How far will house prices fall [volume 4]

Discussion

anonymous said:

[redacted]

If the nominal like-for-like salary has tripled since 2000, then that is pretty good going. The first job I had after graduating seems to pay less than 50% more than when I did it almost 20 years ago. In the same period, the flat that I had then has quadrupled in value.Flats in West Hampstead have always been difficult for young people to buy even if they are well paid, and maybe that is how it should be. The problem is that the same now also applies to MUCH less flashy areas.

Interest rates have taken up the slack. It was very difficult to get a fixed rate mortgage below 5% 20 years ago, the last time I agreed a mortgage, it was 1.49%.

Edited by kingston12 on Saturday 18th November 12:33

Graemsay said:

Just shows how values have moved - in the mid-90's our youngest child moved up to senior school in the nearby bigger Cheshire village and we looked at moving house there too. Our house was worth £75K and the step up in size and location would have meant spending £150K. At the time the difference just seemed ridiculous.ClaphamGT3 said:

Credible offer £25k below asking from one of yesterday's two viewings came in this morning

Good news. I know you are financially savvy, but grab it with both hands, get a decent lawyer and get it over the line as quick as you can.I am involved with housebuilding in one of my roles, and my view, FWIW, is that London is in for a decent amount of pain. At least you will be adding value to your new place, as I recall.

Outside, where you are sub-£400 psf, prices look much more affordable and sustainable.

Inside London, £700psf for Dalston or wherever is nuts when you look at who actually lives there.

I remember looking at a 4 bed detached around 2000ish for 75k. I can remember my exact words to the Mrs, nobody spends 75k on a house, we aren't millionaires. So I bought an Elise and rented.

4 years later I bought a 3 bed semi that needed gutting for 95k and sold the Elise to pay for the kitchen!

4 years later I bought a 3 bed semi that needed gutting for 95k and sold the Elise to pay for the kitchen!

GreatGranny said:

Just a whinge about FTBs and their constant moan re. deposits etc...

When my wife (then fiancé) were saving up for a deposit in '95/96 we rented 1 room in a shared house, drove around in a £500 Fiesta, only went out max. twice a week, didn't go on holiday for a year and basically lived off 1 salary whilst saving the other. By the end of the year we had enough saved for a decent deposit on a 3 bed semi in a nice Sheffield suburb.

The grads in our company all moan how they struggle to save for a deposit yet are renting a house for £600pcm + bills, have a nice car on PCP, go out at least 3 times a week and go on holiday abroad twice a year (eg. 2 weeks in Mexico + skiing!).

When I point out that they could probably save £8-10k by maybe economising more they look at me like I'm mad.

One grad calculated he has spent £26k on rent since he started work!

If this is the case for the majority of spoiled and indebted millennials, the maths for current house prices still don't add up. They won't change their behaviour as the opportunity to own a house becomes ever more unlikely. And there's a horde of buy to let amateurs about to get some news they will need to sit down for about tax and their little monopoly portfolio. When my wife (then fiancé) were saving up for a deposit in '95/96 we rented 1 room in a shared house, drove around in a £500 Fiesta, only went out max. twice a week, didn't go on holiday for a year and basically lived off 1 salary whilst saving the other. By the end of the year we had enough saved for a decent deposit on a 3 bed semi in a nice Sheffield suburb.

The grads in our company all moan how they struggle to save for a deposit yet are renting a house for £600pcm + bills, have a nice car on PCP, go out at least 3 times a week and go on holiday abroad twice a year (eg. 2 weeks in Mexico + skiing!).

When I point out that they could probably save £8-10k by maybe economising more they look at me like I'm mad.

One grad calculated he has spent £26k on rent since he started work!

Sheepshanks said:

Graemsay said:

Just shows how values have moved - in the mid-90's our youngest child moved up to senior school in the nearby bigger Cheshire village and we looked at moving house there too. Our house was worth £75K and the step up in size and location would have meant spending £150K. At the time the difference just seemed ridiculous.anonymous said:

[redacted]

I think it is somewhere in between..........When we bought our 3 year old house in 2007, we bought it because it was modern and neutral. There were 15 year old houses priced similarly that would have required new bathrooms, and kitchens, but were larger. We had the deposit, which was same on either house. At that time we could have given up our Iphones/Sky/Socializing - but we didn't want to. We wanted to enjoy our life, and also buy a house. We didn't need to live on Value beans either.

Financially things changed for the better in 2009 for us, and by early 2010 we could have afforded new bathrooms and kitchens in that older house. 3 years of old bathroom and kitchen to put up with though.

