Europe heading into recession

Discussion

fesuvious said:

fblm said:

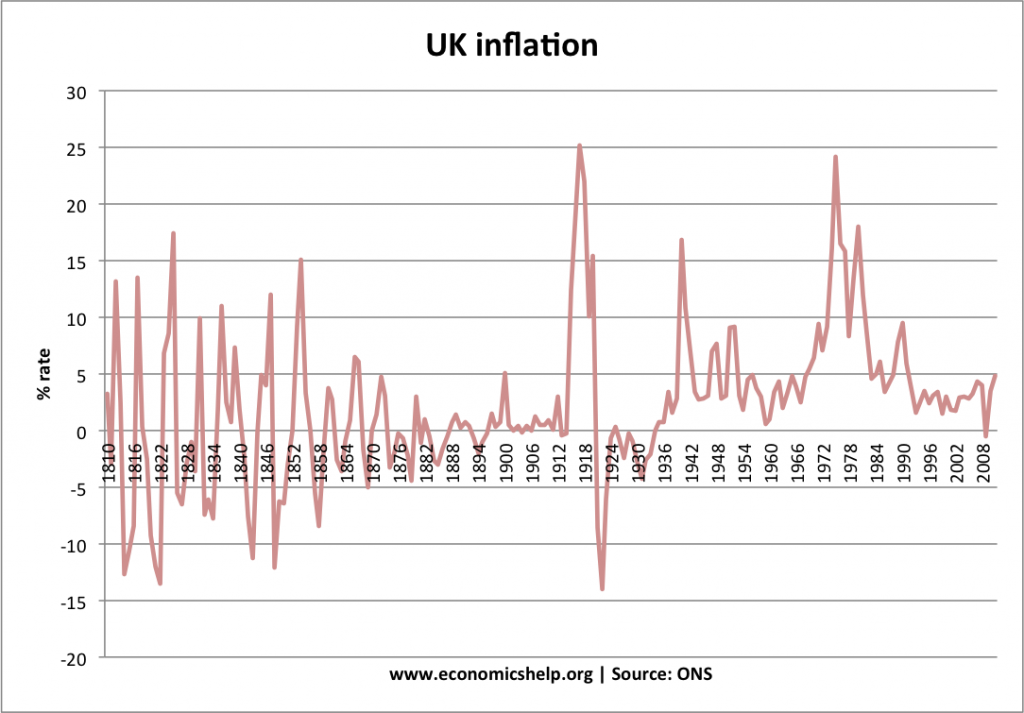

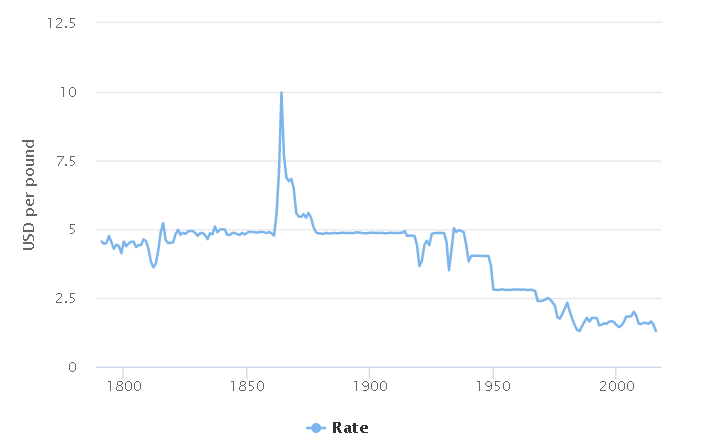

All those that think we're in any trend, circumstance/ manufactured new age that is, for ever more only needs look at those.The market will shake this s

t out one way or another. All the basic core principles and fundamentals dont change.

t out one way or another. All the basic core principles and fundamentals dont change. We are in a barter system. We exchange currency or items for currency or items. Humans still have the same basic needs, wants and desires.

Eventually once we have finished trying to conjure our way out of a self made problem through Narnia economics involving collapsed rates, money from thin air and fraudulent government debt levels....

We will go straight back to where we were, and where the market should be.

The only question is when, and how vicious it will be. The severity depends on how much more can kicking. The when is the ammo running out.

Both coming together will be determined by the insanity that is allowed to prevail. Sanity left ages ago.

At some point people will realise what a brick, apple, or a lb of gold is worth. They'll also know that rates don't work as stimulus. They are a device allowing those who respect both money and the market to prosper.

They are also key to creating a healthy growing economy.

As with any recovery (from this bonkers set of policies being habitually followed as ZIrp and Nirp are addictive) there needs to be a period of denial before gradually acceptance of the addiction sets in.

Addiction is where you cant give something up. You THINK you need it. And you know cold Turkey will hurt.

Interesting one today. S&P (the rating agency), is suggesting that the ECB add house price inflation into their core inflation calculation. That way they can improve the core number.

Now, I'm not entirely sure that's a good idea as:

A) is a mark to market valuation anyway

B) Assumes the growth is crystallized through drawdown / re-mortgaged or sold

Seems a bit like "failed on monetary policy", fix results.

I could be wrong, evidently is is done elsewhere - does anyone have more on this calc method?

Now, I'm not entirely sure that's a good idea as:

A) is a mark to market valuation anyway

B) Assumes the growth is crystallized through drawdown / re-mortgaged or sold

Seems a bit like "failed on monetary policy", fix results.

I could be wrong, evidently is is done elsewhere - does anyone have more on this calc method?

stongle said:

Interesting one today. S&P (the rating agency), is suggesting that the ECB add house price inflation into their core inflation calculation. That way they can improve the core number.

Now, I'm not entirely sure that's a good idea as:

A) is a mark to market valuation anyway

B) Assumes the growth is crystallized through drawdown / re-mortgaged or sold

Seems a bit like "failed on monetary policy", fix results.

I could be wrong, evidently is is done elsewhere - does anyone have more on this calc method?

Move back to RPI! You couldn't make it up as you go along. Oh right.Now, I'm not entirely sure that's a good idea as:

A) is a mark to market valuation anyway

B) Assumes the growth is crystallized through drawdown / re-mortgaged or sold

Seems a bit like "failed on monetary policy", fix results.

I could be wrong, evidently is is done elsewhere - does anyone have more on this calc method?

Yup, baking asset price growth into inflation - seems like a recipe for disaster. I guess it could be weighted, but if inflation also includes store of wealth, you might contract money supply. Which isn't going to help your industries.

Oh, a bit like they did in Sept when they gave the banks tiering, and sucked money out the system. Mind you, if you had a 2 trillion excess - it's only a matter of time before one of em goes pop. So maybe tiering is just an indirect subsidy. Who'd have thunk it.

It's really intriguing though, I'd love someone to have a crack at explaining how its a good idea.

Oh, a bit like they did in Sept when they gave the banks tiering, and sucked money out the system. Mind you, if you had a 2 trillion excess - it's only a matter of time before one of em goes pop. So maybe tiering is just an indirect subsidy. Who'd have thunk it.

It's really intriguing though, I'd love someone to have a crack at explaining how its a good idea.

stongle said:

Yup, baking asset price growth into inflation - seems like a recipe for disaster. I guess it could be weighted, but if inflation also includes store of wealth, you might contract money supply. Which isn't going to help your industries.

Oh, a bit like they did in Sept when they gave the banks tiering, and sucked money out the system. Mind you, if you had a 2 trillion excess - it's only a matter of time before one of em goes pop. So maybe tiering is just an indirect subsidy. Who'd have thunk it.

It's really intriguing though, I'd love someone to have a crack at explaining how its a good idea.

I guess if your zirp isn't working in a low temperature environment and nirp doesn't fit the model then you can adjust the ice core temperature up until zirp looks like a relatively good rate again. I'm trying to cut down on my post count by consolidating threads. (aka spoofing a lower real interest rate?)Oh, a bit like they did in Sept when they gave the banks tiering, and sucked money out the system. Mind you, if you had a 2 trillion excess - it's only a matter of time before one of em goes pop. So maybe tiering is just an indirect subsidy. Who'd have thunk it.

It's really intriguing though, I'd love someone to have a crack at explaining how its a good idea.

fesuvious said:

Didn't I write pages ago about how GDP and inflation figures were cooked up in a pot from whichever ingredients would make the dish taste exactly as the chef desired?

Indeed you may have, they are composites. The Irony here though is whom's suggesting it. Its looking like a re-run of The Big Short, this time with hooky sovereign debt. ECB has already dished out liquidity fix, now S&P sticks the rating cherry on top.A.J.M said:

Dipping back into this as I enjoy reading it all but won’t pretend to understand it all.

1.) Do we think Germany will slip into recession, or is it looking pretty certain at this point?

2.) How many other EU members are also on the verge?

1.) It's in there.1.) Do we think Germany will slip into recession, or is it looking pretty certain at this point?

2.) How many other EU members are also on the verge?

2.) Most of them. The EU cannot avoid negative effects of both it's main economy entering recession and also one of it's main budgetary contributors leaving. The cake will be smaller.

A.J.M said:

Dipping back into this as I enjoy reading it all but won’t pretend to understand it all.

Do we think Germany will slip into recession, or is it looking pretty certain at this point?

How many other EU members are also on the verge?

It depends on if Germany actually joins the 21st century and opens the taps on fiscal stimulus. Do we think Germany will slip into recession, or is it looking pretty certain at this point?

How many other EU members are also on the verge?

If they continue to fight an imaginary inflation baked into the psyche then they are screwed.

jsf said:

A.J.M said:

Dipping back into this as I enjoy reading it all but won’t pretend to understand it all.

Do we think Germany will slip into recession, or is it looking pretty certain at this point?

How many other EU members are also on the verge?

It depends on if Germany actually joins the 21st century and opens the taps on fiscal stimulus. Do we think Germany will slip into recession, or is it looking pretty certain at this point?

How many other EU members are also on the verge?

If they continue to fight an imaginary inflation baked into the psyche then they are screwed.

An economic stimulus is the use of monetary or fiscal policy changes to kickstart growth during a recession. Governments can accomplish this by using tactics such as lowering interest rates, increasing government spending and quantitative easing, to name a few

germany and the ecb have been lowering interest rates/ quantitative easing for years now ....we are in negative rates now !

jsf said:

A.J.M said:

Dipping back into this as I enjoy reading it all but won’t pretend to understand it all.

Do we think Germany will slip into recession, or is it looking pretty certain at this point?

How many other EU members are also on the verge?

It depends on if Germany actually joins the 21st century and opens the taps on fiscal stimulus. Do we think Germany will slip into recession, or is it looking pretty certain at this point?

How many other EU members are also on the verge?

If they continue to fight an imaginary inflation baked into the psyche then they are screwed.

Mind you, not that being fiscally conservative is necessarily a 'bad' thing.

housen said:

eh ???????

An economic stimulus is the use of monetary or fiscal policy changes to kickstart growth during a recession. Governments can accomplish this by using tactics such as lowering interest rates, increasing government spending and quantitative easing, to name a few

germany and the ecb have been lowering interest rates/ quantitative easing for years now ....we are in negative rates now !

Thats what he said, except he's echo'd Draghi, Lagarde, Carney, Powell etc in saying that it needs to be Fiscal over Monetary stimulus. The Monetary firepower the ECB has has dimished as they are STILL struggling to pay people to take away the cash to stimunlate demand inflation. There is a lot of theory that suggests after the first slug of NIRP; it largely ceases to work OR you go very negative (say -1.5%). It's S&P that are suggesting that include asset inflation into their inflation metric to give a better reading of the numbers.An economic stimulus is the use of monetary or fiscal policy changes to kickstart growth during a recession. Governments can accomplish this by using tactics such as lowering interest rates, increasing government spending and quantitative easing, to name a few

germany and the ecb have been lowering interest rates/ quantitative easing for years now ....we are in negative rates now !

Interesting the IMF is saying that GLOBALLY, we are STILL going to see expansive monetary stimulus this year. They are however VERY close to what they term global recession (2020 global growth they have lowere to 3%; they deem 2.5% a recessionary level - they include China, India etc); and everyone is betting the farm on consumer activity (low unemployment). If that consumer spending gives in a major economy (like the UK or Germany), due to a manufacturing, demand, fear slump - we can burn right through their 3% growth prediction (down from%).

stongle said:

Thats what he said, except he's echo'd Draghi, Lagarde, Carney, Powell etc in saying that it needs to be Fiscal over Monetary stimulus. The Monetary firepower the ECB has has dimished as they are STILL struggling to pay people to take away the cash to stimunlate demand inflation. There is a lot of theory that suggests after the first slug of NIRP; it largely ceases to work OR you go very negative (say -1.5%). It's S&P that are suggesting that include asset inflation into their inflation metric to give a better reading of the numbers.

Interesting the IMF is saying that GLOBALLY, we are STILL going to see expansive monetary stimulus this year. They are however VERY close to what they term global recession (2020 global growth they have lowere to 3%; they deem 2.5% a recessionary level - they include China, India etc); and everyone is betting the farm on consumer activity (low unemployment). If that consumer spending gives in a major economy (like the UK or Germany), due to a manufacturing, demand, fear slump - we can burn right through their 3% growth prediction (down from%).

Exactly. USA consumer spending is right on the edge of a downward trend and once Trump has got his phase1 China deal sorted, he is going after the EU and in particular the German manufacturing sector.Interesting the IMF is saying that GLOBALLY, we are STILL going to see expansive monetary stimulus this year. They are however VERY close to what they term global recession (2020 global growth they have lowere to 3%; they deem 2.5% a recessionary level - they include China, India etc); and everyone is betting the farm on consumer activity (low unemployment). If that consumer spending gives in a major economy (like the UK or Germany), due to a manufacturing, demand, fear slump - we can burn right through their 3% growth prediction (down from%).

Thats going to suppress USA and EU confidence and consumer spend IMHO and hit the German bottom line significantly.

Germany needs to open up the taps on their massive surplus cash and spend it on infrastructure, if they dont they will hit the buffers hard.

Digga said:

Change doubtful. Mindset deeply engrained.

Mind you, not that being fiscally conservative is necessarily a 'bad' thing.

Hyperinflation was a deliberate policy by the German government to screw France's war reparations.

Mind you, not that being fiscally conservative is necessarily a 'bad' thing.

It lasted a very short period of time, but that event is baked into their mindset, they dont realise it was a deliberate policy act, so have drawn the wrong conclusions from it.

jsf said:

Germany needs to open up the taps on their massive surplus cash and spend it on infrastructure, if they dont they will hit the buffers hard.

Bigger problem for rest of EUzone. Can't afford fiscal, monetray expansion no takers. Helicopter money?

jsf said:

Digga said:

Change doubtful. Mindset deeply engrained.

Mind you, not that being fiscally conservative is necessarily a 'bad' thing.

Hyperinflation was a deliberate policy by the German government to screw France's war reparations.

Mind you, not that being fiscally conservative is necessarily a 'bad' thing.

It lasted a very short period of time, but that event is baked into their mindset, they dont realise it was a deliberate policy act, so have drawn the wrong conclusions from it.

stongle said:

Quite. Thats why I was asking if anyone could explain why this is a good idea. Genuinely.

They can't think peoples memories are that short, or stupid unless they took the view the collective IQ of 500m people has been sufficiently degraded by BREXIT debate. Maybe someone publoshed a grad intake paper for s ts and giggles.

ts and giggles.

It's a weird one. Maybe they are positioning to upsell the economics of a Corbyn government. FTSE250 equity raid, AAA effort, well done lads. Mind you that is a policy that is 90/10 weighted towards Tax raid than the workers (those tricksters).

Not sure why I'm quoting myself; responding to Murph. Damned lying forum thingymabobs.They can't think peoples memories are that short, or stupid unless they took the view the collective IQ of 500m people has been sufficiently degraded by BREXIT debate. Maybe someone publoshed a grad intake paper for s

ts and giggles.

ts and giggles.It's a weird one. Maybe they are positioning to upsell the economics of a Corbyn government. FTSE250 equity raid, AAA effort, well done lads. Mind you that is a policy that is 90/10 weighted towards Tax raid than the workers (those tricksters).

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff