Liz Truss Prime Minister

Discussion

President Merkin said:

Straight to the heart of the issue there. If Kwarteng had chosen history teacher instead of politics, millions wouldn't be facing cliff edges on their mortgages. If you boys are even vaguely representative of what passes for debate in Tory circles, then it sure is a mystery how they've ended up 20 points behind in the polls forever & a day.

I think you have fallen for the myth there. If it were all down to the mini-budget why are interest rates still at 5.25% over 18 months later?Interest rates were going up rapidly in any case and would in any case have reached the current level.

You saw the exact same process in the US and we would have partly tracked them and partly sharply raised interest rates due to high inflation in any case.

https://www.forbes.com/advisor/investing/fed-funds...

You're telling me I'm unreliable at processing information & simutaneously asking me a question.

Not sure who's falling for what round here but I have a fair idea of what actually went on for 49 days in 2022, about 20 of those, nothing at all other than a very grand funeral, then another much shorter one.

Not sure who's falling for what round here but I have a fair idea of what actually went on for 49 days in 2022, about 20 of those, nothing at all other than a very grand funeral, then another much shorter one.

Wombat3 said:

skwdenyer said:

xeny said:

skwdenyer said:

“Best value” is a wide measure, and should include the wider benefits to the economy - not to mention how hard it is to persuade export buyers to buy British when our own Government won’t! The short-termism inherent in buying a slightly cheaper overseas option is a part of how our economy ended up in a mess.

I saw an analysis of the US armed forces on this basis - essentially tax from the companies making the weapons acts as a discount to the US Defence budget, as well as amortising development costs. The firms then sell the product overseas, generating more tax take for the US Gov't. They get decent weapons at a huge discount when all the cash flows are included.

Adopting your apparent logic, government expenditure should have been slashed during Covid, not expanded.

Governments exist for a different purpose. The GFC and its aftermath was one of those times when Governments’ ability to borrow almost-limitless money is critical. Keeping the economy going is the most important factor. It is far better in such circumstances to have high spending and higher taxes to match.

Truss wanted to increase public spending whilst cutting taxes, relying on presumptions of double-digit growth to manage the shortfall. That was clearly hard to fathom.

skwdenyer said:

Yup. Which is precisely why “austerity” was so stupid. You can’t cut your way to a higher tax take. Thatcher did everyone a disservice by allowing people to pretend that the national accounts are like a household budget.

You can't cut your way to a higher tax take but you might very well spend your way to a near economic collapse. See southern europe in 2010. That splurging money in 2020 over the pandemic was possible doesn't mean that doing the same without regard for whether people would fund that government largesse in 2010 with debt markets in a very different state. Expecting government spending to continue as if nothing had changed in 2008 and that capital markets would dutifully fund it as required is a rather rose-tinted view of things I'd suggest but ymmv.

turbobloke said:

It's getting a bit more O/T at this stage but OK. There's an O/T icon for times like this after all.

Did the discussion not involve next-steps for Kwarteng? A role on TV was mentioned. BBC hiring political types and ex-Labour people in particular is a known habit, so he'd have to start somewhere. The fall in pay that comes with the advertised job would be in keeping with, and atone for, his fall from grace on social media.

The well-worn path from Labour to BBC is more of a trench, trodden over time at all levels from Robert Kilroy SIlk through James Purnell to Oscar Bentley. Micro-rebalancing the BBC with a turned Tory would do no harm. He'd do OK at the interview, probably, if they held one.

HTH

https://europeanconservative.com/articles/news/bbc...

https://www.telegraph.co.uk/news/2021/05/24/bbc-ac...

https://www.thetimes.co.uk/article/x-bbc-launches-...

Nope, apart from some BBC boo hiss, still not sure what you are on about. Did the discussion not involve next-steps for Kwarteng? A role on TV was mentioned. BBC hiring political types and ex-Labour people in particular is a known habit, so he'd have to start somewhere. The fall in pay that comes with the advertised job would be in keeping with, and atone for, his fall from grace on social media.

The well-worn path from Labour to BBC is more of a trench, trodden over time at all levels from Robert Kilroy SIlk through James Purnell to Oscar Bentley. Micro-rebalancing the BBC with a turned Tory would do no harm. He'd do OK at the interview, probably, if they held one.

HTH

https://europeanconservative.com/articles/news/bbc...

https://www.telegraph.co.uk/news/2021/05/24/bbc-ac...

https://www.thetimes.co.uk/article/x-bbc-launches-...

I suspect his path leads towards a few NED's, a think tank and a nice earner in an American PE outfit, not presenting Match of the Day with Lineker.

isaldiri said:

You can't cut your way to a higher tax take but you might very well spend your way to a near economic collapse. See southern europe in 2010. That splurging money in 2020 over the pandemic was possible doesn't mean that doing the same without regard for whether people would fund that government largesse in 2010 with debt markets in a very different state.

Expecting government spending to continue as if nothing had changed in 2008 and that capital markets would dutifully fund it as required is a rather rose-tinted view of things I'd suggest but ymmv.

The IMF gave warnings of high government borrowing in 2010 https://www.imf.org/en/News/Articles/2015/09/28/04...Expecting government spending to continue as if nothing had changed in 2008 and that capital markets would dutifully fund it as required is a rather rose-tinted view of things I'd suggest but ymmv.

The European Commission and ratings agencies saw a risk just before the 2010 election https://www.theguardian.com/business/2010/may/05/u...

Mervyn King also warned that it was a good election to lose because of all the cuts that needed to be made https://www.theguardian.com/business/2010/apr/29/m...

Brown also planned to cut spending, just slower than the Conservatives https://www.theguardian.com/politics/2009/sep/15/g...

A lot of people seem to forget what a pickle we (and the rest of Europe) were in in 2010.

Even now, the IMF are warning the Americans (and us) about their (and our) deficit https://www.ft.com/content/0d098011-0ff5-4125-8cbb...

Mr Penguin said:

isaldiri said:

You can't cut your way to a higher tax take but you might very well spend your way to a near economic collapse. See southern europe in 2010. That splurging money in 2020 over the pandemic was possible doesn't mean that doing the same without regard for whether people would fund that government largesse in 2010 with debt markets in a very different state.

Expecting government spending to continue as if nothing had changed in 2008 and that capital markets would dutifully fund it as required is a rather rose-tinted view of things I'd suggest but ymmv.

The IMF gave warnings of high government borrowing in 2010 https://www.imf.org/en/News/Articles/2015/09/28/04...Expecting government spending to continue as if nothing had changed in 2008 and that capital markets would dutifully fund it as required is a rather rose-tinted view of things I'd suggest but ymmv.

The European Commission and ratings agencies saw a risk just before the 2010 election https://www.theguardian.com/business/2010/may/05/u...

Mervyn King also warned that it was a good election to lose because of all the cuts that needed to be made https://www.theguardian.com/business/2010/apr/29/m...

Brown also planned to cut spending, just slower than the Conservatives https://www.theguardian.com/politics/2009/sep/15/g...

A lot of people seem to forget what a pickle we (and the rest of Europe) were in in 2010.

Even now, the IMF are warning the Americans (and us) about their (and our) deficit https://www.ft.com/content/0d098011-0ff5-4125-8cbb...

The warning about the UK deficit - 12% of GDP - is important, but doesn't say what you think it says. The reported report highlights that the UK wasn't being impacted by Government spending per se, but by "pressures on private consumption, a key growth driver, from employment worries and stagnant wages."

Growth was the problem, not spending per se. You can't cut your way to a surplus in that sort of scenario - those costs will have a ratcheting-down effect on the economy at large, resulting a tail that can be ever chased but never caught.

The problem with these debates is they get narrowly-focussed on the wrong things. Let's consider Govt income and expenditure:

