Monzo or Revolut for travelling?

Discussion

New to all this! Normally just take cash or a pre-loaded exchange type card.

But I don't know how much I'll be spending this trip and/or what countries I'll be spending in. Been told about setting up a Monzo or Revolut accound and then just transferring my budget into there (with a little cash just in case).

Anyone got any experience with these and know which is best?

I see that Revolut add a 0.5% mark up to exchange rate at weekends to cover themselves, not sure if Monzo do this? Monzo have a £200 cash withdrawal limit before a 3% charge is added, Revolut only has a 2% charge.

Doesn't seem to be much in it?

But I don't know how much I'll be spending this trip and/or what countries I'll be spending in. Been told about setting up a Monzo or Revolut accound and then just transferring my budget into there (with a little cash just in case).

Anyone got any experience with these and know which is best?

I see that Revolut add a 0.5% mark up to exchange rate at weekends to cover themselves, not sure if Monzo do this? Monzo have a £200 cash withdrawal limit before a 3% charge is added, Revolut only has a 2% charge.

Doesn't seem to be much in it?

The Nur said:

I use Revolut on recommendation of Doublesix on here and it was great. No problems at all. I have no experience of Monzo.

Good to hear.However, just went to sign up – I need my physical card before the end of next week. This means either committing to £6.99 a month for a premium account, and getting 'FREE express delivery', or paying £11.99 for delivery!!

This immediately counters any savings I'll be making by using a card like this abroad

WonkeyDonkey said:

What are the advantages of using one of these compared to a fee free exchange card from a mainstream bank like the Halifax clarity card?

The way I see it, is that most the cards from banks are credit cards? Which require me to pay off after my trip.This is a debit card so I'll load account with money then just use it as I would. Also get a lot of benefits from the app and user interface, and also don't need to deal with a bank and applying for a CC or opening an account.

The Nur said:

I use Revolut on recommendation of Doublesix on here and it was great. No problems at all. I have no experience of Monzo.

Same here. I like that you can easily exchange between currencies, and having the app on my phone means I can track my spending very easily.

I also load the revolut card in the months before my holiday with £100pm, helps me to save for the trip (as I'm not a PH Director type with unlimited funds)

Just to muddy the waters a little more.

I opened a Starling account last year and used the card to withdraw money on holiday in Malta. I didn't want to be carrying too much money around with us, so this was really useful. As soon as i withdrew money i got a msg on my phone. There was a limit as to how much i could withdraw daily, think it was around £400.

I occasionally use the card over in the UK but i use it as a second account, i still retain my main current account.

I opened a Starling account last year and used the card to withdraw money on holiday in Malta. I didn't want to be carrying too much money around with us, so this was really useful. As soon as i withdrew money i got a msg on my phone. There was a limit as to how much i could withdraw daily, think it was around £400.

I occasionally use the card over in the UK but i use it as a second account, i still retain my main current account.

Halifax card has much better protection (because it's a credit card), and also the exchange rates are good. There is an app to check your spending, if that's what you want, and you can pay off the balance whenever or put it on a direct debit to be paid off at the end of each month.

The Revolut exchange rate has been discussed on here before, and nobody can actually explain what rates they use. It is certainly not as simple and favourable to the customer as their website makes out. It also has no protection from fraud in the same way a credit card does.

EDIT

This is a debit card so I'll load account with money then just use it as I would. Also get a lot of benefits from the app and user interface, and also don't need to deal with a bank and applying for a CC or opening an account.This makes no sense, both Monzo and Revolut are banks, so saying you don't need to deal with a bank is totally wrong. Not only that, you're dealing with a bank (in the case of Revolut) based in Lithuania as opposed to a bank on the high street.

The Revolut exchange rate has been discussed on here before, and nobody can actually explain what rates they use. It is certainly not as simple and favourable to the customer as their website makes out. It also has no protection from fraud in the same way a credit card does.

EDIT

Kewy said:

WonkeyDonkey said:

What are the advantages of using one of these compared to a fee free exchange card from a mainstream bank like the Halifax clarity card?

The way I see it, is that most the cards from banks are credit cards? Which require me to pay off after my trip.This is a debit card so I'll load account with money then just use it as I would. Also get a lot of benefits from the app and user interface, and also don't need to deal with a bank and applying for a CC or opening an account.

Edited by Condi on Tuesday 30th April 13:44

Condi said:

This makes no sense, both Monzo and Revolut are banks, so saying you don't need to deal with a bank is totally wrong. Not only that, you're dealing with a bank (in the case of Revolut) based in Lithuania as opposed to a bank on the high street.

Thanks your post is pretty helpful Edited by Condi on Tuesday 30th April 13:44

I meant that I don't have to go into a bank and/or phone up and apply for a credit card etc etc I just downloaded the app, took less than 3 minutes to open an account and once a card is on the way I'm good to go.

Will look into the Halifax card this evening though. If approved, does anyone know roughly how long it takes for a card to turn up and activate? Pushing it with time a bit now.

hab1966 said:

Just to muddy the waters a little more.

I opened a Starling account last year and used the card to withdraw money on holiday in Malta. I didn't want to be carrying too much money around with us, so this was really useful. As soon as i withdrew money i got a msg on my phone. There was a limit as to how much i could withdraw daily, think it was around £400.

I occasionally use the card over in the UK but i use it as a second account, i still retain my main current account.

Yeh I think a lot of them have a limit where there are no charges, and then a small percentage after. Revolut is £200 then a 2% charge on anything after that, or £400 if it's a Premium account (£6 a month).I opened a Starling account last year and used the card to withdraw money on holiday in Malta. I didn't want to be carrying too much money around with us, so this was really useful. As soon as i withdrew money i got a msg on my phone. There was a limit as to how much i could withdraw daily, think it was around £400.

I occasionally use the card over in the UK but i use it as a second account, i still retain my main current account.

I don't think I'll worry about cash too much though, I'll take a little with me and probably won't need to withdraw more than the £200. It's more card payments I'm concerned about for all the fuel stops etc.

hab1966 said:

Just to muddy the waters a little more.

I opened a Starling account last year and used the card to withdraw money on holiday in Malta. I didn't want to be carrying too much money around with us, so this was really useful. As soon as i withdrew money i got a msg on my phone. There was a limit as to how much i could withdraw daily, think it was around £400.

I occasionally use the card over in the UK but i use it as a second account, i still retain my main current account.

We have both Starling and Monzo.....very similar: hadn't clocked Monzo had gone down to £200 pcm charge-free cash withdrawals....Starling is still £300....I opened a Starling account last year and used the card to withdraw money on holiday in Malta. I didn't want to be carrying too much money around with us, so this was really useful. As soon as i withdrew money i got a msg on my phone. There was a limit as to how much i could withdraw daily, think it was around £400.

I occasionally use the card over in the UK but i use it as a second account, i still retain my main current account.

Both seem to work fine when we have used them, I always like to have an alternative just in case!!

WonkeyDonkey said:

What are the advantages of using one of these compared to a fee free exchange card from a mainstream bank like the Halifax clarity card?

With Revolut you've already bought your foreign currency. With Clarity you don't know what exchange rate will be applied until they do the reconciliation on your transactions at a later date.audidoody said:

WonkeyDonkey said:

What are the advantages of using one of these compared to a fee free exchange card from a mainstream bank like the Halifax clarity card?

With Revolut you've already bought your foreign currency. With Clarity you don't know what exchange rate will be applied until they do the reconciliation on your transactions at a later date.Even currency traders will admit their ability to call the market right is only somewhat marginal, and really they rely on doing massive volumes at small spreads to make money. Why does average Joe think that the rate he sets today has anything better than a 50/50 chance of being right in 3 months time? I don't understand it; yes it gives you certainty, but you've absolutely no certainty at all whether the rate on the day will be better or worse than what you've already fixed at. In which case, you may as well take your chances and just accept whatever the spot rate is.

mikeiow said:

We have both Starling and Monzo.....very similar: hadn't clocked Monzo had gone down to £200 pcm charge-free cash withdrawals....Starling is still £300....

Both seem to work fine when we have used them, I always like to have an alternative just in case!!

I think Monzo is £200 a month. Starling is £300 per day.Both seem to work fine when we have used them, I always like to have an alternative just in case!!

Shiv_P said:

With starling at ATMs it will display the exchnge rate you will get before you take out the money. Had no problems using it abroad at all, really good.

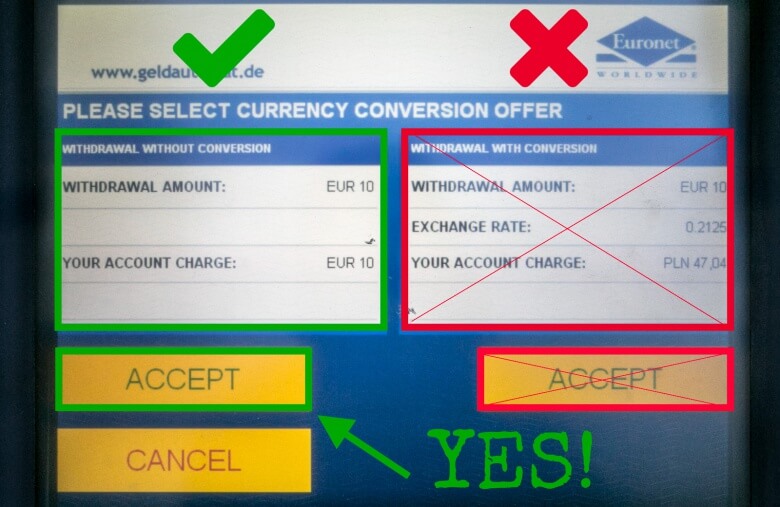

I'd be careful with this. I've used starling abroad in loads of countries and never seen this, except when the ATM provider is wanting to do the conversion for you... Of course the rate you get is rubbish. If an ATM asks you if you want to do a conversion just press reject.

Edited by ponchie on Wednesday 1st May 08:19

Gassing Station | Finance | Top of Page | What's New | My Stuff