State Pension potential shortfall warning

Discussion

i4got said:

It will already have been factored into the forecast. **

The COPE doesn’t really affect the forecast as it is just the GMP paid by the private scheme. It affects the initial calculation at 2016 and as you were contracted out it may mean more years of paying NI at the qualifying level.- assuming they've calculated it correctly.

the tribester said:

However, if you previously 'COPEed out' some NI contributions into your private pension scheme, then although you may have a 'full' 35 years NI record, it will not be 35 full years worth towards pension contributions, and you could end up like I did, with 35 years NI contributions, but still 7 years short of max State Pension entitlement.

I've just been rereading the whole thread to try to get to the bottom of this "more than 35 years needed" question. Looks very much as though the tribester put his finger on one element of it way back at the beginning, namely the impact of transferring out to a SIPP if that takes some NI with it.I found this explanation of the post-2016 state pension changes which looks to be a helpful summary,

https://www.royallondon.com/contentassets/8c6335d8...

It includes, "I’ve paid in more than 35 years, why don’t I get a full pension?"

"Almost certainly this will be because at some point you were a member of a ‘contracted out’ pension scheme and in those years you were putting less in to the system than someone who was not ‘contracted out’. For example, if you were a member of a salary related pension then during the years in question you and your employer would have benefited from paying in a reduced rate of NI Contributions. In return, your pension scheme made a promise to replace part of the state pension you would have been building up if you had not been contracted out. Because of this deal, a one-off deduction is made from the new state pension to take account of the pension your employer has promised to pay."

LeoSayer said:

That doesn't explain why, after 35 years of contributions, I will get the full State Pension even though I was contracted out for at least half of those.

Have a look at my postings on this thread. I was in the same situation. Showed full pension - no more contributions required and no COPE amount. When I asked for a written forecast they 'found' the contracted out details and updated the online forecast to show a) a COPE amount and b) a shortfall in years for the full pension

The Gov are aware that a small percentage of online forecasts are incorrect (reported on MSE site) and only get corrected when a written forecast is issued.

i4got said:

Have a look at my postings on this thread.

I was in the same situation. Showed full pension - no more contributions required and no COPE amount. When I asked for a written forecast they 'found' the contracted out details and updated the online forecast to show a) a COPE amount and b) a shortfall in years for the full pension

The Gov are aware that a small percentage of online forecasts are incorrect (reported on MSE site) and only get corrected when a written forecast is issued.

I should have said in my earlier post - my State Pension forecast includes a COPE amount of £49.65 pw.I was in the same situation. Showed full pension - no more contributions required and no COPE amount. When I asked for a written forecast they 'found' the contracted out details and updated the online forecast to show a) a COPE amount and b) a shortfall in years for the full pension

The Gov are aware that a small percentage of online forecasts are incorrect (reported on MSE site) and only get corrected when a written forecast is issued.

How old are you and is 2025 your retirement date.

Are you still working and paying NI?

https://www.gov.uk/government/publications/applica...

Are you still working and paying NI?

https://www.gov.uk/government/publications/applica...

Waitforme said:

Igot

Could you please advise where I may get form BR19 ?

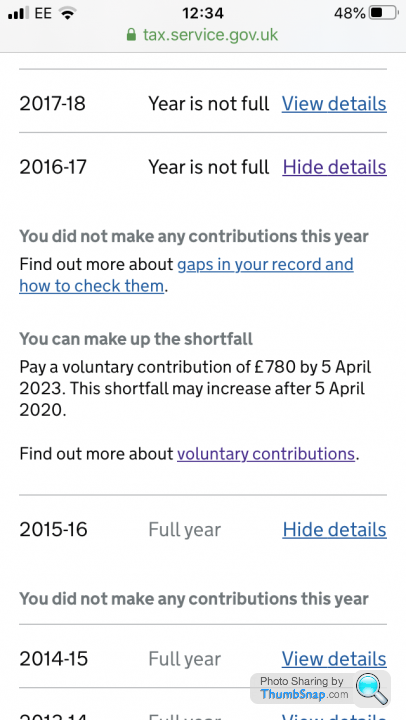

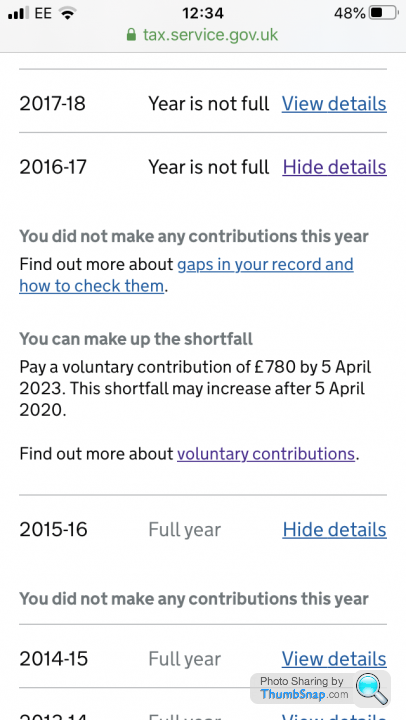

I found this very interesting thread and have read all 16 pages, created a Gov account and found out I’m short of full pension. See below.....

Here is the form link.Could you please advise where I may get form BR19 ?

I found this very interesting thread and have read all 16 pages, created a Gov account and found out I’m short of full pension. See below.....

https://www.gov.uk/government/publications/applica...

Thanks for the link.

Born September 59 , so turned 60 last September.

Full years contributions from 75 to 2016

I’m still working but as a ltd co taking minimum wage out so not paying NI. Taking money out in dividends

It says I have a full year for 15/16 but didn’t make any contributions?

Born September 59 , so turned 60 last September.

Full years contributions from 75 to 2016

I’m still working but as a ltd co taking minimum wage out so not paying NI. Taking money out in dividends

It says I have a full year for 15/16 but didn’t make any contributions?

Edited by anonymous-user on Saturday 15th February 12:20

Edited by anonymous-user on Saturday 15th February 12:37

Waitforme said:

I’m still working but as a ltd co taking minimum wage out so not paying NI. Taking money out in dividends

It says I have a full year for 15/16 but didn’t make any contributions?

You’re supposed to pay yourself between the LEL and the PT:It says I have a full year for 15/16 but didn’t make any contributions?

https://www.gov.uk/government/publications/rates-a...

Gassing Station | Finance | Top of Page | What's New | My Stuff