How far will house prices fall [volume 4]

Discussion

Interesting, I haven't looked at this thread for a while but it does seem that what I was seeing in my searches/area of London is spreading out rather further and deeper than I thought it would by this point. Also people appear to be finally seeing the drops I have been mentioning for a while now (broken record).

Lots of properties I have looked at in London seem to be have dropped to an asking price that matches their 2014 sell price.

Not scientific in any way (and based solely on my own specific search in North West/West London), but I do see lots of:

2013 - Not at 2013 sold prices typically

2014 - The large majority of competitive properties I look at in London are asking their 2014 sold value, having dropped a couple of times.

2015 - A few are at this kind of money

2016/2017 - I can't recall the last time I saw a competitively priced (i.e not kite flying) property that wasn't lower than its 16/17 sold value.

There seems to be some sizeable drops spreading out along the M4 towards Reading (FI pulling out?), and a mix of desirable/less desirable parts of Surrey that are suffering. Although typically the part of Woking I liked is looking rather stubbornly stable, which will likely push me to a west London house on a tube line/decent rail link - unexciting but getting suitably chewed up by the drops.

There is anecdotal talk from surveyors talking about some seriously eye watering drops on £1m plus property, and people noticing that EAs seem to be updating property listings in batches with some sizeable asking price drops, presumably as a result of a campaign to owners along the lines of 'drop it now, or chase it to the bottom - you will not sell at this price'.

I am certainly seeing a ramp up in "motivated seller" emails from EA's

Lots of properties I have looked at in London seem to be have dropped to an asking price that matches their 2014 sell price.

Not scientific in any way (and based solely on my own specific search in North West/West London), but I do see lots of:

2013 - Not at 2013 sold prices typically

2014 - The large majority of competitive properties I look at in London are asking their 2014 sold value, having dropped a couple of times.

2015 - A few are at this kind of money

2016/2017 - I can't recall the last time I saw a competitively priced (i.e not kite flying) property that wasn't lower than its 16/17 sold value.

There seems to be some sizeable drops spreading out along the M4 towards Reading (FI pulling out?), and a mix of desirable/less desirable parts of Surrey that are suffering. Although typically the part of Woking I liked is looking rather stubbornly stable, which will likely push me to a west London house on a tube line/decent rail link - unexciting but getting suitably chewed up by the drops.

There is anecdotal talk from surveyors talking about some seriously eye watering drops on £1m plus property, and people noticing that EAs seem to be updating property listings in batches with some sizeable asking price drops, presumably as a result of a campaign to owners along the lines of 'drop it now, or chase it to the bottom - you will not sell at this price'.

I am certainly seeing a ramp up in "motivated seller" emails from EA's

soxboy said:

Surely if you're already going to be moving you are going to be paying stamp duty and EA costs anyway?

Not if you are selling with the sole intention of taking advantage of a falling market. As I say, I'd only sit out of the market if I was looking to move anyway, it is too risky to do it for profit alone.I wonder how many people lost money doing that in London/SE after 2008, selling and waiting patiently for the bottom of the market, but missing it and finding prices in a lot of areas back to their previous 2007 peak a lot quicker than they should have been.

kingston12 said:

soxboy said:

Surely if you're already going to be moving you are going to be paying stamp duty and EA costs anyway?

Not if you are selling with the sole intention of taking advantage of a falling market. As I say, I'd only sit out of the market if I was looking to move anyway, it is too risky to do it for profit alone.I wonder how many people lost money doing that in London/SE after 2008, selling and waiting patiently for the bottom of the market, but missing it and finding prices in a lot of areas back to their previous 2007 peak a lot quicker than they should have been.

http://www.housepricecrash.co.uk/media/LondonTonig...

Thirteen years later and they are still going on about how they will not buy as the crash is imminent and trying to convince themselves that renting for all that time has been cheaper than buying.

If anybody dares post to the contrary their posts are deleted.

kingston12 said:

Not if you are selling with the sole intention of taking advantage of a falling market. As I say, I'd only sit out of the market if I was looking to move anyway, it is too risky to do it for profit alone.

I wonder how many people lost money doing that in London/SE after 2008, selling and waiting patiently for the bottom of the market, but missing it and finding prices in a lot of areas back to their previous 2007 peak a lot quicker than they should have been.

The great house price crash forum must be an interesting place right now...I wonder how many people lost money doing that in London/SE after 2008, selling and waiting patiently for the bottom of the market, but missing it and finding prices in a lot of areas back to their previous 2007 peak a lot quicker than they should have been.

kingston12 said:

If I could be confident that would stretch to my area, I'd definitely do it, but only as part of a planned move.

If I wanted to upgrade from a £750k property to a £1.2m one, that 15% would come in very useful - almost £200k saving. The saving on stamp duty alone would cover the other costs of moving.

On the other hand, if I just wanted to buy a similar £750k property back cheaper later, it might be a little bit less clear cut. The £100k saving would be eaten into by stamp duty, the other moving costs and the rent I'd have to pay the year. Still good if you are 100% confident of the fall happening, but if I'd done that last year and left it too late it could have cost me some money.

This rather makes the assumption that your house at 750 would not have buyers either offering you 15% less, if they are indeed present at all in a falling market. If I wanted to upgrade from a £750k property to a £1.2m one, that 15% would come in very useful - almost £200k saving. The saving on stamp duty alone would cover the other costs of moving.

On the other hand, if I just wanted to buy a similar £750k property back cheaper later, it might be a little bit less clear cut. The £100k saving would be eaten into by stamp duty, the other moving costs and the rent I'd have to pay the year. Still good if you are 100% confident of the fall happening, but if I'd done that last year and left it too late it could have cost me some money.

To make a sell/ buy back work, I dare suggest your money needs to be in the bank already. Which also likely means you're now paying rent, which further f

ks the maths.

ks the maths.z4RRSchris said:

dom9 said:

i like thatp1stonhead said:

z4RRSchris said:

dom9 said:

i like thatkingston12 said:

p1stonhead said:

z4RRSchris said:

dom9 said:

i like thatI suspect those rooms feel a lot smaller when actually there than they do on the photos.

p1stonhead said:

kingston12 said:

p1stonhead said:

z4RRSchris said:

dom9 said:

i like thatI suspect those rooms feel a lot smaller when actually there than they do on the photos.

kingston12 said:

p1stonhead said:

z4RRSchris said:

dom9 said:

i like thatOkay well my tupence worth...

I think the effects of Brexit will a significant factor in causing economic stagnation and will precipitate some recession in economic growth at some point in the next few years. I don't want to get into a debate about the pro's and con's of Brexit here, in the long run there may well be some benefits and some kind of sunlit uplands, but in the short to medium term I see downward pressures being pretty much unavoidable. Foreign investment in London property could well be falling already and more companies like Unilever may up sticks, taking jobs with them.

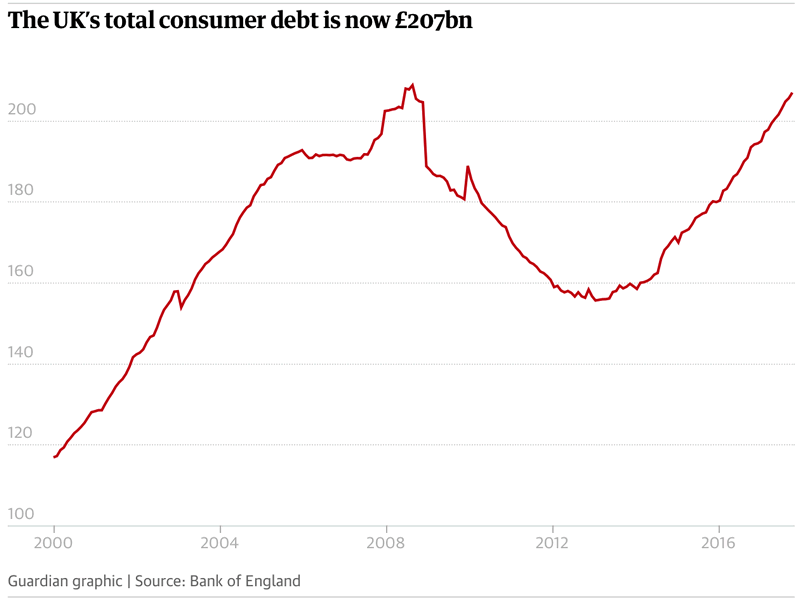

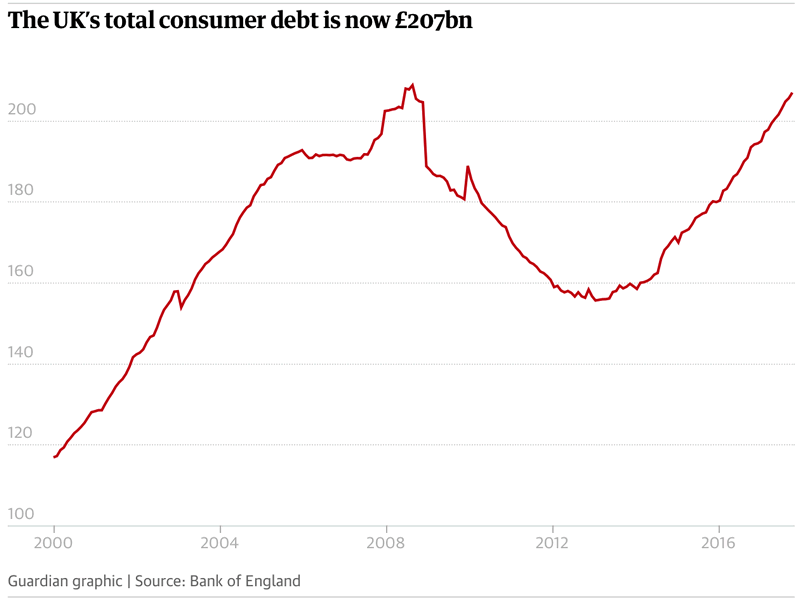

Although hardly what you might call a boom, we've had a fairly decent run since the financial crisis of '08, but this economic/credit cycle will run out of steam sooner or later. Some of the indicators have started to flash red, UK annual consumer credit growth for example has hit 10%, whilst income growth is around 2%. Here's a graph...

I think this will have to mean house price falls, but I don't see an outright crash that some are hoping and prayer for though. Personally I wouldn't sell and step off the ladder in the hope of a furture bargain, whilst interest rates are so low it is cheaper to own if you have reasonable LTV. Better to batten down the hatches and make sure one doesn't have excessive unsecured debts, get the finances in shape early for whatever may come to pass...

I think the effects of Brexit will a significant factor in causing economic stagnation and will precipitate some recession in economic growth at some point in the next few years. I don't want to get into a debate about the pro's and con's of Brexit here, in the long run there may well be some benefits and some kind of sunlit uplands, but in the short to medium term I see downward pressures being pretty much unavoidable. Foreign investment in London property could well be falling already and more companies like Unilever may up sticks, taking jobs with them.

Although hardly what you might call a boom, we've had a fairly decent run since the financial crisis of '08, but this economic/credit cycle will run out of steam sooner or later. Some of the indicators have started to flash red, UK annual consumer credit growth for example has hit 10%, whilst income growth is around 2%. Here's a graph...

I think this will have to mean house price falls, but I don't see an outright crash that some are hoping and prayer for though. Personally I wouldn't sell and step off the ladder in the hope of a furture bargain, whilst interest rates are so low it is cheaper to own if you have reasonable LTV. Better to batten down the hatches and make sure one doesn't have excessive unsecured debts, get the finances in shape early for whatever may come to pass...

MX6 said:

Okay well my tupence worth...

I think the effects of Brexit will a significant factor in causing economic stagnation and will precipitate some recession in economic growth at some point in the next few years. I don't want to get into a debate about the pro's and con's of Brexit here, in the long run there may well be some benefits and some kind of sunlit uplands, but in the short to medium term I see downward pressures being pretty much unavoidable. Foreign investment in London property could well be falling already and more companies like Unilever may up sticks, taking jobs with them.

I think this will have to mean house price falls, but I don't see an outright crash that some are hoping and prayer for though. Personally I wouldn't sell and step off the ladder in the hope of a furture bargain, whilst interest rates are so low it is cheaper to own if you have reasonable LTV. Better to batten down the hatches and make sure one doesn't have excessive unsecured debts, get the finances in shape early for whatever may come to pass...

How dare you be so rational and reasonable and not take the opportunity to beat some kind of drum to the tune of your agenda.I think the effects of Brexit will a significant factor in causing economic stagnation and will precipitate some recession in economic growth at some point in the next few years. I don't want to get into a debate about the pro's and con's of Brexit here, in the long run there may well be some benefits and some kind of sunlit uplands, but in the short to medium term I see downward pressures being pretty much unavoidable. Foreign investment in London property could well be falling already and more companies like Unilever may up sticks, taking jobs with them.

I think this will have to mean house price falls, but I don't see an outright crash that some are hoping and prayer for though. Personally I wouldn't sell and step off the ladder in the hope of a furture bargain, whilst interest rates are so low it is cheaper to own if you have reasonable LTV. Better to batten down the hatches and make sure one doesn't have excessive unsecured debts, get the finances in shape early for whatever may come to pass...

gibbon said:

MX6 said:

Okay well my tupence worth...

I think the effects of Brexit will a significant factor in causing economic stagnation and will precipitate some recession in economic growth at some point in the next few years. I don't want to get into a debate about the pro's and con's of Brexit here, in the long run there may well be some benefits and some kind of sunlit uplands, but in the short to medium term I see downward pressures being pretty much unavoidable. Foreign investment in London property could well be falling already and more companies like Unilever may up sticks, taking jobs with them.

I think this will have to mean house price falls, but I don't see an outright crash that some are hoping and prayer for though. Personally I wouldn't sell and step off the ladder in the hope of a furture bargain, whilst interest rates are so low it is cheaper to own if you have reasonable LTV. Better to batten down the hatches and make sure one doesn't have excessive unsecured debts, get the finances in shape early for whatever may come to pass...

How dare you be so rational and reasonable and not take the opportunity to beat some kind of drum to the tune of your agenda.I think the effects of Brexit will a significant factor in causing economic stagnation and will precipitate some recession in economic growth at some point in the next few years. I don't want to get into a debate about the pro's and con's of Brexit here, in the long run there may well be some benefits and some kind of sunlit uplands, but in the short to medium term I see downward pressures being pretty much unavoidable. Foreign investment in London property could well be falling already and more companies like Unilever may up sticks, taking jobs with them.

I think this will have to mean house price falls, but I don't see an outright crash that some are hoping and prayer for though. Personally I wouldn't sell and step off the ladder in the hope of a furture bargain, whilst interest rates are so low it is cheaper to own if you have reasonable LTV. Better to batten down the hatches and make sure one doesn't have excessive unsecured debts, get the finances in shape early for whatever may come to pass...

The threat/talk of seizure of property pending proof funding was not criminally obtained might give some Chinese investors the collywobbles also.

Yeah, I thought it was pretty good value (the 3-bed in Oxshott) compared to some others, certainly on a £/sq.ft basis.

It's literally spitting distance from our current home (rental) and we're looking to buy. However, it is still a fair wedge sans Garage, small-ish garden and it is quite narrow in person.

There's a 4-bed (small rooms), detached with garage (small) about 0.5 miles away at £750k and I think that looks pricy.

Might go and see this one though as it's the exact right spot for us, despite being above my budget limit (self-imposed, though I hate the idea of a big mortgage).

It's literally spitting distance from our current home (rental) and we're looking to buy. However, it is still a fair wedge sans Garage, small-ish garden and it is quite narrow in person.

There's a 4-bed (small rooms), detached with garage (small) about 0.5 miles away at £750k and I think that looks pricy.

Might go and see this one though as it's the exact right spot for us, despite being above my budget limit (self-imposed, though I hate the idea of a big mortgage).

turbobloke said:

kingston12 said:

p1stonhead said:

z4RRSchris said:

dom9 said:

i like thatI think you overestimate the amount of 'cash' someone buying such a house might have. Decent £350k deposit from past moves (tied up in their existing house) and a half million mortgage will get you in. You still may not have two sticks to rub together at the end of each month though when all bills (inc two nice cars leased) come out.

This is a picture of a lot of people.

Edited by p1stonhead on Thursday 15th March 13:13

p1stonhead said:

I think you overestimate the amount of 'cash' someone buying such a house might have. Decent £350k deposit from past moves (tied up in their existing house) and a half million mortgage will get you in. You still may not have two sticks to rub together at the end of each month though when all bills (inc two nice cars leased) come out.

This is a picture of a lot of people.

And this illustrates how fThis is a picture of a lot of people.

king ridiculous this state of affairs really is.

king ridiculous this state of affairs really is.Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff