More hype and plain silliness

Discussion

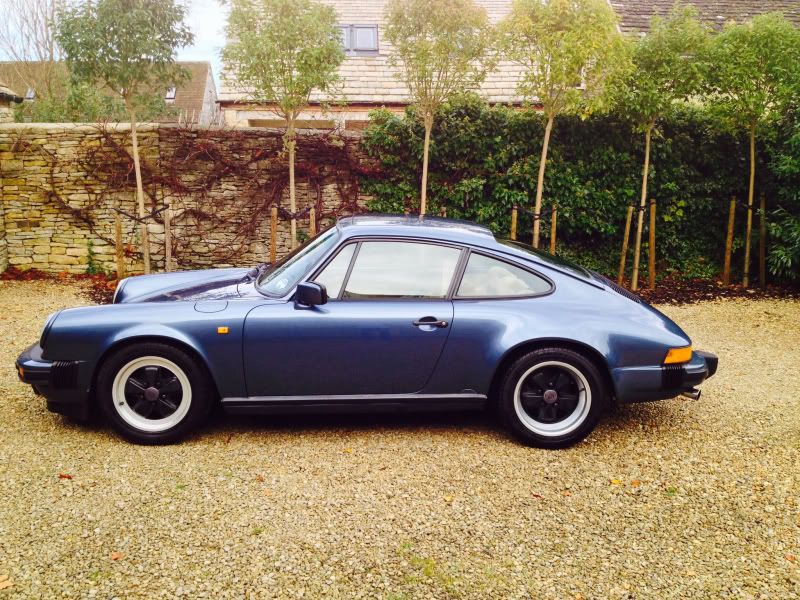

Its interesting that the Hexagon guys don't sell their very best stock. I'd love to buy the car below and stick a few miles on it! Sad really..

http://hexagonclassics.com/cars/1989-porsche-carre...

http://hexagonclassics.com/cars/1989-porsche-carre...

9e 28 said:

Its interesting that the Hexagon guys don't sell their very best stock. I'd love to buy the car below and stick a few miles on it! Sad really..

http://hexagonclassics.com/cars/1989-porsche-carre...

And I wonder how much that would be if he did decide to sell?http://hexagonclassics.com/cars/1989-porsche-carre...

89coupe said:

9e 28 said:

Its interesting that the Hexagon guys don't sell their very best stock. I'd love to buy the car below and stick a few miles on it! Sad really..

http://hexagonclassics.com/cars/1989-porsche-carre...

And I wonder how much that would be if he did decide to sell?http://hexagonclassics.com/cars/1989-porsche-carre...

89coupe said:

9e 28 said:

Its interesting that the Hexagon guys don't sell their very best stock. I'd love to buy the car below and stick a few miles on it! Sad really..

http://hexagonclassics.com/cars/1989-porsche-carre...

And I wonder how much that would be if he did decide to sell?http://hexagonclassics.com/cars/1989-porsche-carre...

Koln-RS said:

89coupe said:

9e 28 said:

Its interesting that the Hexagon guys don't sell their very best stock. I'd love to buy the car below and stick a few miles on it! Sad really..

http://hexagonclassics.com/cars/1989-porsche-carre...

And I wonder how much that would be if he did decide to sell?http://hexagonclassics.com/cars/1989-porsche-carre...

roygarth said:

Koln-RS said:

I'd much prefer a 'narrow bodied' 3.2. Never got the purpose of the 'turbo look' models.

Agree, always thought it a rather un-Porsche thing to do....

Sublime

anonymous said:

[redacted]

If you were driving at Le Mans perhaps. Pottering around on road very little difference. I suppose the extra weight is cumbersome. Its just a nod to the old racing cars. I had a 84 911 turbo and looks wise it drew a lot of admiring glances. Crap to drive (perhaps one of the most disappointing sports cars I've owned in many ways) but I still want one!

isaldiri said:

mollytherocker said:

I struggle to explain it in cold hard logic terms which you are asking for.

I suppose its a sea change, almost a movement? The perfect storm,

and that belief perfectly explains why there's this current (insane imo) bubble....I suppose its a sea change, almost a movement? The perfect storm,

Classicdriver said:

Which explains perfectly why none of these cars are selling. I believe even collectors/speculators have even eased off now. These bloody cars have been ornaments in the showrooms for yonks, beggars belief how some of these traders make a living sat on so much stock

But this time it's different.....

Wozy68 said:

Classicdriver said:

,beggars belief how some of these traders make a living sat on so much stock

Borrows against them maybe, hoping the 'asset' will rise? Loan are pretty damn cheap these days.If you go by that logic then prices remain strong till there is significant movement on interest rates. For the record classic car prices started going up just as interest rates started coming down circa 2010. On the other hand there was hardly any movement on classics when interest rates remained circa 5% from mid 90's to 2010.

Mondrian said:

Wozy68 said:

Classicdriver said:

,beggars belief how some of these traders make a living sat on so much stock

Borrows against them maybe, hoping the 'asset' will rise? Loan are pretty damn cheap these days.If you go by that logic then prices remain strong till there is significant movement on interest rates. For the record classic car prices started going up just as interest rates started coming down circa 2010. On the other hand there was hardly any movement on classics when interest rates remained circa 5% from mid 90's to 2010.

But were cars hanging around back before the recession like some seem to be now?

But were cars hanging around back before the recession like some seem to be now? The risk would seem small (well until the last few months) to borrow because prices have been heading north at faster and faster rates over the last four years. Why use your own money if you could borrow at 3-4% when sale prices were rising in certain circumstances by around 30% or more per year, but could just have easily stagnated but doubtful they would fall.

Paying off the (low) interest of a loan seems a good way to stock up on a lot of continuing profit making cars without the outlay, and in a way also help manipulate the market a little if you generally sell higher end/quality cars.

I'm not so sure that so many of these dealers in classic cars are as financially secure as we'd like to think. Hopefully they are but I guess the proof is in the pudding and only time will tell.

Finally. Surely the reason classic car prices have gone up so quickly is partly due to punters seeing them as investments where the returns are higher than the banks, and classic cars dealers have jumped on that wagon. If you have 30K kicking about to spend but do not want massive risk; with interest rates so flat surely the enjoyment of owning v risk is minimal even if the returns are potencially low.. Something my accountant has actually done a while back, went out and bought a car he always wanted (a Vega 'Facel II). You basically can have your cake and eat it .......

No idea really, just my two pennies.

Mondrian said:

Actually the ones that are sat on a lot of prime stock are the dealers with money, the way they look at it is why put money in bank and get 0.5% interest when they stand to make lots more putting it into cars - even if it means sitting on it for a few years. However the returns would look very different if they had to borrow (as well as risks).

If you go by that logic then prices remain strong till there is significant movement on interest rates. For the record classic car prices started going up just as interest rates started coming down circa 2010. On the other hand there was hardly any movement on classics when interest rates remained circa 5% from mid 90's to 2010.

Good point, but no one likes having all their profit in stock that is not selling, whatever is supposed to be happening to the value of that stock. Paper gains are fine in theory, but you have to pay overheads and live. Traders need to trade to stay in business.If you go by that logic then prices remain strong till there is significant movement on interest rates. For the record classic car prices started going up just as interest rates started coming down circa 2010. On the other hand there was hardly any movement on classics when interest rates remained circa 5% from mid 90's to 2010.

Gassing Station | Porsche Classics | Top of Page | What's New | My Stuff