Problem with paid for current account

Discussion

I bank with an ex building society who have a tendency to give £100 payments every so often when they distribute profits. Nice bunch. No issues for the decade plus I’ve been with them other than the rising monthly fees which are now £18

Fees buy me mobile phone insurance, travel insurance, breakdown cover and fee free use of my debit card abroad.

I recently tried to pay about £1500 for a hotel in Malaysia. Transaction didn’t go through so I called them. They said they can see the transaction but it’s being stopped because of some tight security system they use. They tried a few times to give me time to pay but each time the payment was blocked. Ultimately, I couldn’t make the payment and made it with another current account with different bank that went through first time.

I was on the phone to the bank for 40 mins

I complained during the call asking for my fees paid to the other bank to be repaid as a minimum. This was about £45

Bank wrote back to say no they will not be doing that. I’m quite pissed off at this given their system has let them down but they’re not admitting liability.

Should I take this up with the ombudsman?

Fees buy me mobile phone insurance, travel insurance, breakdown cover and fee free use of my debit card abroad.

I recently tried to pay about £1500 for a hotel in Malaysia. Transaction didn’t go through so I called them. They said they can see the transaction but it’s being stopped because of some tight security system they use. They tried a few times to give me time to pay but each time the payment was blocked. Ultimately, I couldn’t make the payment and made it with another current account with different bank that went through first time.

I was on the phone to the bank for 40 mins

I complained during the call asking for my fees paid to the other bank to be repaid as a minimum. This was about £45

Bank wrote back to say no they will not be doing that. I’m quite pissed off at this given their system has let them down but they’re not admitting liability.

Should I take this up with the ombudsman?

The customer service at this particular building society that likes to pretend it’s a bank has gone down the pan over the last few years. I recently closed all my accounts after 25 years as a member because I was sick of them plus I was unhappy at the way they went about a recent high profile takeover of the chief executive’s former employer. I also used to have the same paid for account as the OP but binned it when they slashed the benefits but not the cost.

In short, leave. I got £180 switching incentive and £35 cashback moving to First Direct and they just feel like a more professional outfit, though I’m sure there are some horror stories out there.

Also, for your travels, get one or more fee-free credit cards. If you like your current supplier, either their own or their Virgin Money branded cards are fee-free or alternatively there’s the Halifax Clarity card if you’d rather deal with Lloyds group

In short, leave. I got £180 switching incentive and £35 cashback moving to First Direct and they just feel like a more professional outfit, though I’m sure there are some horror stories out there.

Also, for your travels, get one or more fee-free credit cards. If you like your current supplier, either their own or their Virgin Money branded cards are fee-free or alternatively there’s the Halifax Clarity card if you’d rather deal with Lloyds group

Edited by alangla on Sunday 17th August 18:31

alangla said:

Also, for your travels, get one or more fee-free credit cards. If you like your current supplier, either their own or their Virgin Money branded cards are fee-free or alternatively there’s the Halifax Clarity card if you’d rather deal with Lloyds group

There's also a Hilton Honors debit card that seems to be very good for foreign transactions, if you don't want a credit card. Probably others, too.I only use nationwide for the worldwide annual travel insurance and EU/UK breakdown cover so just keep dropping a few hundred when I need to. It was OK at £13pm now it's £18pm is 'just about' OK.

I stick with Nat West for my current account needs but make sure I update the App to notify them when I'm travelling abroad so they know that if an overseas payment is requested and it correlates to where I've told them I'll be it will go through. Well that's the theory anyway but I've never had an issue.

Does nationwide not offer advance overseas notice via its App?

I stick with Nat West for my current account needs but make sure I update the App to notify them when I'm travelling abroad so they know that if an overseas payment is requested and it correlates to where I've told them I'll be it will go through. Well that's the theory anyway but I've never had an issue.

Does nationwide not offer advance overseas notice via its App?

No such feature on the app that allows prior notification

Although I was not in Malaysia at that time. I was actually in Switzerland and explained all this on the phone to the very polite lady who I first spoke to.

The payment for the hotel was also made from Switzerland from my Santander current account. First time. No blockages made by the bank or calls needed.

It’s £45. Not a huge amount but neither is it a small amount (for me). I think I’ll call the lady and politely explain why they should pay me back the fees at least. If they don’t, I’ll leave because this supposed better value, is anything but

Although I was not in Malaysia at that time. I was actually in Switzerland and explained all this on the phone to the very polite lady who I first spoke to.

The payment for the hotel was also made from Switzerland from my Santander current account. First time. No blockages made by the bank or calls needed.

It’s £45. Not a huge amount but neither is it a small amount (for me). I think I’ll call the lady and politely explain why they should pay me back the fees at least. If they don’t, I’ll leave because this supposed better value, is anything but

I’m also with them (technically still a building society). I haven’t had the same issue with you abroad, but more often than not my card will not work for online purchases. Apple Pay or Revolut are the ways out for me, but it’s bloody annoying. The extras are worth the hassle for me at the moment, but won’t be staying if they hike the fees again.

I'm with NW, and agree that £18/month is just about okay.

Anyway, I recently spent 2 weeks travelling around Indonesia (Bali and Lombok) and used my NW Debit Card in various hotels, restaurants and cash point machines. I never had an issue, and everything worked well. However I wasn't spending anything more than £150 in one go.

I'd complain if it were me.

Anyway, I recently spent 2 weeks travelling around Indonesia (Bali and Lombok) and used my NW Debit Card in various hotels, restaurants and cash point machines. I never had an issue, and everything worked well. However I wasn't spending anything more than £150 in one go.

I'd complain if it were me.

deggles said:

I'd definitely be escalating that to the ombudsman. Their explanation is effectively admitting their system is at fault, without actually accepting they're at fault.

They call themselves a bank but it’s all a bit ‘Mickey Mouse’ imo. I bank with Lloyds and Chase, not had any problems so far. The Lloyds bank travel insurance works very well. We had to claim when my mum got a terminal prognosis, they paid without fuss.

Edited by bad company on Tuesday 19th August 10:54

Armitage.Shanks said:

I only use nationwide for the worldwide annual travel insurance and EU/UK breakdown cover so just keep dropping a few hundred when I need to. It was OK at £13pm now it's £18pm is 'just about' OK.

Do the insurances cover a couple? If so, seems like a bargain to me - of course assuming you’re not just duplicating cover elsewhere.Issue we had with included travel insurance is they’re keen to heftily load it for pre-existing conditions and then they wouldn’t cover my wife at all.

I'm with First Direct and I can give you the good and the bad.

For Debit cards all good, if a transaction is blocked I get a text to say so, and I have to reply that it was me. Then it all goes through ok.

I was blocked last year on my credit card though making a purchase at Dubai airport. Wasn't able to sort it as the credit card team were out of hours. Transferred money across to my Debit and paid that way.

For Debit cards all good, if a transaction is blocked I get a text to say so, and I have to reply that it was me. Then it all goes through ok.

I was blocked last year on my credit card though making a purchase at Dubai airport. Wasn't able to sort it as the credit card team were out of hours. Transferred money across to my Debit and paid that way.

tescor said:

I'm with NW, and agree that £18/month is just about okay.

Anyway, I recently spent 2 weeks travelling around Indonesia (Bali and Lombok) and used my NW Debit Card in various hotels, restaurants and cash point machines. I never had an issue, and everything worked well. However I wasn't spending anything more than £150 in one go.

I'd complain if it were me.

Yep, I’m in Malaysia right now and have added my card to the grab app for taxis and it’s fine. All card purchases and ATM withdrawals all fine. Everything goes through on tap, not had to use my PIN other than at ATMAnyway, I recently spent 2 weeks travelling around Indonesia (Bali and Lombok) and used my NW Debit Card in various hotels, restaurants and cash point machines. I never had an issue, and everything worked well. However I wasn't spending anything more than £150 in one go.

I'd complain if it were me.

I can’t let the £45 in fees go though. Will call them when I’m back and hopefully they’ll see sense or they will lose my custom

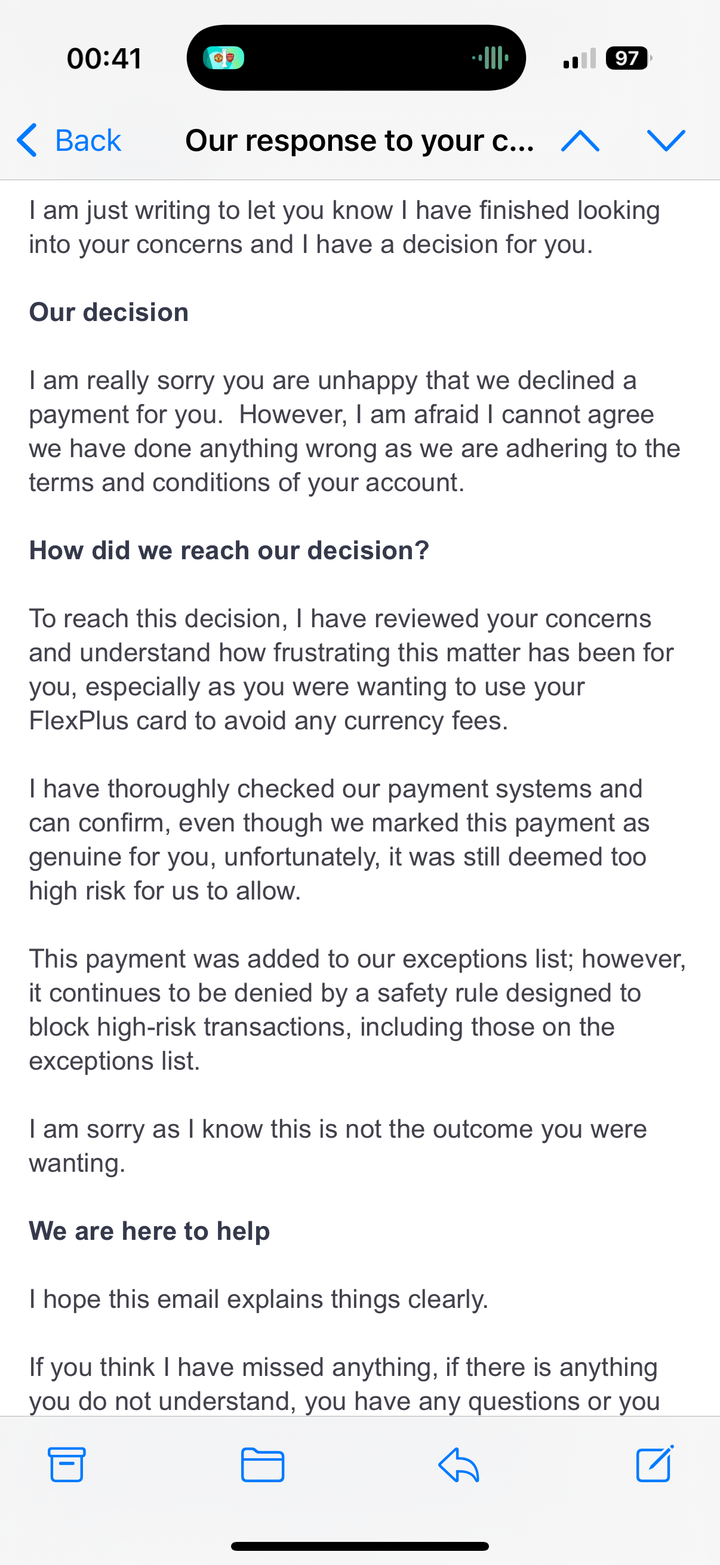

I spoke to the lady who responded to my complaint. She said she’d get back to me and called today and said they’re sticking by their decision. But will give me £50 but not admitting any liability.

Then says that the reason the payment wouldn’t go through is I was using my UK bank account debit card in Swiss to make a payment to Malaysia. Computer didn’t like that

I said that if they just told me that at the time, I could have made payment later that day when I returned home.

That really pissed me off cos this was very avoidable

I’ve completed the financial ombudsman form. I want my account fees back for that month at the very least

Then says that the reason the payment wouldn’t go through is I was using my UK bank account debit card in Swiss to make a payment to Malaysia. Computer didn’t like that

I said that if they just told me that at the time, I could have made payment later that day when I returned home.

That really pissed me off cos this was very avoidable

I’ve completed the financial ombudsman form. I want my account fees back for that month at the very least

Gassing Station | Finance | Top of Page | What's New | My Stuff