Mortgage advise.

Discussion

My mortgage is up for renewal in January. it’s currently with Barclays

Have a 5 year fixed currently at around 1.6% if I remember correctly.

Starting to look at what’s about but not sure if I should fix for 2year, 5 years or higher.

Any advise would be greatly appreciated, what are people’s thought for they years ahead? Are rates going to drop anytime soon ?

Would like to stay with Barclays if possible.

Have a 5 year fixed currently at around 1.6% if I remember correctly.

Starting to look at what’s about but not sure if I should fix for 2year, 5 years or higher.

Any advise would be greatly appreciated, what are people’s thought for they years ahead? Are rates going to drop anytime soon ?

Would like to stay with Barclays if possible.

andyb28 said:

No advice to offer.

But our 5 year deal just ended also. We were on 1.6% and are now on 4.18%

Is this for 5 years ? But our 5 year deal just ended also. We were on 1.6% and are now on 4.18%

I’ve just logged on and checked my rates. I’m currently on 1.43% if I do nothing it increases to 7.49%

I can fix for 5 years for 4.14% no fees.

Part of me thinks 2 years is too short. I’m thinking rates could get out of hand under this government.

Crystal ball anyone ?

You can generally see which way the banks etc think rates are going to go from the type and number of offers available.

If the market is flooded with good value 5 / 7 / 10 year fixed rate deals then the banks reckon rates are either flat or falling in the medium term.

When they reckon rates are going to go up then fixed rates are much harder to come by for obvious reasons.

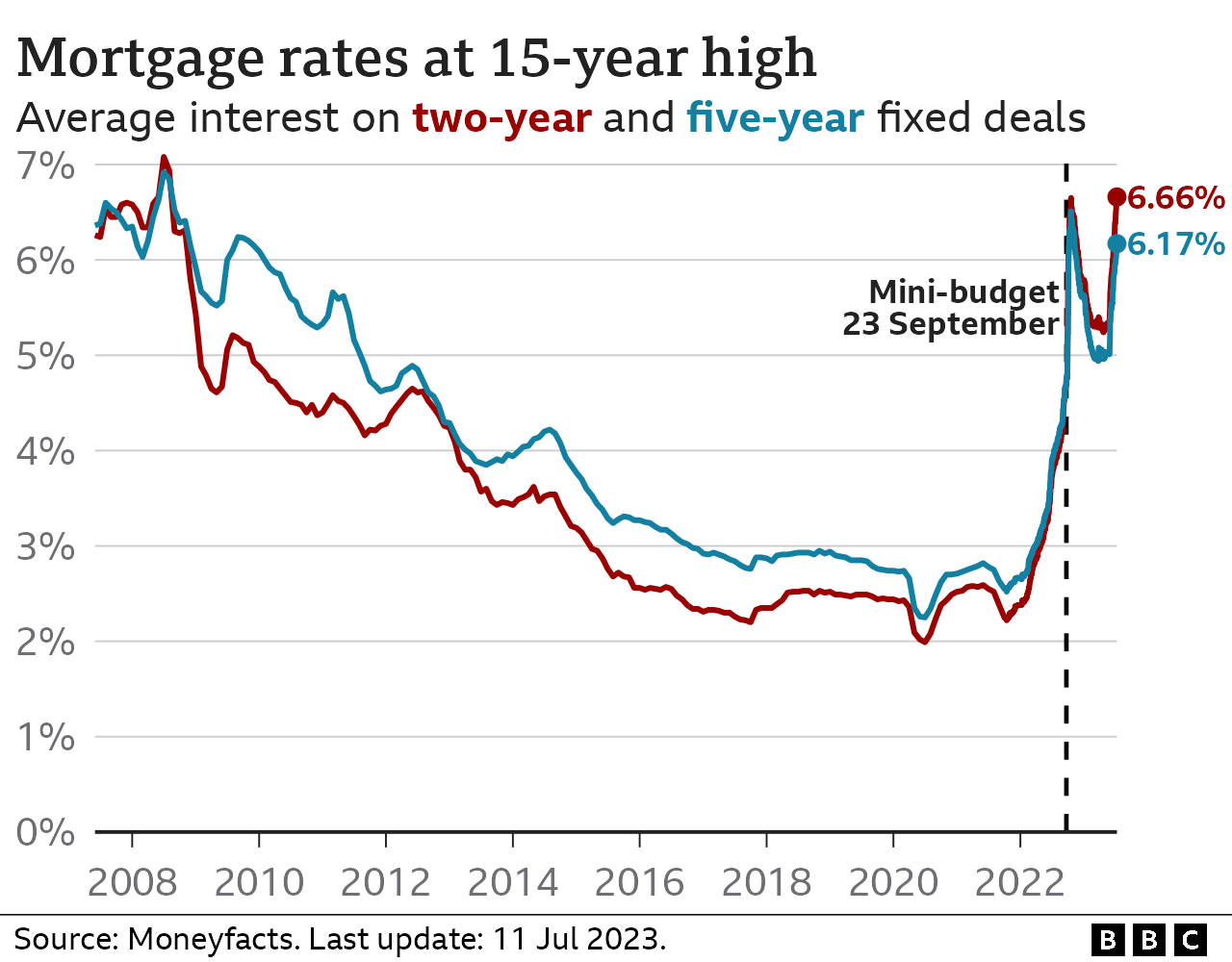

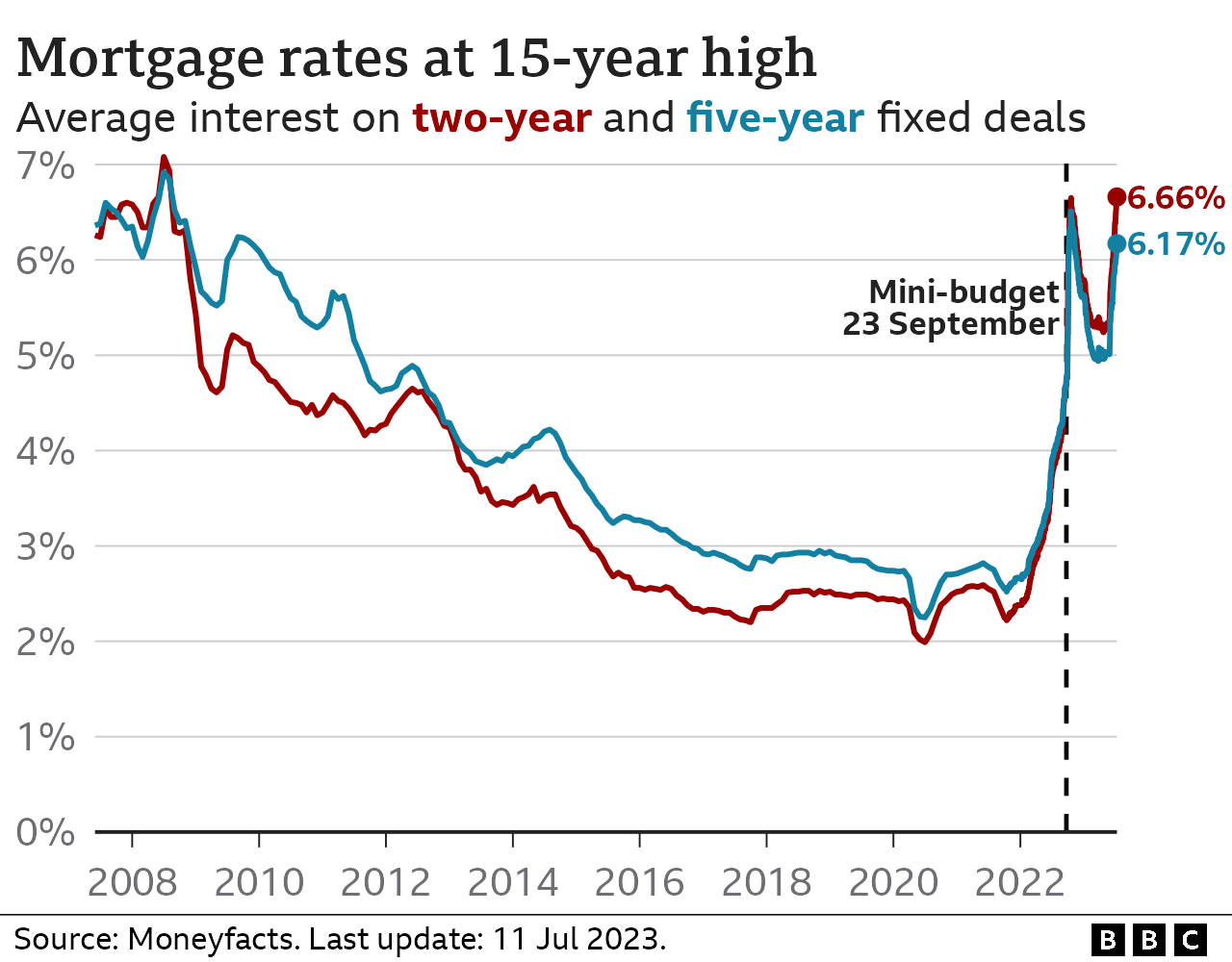

Under the current shambles I really can't see rates falling much over the next couple of years.

If the market is flooded with good value 5 / 7 / 10 year fixed rate deals then the banks reckon rates are either flat or falling in the medium term.

When they reckon rates are going to go up then fixed rates are much harder to come by for obvious reasons.

Under the current shambles I really can't see rates falling much over the next couple of years.

It feels like current rates are at a long-term average, I highly doubt we'll see the mad 1.5-2% rates again in my lifetime but the reality is no one knows.

We fixed our sub 2% long enough to essentially see us mortgage free when we exit the fixed. Inflation has really helped us reduce the real cost of the borrowing over time, and the sub 2% rates were what paid for our house building works, so I'm really glad we took out the additional borrowing rather than worried about paying the mortgage off back than.

Rember the rate in 1980/90s were double digits at one point, so I've always taken a risk adverse approach and fix for 5-10 years at a time.

We fixed our sub 2% long enough to essentially see us mortgage free when we exit the fixed. Inflation has really helped us reduce the real cost of the borrowing over time, and the sub 2% rates were what paid for our house building works, so I'm really glad we took out the additional borrowing rather than worried about paying the mortgage off back than.

Rember the rate in 1980/90s were double digits at one point, so I've always taken a risk adverse approach and fix for 5-10 years at a time.

Wish said:

andyb28 said:

No advice to offer.

But our 5 year deal just ended also. We were on 1.6% and are now on 4.18%

Is this for 5 years ? But our 5 year deal just ended also. We were on 1.6% and are now on 4.18%

I ve just logged on and checked my rates. I m currently on 1.43% if I do nothing it increases to 7.49%

I can fix for 5 years for 4.14% no fees.

Part of me thinks 2 years is too short. I m thinking rates could get out of hand under this government.

Crystal ball anyone ?

It was the best our Mortgage Broker could find.

Big Pants said:

Is Sarnie still around these parts? Truly excellent mortgage broker, and helped me find a terrific deal.

Annoyingly I can't find his contact details - would welcome them if any has them.

Yup, he's still around and doing mortgages.Annoyingly I can't find his contact details - would welcome them if any has them.

https://www.pistonheads.com/gassing/profile.asp?me...

ukwill said:

First Direct are offering 3.98% (5yrs) on 60% ltv. If I were looking now I'd probably take that. I think we'll be battling with inflation for some time to come.

My bet's the other way... While I think inflation will continue to be sticky for the rest of the year, I think that the crashing of the economy (measured by employment numbers, business confidence, etc) will mean that the BoE end up having to cut rates to prevent a recession pretty soon.

There seems to be some consensus that 2 rate cuts by the mid-end '26 are likely, but if the economy continues to stall, I personally can see more than this happening.

fat80b said:

ukwill said:

First Direct are offering 3.98% (5yrs) on 60% ltv. If I were looking now I'd probably take that. I think we'll be battling with inflation for some time to come.

My bet's the other way... While I think inflation will continue to be sticky for the rest of the year, I think that the crashing of the economy (measured by employment numbers, business confidence, etc) will mean that the BoE end up having to cut rates to prevent a recession pretty soon.

There seems to be some consensus that 2 rate cuts by the mid-end '26 are likely, but if the economy continues to stall, I personally can see more than this happening.

Either way, I've no doubt there will be some period of time before mortgage rates are changed to reflect base rate changes. If you were looking to renew say late next year, you may well be fortunate enough to get a 3.5% deal. But you can get 3.98% now and not give a toss what inflation does for the next 5rs. You pays yer money etc.

Mostly in for the interest rate predictions. My armchair economist view is that they may slide a bit lower in the next 12 months but not to 1%. They're more likely to shoot up as inflation becomes an issue. How far is anyone's guess.

Also look at exit fees. They do vary. I actually paid them to get out of my mortgage with Halifax and locked in 5 years at good rates at what turned out to be just the right time. I like the peace of mind of a long fix but it's also good to know you can get out if something unexpected does happen and better deals become available.

Also look at exit fees. They do vary. I actually paid them to get out of my mortgage with Halifax and locked in 5 years at good rates at what turned out to be just the right time. I like the peace of mind of a long fix but it's also good to know you can get out if something unexpected does happen and better deals become available.

Gassing Station | Finance | Top of Page | What's New | My Stuff

k around

k around