Our house has increased approx. 20% in that time, the older house probably by 40% In hindsight with what we know now, we should have bought the older bigger house, but we made our choice with what we knew at the time. The "lick of paint" was just not affordable to us. If we were back in same situation, we would have made the same choice again.

Fats25 said:

Our house has increased approx. 20% in that time, the older house probably by 40% In hindsight with what we know now, we should have bought the older bigger house, but we made our choice with what we knew at the time. The "lick of paint" was just not affordable to us. If we were back in same situation, we would have made the same choice again.

I'm only 29, but for as long as I can remember I've had the phrase "Worst house in the nicest area you can afford, then do it up" in my head! TheLordJohn said:

I'm only 29, but for as long as I can remember I've had the phrase "Worst house in the nicest area you can afford, then do it up" in my head!

The second rule (after location, location, location) is always buy the smallest/ worst house in the better area rather than the bigger house in the cheaper area.TheLordJohn said:

I'm only 29, but for as long as I can remember I've had the phrase "Worst house in the nicest area you can afford, then do it up" in my head!

Whenever I've looked at houses the worst houses are either unredeemable or aren't much of a bargain when you consider the cost and time of renovating it. frisbee said:

Whenever I've looked at houses the worst houses are either unredeemable or aren't much of a bargain when you consider the cost and time of renovating it.

No one takes asking prices seriously, surely? Mine was bought according to my first rule less than 3 years ago. Offered 10% less than an 'offers over' asking price, and with a bit of updating and mortgage paying we're down to <60% LTV from 80% at the time.

Cost of renovating has been around 1/4 of the value added. So i remortgaged recently with the much better LTV (and base rate at .25%) for 5 years. I'll then be down to c40% LTV.

I can't see any logic in what you're saying as if you buy a house which doesn't need anything do to it, then someone, somewhere has already spent the time, effort and money doing what you could have done and has also reaped the financial benefit you could also have had.

Or you buy a new build Barratt box, have a tiny rear garden, a tiny garage, driveway for 2 cars, cars parked down both sides of the road and 10 speed bumps to get to your cul-de-sac.

Oh, and the builder has made all the profit out of it.

Edited by TheLordJohn on Sunday 19th November 15:07

frisbee said:

Whenever I've looked at houses the worst houses are either unredeemable or aren't much of a bargain when you consider the cost and time of renovating it.

Maybe you're looking in the wrong places.I bought my wreck for £220k 18 months ago. I've so far spent about £37k on it (including tools & machinery) plus a lot of my own work & time organising things. As the place stands I could easily get £400k for it and when it's finished it'll be more like £500k.

My previous wreck was £97k & £7k spent on it- worth £125k immediately after & £140k three years later.

As Einstein said, many people don't recognise opportunities because they come disguised as hard work.

Rovinghawk said:

As Einstein said, many people don't recognise opportunities because they come disguised as hard work.

Excellent saying. In my peer group, those who let women make the financial decisions and want an easy life live in new builds.

Those who want to make some money and don’t think a 40 hour a week office job means they’re too tired to do anything more than ‘Netflix and chill’ on a night, don’t.

Rovinghawk said:

frisbee said:

Whenever I've looked at houses the worst houses are either unredeemable or aren't much of a bargain when you consider the cost and time of renovating it.

Maybe you're looking in the wrong places.I bought my wreck for £220k 18 months ago. I've so far spent about £37k on it (including tools & machinery) plus a lot of my own work & time organising things. As the place stands I could easily get £400k for it and when it's finished it'll be more like £500k.

p1stonhead said:

Where is it? That return is pretty ridiculous in any measure.

Thank you. It's near Birmingham. The return is bloody good because I bought something where others weren't willing to put the effort & risk in.The asbestos wasn't actually asbestos, the right of way issue was easily resolved & the council updated their records so that the public footpath wasn't actually in my garden.

I rewired, put new doors & rooves on the outbuildings, refloored one of the garages, rebuilt the conservatory, windows throughout, insulated & boarded the loft, put a new kitchen in & redecorated. Guys I work with helped lay the patios & plant the orchard.

Niggling problems were found & fixed. A mixture of shopping around & mates' rates kept the budget under control.

With a bit of luck finding the right property, willingness to put the effort in & the balls to go for it a very good return can be made. Some don't even try, preferring to tell everyone it's too hard.

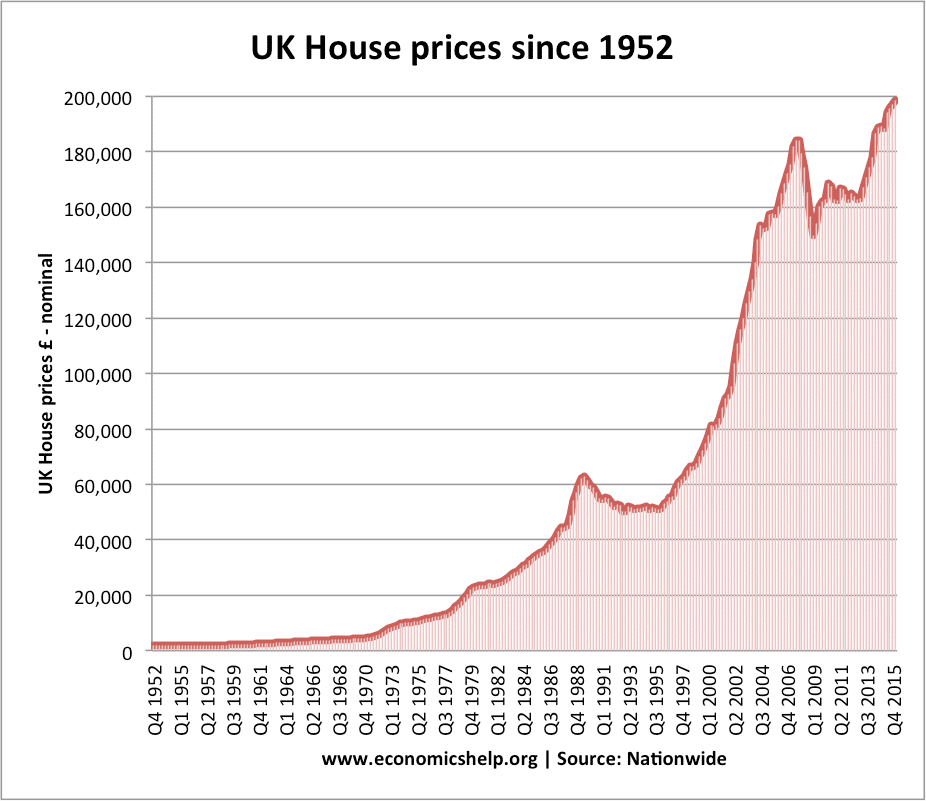

You're quite right, the 2008 ''crash'' was no such thing, it was strangled at birth and wasn't allowed to happen.

Governments/central banks have been using every trick in the book and throwing everything on to the bonfire since then to prop up and further inflate property prices at the expense of just about every other aspect of the economy.

They know full well that the wider economy is f ked beyond repair and the only thing they've got any semblance of control and manipulation over is property prices... and it's the only way they can give the masses any kind of illusory economic ''feel good factor''

ked beyond repair and the only thing they've got any semblance of control and manipulation over is property prices... and it's the only way they can give the masses any kind of illusory economic ''feel good factor''

.... and yet some simpletons will still insist it's down to nothing more than ''supply and demand innit''

Governments/central banks have been using every trick in the book and throwing everything on to the bonfire since then to prop up and further inflate property prices at the expense of just about every other aspect of the economy.

They know full well that the wider economy is f

ked beyond repair and the only thing they've got any semblance of control and manipulation over is property prices... and it's the only way they can give the masses any kind of illusory economic ''feel good factor''

ked beyond repair and the only thing they've got any semblance of control and manipulation over is property prices... and it's the only way they can give the masses any kind of illusory economic ''feel good factor''.... and yet some simpletons will still insist it's down to nothing more than ''supply and demand innit''

Rovinghawk said:

p1stonhead said:

Where is it? That return is pretty ridiculous in any measure.

Thank you. It's near Birmingham. The return is bloody good because I bought something where others weren't willing to put the effort & risk in.The asbestos wasn't actually asbestos, the right of way issue was easily resolved & the council updated their records so that the public footpath wasn't actually in my garden.

I rewired, put new doors & rooves on the outbuildings, refloored one of the garages, rebuilt the conservatory, windows throughout, insulated & boarded the loft, put a new kitchen in & redecorated. Guys I work with helped lay the patios & plant the orchard.

Niggling problems were found & fixed. A mixture of shopping around & mates' rates kept the budget under control.

With a bit of luck finding the right property, willingness to put the effort in & the balls to go for it a very good return can be made. Some don't even try, preferring to tell everyone it's too hard.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff