Europe heading into recession

Discussion

Digga said:

jsf said:

tobinen said:

Can any of the informed posters here recommend some reading for the non-expert? e.g. a EU/Euro financial system overview for dummies?

I'm with SJ (I think) in that I'd like to at least know some basics and reasonings, but I don't need or want to know fine detail at professional level.

do a search on youtube for Mark Blyth, he does some excellent talks that the layman should be able to understand.I'm with SJ (I think) in that I'd like to at least know some basics and reasonings, but I don't need or want to know fine detail at professional level.

Joseph Stiglitz book on the Euro is also extremely useful.

tobinen said:

Sorry, I meant in relation to this thread rather than personal finance. Agreed, we had nothing in that area and I think it would be a good idea if it was taught.

i hear u but i also think it is related

basically this euro situation with 0% interest rates effects everything we do

mainly in terms of property and investments

when rates were 5% lets say property generally was about 1/3 cheaper

the more cheap money you pump into the system the more that assets will rise as there is no yield in traditional bonds etc .

question is where do we go from here ?

fesuvious said:

what goes up...…

and, lets not forget, the market ultimately will finds its level. The natural order will return. Policy makers and planners can have their few decades of Narnian economics.

Sooner or later, things will equalise, rates will rise, and the natural order of things will return.

Many will get burned, many will make fortunes, many will not even notice.....

or it cant be reversed.....look at japan and, lets not forget, the market ultimately will finds its level. The natural order will return. Policy makers and planners can have their few decades of Narnian economics.

Sooner or later, things will equalise, rates will rise, and the natural order of things will return.

Many will get burned, many will make fortunes, many will not even notice.....

sadly i feel the days or normal markets are gone

i know this as i trade government bonds for a job ....its like sitting in a library these days ....no liquidity ....no prop ....no yield ....no hope

housen said:

fesuvious said:

what goes up...…

and, lets not forget, the market ultimately will finds its level. The natural order will return. Policy makers and planners can have their few decades of Narnian economics.

Sooner or later, things will equalise, rates will rise, and the natural order of things will return.

Many will get burned, many will make fortunes, many will not even notice.....

or it cant be reversed.....look at japan and, lets not forget, the market ultimately will finds its level. The natural order will return. Policy makers and planners can have their few decades of Narnian economics.

Sooner or later, things will equalise, rates will rise, and the natural order of things will return.

Many will get burned, many will make fortunes, many will not even notice.....

sadly i feel the days or normal markets are gone

i know this as i trade government bonds for a job ....its like sitting in a library these days ....no liquidity ....no prop ....no yield ....no hope

It's generally applied to things in compression or tension - springs etc. - but you do wonder about interest rates. Have central banks 'broken' them?

Digga said:

housen said:

fesuvious said:

what goes up...…

and, lets not forget, the market ultimately will finds its level. The natural order will return. Policy makers and planners can have their few decades of Narnian economics.

Sooner or later, things will equalise, rates will rise, and the natural order of things will return.

Many will get burned, many will make fortunes, many will not even notice.....

or it cant be reversed.....look at japan and, lets not forget, the market ultimately will finds its level. The natural order will return. Policy makers and planners can have their few decades of Narnian economics.

Sooner or later, things will equalise, rates will rise, and the natural order of things will return.

Many will get burned, many will make fortunes, many will not even notice.....

sadly i feel the days or normal markets are gone

i know this as i trade government bonds for a job ....its like sitting in a library these days ....no liquidity ....no prop ....no yield ....no hope

It's generally applied to things in compression or tension - springs etc. - but you do wonder about interest rates. Have central banks 'broken' them?

if we were in a normal free market ...would spain portugal and greece still be in the eu ?

housen said:

yeah basic common sense gcses

like dont get in to debt

who is out to fck you in the real world

what jobs pay but what the downsides are etc

pensions and why u need them and best to get started asap so u can chill sooner

But does that apply today? I’m struggling with how this ends. like dont get in to debt

who is out to fck you in the real world

what jobs pay but what the downsides are etc

pensions and why u need them and best to get started asap so u can chill sooner

We’ve gone from the mild insanity of the Germans being able to borrow money for 30 years at 1%, to the full bore madness of paying the Greeks to borrow money for 13 weeks. I recall some Scandi outfit is mortgaging at zero or negative rates, which will probably come to us.

At that point do you say “all debt is bad”, or do you lev up to the hilt and spank 5 million on a house at 0% for 30 years? After all, you only live once, and if money is effectively “free” you might as well fill your boots.

Honestly I feel like we’re all on one of those ghost trains, and its all getting madder and madder - the only thing we don’t know is what happens at the end.

rxe said:

At that point do you say “all debt is bad”, or do you lev up to the hilt and spank 5 million on a house at 0% for 30 years? After all, you only live once, and if money is effectively “free” you might as well fill your boots.

Most individuals are not able to borrow privately at anything near 0%. Sure, the ultra-rich may well do, but for the average Joe, you're paying at least 6% APR on a car loan and anything from 2.5 to 5% on a mortgage. And then there are the disadvantaged and/or dim who are paying double-digit APRs on things like domestic appliances and credit card debts.In general, debt is still not great. Certainly not too much of it for anyone.

Digga said:

ost individuals are not able to borrow privately at anything near 0%. Sure, the ultra-rich may well do, but for the average Joe, you're paying at least 6% APR on a car loan and anything from 2.5 to 5% on a mortgage. And then there are the disadvantaged and/or dim who are paying double-digit APRs on things like domestic appliances and credit card debts.

In general, debt is still not great. Certainly not too much of it for anyone.

If I’d said to you 2 years ago that the Greeks would be able to borrow at negative rates .... you would have rightly thought me mad. What if the ECB rate drops to -5%?In general, debt is still not great. Certainly not too much of it for anyone.

rxe said:

Digga said:

ost individuals are not able to borrow privately at anything near 0%. Sure, the ultra-rich may well do, but for the average Joe, you're paying at least 6% APR on a car loan and anything from 2.5 to 5% on a mortgage. And then there are the disadvantaged and/or dim who are paying double-digit APRs on things like domestic appliances and credit card debts.

In general, debt is still not great. Certainly not too much of it for anyone.

If I’d said to you 2 years ago that the Greeks would be able to borrow at negative rates .... you would have rightly thought me mad. What if the ECB rate drops to -5%?In general, debt is still not great. Certainly not too much of it for anyone.

Digga said:

rxe said:

At that point do you say “all debt is bad”, or do you lev up to the hilt and spank 5 million on a house at 0% for 30 years? After all, you only live once, and if money is effectively “free” you might as well fill your boots.

Most individuals are not able to borrow privately at anything near 0%. Sure, the ultra-rich may well do, but for the average Joe, you're paying at least 6% APR on a car loan and anything from 2.5 to 5% on a mortgage. And then there are the disadvantaged and/or dim who are paying double-digit APRs on things like domestic appliances and credit card debts.In general, debt is still not great. Certainly not too much of it for anyone.

Vanden Saab said:

Digga said:

rxe said:

At that point do you say “all debt is bad”, or do you lev up to the hilt and spank 5 million on a house at 0% for 30 years? After all, you only live once, and if money is effectively “free” you might as well fill your boots.

Most individuals are not able to borrow privately at anything near 0%. Sure, the ultra-rich may well do, but for the average Joe, you're paying at least 6% APR on a car loan and anything from 2.5 to 5% on a mortgage. And then there are the disadvantaged and/or dim who are paying double-digit APRs on things like domestic appliances and credit card debts.In general, debt is still not great. Certainly not too much of it for anyone.

Still though, reasonable as that is, you aren't buying many new cars for £20k and the rule of thumb or general consensus is about 6% APR.

Digga said:

With a clean credit history. Is that flat or APR? Again, the distinction is key and not often understood - personal finance 101.

Still though, reasonable as that is, you aren't buying many new cars for £20k and the rule of thumb or general consensus is about 6% APR.

I have taken out 4 loans over the last 5-6 years and all between 3.1% and 3.9% apr. Still though, reasonable as that is, you aren't buying many new cars for £20k and the rule of thumb or general consensus is about 6% APR.

They have all been with Hitachi Capital Finance.

That is only for loans up to £24,999.

Natwest have offered me the same recently too.

However, I am in pay down mode as need remortgage.

I'm on .25% above base and have been for over a decade, but want to fix for the last 10 years now.

Not worried about rates increasing, more concerned about if the world goes tits up and lending criteria gets tighter I may not be able to get what I need.

My issue is my building I own, but have two mortgages on the two separate leases. Some lenders just look at the one mortgage on the residential and see that the commercial property is covering itself and some don't, and I could be in a position in 2-3 years if I chases cheapest where "I'm sorry sir, you don't meet our criteria."

So, probably pay a rate in my mortgage that is not far off a short term unsecured loan.

But feel more comfortable knowing I am left alone for 10 years. At that point both properties will be at a LTV and amount where working in McDonalds would get me a decent deal.

Digga said:

Vanden Saab said:

Digga said:

rxe said:

At that point do you say “all debt is bad”, or do you lev up to the hilt and spank 5 million on a house at 0% for 30 years? After all, you only live once, and if money is effectively “free” you might as well fill your boots.

Most individuals are not able to borrow privately at anything near 0%. Sure, the ultra-rich may well do, but for the average Joe, you're paying at least 6% APR on a car loan and anything from 2.5 to 5% on a mortgage. And then there are the disadvantaged and/or dim who are paying double-digit APRs on things like domestic appliances and credit card debts.In general, debt is still not great. Certainly not too much of it for anyone.

Still though, reasonable as that is, you aren't buying many new cars for £20k and the rule of thumb or general consensus is about 6% APR.

Vanden Saab said:

APR and fixed rate... It has actually improved since the last offer popped up on my online banking. Now 3.4% up to £20,000 and 3.9% from £20000 to £25000. For borrowing £25000 it is £1500 interest over three years or £1000 over two...

With respect. This is probably without question one of the most interesting and informative threads I have ever read on PH. Please don't derail it with details of current non secured loan rates. I'd go to compare the market if I wanted that info.fesuvious said:

We will go straight back to where we were, and where the market should be.

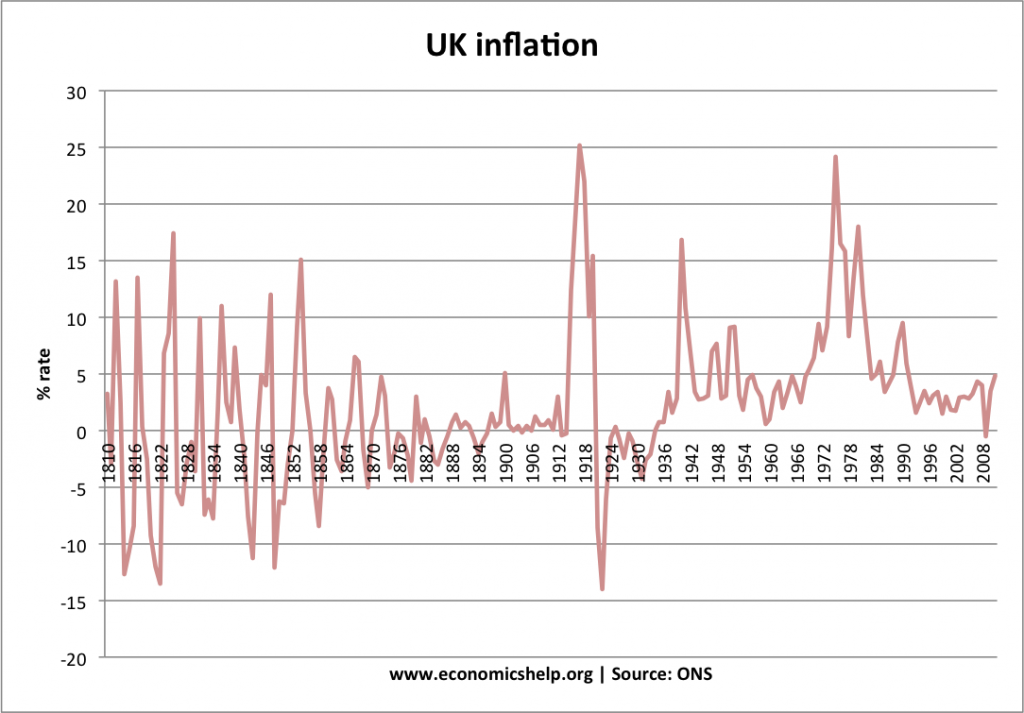

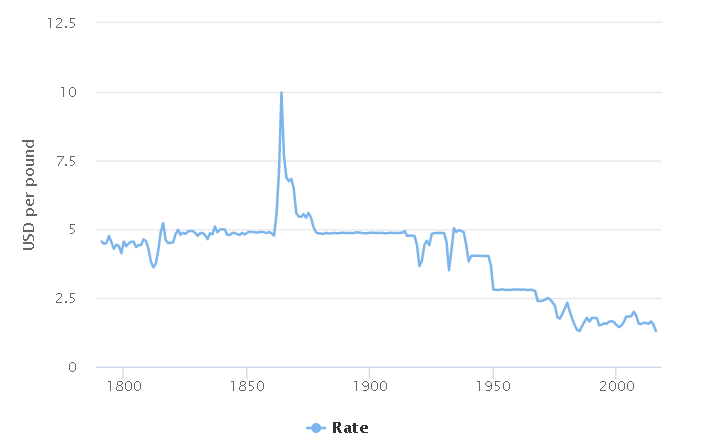

Where should the market be?The rates most of us have grown up with were not the normal situation if you look at long term historical rates.

I see nothing to suggest we will see high rates again, it would crash most economies if that were the case.

jsf said:

fesuvious said:

We will go straight back to where we were, and where the market should be.

Where should the market be?The rates most of us have grown up with were not the normal situation if you look at long term historical rates.

I see nothing to suggest we will see high rates again, it would crash most economies if that were the case.

Fesuvious...you are in danger of “talking your own book”, I’m afraid.

For anyone following this thread, and had asked for further reading the Harvard Atlas of Economic Complexity is worth a look:

http://atlas.cid.harvard.edu/

It's a free to use / open to all resource and tracks economic development of countries.

It makes a very interestiing observation about Germany. It's peaked.

Basically, Germany has been a highly successful country in the past, it has perfected manufacturing process and product - but it's out of ideas. They built a highly adaptive economy - but it's innovation that is a problem. They have to come up with products that no one knows they need yet - but are transformative - like an ipod, Terminators, fuddlejigs or whatevers.

If Germany cannot grow naturally (and Harvard suggests it is Peak industrial growth); it's difficult to dig itself (and rest of Europe out of a hole). PMI data is in the toilet; Trump is going to tariff the granny out of their exports given the low ECB rate / non-competitive $ / make America great again policies and their service sector is shot to pieces. The Sparkasse / landesbank model is problematic. Attempts to semi privatise them have failed; and their Investment banks don't cut it in the global space.

Oh, and they've lent 100's of billion's to the peripherals; the chances of getting it all back look worse than me having a 3 way with the Minogue sisters.

The 50bn budget surplus they generate, may not be enough to generate the quantum jump they need to make. They need to chance the way they think. I was at the Munich Beer festival (should be anyone's bucket list - beer and crumpet is tip top) 2 weeks a go, and caught up with a friend whom works in materials science for BMW. Now, he was telling he has half his team now working on AI to generate better materials; but its process improvement on existing products. I'm pretty sure that inventing mimetic polyalloy, or beamers that can turn into Terminators (and back) - is not on the agenda. Just better bonnets. I mean whose NOT going to PCP a BMW that can turn inito a psychotic stabby robot?

If indeed Germany has peaked, as has loose monetary policy (seems to be the rough consensus in here); The economic arguements for (or against BREXIT) take on a different tone. The case for Remain consists almost entirely of historical observation. The split in the ECB is a real issue. France, Germany, Netherlands, Austria, Slovenia and Estonia oppose increasing QE -- everyone else wants more expansive policy. The political AND economic survival of the block seems to be speeding up to the inflection point of either failure or extra, extra, extraordinary policy response (please let it be Terminators).

http://atlas.cid.harvard.edu/

It's a free to use / open to all resource and tracks economic development of countries.

It makes a very interestiing observation about Germany. It's peaked.

Basically, Germany has been a highly successful country in the past, it has perfected manufacturing process and product - but it's out of ideas. They built a highly adaptive economy - but it's innovation that is a problem. They have to come up with products that no one knows they need yet - but are transformative - like an ipod, Terminators, fuddlejigs or whatevers.

If Germany cannot grow naturally (and Harvard suggests it is Peak industrial growth); it's difficult to dig itself (and rest of Europe out of a hole). PMI data is in the toilet; Trump is going to tariff the granny out of their exports given the low ECB rate / non-competitive $ / make America great again policies and their service sector is shot to pieces. The Sparkasse / landesbank model is problematic. Attempts to semi privatise them have failed; and their Investment banks don't cut it in the global space.

Oh, and they've lent 100's of billion's to the peripherals; the chances of getting it all back look worse than me having a 3 way with the Minogue sisters.

The 50bn budget surplus they generate, may not be enough to generate the quantum jump they need to make. They need to chance the way they think. I was at the Munich Beer festival (should be anyone's bucket list - beer and crumpet is tip top) 2 weeks a go, and caught up with a friend whom works in materials science for BMW. Now, he was telling he has half his team now working on AI to generate better materials; but its process improvement on existing products. I'm pretty sure that inventing mimetic polyalloy, or beamers that can turn into Terminators (and back) - is not on the agenda. Just better bonnets. I mean whose NOT going to PCP a BMW that can turn inito a psychotic stabby robot?

If indeed Germany has peaked, as has loose monetary policy (seems to be the rough consensus in here); The economic arguements for (or against BREXIT) take on a different tone. The case for Remain consists almost entirely of historical observation. The split in the ECB is a real issue. France, Germany, Netherlands, Austria, Slovenia and Estonia oppose increasing QE -- everyone else wants more expansive policy. The political AND economic survival of the block seems to be speeding up to the inflection point of either failure or extra, extra, extraordinary policy response (please let it be Terminators).

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff