AML - Stock Market Listing

Discussion

jonby said:

Even though I'd be breaking my own rule about personal direct equity investments which I imposed upon myself when I left the market 23 years ago, I have to say when the price dropped to £10 it was very tempting. I see the price has now dropped even further to £8.

Assuming the company doesn't literally collapse, surely in the medium term it cannot be a bad buy at less than half the float price ?

I don’t think it would be unreasonable to say the float price was inflated - although one might argue it was worth on that day what people were prepared to pay for it. In the colder light of the day after, without the crescendo of hype that always precedes IPO’s one has to question if this should be valued as a manfacturer of engineered products or a luxury brand. The insiders pre-IPO stood to gain by promoting the latter, while that maybe missing a lot of the capital intense realities of the former especially as we approach a likely downturn in the economic cycle.Assuming the company doesn't literally collapse, surely in the medium term it cannot be a bad buy at less than half the float price ?

I’d say this is a risky investment at any price. Better to buy a modern classic (80-90’s) and drive it gently.

jonby said:

Even though I'd be breaking my own rule about personal direct equity investments which I imposed upon myself when I left the market 23 years ago, I have to say when the price dropped to £10 it was very tempting. I see the price has now dropped even further to £8.

Assuming the company doesn't literally collapse, surely in the medium term it cannot be a bad buy at less than half the float price ?

Assuming the company doesn't literally collapse, surely in the medium term it cannot be a bad buy at less than half the float price ?

When you say left the market Jonby, were you employed in the City, or perhaps could it be that your own rule followed disappointment with the market? I only ask because you won't want me mentioning PE ratios, etc., if you already know.

AML is presently valued at nearly £2 billion, with debt including leases of £702 million,

An investor might think along the lines of; what future return should I hope for from a £2 billion business.

If you wanted to, you could alway buy just a few shares (for less than an AMOC membership fee), and you would then be a part owner of the Company, have your own share certificate, and be entitled to attend the Annual General Meetings.

Edited by Jon39 on Wednesday 15th May 18:15

ExitLeft said:

I don’t think it would be unreasonable to say the float price was inflated - although one might argue it was worth on that day what people were prepared to pay for it. In the colder light of the day after, without the crescendo of hype that always precedes IPO’s one has to question if this should be valued as a manfacturer of engineered products or a luxury brand. The insiders pre-IPO stood to gain by promoting the latter, while that maybe missing a lot of the capital intense realities of the former especially as we approach a likely downturn in the economic cycle.

I’d say this is a risky investment at any price. Better to buy a modern classic (80-90’s) and drive it gently.

Agree with the first part, but as I mention in the previous post, unless the company literally collapses, the lower the price gets, the less I see the riskI’d say this is a risky investment at any price. Better to buy a modern classic (80-90’s) and drive it gently.

Jon39 said:

When you say left the market Jonby, were you employed in the City, or perhaps could it be that your own rule followed disappointment with the market? I only ask because you won't want me mentioning PE ratios, etc., if you already know.

AML is presently valued at nearly £2 billion, with debt including leases of £702 million,

An investor might think along the lines of; what future return should I hope for from a £2 billion business.

If you wanted to, you could alway buy just a few shares (for less than an AMOC membership fee), and you would then be a part owner of the Company, have your own share certificate, and be entitled to attend the Annual General Meetings.

Not bothered about the certificate/ownership, just looking at it from a straight investment point of view

I just wonder how much lower the share price can get. What I particularly don't get is that markets normally react to events compared to expectation and so far, the results don't seem hugely out of line with predictions ? Meanwhile specials which produce both great cash flow and great profit seem to be doing brilliantly, albeit it will take another year or two to fully hit the bottom line

They have announced that Rb003 has sold out, so presumably they will do a convertible and track only amr pro version of that, which will be even more profitable given the groundwork has already been done

A lot really does therefore appear to be riding on DBX which right now is the biggest unknown..................................

I have just bought in; basis is they have a strong pipeline, the 4x4 will sell like hot cakes, the Vantage revision will increase sales along with other stuff they said they would do around leasing which is now helping them in the US.

Probably a little bit of emotion in the decision too.

Probably a little bit of emotion in the decision too.

- This does not constitute investment advice and AML may not be a suitable investment for you, seek professional advice likely not on a motoring forum before investing **

Weren't the ratios at lunatic levels when the IPO was priced ? 60 rings a bell ? Even at half that price I am not sure it sounds like value. Before buying I would look at which institutional shareholders have been buying (if any)....if there's no institutional support its going to keep heading south.

Cheib said:

Weren't the ratios at lunatic levels when the IPO was priced ? 60 rings a bell ? Even at half that price I am not sure it sounds like value. Before buying I would look at which institutional shareholders have been buying (if any)....if there's no institutional support its going to keep heading south.

I seem to remember it was priced at a higher ratio than Ferrari was trading at the time. Was why I didn’t go in at IPO. Ratio more realistic now...Ken Figenus said:

Guys what is a good portal for an amateur to burn some fingers buying some shares?

From what little that I have seen about internet share tip forums, it appears the conversation tends to be the hope of making a fortune in just a few weeks.

I have always been more interested in large steady understandable businesses, which are not too cyclical, and have a record of profit growth and dividend payments. Some (including Mr Buffett) dislike the dividend payment system because of the tax aspect, but it suits me. Once bought, I then hold for years, so not interested in short-term gambles.

Obviously not every holding is a winner, but a few suffering rocky times is not a problem, if you can have say a collection of 25 or so holdings. BP was one example of trouble, with their dreadful Gulf of Mexico accident. They were large enough to survive that disaster (hence my desire for large). I think they stopped paying their dividend briefly, but income for investors did continue, and that company is now making progress again.

I can never tell what might happen in the future, but one stock comes to mind, which might be something that could be of interest to you Dewi. I have held Compass Group plc for decades and will continue to do so. Their business is about as basic as you can get. They feed people. Probably not a very well known company, but it is a very big business, international, and has achieved steady revenue and profits growth. Dividend income is about 2%, but the dividend payments have been increasing by a big percentage each year. Study their annual report to learn more if you wish.

Sorry to go off topic.

Ken Figenus said:

Those US and Asia figures are good - they must be liking the new Vantage. DBX confirmed to be having a hybrid option too which I consider critical. Guys what is a good portal for an amateur to burn some fingers buying some shares?

I think the US has got some ultra attractive leasing deals on the new Vantage (maybe one of our US posters could confirm?). APAC sales are very encouraging (particular given the recent declines in the Chinese market). I think there’s been some dealership expansion there but it also looks as though brand awareness is increasing- both of which will be very important when DBX comes on-stream later this year

RobDown said:

I think the US has got some ultra attractive leasing deals on the new Vantage (maybe one of our US posters could confirm?).

APAC sales are very encouraging (particular given the recent declines in the Chinese market). I think there’s been some dealership expansion there but it also looks as though brand awareness is increasing- both of which will be very important when DBX comes on-stream later this year

Yes. I can confirm that the leasing deals are attractive in the US. Looking at $5k down with $1500 to $2000 a month depending on options. 2500 miles a year for 3 years. Also in some cases, the first 3 months are free. APAC sales are very encouraging (particular given the recent declines in the Chinese market). I think there’s been some dealership expansion there but it also looks as though brand awareness is increasing- both of which will be very important when DBX comes on-stream later this year

AP just tweeted that wholesale sales were up 12% and retail up 39% - at least that would seem to suggest that the volume going into dealer stock is lower than the amount being sold out to actual owners - which would seem a positive indicator if you subscribe to the fact that excess dealer stock will affect sales prices as the older it is the more likely you will be to get a discount - which in turn could affect residuals?

The issue they had was around a production lag that, when resolved, led to a wall of Vantages hitting the dealer at the end of the year. Hence the heavy discount we saw at Christmas.

Sounds like the inventory is now reduced to more normal levels (but will naturally build again in the ramp up of DBX next year).

CFO saying 75% of US sales are leasing. Presumably will be a buyers market in three years time when they start to hit

Vantage Roadster launching later this year

And for would-be DBX buyers, order books to open in September (with private viewings), official unveil in December. So if you’re interested in one sounds like you should be getting in touch with your dealer over the Summer

Sounds like the inventory is now reduced to more normal levels (but will naturally build again in the ramp up of DBX next year).

CFO saying 75% of US sales are leasing. Presumably will be a buyers market in three years time when they start to hit

Vantage Roadster launching later this year

And for would-be DBX buyers, order books to open in September (with private viewings), official unveil in December. So if you’re interested in one sounds like you should be getting in touch with your dealer over the Summer

RobDown said:

CFO saying 75% of US sales are leasing. Presumably will be a buyers market in three years time when they start to hit

Would the attractive US leasing offers have to involve a financial subsidy by AML?

V12Vin above; 'Yes. I can confirm that the leasing deals are attractive in the US. Looking at $5k down with $1500 to $2000 a month depending on options. 2500 miles a year for 3 years. Also in some cases, the first 3 months are free.'

I am no expert on PCP, but would this ( $5k + 33 x $1500 @ fx1.30) indicate a trade price residual value of about £75,000 for a 3 year old 7,500 mile Vantage?

Edited by Jon39 on Friday 17th May 09:58

Thanks a lot Jon - time for me to have a dabble again I think.

I had most definitely heard of Compass as I often work in the events industry. Catering seems to be quite a successful business for those that get it right.

I wouldn't cash in on any Aston shares until the Rapide has doubled in value mind - in it for the long (very long!) game

I had most definitely heard of Compass as I often work in the events industry. Catering seems to be quite a successful business for those that get it right.

I wouldn't cash in on any Aston shares until the Rapide has doubled in value mind - in it for the long (very long!) game

Ken Figenus said:

Those US and Asia figures are good - they must be liking the new Vantage. DBX confirmed to be having a hybrid option too which I consider critical. Guys what is a good portal for an amateur to burn some fingers buying some shares?

Hargreaves Lansdown hl.co.ukIf you start a sip you can invest for your retirement and keep the potential gains and losses for yourself. As others have said, don't go thinking short term. The market showed some signs of weakness last year but has since risen again, there is a saying "90% of people lose 90% in the first 90 days" - good luck

bananarob said:

Every time I think it’s now at a tempting price it drops further... Surely can’t be much further to go..!

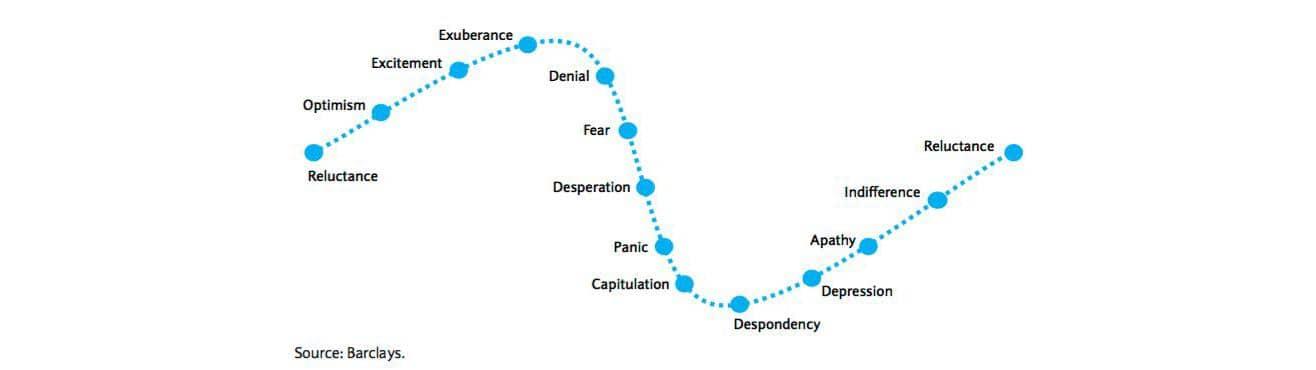

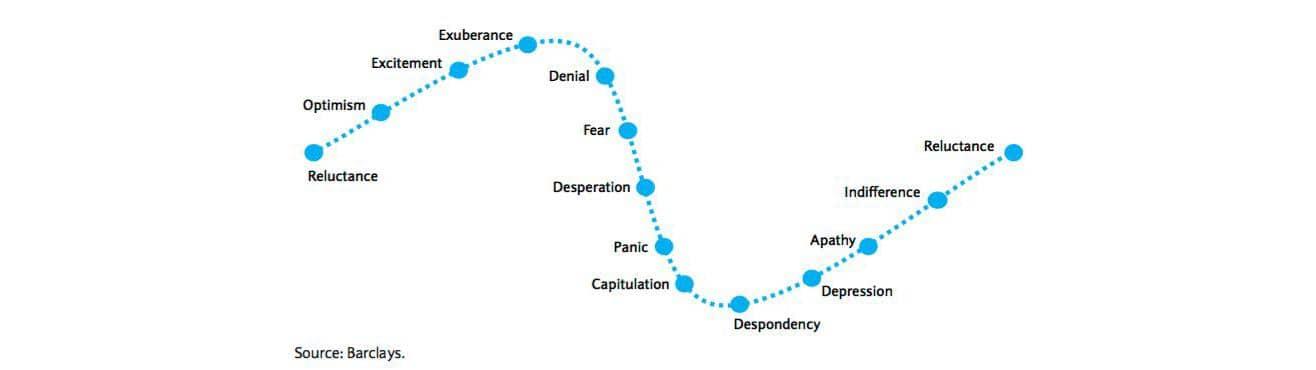

Buying shares when they are down is generally a good strategy - but not always. A stock that has fallen 90% is a stock that fell 80%, then halved.I think you need to go through a period of despondency and move towards apathy before it gets better.

Where we are on that cycle is subjective but I think we're more at desperation or capitulation.

AstonZagato said:

bananarob said:

Every time I think it’s now at a tempting price it drops further... Surely can’t be much further to go..!

Buying shares when they are down is generally a good strategy - but not always. A stock that has fallen 90% is a stock that fell 80%, then halved.I think you need to go through a period of despondency and move towards apathy before it gets better.

Where we are on that cycle is subjective but I think we're more at desperation or capitulation.

I notice AstonZagato, that your graphic is from the Smart Investor website. If you still use them following their pathetic reorganisation, are you affected by their 10 fold increase in annual fees, which coincided with their collapse in service levels? Before the changes they were excellent.

Anyway back to your point. If you think 'capitulation', then the chart shows now is the buying opportunity.

This reminds me of one of Warren Buffett's quotes. 'Beware of geeks bearing formulas.'

Have you noticed, that almost all the trades in AML stock, seem to be fairly small transactions. Even when there was shorting, I did not happen to spot large transactions. Do you think what we see, might be mostly private individuals, rather than any institutions?

Gassing Station | Aston Martin | Top of Page | What's New | My Stuff