current facts?

2. If not now, is there a rule re a point in time (such as after this 2nd complete tax year) when he can force a review.

3. To compound the issue, if he gets into debt to satisfy this he will very likely lose his job and profession (think contractual requirement etc). If that happens it is too late and no-one gets paid. Therefore the children lose out too. Is there a way for this unintended impact on others (like losing your driving licence etc) to force a more urgent review before it kicks in.

And How? if no-one is listening. Complaint submitted just gets ignored/no dialogue/closed/no notification.

4. (And least preferable as the 5 figure legal support on a previous non CSA git him precisely nowhere), any recommendations for probono or professionals that have a track record of getting fair results in ugly situations like this.

Thanks in advance. He wants to do the right thing - but can't magic up money that he doesn't have.

Ps.

It has made me think how awful this it for anyone that goes through this stuff. I've read some horrible stories on PH over the years - so apologies if this triggers bad memories for anyone reading.

Friend other than 1 year (15 mths ago) doesn't earn much.

Child Suuport Ageny have calculated an award based on that 1 single year.

They appear to have taken no account of the last full year onwards (and more) that is much lower.

The kicker is that the calculated amount is (loads) more than his recent/current salary. As in 150% of this.

He doesn't seem to be able to get anyone to look at the curent facts.

He is very happy (and has done in the past) to make fair or even stretch contributions. But way more than he even earns is just not do-able or fair.

Questions please:

1. Is there some angle/right/route/words to force them to look at the recent/current facts?

2. If not now, is there a rule re a point in time (such as after this 2nd complete tax year) when he can force a review.

3. To compound the issue, if he gets into debt to satisfy this he will very likely lose his job and profession (think contractual requirement etc). If that happens it is too late and no-one gets paid. Therefore the children lose out too. Is there a way for this unintended impact on others (like losing your driving licence etc) to force a more urgent review before it kicks in.

And How? if no-one is listening. Complaint submitted just gets ignored/no dialogue/closed/no notification.

4. (And least preferable as the 5 figure legal support on a previous non CSA git him precisely nowhere), any recommendations for probono or professionals that have a track record of getting fair results in ugly situations like this.

Thanks in advance. He wants to do the right thing - but can't magic up money that he doesn't have.

Ps.

It has made me think how awful this it for anyone that goes through this stuff. I've read some horrible stories on PH over the years - so apologies if this triggers bad memories for anyone reading.

Edited by C-J on Sunday 20th July 18:41

https://www.gov.uk/how-child-maintenance-is-worked...

He needs to contact - advise change of circumstances & request a variation

Trigger is 25% change in income up or down

He needs to contact - advise change of circumstances & request a variation

Trigger is 25% change in income up or down

Thanks for the swift replies.

Is it stated anywhere that one can appeal within the first 30 days. I couldn't see a link? But maybe it is on the paperwork he receives?

The appeal blocker could be that there hasn't been any change since they calculated it - the issue is that there was a change long before they calculated - which they can see in black and white - but they seem to not want to look.

Is it stated anywhere that one can appeal within the first 30 days. I couldn't see a link? But maybe it is on the paperwork he receives?

The appeal blocker could be that there hasn't been any change since they calculated it - the issue is that there was a change long before they calculated - which they can see in black and white - but they seem to not want to look.

There s two things here

You can appeal their assessment with reasons why you think are relevant

Or

At any time if your circumstances change you need to tell CSA & they will re-assess (don’t need a p60 for this) - which can then also be appealed (in the case of earnings changes they need to be significant at 25% different - up or down - which it sounds like they are)

(If it was the other way & he got promoted & didn t tell them he d get fined for not giving the info to re-assess)

Your friend will likely get payments reduced with a drop in income

You can appeal their assessment with reasons why you think are relevant

Or

At any time if your circumstances change you need to tell CSA & they will re-assess (don’t need a p60 for this) - which can then also be appealed (in the case of earnings changes they need to be significant at 25% different - up or down - which it sounds like they are)

(If it was the other way & he got promoted & didn t tell them he d get fined for not giving the info to re-assess)

Your friend will likely get payments reduced with a drop in income

I ve used the CMS section on the Gov website. Punch the details in and gives you the arbitrary number to pay.

Having to go through the CSA itself just incurs charges and the little ones are who miss out.

It s a crap situation your friend is in, I wish them luck in navigating this. It is unfortunately still a minefield even after all these years.

Having to go through the CSA itself just incurs charges and the little ones are who miss out.

It s a crap situation your friend is in, I wish them luck in navigating this. It is unfortunately still a minefield even after all these years.

Matt p said:

I ve used the CMS section on the Gov website. Punch the details in and gives you the arbitrary number to pay.

Having to go through the CSA itself just incurs charges and the little ones are who miss out.

CSA already appears involved, definitely keep on side & get them to re-assess, rather than changing the number yourself - especially if other party is unhappyHaving to go through the CSA itself just incurs charges and the little ones are who miss out.

In this situation I suspect there will be no charges made unless the paying party defaults & then you have no choice but to use their collection services. Which is ridiculously expensive.

Let the CSA work out revised figure based on new info & then continue to make payments directly. They will inform the other party etc

Eta Just checked terminology

CSA describes two methods of payment

After they calculate the number

Direct Pay - where paying party pays receiving directly (suggested by standing order). There are no fees involved

Collect & Pay - if they need to step in. about 5% deducted from receiver & extra 20% added to payer,

(If they step in it’s non negotiable & can’t switch back, they will step in if they default on a current agreement before it’s re-assessed

Edited by AndyAudi on Monday 21st July 21:12

C-J said:

Cheers folks - will pass info on.

The issue (as I understand) is not what is the process he's happy to be following that) - it's that CSA aparantly are not following their own processes for the calculation.

He's trying to work out what to do to get clarity and a sensible outcome.

The Child Maintenance Service will find out the paying parent’s yearly gross income from information supplied by HM Revenue and Customs (HMRC).The issue (as I understand) is not what is the process he's happy to be following that) - it's that CSA aparantly are not following their own processes for the calculation.

He's trying to work out what to do to get clarity and a sensible outcome.

Weirdly they probably are following the own process,

As a default they use the previous years income to get an an annual figure. Result is folks paying now will be doing so based on income tax year ended April 24 (unless they have told them their income is more than 25% different).

If your mate advises them they do have access to current info to so they can verify.

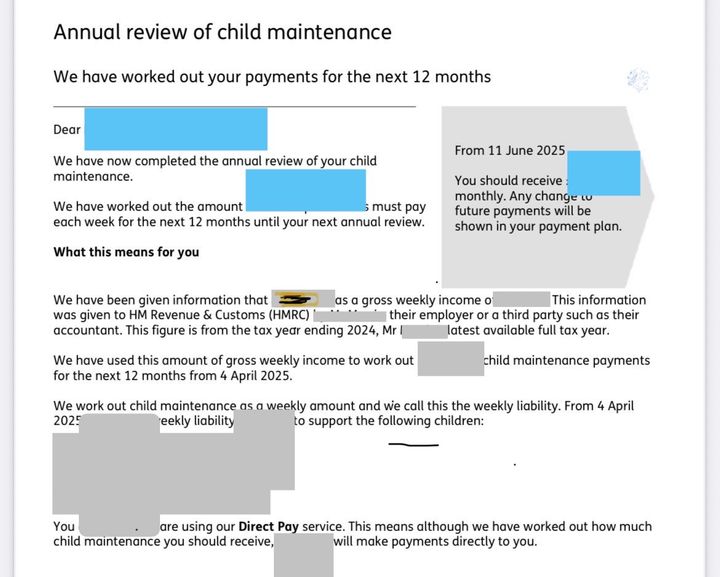

What a pain to redact, this is a copy I got sent from a receiving party a couple of months back just to confirm the calculation was made as standard,

FYI this one was the opposite way, the receiving party asked for a re-assessment as they knew the payer was earning significantly more, (which they got)

Key thing is your pal is NOT appealing their calculation (that s potentially time expired). He s notifying them of a change of circumstances (same as if he was made unemployed) so they can re-assess. He can probably do this over the phone as they have the info to re-calc, he’s not providing them with reasons for appeal

FYI this one was the opposite way, the receiving party asked for a re-assessment as they knew the payer was earning significantly more, (which they got)

Key thing is your pal is NOT appealing their calculation (that s potentially time expired). He s notifying them of a change of circumstances (same as if he was made unemployed) so they can re-assess. He can probably do this over the phone as they have the info to re-calc, he’s not providing them with reasons for appeal

Many thanks for going to the effort of posting a redacted letter - much

If the default is April 24 position that is a good point - it could be he is asking the wrong thing or speaking to the wrong team/wrong route.

In his defence they've not told him any of this (as far as i know). Just "that is what we are doing".

I'll let him know in the hope that they can unlock this - he's a reasonable chap, but they don't sound very easy to engage with.

If the default is April 24 position that is a good point - it could be he is asking the wrong thing or speaking to the wrong team/wrong route.

In his defence they've not told him any of this (as far as i know). Just "that is what we are doing".

I'll let him know in the hope that they can unlock this - he's a reasonable chap, but they don't sound very easy to engage with.

Edited by C-J on Wednesday 23 July 08:38

C-J said:

Many thanks for going to the effort of posting a redacted letter - much

If the default is April 24 position that is a good point - it could be he is asking the wrong thing or speaking to the wrong team/wrong route.

In his defence they've not told him any of this (as far as i know). Just "that is what we are doing".

I'll let him know in the hope that they can unlock this - he's a reasonable chap, but they don't sound very easy to engage with.

Dragging this back up, a mate at work has just had thos through l, has your mate had any luck? If the default is April 24 position that is a good point - it could be he is asking the wrong thing or speaking to the wrong team/wrong route.

In his defence they've not told him any of this (as far as i know). Just "that is what we are doing".

I'll let him know in the hope that they can unlock this - he's a reasonable chap, but they don't sound very easy to engage with.

Edited by C-J on Wednesday 23 July 08:38

As he's currently going nuclear, quitting job selling up etc so want try and help l.

Also definitely not me I have no off spring

Gassing Station | Finance | Top of Page | What's New | My Stuff