How far will house prices fall [volume 4]

Discussion

battered said:

Inflation is only half the tale. Borrowing 50k in 1976 would have cost a fortune because of heavy interest rates. You would have needed a hefty income to service that. My parents, both teachers, borrowed 14k in 79 and had 2 salaries. One full salary went on the mortgage.

I guess the £50K for a 3 bed house in 1976 is a London thing, but even so that would have been a pretty immense purchase.Our first house in the NW in 1980 was a new 3 bed detached at £20K and people thought we were insane. Your typical 3 bed semi was £15K.

I didn't think there was such a difference between the regions back then?

battered said:

ukbabz said:

p1stonhead said:

Isnt £50k, 40 years ago, still really really expensive? Average price was what £5-10k?

£50k in 1976 would be worth £324,633.99 in 2015 according to http://www.bankofengland.co.uk/education/Pages/res...However, the mortgage costs I was paying at the time would be similar to the cost of a mortgage at current interest rates at current house price.

The key to understanding house prices is how affordable people find the mortgage.

EddieSteadyGo said:

battered said:

ukbabz said:

p1stonhead said:

Isnt £50k, 40 years ago, still really really expensive? Average price was what £5-10k?

£50k in 1976 would be worth £324,633.99 in 2015 according to http://www.bankofengland.co.uk/education/Pages/res...However, the mortgage costs I was paying at the time would be similar to the cost of a mortgage at current interest rates at current house price.

The key to understanding house prices is how affordable people find the mortgage.

Derek Chevalier said:

The key to understanding it is how interest rates and wage inflation are linked. In times of high inflation and high wage growth, the pain was in the early years, but wage growth soon reduced the pain of the monthly payments. We do not have that luxury today.

Would be interested to see the analysis which draws you to the conclusion that the relationship between inflation and wages (often called 'real wages') is the main factor. You can borrow £300,000 at a cost of around £675 / month (excluding repayments for a moment to make it easier to compare like with like).

My first mortgage had an interest rate of around 6.5%. If you borrowed £100,000 at the time it made the interest only repayment circa £540 / month.

Adjusting for 20 years of wage inflation, current mortgages affordability is similar.

Most people buying a house look at what they can afford on a monthly basis. Dividend that number by the mortgage rate and multiple by 12 gives you a good indication of the price of the house they are buying. It has always been pretty such the same.

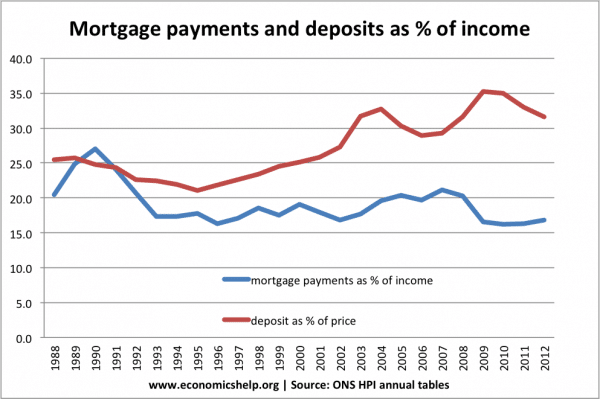

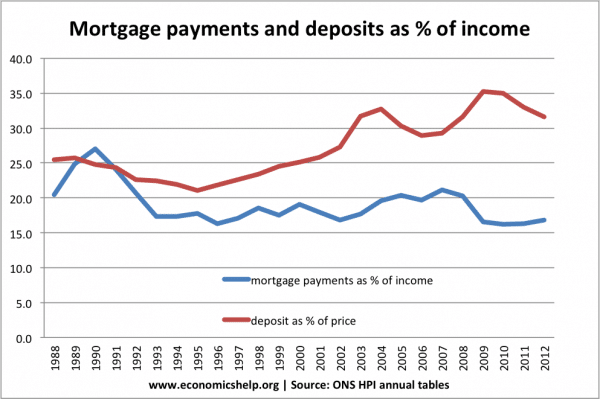

This one is old - needs updating.

The point is absolutely valid - the low rates certainly do make housing "affordable".

The problem is more for deposits, particularly for FTBs.

I believe for most FTBs if they switched to a mortgage it would be cheaper than rent - it's just coming up with 25% deposit is nearly impossible.

The point is absolutely valid - the low rates certainly do make housing "affordable".

The problem is more for deposits, particularly for FTBs.

I believe for most FTBs if they switched to a mortgage it would be cheaper than rent - it's just coming up with 25% deposit is nearly impossible.

This is a fundamental shift. I remember when I bought my first house in 1995 I had a 10% deposit (£4k) and this was regarded as pretty good. It actually got me a lower rate. In addition I went from paying £360pcm rent for a 2 bed flat to about £230 on a whole house. My net income at the time was £900pcm ish, living in the flat was tight. The difference is that the part that actually paid very little to reduce the capital, it was an endowment (remember them?) of about £60pcm.

Fast forward to the present day. That house is now about £125k. Anyone sane is now on a repayment scheme, you need to pay back 5k a year plus interest. That's 600pcm plus maybe 4k interest, so £930ish total, for a 100% loan. A 90% loan like I had would be say £800. You can see that the actual capital payback amount is now 2/3 of the total, whereas it was only 25%.

Rental price on that house will be about £500pcm. Maybe 550 tops. That's a long way off the £800 pcm you'll need even if you can come up with the £12.5k 10% deposit. This is a 2 bed starter home in a decent but by no means posh bit of Leeds. I wish I still bloody had it. I could have boarded it up and paid the mortgage and made money.

Fast forward to the present day. That house is now about £125k. Anyone sane is now on a repayment scheme, you need to pay back 5k a year plus interest. That's 600pcm plus maybe 4k interest, so £930ish total, for a 100% loan. A 90% loan like I had would be say £800. You can see that the actual capital payback amount is now 2/3 of the total, whereas it was only 25%.

Rental price on that house will be about £500pcm. Maybe 550 tops. That's a long way off the £800 pcm you'll need even if you can come up with the £12.5k 10% deposit. This is a 2 bed starter home in a decent but by no means posh bit of Leeds. I wish I still bloody had it. I could have boarded it up and paid the mortgage and made money.

battered said:

This is a fundamental shift. I remember when I bought my first house in 1995 I had a 10% deposit (£4k) and this was regarded as pretty good. It actually got me a lower rate. In addition I went from paying £360pcm rent for a 2 bed flat to about £230 on a whole house. My net income at the time was £900pcm ish, living in the flat was tight. The difference is that the part that actually paid very little to reduce the capital, it was an endowment (remember them?) of about £60pcm.

Fast forward to the present day. That house is now about £125k. Anyone sane is now on a repayment scheme, you need to pay back 5k a year plus interest. That's 600pcm plus maybe 4k interest, so £930ish total, for a 100% loan. A 90% loan like I had would be say £800. You can see that the actual capital payback amount is now 2/3 of the total, whereas it was only 25%.

Rental price on that house will be about £500pcm. Maybe 550 tops. That's a long way off the £800 pcm you'll need even if you can come up with the £12.5k 10% deposit. This is a 2 bed starter home in a decent but by no means posh bit of Leeds. I wish I still bloody had it. I could have boarded it up and paid the mortgage and made money.

Your math is off. It's £600 worst case on such a mortgage (standard table mtge).Fast forward to the present day. That house is now about £125k. Anyone sane is now on a repayment scheme, you need to pay back 5k a year plus interest. That's 600pcm plus maybe 4k interest, so £930ish total, for a 100% loan. A 90% loan like I had would be say £800. You can see that the actual capital payback amount is now 2/3 of the total, whereas it was only 25%.

Rental price on that house will be about £500pcm. Maybe 550 tops. That's a long way off the £800 pcm you'll need even if you can come up with the £12.5k 10% deposit. This is a 2 bed starter home in a decent but by no means posh bit of Leeds. I wish I still bloody had it. I could have boarded it up and paid the mortgage and made money.

I think wage stagnation, if that is a saying has been the biggest hold on the economy, precession days Friday nights and Saturday nights were equally busy here in Essex, Friday nights became pretty quiet and even Saturday's are not as lively as they use to be, I think this is generally down to people having less money to splash out. I earn 20k a year more than I did in 2008 and I don't think much better off and I have no debt other than my mortgage.

In which case money is even cheaper to borrow than I thought. 125k across 25 years is 5k a year just to give back the money without any interest. £600 a month is £7200 a year so you are only paying £2200 interest on 125k. Less than 2%. No wonder housing is going mad.

The rest of my point still stands even if the numbers are different. The capital payment used to be trivial compared to the interest, now it's all about the capital payback. It's also interesting that rental is now cheaper than buying, so maybe prices will stabilise.

The rest of my point still stands even if the numbers are different. The capital payment used to be trivial compared to the interest, now it's all about the capital payback. It's also interesting that rental is now cheaper than buying, so maybe prices will stabilise.

And yet Houses selling in record time despite worries over EU vote

http://www.thetimes.co.uk/article/221e0844-365f-11...

http://www.thetimes.co.uk/article/221e0844-365f-11...

J4CKO said:

Sheepshanks said:

J4CKO said:

I think things have officially gone mad, one went up over the road at 100/125 grand more than I would have expected, had several buyers in a week and they resorted to sealed bids above the asking price, so probably 150 grand more than I would have thought it was worth.

All very well, this middle class self congratulatory house price stuff but I have three kids that will need to get something in the next five or so years, a 3 bed family house shouldnt be that expensive.

I see your profile says you're in Cheshire - I'm in a village in west Cheshire and anything that looks even slightly OTT price-wise is just sitting there.All very well, this middle class self congratulatory house price stuff but I have three kids that will need to get something in the next five or so years, a 3 bed family house shouldnt be that expensive.

Someone mentioned proximity to good schools earlier - an issue all over West Cheshire and into Chester is the good schools are rammed so young families won't move into the area as they can't get places for their kids.

I know someone in one of the houses paid £260K in 2006 - seems incredible compared to some areas that they're still not back to their peak prices.

Edited by Sheepshanks on Monday 20th June 13:56

Femur said:

And yet Houses selling in record time despite worries over EU vote

http://www.thetimes.co.uk/article/221e0844-365f-11...

Call me cynical, but if there are say 100 homes on the market for sale and 10 sell, then an average is calculated on the time for that property to sell.http://www.thetimes.co.uk/article/221e0844-365f-11...

However if 3 years ago there were 100 homes on the market and 80 sell, the average could be higher but with far more homes sold.

Also how many of those sold were with discount? and across which areas e.t.c

V6Alfisti said:

Femur said:

And yet Houses selling in record time despite worries over EU vote

http://www.thetimes.co.uk/article/221e0844-365f-11...

Call me cynical, but if there are say 100 homes on the market for sale and 10 sell, then an average is calculated on the time for that property to sell.http://www.thetimes.co.uk/article/221e0844-365f-11...

However if 3 years ago there were 100 homes on the market and 80 sell, the average could be higher but with far more homes sold.

Also how many of those sold were with discount? and across which areas e.t.c

Femur said:

It's easy to make up stats and suggest that they might be the truth but is there anything, other than anecdotal evidence, that you can show that backs it up?

The point being there is no information to back up the figures, so they are meaninglesss. That was anecdotal as I said, but just as good as meaningless data with no supporting information.

There have been a number of articles stating that the average property now sells on average 10-15% below, there are a number of articles showing that volumes are way down. There are a number of articles from RICS saying that demand has collapsed and they are expecting a drop in price.

It is not beyond the wit of man to put a few pieces together.

In fact alot of this is included in the below, this at least covers multiple factors.

Edited by V6Alfisti on Monday 20th June 14:18

V6Alfisti said:

Call me cynical, but if there are say 100 homes on the market for sale and 10 sell, then an average is calculated on the time for that property to sell.

However if 3 years ago there were 100 homes on the market and 80 sell, the average could be higher but with far more homes sold.

Also how many of those sold were with discount? and across which areas e.t.c

It's a simple average of the time from listing for sale to listing as SOLD on Rightmove.However if 3 years ago there were 100 homes on the market and 80 sell, the average could be higher but with far more homes sold.

Also how many of those sold were with discount? and across which areas e.t.c

Nothing more scientific than that.

I imagine we are still feeling the fallout from the BTL changes as well as severely limited supply.

Either way it is a LOT more than 100 properties.

walm said:

It's a simple average of the time from listing for sale to listing as SOLD on Rightmove.

Nothing more scientific than that.

I imagine we are still feeling the fallout from the BTL changes as well as severely limited supply.

Either way it is a LOT more than 100 properties.

Of course there are alot more than 100 properties for sale on the market. It was an example.Nothing more scientific than that.

I imagine we are still feeling the fallout from the BTL changes as well as severely limited supply.

Either way it is a LOT more than 100 properties.

Exactly my point, it is a great headline but meaningless as you only get the value with associated information.

V6Alfisti said:

walm said:

It's a simple average of the time from listing for sale to listing as SOLD on Rightmove.

Nothing more scientific than that.

I imagine we are still feeling the fallout from the BTL changes as well as severely limited supply.

Either way it is a LOT more than 100 properties.

Of course there are alot more than 100 properties for sale on the market. It was an example.Nothing more scientific than that.

I imagine we are still feeling the fallout from the BTL changes as well as severely limited supply.

Either way it is a LOT more than 100 properties.

Exactly my point, it is a great headline but meaningless as you only get the value with associated information.

Femur said:

It's certainly not meaningless, it's a summary of the results. I agree you need more figures to see exactly what's happened but the summary is correct nonetheless. You're being needlessly fatalistic.

For the reasons I have described, there is very little value in the information and is just there for a headline. I would give more examples as to how relatively meaningless it is but some people seem to read examples as facts. It is in reality saying, that homes sell 3 days quicker than the figures recorded in the past month but at an unknown discount and across an unknown period (does this include delayed figures relating to the delayed BTL pre April buy in?) e.t.c e.t.c

I am not sure what value you can take from that.

Either way, we disagree.

Edited by V6Alfisti on Tuesday 21st June 10:33

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff