AML - Stock Market Listing

Discussion

RobDown said:

Here you go:

1. Sales figures were already disclosed in FY results. So it’s already “known” by the market. Actually volumes were not a major concern (margins more so).

2. As Jon says it’s UK only. I think i posted the geographic mix of sales a few pages back, the UK is an important market clearly for AML. But others are overtaking

3. That list isn’t complete - is the data for the Vanquish Jon? And of course the mega margin is in the “specials”; some zagatos and DB4 GTs were delivered in Q4 I think

Finally I’d just be wary of extrapolating too much from one quarter. Jon will know better than me but I would guess Q4 is seasonally quite, I think there were some production delays and of course who knows what impact the model range rollouts is having (positive or negative to a given quarter)?

1. Sales figures were already disclosed in FY results. So it’s already “known” by the market. Actually volumes were not a major concern (margins more so).

2. As Jon says it’s UK only. I think i posted the geographic mix of sales a few pages back, the UK is an important market clearly for AML. But others are overtaking

3. That list isn’t complete - is the data for the Vanquish Jon? And of course the mega margin is in the “specials”; some zagatos and DB4 GTs were delivered in Q4 I think

Finally I’d just be wary of extrapolating too much from one quarter. Jon will know better than me but I would guess Q4 is seasonally quite, I think there were some production delays and of course who knows what impact the model range rollouts is having (positive or negative to a given quarter)?

One interesting point (or perhaps it might be, if we didn't have the usual annoyance of DVLA figures being UK only) the AML numbers are sales from factory to dealers, whereas the new registrations exclude unregistered dealer cars.

Here is a quick copy showing Vanquish and 'old' Vantage (UK 4th quarter 2018)

The DB4 GTs I don't think are road legal, so DVLA would not be involved.

VANQUISH S V12 AUTO = 9

VANQUISH S VOLANTE V12 AUTO = 3

VANQUISH ZAGATO SPEEDSTER AUTO = 1

VANQUISH ZAGATO V12 AUTO = 2

VANTAGE AMR V12 = 2

VANTAGE AMR V8 = 1

VANTAGE AMR V8 AUTO = 5

VANTAGE AMR V8 ROADSTER AUTO = 2

VANTAGE GT8 = 1

VANTAGE S V12 = 3

VANTAGE S V8 = 2

VANTAGE V8 = 1

Yes, lower numbers are usual in the 4th quarter.

The initial production for the Vantage showed during the 3rd quarter = 215.

For a brand new model, would have expected similar in 4th quarter, because AML mentioned a full order book, but it was 4th quarter = 107. Perhaps they gave priority to export production.

We have recently been debating the usefulness and accuracy of City brokers company forecasts.

For your information, J P Morgan have today published a recommendation (closing price 937p).

'Aston Martin Lagonda: JP Morgan reiterates overweight with a target price of 1.500p.'

Their previous recommendation was on 1st March 2019 (closing price 1,070p).

'Aston Martin Lagonda: JP Morgan reiterates overweight with a target price of 1,800p.'

( I expect you already know, but an overweight holding would be a shareholding worth more, than most of the other company shareholdings in your portfolio. )

RobDown said:

Overweight means ‘Buy’. Underweight means sell. There’s usually some tedious compliance reason as to why you don’t use Buy/Sell .....

I am puzzled Rob.

You explain a change to the meaning of those words, but Deutsche Bank are quoted as still using the (presumably now) old convention words, 'Buy and Hold'.

(broker) Deutsche Bank - (date) 08/04 - (rating) Downgrades - (previous assessment) Buy - (latest assesment) Hold - (latest target) 1,000.00p.

I watched the video on the AML website (Q4 Investor Results Call).

Some interesting comments by AP about the sequence of initial production of the DBX.

There was also a question from a brave person about the new Vantage. "... doesn't quite have market traction, what can you do to relaunch, reposition or restyle?"

AP replied to that question saying, "We do see different speeds of adoption, but we seem to have hit the sweet spot particularly with the lease price point in the US. We don't see the style of the car being an issue, we see it as a strength".

He then spoke about the big price jump that previous model owners faced when moving to the new model, but will use the (lease) lessons from the US in Europe, where the take up has been softer.

Ref. Vantage.

AP - "When you see the Roadster, I think it will answer some of you questions perhaps on the style of the car."

Do you think that might mean styling changes, which will be unique to the Roadster model, because any 'facelift' changes now to the Coupe, will obviously upset the customers who have already purchased?

For those of us who are interested in the business part of Aston Martin Lagonda, the 1st quarter results have been announced by the Company today.

https://www.astonmartinlagonda.com/investors/resul...

jonby said:

Even though I'd be breaking my own rule about personal direct equity investments which I imposed upon myself when I left the market 23 years ago, I have to say when the price dropped to £10 it was very tempting. I see the price has now dropped even further to £8.

Assuming the company doesn't literally collapse, surely in the medium term it cannot be a bad buy at less than half the float price ?

Assuming the company doesn't literally collapse, surely in the medium term it cannot be a bad buy at less than half the float price ?

When you say left the market Jonby, were you employed in the City, or perhaps could it be that your own rule followed disappointment with the market? I only ask because you won't want me mentioning PE ratios, etc., if you already know.

AML is presently valued at nearly £2 billion, with debt including leases of £702 million,

An investor might think along the lines of; what future return should I hope for from a £2 billion business.

If you wanted to, you could alway buy just a few shares (for less than an AMOC membership fee), and you would then be a part owner of the Company, have your own share certificate, and be entitled to attend the Annual General Meetings.

Edited by Jon39 on Wednesday 15th May 18:15

Ken Figenus said:

Guys what is a good portal for an amateur to burn some fingers buying some shares?

From what little that I have seen about internet share tip forums, it appears the conversation tends to be the hope of making a fortune in just a few weeks.

I have always been more interested in large steady understandable businesses, which are not too cyclical, and have a record of profit growth and dividend payments. Some (including Mr Buffett) dislike the dividend payment system because of the tax aspect, but it suits me. Once bought, I then hold for years, so not interested in short-term gambles.

Obviously not every holding is a winner, but a few suffering rocky times is not a problem, if you can have say a collection of 25 or so holdings. BP was one example of trouble, with their dreadful Gulf of Mexico accident. They were large enough to survive that disaster (hence my desire for large). I think they stopped paying their dividend briefly, but income for investors did continue, and that company is now making progress again.

I can never tell what might happen in the future, but one stock comes to mind, which might be something that could be of interest to you Dewi. I have held Compass Group plc for decades and will continue to do so. Their business is about as basic as you can get. They feed people. Probably not a very well known company, but it is a very big business, international, and has achieved steady revenue and profits growth. Dividend income is about 2%, but the dividend payments have been increasing by a big percentage each year. Study their annual report to learn more if you wish.

Sorry to go off topic.

RobDown said:

CFO saying 75% of US sales are leasing. Presumably will be a buyers market in three years time when they start to hit

Would the attractive US leasing offers have to involve a financial subsidy by AML?

V12Vin above; 'Yes. I can confirm that the leasing deals are attractive in the US. Looking at $5k down with $1500 to $2000 a month depending on options. 2500 miles a year for 3 years. Also in some cases, the first 3 months are free.'

I am no expert on PCP, but would this ( $5k + 33 x $1500 @ fx1.30) indicate a trade price residual value of about £75,000 for a 3 year old 7,500 mile Vantage?

Edited by Jon39 on Friday 17th May 09:58

AstonZagato said:

bananarob said:

Every time I think it’s now at a tempting price it drops further... Surely can’t be much further to go..!

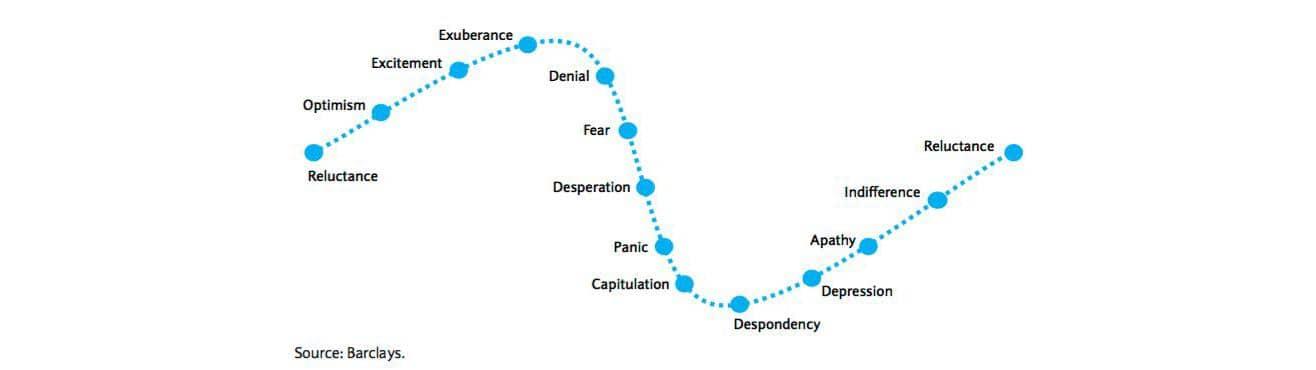

Buying shares when they are down is generally a good strategy - but not always. A stock that has fallen 90% is a stock that fell 80%, then halved.I think you need to go through a period of despondency and move towards apathy before it gets better.

Where we are on that cycle is subjective but I think we're more at desperation or capitulation.

I notice AstonZagato, that your graphic is from the Smart Investor website. If you still use them following their pathetic reorganisation, are you affected by their 10 fold increase in annual fees, which coincided with their collapse in service levels? Before the changes they were excellent.

Anyway back to your point. If you think 'capitulation', then the chart shows now is the buying opportunity.

This reminds me of one of Warren Buffett's quotes. 'Beware of geeks bearing formulas.'

Have you noticed, that almost all the trades in AML stock, seem to be fairly small transactions. Even when there was shorting, I did not happen to spot large transactions. Do you think what we see, might be mostly private individuals, rather than any institutions?

AstonZagato said:

..... (as Buffett once said, "there are two rules to investing: Rule 1 - Don't lose money; Rule 2. Don't forget Rule 1").

He has made many wonderful quotes, but that one has puzzled me. Markets have risks, even for the worlds best investor.

Try not to mention too often, his purchase and subsequent sale of Tesco.

V12Vin said:

I am sure ALLY Financial has some deals with AML. Btw, the fx is 0.80 for USD -> GBP.

Thanks V12Vin.

Ref FX; we have both put our own countries first, so 0.80 is 1.3 but the other way around (1.2784 at present, either the £ has weakened, or $ has strengthened).

I am a low mileage AM user (winter hibernation), but I did wonder whether the stated lease mileage limit of 2,500, might be too low for many people.

Our AMs tend to be 'toys', but as the US is such a big country, do your everyday cars tend to have fairly high average annual mileages?

In the UK it is probably about 10,000 / 12,000 miles.

RobDown said:

https://www.autonews.com/finance-insurance/aston-p...

I appreciate that we’re getting side tracked. But that article suggests Chase are now providing the finance in the US. Also seems to suggest monthly sales figures are available as well (one for Jon!)

I appreciate that we’re getting side tracked. But that article suggests Chase are now providing the finance in the US. Also seems to suggest monthly sales figures are available as well (one for Jon!)

Thank you Rob. I will have to learn American now!

' Aston Martin sold an estimated 388 vehicles in the U.S. through April, according to the Automotive News Data Center. Last year, Aston Martin sold an estimated 1,140 vehicles in the U.S.'

Presumably 'through April' is not what we think of (1st Apr to 30 Apr), but perhaps 1 January to 30 April.

I have forgotten, but in the first quarter 2018, the old Vantage might not have been available in USA, therefore if so, that would inflate the 2019 comparison for one of the core models.

You helpfully contributed to the subject of the low value of many AML share trades. My market involvement is purely buying and holding big companies long-term, so I knew nothing about the extent these days of computer trading, or splitting trades to minimise market price movements.

Would I be correct to assume the splitting activity would vary depending on the market capitalisation of companies? A quick look at trades in the FTSE 100 top five, shows many £10,000 plus trades, whereas with AML.L, there are numerous trades under £1,000.

Edited by Jon39 on Saturday 18th May 19:12

Thank you WLD for your explanation.

A friend recently bought just a few AML shares and when he afterwards looked at the list of recent trades, his purchase was shown, but another trade at exactly the same time and for an identical quantity purchase was also shown. It certainly seemed a mighty coincidence, especially as the quantity was insignificant, but could that have been an 'algo' purchase? If so, I cannot understand how a computer can expect to make money, by copying the actions of a random private individual on so few shares.

Edited by Jon39 on Saturday 18th May 19:14

Westlondondriver said:

It can get very technical and I am not an expert but 2 possible explanations. Either legally he sold the stock to someone directly rather then put it into the exchange eg his bank or broker acting as principal - under certain circumstances this gets reported to the exchange by the agent he sold to who then immediately executes the trade on the market which also gets reported. Hence looks like the same trade happens twice and is known as riskless principal execution. How trade events are reported depends on the legal status of the trades.

Also a second potential reason is that some algo’s try to spot what other algo’s are doing eg if a big fund wants to buy £2m worth of shares at VWAP (volume weighted average price) it would divide its trade over a few days and put in a large number of small trades during each day of size and frequency driven by some well known maths. One way of trying to stop others spotting the behaviour and profiting from that knowledge could be to mimic other traders trades so the sequence is hidden - ie it doesn’t look like part of their trade.

I’d guess since AML is more of a retail stock 1 is the most likely.

Also a second potential reason is that some algo’s try to spot what other algo’s are doing eg if a big fund wants to buy £2m worth of shares at VWAP (volume weighted average price) it would divide its trade over a few days and put in a large number of small trades during each day of size and frequency driven by some well known maths. One way of trying to stop others spotting the behaviour and profiting from that knowledge could be to mimic other traders trades so the sequence is hidden - ie it doesn’t look like part of their trade.

I’d guess since AML is more of a retail stock 1 is the most likely.

My friend made a straightforward purchase (tiny amount) through a stockbroker (you are referring to a sale), but then the stock exchange list of trades showed two identical bought transactions (same time, same quantity, same prices). Just puzzled, because it seemed too much of a coincidence.

Rob,

There were s couple of discloseable transsctions by one of the principal shareholders, towards the end of May.

I could not make out whether a straight sale was being reported, or perhaps a sale and buy back by a related party.

The stock exchange forms are not always easy to understand.

Funny how there were two disclosures for AP's purchase. In the first one, he was demoted to Vice President.

Perhaps someone was 'for it'.

In what way would a company worth £50 billion, benefit financially by acquiring a £2 billion company?

The arithmetic when Ford had a go was probably even more extreme, and the winner after that acquisition was certainly Aston Martin.

The present principal shareholder groups of course have the say.

If a different buyer appeared, there is the problem of the Daimler contract (V8 and electronics) ending.

RobDown said:

I don’t know Madcal. But it gets a little tedious, I feel some people just have a negative outlook on life

A whole load of institutional investors bought the stock. They did their own valuations and decided it was worth it.

So if you have complaints raise them with the institutional buyers, they set the price (that retail investors ultimately had to pay)

A whole load of institutional investors bought the stock. They did their own valuations and decided it was worth it.

So if you have complaints raise them with the institutional buyers, they set the price (that retail investors ultimately had to pay)

I agree with you Rob. Should we remember though, that institutions are not usually buying with their own money?

Generally the criticism on here has not centered on future prospects, which hopefully will be very good, but only on the Company IPO value of £4,332,054,910.

Of course such comments have not been made simply with the benefit of hindsight (refer to the earlier pages of this topic). There was the perfectly understandable wish by the principal owners to sell at the best possible price, and that was so obviously accompanied by all the luxury goods hype and multiple new model announcements in advance of the IPO.

In October 2018 (IPO) the debt was known, huge continuing capital expenditure for new models was known, and the importance of the DBX was known (profitability would not improve materially until DBX sales in 2020). Market values of course are based on estimated future profitability.

Good DBX sales means the future for AML is looking good.

I have just heard from someone, who attended the Aston Martin Lagonda Annual General Meeting.

It sounds as though only a few shareholders attended.

As is usual at AGMs, there was coffee upon arrival, but that appears to have been it, not even one measly biscuit. That does seem very mean, particularly as many of those shareholders will have probably experienced their IPO investment halve in value.

Gassing Station | Aston Martin | Top of Page | What's New | My Stuff