AML - Stock Market Listing

Discussion

Jon39 said:

Have you noticed, that almost all the trades in AML stock, seem to be fairly small transactions. Even when there was shorting, I did not happen to spot large transactions. Do you think what we see, might be mostly private individuals, rather than any institutions?

Any liquid listed equity will generally trade on exchange in small sizes. That's an algorithm trading, not a human. If you look at any lit order book market the average trade value has shrunk radically over the last 20 or so years.

Jon39 said:

AstonZagato said:

bananarob said:

Every time I think it’s now at a tempting price it drops further... Surely can’t be much further to go..!

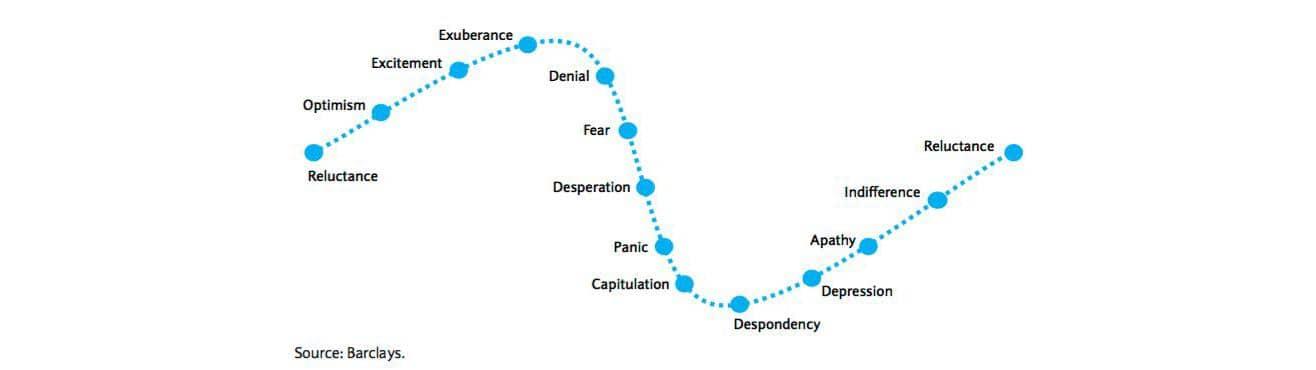

Buying shares when they are down is generally a good strategy - but not always. A stock that has fallen 90% is a stock that fell 80%, then halved.I think you need to go through a period of despondency and move towards apathy before it gets better.

Where we are on that cycle is subjective but I think we're more at desperation or capitulation.

I notice AstonZagato, that your graphic is from the Smart Investor website. If you still use them following their pathetic reorganisation, are you affected by their 10 fold increase in annual fees, which coincided with their collapse in service levels? Before the changes they were excellent.

Anyway back to your point. If you think 'capitulation', then the chart shows now is the buying opportunity.

This reminds me of one of Warren Buffett's quotes. 'Beware of geeks bearing formulas.'

Have you noticed, that almost all the trades in AML stock, seem to be fairly small transactions. Even when there was shorting, I did not happen to spot large transactions. Do you think what we see, might be mostly private individuals, rather than any institutions?

If you are in doubt that we are at "capitulation", you are better off, imho, waiting. Bottom-ticking the market is only ever done by accident (however smart one thinks one is). It is usually better to miss the first few percent recovery than to leap in too early (as Buffett once said, "there are two rules to investing: Rule 1 - Don't lose money; Rule 2. Don't forget Rule 1"). Averaging in is probably a sensible strategy - buy gradually in small lots - get a feel for how it trades.

One your shorting point, to be honest, I don't follow it closely enough. I spend a lot of my day with my nose pressed to a Bloomberg screen - but I only look in detail at securities which affect my universe - and AML isn't currently one of those.

JohnG1 said:

Off-topic, but...

Any liquid listed equity will generally trade on exchange in small sizes. That's an algorithm trading, not a human. If you look at any lit order book market the average trade value has shrunk radically over the last 20 or so years.

Yes most of the trading is algo now. Basically computer programmes that can be designed to do different things - for example like making sure a large trade is split into a raft of much smaller ones that are done proportionately to overall market volume to avoid moving the price too much.Any liquid listed equity will generally trade on exchange in small sizes. That's an algorithm trading, not a human. If you look at any lit order book market the average trade value has shrunk radically over the last 20 or so years.

The other you will see now is much of the trading is actually done in the closing auction at 4.30. Not during the normal trading day

I think the feedback from the AML results call was much more upbeat this time; CFO handled questions well. But as ever DBX is key

AstonZagato said:

..... (as Buffett once said, "there are two rules to investing: Rule 1 - Don't lose money; Rule 2. Don't forget Rule 1").

He has made many wonderful quotes, but that one has puzzled me. Markets have risks, even for the worlds best investor.

Try not to mention too often, his purchase and subsequent sale of Tesco.

Jon39 said:

AstonZagato said:

..... (as Buffett once said, "there are two rules to investing: Rule 1 - Don't lose money; Rule 2. Don't forget Rule 1").

He has made many wonderful quotes, but that one has puzzled me. Markets have risks, even for the worlds best investor.

Try not to mention too often, his purchase and subsequent sale of Tesco.

Jon39 said:

Would the attractive US leasing offers have to involve a financial subsidy by AML?

V12Vin above; 'Yes. I can confirm that the leasing deals are attractive in the US. Looking at $5k down with $1500 to $2000 a month depending on options. 2500 miles a year for 3 years. Also in some cases, the first 3 months are free.'

I am no expert on PCP, but would this ( $5k + 33 x $1500 @ fx1.30) indicate a trade price residual value of about £75,000 for a 3 year old 7,500 mile Vantage?

Edited by Jon39 on Friday 17th May 09:58

V12Vin said:

I am sure ALLY Financial has some deals with AML. Btw, the fx is 0.80 for USD -> GBP.

Thanks V12Vin.

Ref FX; we have both put our own countries first, so 0.80 is 1.3 but the other way around (1.2784 at present, either the £ has weakened, or $ has strengthened).

I am a low mileage AM user (winter hibernation), but I did wonder whether the stated lease mileage limit of 2,500, might be too low for many people.

Our AMs tend to be 'toys', but as the US is such a big country, do your everyday cars tend to have fairly high average annual mileages?

In the UK it is probably about 10,000 / 12,000 miles.

Jon39 said:

Thanks V12Vin.

Ref FX; we have both put our own countries first, so 0.80 is 1.3 but the other way around (1.2784 at present, either the £ has weakened, or $ has strengthened).

I am a low mileage AM user (winter hibernation), but I did wonder whether the stated lease mileage limit of 2,500, might be too low for many people.

Our AMs tend to be 'toys', but as the US is such a big country, do your everyday cars tend to have fairly high average annual mileages?

In the UK it is probably about 10,000 / 12,000 miles.

And back to the topic - if AML are reliant upon stacking up stock In dealers and engineering leases in a low interest economy at the top of the cycle then I would worry about the business model. The DBX is becoming the critical factor it seems if they are moving to a ‘pile it high’ play; would be interesting how Maserati are doing in US - lots about in a high depreciation lease special model - but do they make money at it? dunno.

Edited by ExitLeft on Saturday 18th May 14:27

I think that was just one example being quoted above. Presumably a range of options just like there is for PCP here.

And the reality is (according to AML) it’s 75% leasing in the US, whatever the deal happens to be. So clearly most find it an attractive option

The call seems to suggest that they have someone taking the residual value risk, not sure who that is. In Europe there’s a new finance partner, FCA (which is essentially Credit Agricole).

And the reality is (according to AML) it’s 75% leasing in the US, whatever the deal happens to be. So clearly most find it an attractive option

The call seems to suggest that they have someone taking the residual value risk, not sure who that is. In Europe there’s a new finance partner, FCA (which is essentially Credit Agricole).

In USA the residual is 60% on a vantage 3yr lease. 60% is too high based on prior vantage resale value so lender will be upside down in 2022 on these cars adding more financial pain for AM (ex: I paid 50% MSRP on my 3yr old vantage with 4k miles from AM dealer). On a $200k car that is a $120k wholesale at auction (not retail) and I bet you will be able to buy these 2019's at $100k retail all day long...I think Palmer is just playing finance games with jacking up the residual and paying first 3 payments. USA first year launch is a disaster and the car is overpriced for the current design...the market is always right as I have said before...AML will pay now or pay later...

TheEnigma said:

In USA the residual is 60% on a vantage 3yr lease. 60% is too high based on prior vantage resale value so lender will be upside down in 2022 on these cars adding more financial pain for AM (ex: I paid 50% MSRP on my 3yr old vantage with 4k miles from AM dealer). On a $200k car that is a $120k wholesale at auction (not retail) and I bet you will be able to buy these 2019's at $100k retail all day long...I think Palmer is just playing finance games with jacking up the residual and paying first 3 payments. USA first year launch is a disaster and the car is overpriced for the current design...the market is always right as I have said before...AML will pay now or pay later...

And breathe....As per my previous post it appears (which is entirely normal with car finance) that’s it’s not AML who are taking the residual value risk....

https://www.autonews.com/finance-insurance/aston-p...

I appreciate that we’re getting side tracked. But that article suggests Chase are now providing the finance in the US. Also seems to suggest monthly sales figures are available as well (one for Jon!)

I appreciate that we’re getting side tracked. But that article suggests Chase are now providing the finance in the US. Also seems to suggest monthly sales figures are available as well (one for Jon!)

RobDown said:

https://www.autonews.com/finance-insurance/aston-p...

I appreciate that we’re getting side tracked. But that article suggests Chase are now providing the finance in the US. Also seems to suggest monthly sales figures are available as well (one for Jon!)

In the US it is very normal to separate loan origination from servicing and underwriting. Chase is processing and servicing, and financing capital too I suspect, and the dealers originate - not sure who is underwriting.I appreciate that we’re getting side tracked. But that article suggests Chase are now providing the finance in the US. Also seems to suggest monthly sales figures are available as well (one for Jon!)

ExitLeft said:

In the US it is very normal to separate loan origination from servicing and underwriting. Chase is processing and servicing, and financing capital too I suspect, and the dealers originate - not sure who is underwriting.

Yep totally. Unfortunately our auto analyst knows nothing about financing so didn’t ask the follow up question on the results call about who was taking the residual value risk RobDown said:

https://www.autonews.com/finance-insurance/aston-p...

I appreciate that we’re getting side tracked. But that article suggests Chase are now providing the finance in the US. Also seems to suggest monthly sales figures are available as well (one for Jon!)

I appreciate that we’re getting side tracked. But that article suggests Chase are now providing the finance in the US. Also seems to suggest monthly sales figures are available as well (one for Jon!)

Thank you Rob. I will have to learn American now!

' Aston Martin sold an estimated 388 vehicles in the U.S. through April, according to the Automotive News Data Center. Last year, Aston Martin sold an estimated 1,140 vehicles in the U.S.'

Presumably 'through April' is not what we think of (1st Apr to 30 Apr), but perhaps 1 January to 30 April.

I have forgotten, but in the first quarter 2018, the old Vantage might not have been available in USA, therefore if so, that would inflate the 2019 comparison for one of the core models.

You helpfully contributed to the subject of the low value of many AML share trades. My market involvement is purely buying and holding big companies long-term, so I knew nothing about the extent these days of computer trading, or splitting trades to minimise market price movements.

Would I be correct to assume the splitting activity would vary depending on the market capitalisation of companies? A quick look at trades in the FTSE 100 top five, shows many £10,000 plus trades, whereas with AML.L, there are numerous trades under £1,000.

Edited by Jon39 on Saturday 18th May 19:12

The size of trades is related to the liquidity of the stock ie how many shares are typically traded in a day (average volume). AML has a very low liquidity since most of the shares are locked up with the original investors and don’t trade. About 405k trades per day ie about £4m worth. Generally if you don’t want to move the market you need to buy or sell less than 5-10% of the average turnover per day and typical sizes of individual trades need to be a lot smaller or you get picked off by algo’s or smart traders. A reasonable % of the volume of any liquid stock is algo’s buying and selling small quantities during the day on small movements but ending up flat by the end of the day. The true net buyers or sellers are only part of the volume so very few in AML’s case.

Thank you WLD for your explanation.

A friend recently bought just a few AML shares and when he afterwards looked at the list of recent trades, his purchase was shown, but another trade at exactly the same time and for an identical quantity purchase was also shown. It certainly seemed a mighty coincidence, especially as the quantity was insignificant, but could that have been an 'algo' purchase? If so, I cannot understand how a computer can expect to make money, by copying the actions of a random private individual on so few shares.

Edited by Jon39 on Saturday 18th May 19:14

It can get very technical and I am not an expert but 2 possible explanations. Either legally he sold the stock to someone directly rather then put it into the exchange eg his bank or broker acting as principal - under certain circumstances this gets reported to the exchange by the agent he sold to who then immediately executes the trade on the market which also gets reported. Hence looks like the same trade happens twice and is known as riskless principal execution. How trade events are reported depends on the legal status of the trades.

Also a second potential reason is that some algo’s try to spot what other algo’s are doing eg if a big fund wants to buy £2m worth of shares at VWAP (volume weighted average price) it would divide its trade over a few days and put in a large number of small trades during each day of size and frequency driven by some well known maths. One way of trying to stop others spotting the behaviour and profiting from that knowledge could be to mimic other traders trades so the sequence is hidden - ie it doesn’t look like part of their trade.

I’d guess since AML is more of a retail stock 1 is the most likely.

Also a second potential reason is that some algo’s try to spot what other algo’s are doing eg if a big fund wants to buy £2m worth of shares at VWAP (volume weighted average price) it would divide its trade over a few days and put in a large number of small trades during each day of size and frequency driven by some well known maths. One way of trying to stop others spotting the behaviour and profiting from that knowledge could be to mimic other traders trades so the sequence is hidden - ie it doesn’t look like part of their trade.

I’d guess since AML is more of a retail stock 1 is the most likely.

Jon39 said:

Thank you WLD for your explanation.

A friend recently bought just a few AML shares and when he afterwards looked at the list of recent trades, his purchase was shown, but another trade at exactly the same time and for an identical quantity purchase was also shown. It certainly seemed a mighty coincidence, especially as the quantity was insignificant, but could that have been an 'algo' purchase? If so, I cannot understand how a computer can expect to make money, by copying the actions of a random private individual on so few shares.

Edited by Jon39 on Saturday 18th May 19:14

Many different firms have algorithms running, some are smarter than others. If you're interested in the topic have a read of http://www.themistrading.com/

Westlondondriver said:

It can get very technical and I am not an expert but 2 possible explanations. Either legally he sold the stock to someone directly rather then put it into the exchange eg his bank or broker acting as principal - under certain circumstances this gets reported to the exchange by the agent he sold to who then immediately executes the trade on the market which also gets reported. Hence looks like the same trade happens twice and is known as riskless principal execution. How trade events are reported depends on the legal status of the trades.

Also a second potential reason is that some algo’s try to spot what other algo’s are doing eg if a big fund wants to buy £2m worth of shares at VWAP (volume weighted average price) it would divide its trade over a few days and put in a large number of small trades during each day of size and frequency driven by some well known maths. One way of trying to stop others spotting the behaviour and profiting from that knowledge could be to mimic other traders trades so the sequence is hidden - ie it doesn’t look like part of their trade.

I’d guess since AML is more of a retail stock 1 is the most likely.

Also a second potential reason is that some algo’s try to spot what other algo’s are doing eg if a big fund wants to buy £2m worth of shares at VWAP (volume weighted average price) it would divide its trade over a few days and put in a large number of small trades during each day of size and frequency driven by some well known maths. One way of trying to stop others spotting the behaviour and profiting from that knowledge could be to mimic other traders trades so the sequence is hidden - ie it doesn’t look like part of their trade.

I’d guess since AML is more of a retail stock 1 is the most likely.

My friend made a straightforward purchase (tiny amount) through a stockbroker (you are referring to a sale), but then the stock exchange list of trades showed two identical bought transactions (same time, same quantity, same prices). Just puzzled, because it seemed too much of a coincidence.

Gassing Station | Aston Martin | Top of Page | What's New | My Stuff