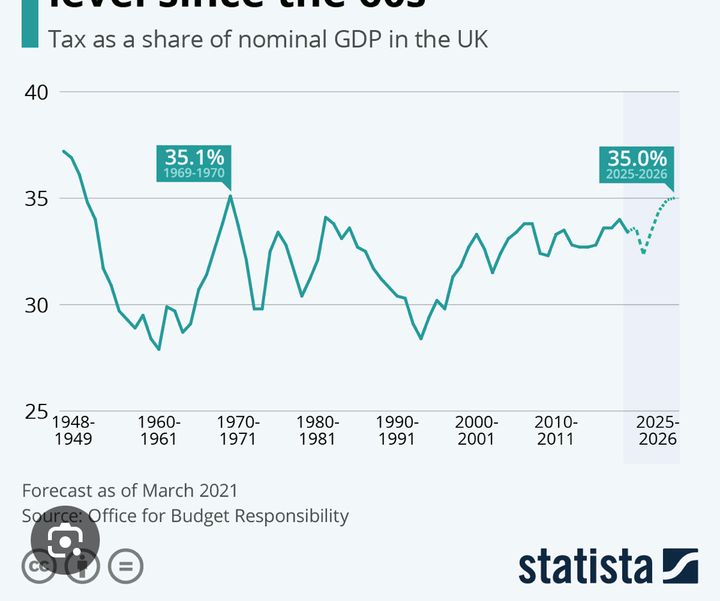

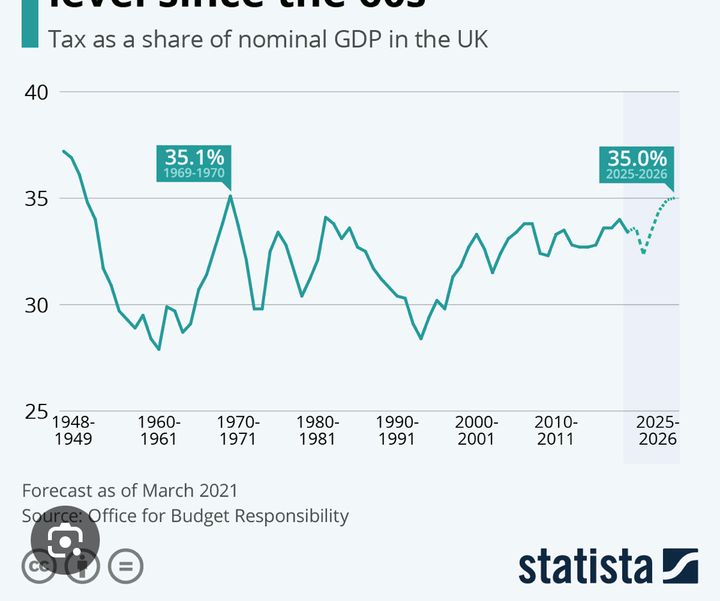

Look at where the highs were. Thatcher was permanently in deficit. Major ran a huge deficit. Note how lots of spending inevitably follows periods of decline. See how the Conservatives presided over a collapse in public revenue - down nearly a quarter in less than 10 years - without ever fixing the broader investment problem. Brown took us into surplus, and then kicked off a rise which mirrored the improvement in the underlying economy. Note how revenues have still been stuck at the same level as the late 1980s, whilst spending has been consistently so much higher - where has all the money being going, given the dramatic cuts to public services...?

: scratchchin:

: scratchchin:Look at how public spending continues to outstrip GDP growth:

and how GDP growth all-but flatlined after 2010. Truss was right one thing: we need growth, especially with an ageing population. Re-base those numbers on a per-capita basis and the picture really isn't pretty.

The smart money was on rebuilding growth in 2010, not on cutting it off at the knees. Compare our performance and behaviour to the USA: a near $1.5tn budget deficit across all of 2009-2012 made a huge difference to the nation's outcomes. Running a deficit of 10% of GDP was the natural response to the crisis.

As for Mervyn King's alleged comments at lunch, nobody was suggesting that UK deficits should continue for years. But, once again, the idea that you cut and cut and cut in the face of flatlining GDP growth rather than investing in order to re-start growth is very peculiar. And that's been born out by what has happened since - failing to re-start GDP growth resulted in continuing problems with Government revenues; deliberately engineering an asset boom and astronomical housing price rises merely made that situation far far worse.

And still you choose to ignore the question that was the main problem in 2010 in Europe - what makes you think that capital markets would unquestioningly have just stumped up money to allow for that increased spending? Fantastical promises of 'growth' won't simply be believed just because politicians say so. The 'bond vigilantes' might well have avoided targeting gilts after southern european debt precisely because government spending was being promised to be reined in after all. When faced with a (rather bloody) large decline in revenues, blithely expecting government spending to carry on as if nothing had happened when you are dependent on others to provide that funding is well... rather Truss-like.

isaldiri said:

And still you choose to ignore the question that was the main problem in 2010 in Europe - what makes you think that capital markets would unquestioningly have just stumped up money to allow for that increased spending? Fantastical promises of 'growth' won't simply be believed just because politicians say so. The 'bond vigilantes' might well have avoided targeting gilts after southern european debt precisely because government spending was being promised to be reined in after all. When faced with a (rather bloody) large decline in revenues, blithely expecting government spending to carry on as if nothing had happened when you are dependent on others to provide that funding is well... rather Truss-like.

Well, getting taxation back in line would have been a start.Here’s overall tax take:

There was obviously a comical drop in tax take in the early 1990s which undermined the public finances, but more seriously we should have been putting taxation at the correct level for a modern economy with the level of public services we have. Which would have settled the capital markets in way Truss’ attempt to cut taxes and boost spending clearly didn’t achieve.

skwdenyer said:

Well, getting taxation back in line would have been a start.

Here’s overall tax take:

There was obviously a comical drop in tax take in the early 1990s which undermined the public finances, but more seriously we should have been putting taxation at the correct level for a modern economy with the level of public services we have. Which would have settled the capital markets in way Truss’ attempt to cut taxes and boost spending clearly didn’t achieve.

Well then I'm sure you are glad it was Cameron/Osborne who reset taxes back to ~33% after Brown/Darling had let it run down towards 30% prior to that with the tax income from the financial sector falling post 2008...Here’s overall tax take:

There was obviously a comical drop in tax take in the early 1990s which undermined the public finances, but more seriously we should have been putting taxation at the correct level for a modern economy with the level of public services we have. Which would have settled the capital markets in way Truss’ attempt to cut taxes and boost spending clearly didn’t achieve.

And unless you think that taxes could/should have been raised high enough in 2010 to allow for government spending to continue unchecked, it doesn't change that government spending had to take into account the new economic reality post 2008.

Edited by isaldiri on Wednesday 15th May 16:50

JagLover said:

President Merkin said:

Straight to the heart of the issue there. If Kwarteng had chosen history teacher instead of politics, millions wouldn't be facing cliff edges on their mortgages. If you boys are even vaguely representative of what passes for debate in Tory circles, then it sure is a mystery how they've ended up 20 points behind in the polls forever & a day.

I think you have fallen for the myth there. If it were all down to the mini-budget why are interest rates still at 5.25% over 18 months later?Interest rates were going up rapidly in any case and would in any case have reached the current level.

You saw the exact same process in the US and we would have partly tracked them and partly sharply raised interest rates due to high inflation in any case.

https://www.forbes.com/advisor/investing/fed-funds...

isaldiri said:

skwdenyer said:

Well, getting taxation back in line would have been a start.

Here’s overall tax take:

There was obviously a comical drop in tax take in the early 1990s which undermined the public finances, but more seriously we should have been putting taxation at the correct level for a modern economy with the level of public services we have. Which would have settled the capital markets in way Truss’ attempt to cut taxes and boost spending clearly didn’t achieve.

Well then I'm sure you are glad it was Cameron/Osborne who reset taxes back to ~33% after Brown/Darling had let it run down towards 30% prior to that with the tax income from the financial sector falling post 2008...Here’s overall tax take:

There was obviously a comical drop in tax take in the early 1990s which undermined the public finances, but more seriously we should have been putting taxation at the correct level for a modern economy with the level of public services we have. Which would have settled the capital markets in way Truss’ attempt to cut taxes and boost spending clearly didn’t achieve.

And unless you think that taxes could/should have been raised high enough in 2010 to allow for government spending to continue unchecked, it doesn't change that government spending had to take into account the new economic reality post 2008.

Edited by isaldiri on Wednesday 15th May 16:50

Doing that after 2008 would have allowed Government spending to be maintained at sensible levels.

The enormous deficits be sustainable levels over such a long time shown on your graphs can be felt in every pothole, every wasted month of waiting for healthcare, every reduced educational outcome or unbuilt home or freezing pensioner or uninsulated home, to name just a few.

Of course people like to be told they can have low taxes and decent government services. It would be nice if politicians stopped peddling that lie.

Legacywr said:

It’s acknowledged by most that the mini budget just accelerated the interest rise, it was coming, though.

Well yesand don't get me wrong, if the Lettuce and Kamikwazi had remained in office interest rates might well have gone higher than 5.25%. What I was objecting to is people saying if you re-mortgage now you will be paying higher interest rates due to the terrible twosome.

JagLover said:

Legacywr said:

It’s acknowledged by most that the mini budget just accelerated the interest rise, it was coming, though.

Well yesand don't get me wrong, if the Lettuce and Kamikwazi had remained in office interest rates might well have gone higher than 5.25%. What I was objecting to is people saying if you re-mortgage now you will be paying higher interest rates due to the terrible twosome.

ks. It just suits a narrative and is only ever trotted out by the usual suspects. Rates were always going to these levels in step with rates in the US and elsewhere.

ks. It just suits a narrative and is only ever trotted out by the usual suspects. Rates were always going to these levels in step with rates in the US and elsewhere.Its arguable in fact that the reason rates have remained so high for so long is that they did not go up soon enough - i.e the BoE was asleep at the wheel.

skwdenyer said:

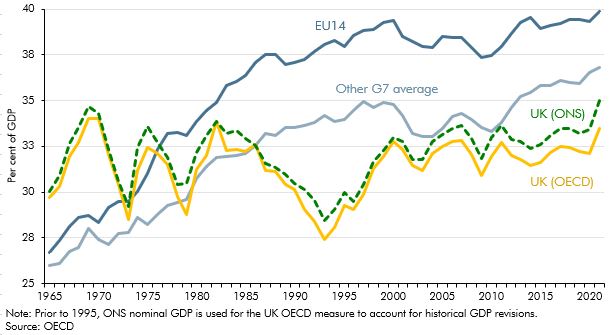

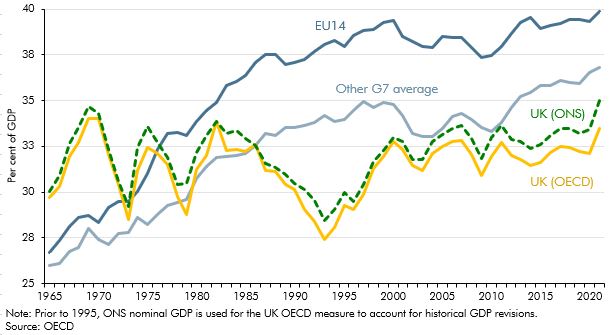

It should have been up at EU14 levels the whole time to be able to cover the necessary spending.

Doing that after 2008 would have allowed Government spending to be maintained at sensible levels.

The enormous deficits be sustainable levels over such a long time shown on your graphs can be felt in every pothole, every wasted month of waiting for healthcare, every reduced educational outcome or unbuilt home or freezing pensioner or uninsulated home, to name just a few.

Of course people like to be told they can have low taxes and decent government services. It would be nice if politicians stopped peddling that lie.

Define 'cover the necessary spending'. Even if tax levels were at EU14 levels, spending would have been there or abouts as well so you'd be resisting any cut to those spending levels either way irrespective to lower government revenues post 2008. Doing that after 2008 would have allowed Government spending to be maintained at sensible levels.

The enormous deficits be sustainable levels over such a long time shown on your graphs can be felt in every pothole, every wasted month of waiting for healthcare, every reduced educational outcome or unbuilt home or freezing pensioner or uninsulated home, to name just a few.

Of course people like to be told they can have low taxes and decent government services. It would be nice if politicians stopped peddling that lie.

The point being made is that in the post 2008 world, especially in the UK with less financial sector revenues, spending could not plausibly have continued at former levels unless you believe that the government could massively raise taxes to offset that decline or you could just merrily borrow more.

Part two of Kwasi on Leading is up. He definitely went down in my estimation after mispronouncing scone. This part also covered his time as Chancellor, how he came to be with Truss, why he was sacked (gilts, not currency) and what he thinks of Truss chasing conspiracy theories.

Rory had a bit of a go because he thought Kwasi was too keen to follow the electorate and presentation focused approach over policy. I think this is a bit unfair because you need to actually get into power to do all the things Rory liked to do, something he seems to completely forget every time he talks about elections.

Kwarteng seemed extremely naive (at best) about Truss' personality and her suitability for office. Or he thought she was more likely to win or just backed the horse from his side of the party and hoped those flaws wouldn't come to fruition.

Rory had a bit of a go because he thought Kwasi was too keen to follow the electorate and presentation focused approach over policy. I think this is a bit unfair because you need to actually get into power to do all the things Rory liked to do, something he seems to completely forget every time he talks about elections.

Kwarteng seemed extremely naive (at best) about Truss' personality and her suitability for office. Or he thought she was more likely to win or just backed the horse from his side of the party and hoped those flaws wouldn't come to fruition.

Carl_VivaEspana said:

UK Government borrowing up to just a smidge over 20 billion in April, higher than forecast. What's a quarter of a trillion a year in borrowing between friends though eh?

You've only got that wrong by a factor of 2 but hey, when did accuracy ever matter eh?https://www.ons.gov.uk/economy/governmentpublicsec...

""Since our March 2024 publication, we have increased our initial estimate of borrowing in the financial year ending March 2024 by £0.8 billion to £121.4 billion, now £7.3 billion more than the £114.1 billion forecast by the OBR.""

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff