How far will house prices fall [volume 4]

Discussion

edh said:

Jobbo said:

edh said:

I don't. I abhor the focus on London. LVT will help rebalance as it makes land in less "desirable" areas cheaper, free even.

LVT doesn't tax people for improving their land, unlike business rates, so stimulates business and the local economy in poorer areas.

LVT also promotes optimal use of existing housing stock and land (gets v expensive to hold vacant lots in city centres), reducing the need for new build.

Surely LVT would tax people for improving their land, since the value of the land goes up (compare the land value of agricultural land with the same land which has received planning consent to build).LVT doesn't tax people for improving their land, unlike business rates, so stimulates business and the local economy in poorer areas.

LVT also promotes optimal use of existing housing stock and land (gets v expensive to hold vacant lots in city centres), reducing the need for new build.

'Promoting optimal use of the existing housing stock' sounds like the opposite of what we need to do, which is build more housing to meet demand. Vacant lots in city centres tend not to be housing estates.

You can build lots of homes on vacant lots & it's certainly better than leaving them idle (which currently costs the land owner / speculator nothing). there's always huge opposition to greenfield developments, but less on renovating & building on city centre eyesores..

Optimal use also means using empty homes to house people instead of as a store of wealth, also encouraging people to downsize. TBH I don't understand why old people don't move out of their big family homes - we're already planning to do just that & build ourselves a place for the two of us now our kids have moved out.

If you want to target empty homes or undeveloped land then do just that.

edh said:

I'm glad you have seen the light (not sure how it helps with adult social care though..)

It's a bloody stupid idea that will cause massive upheaval & will be pretty much guaranteed to supplement rather than replace other taxation.

The light at the end of the tunnel is in this case the front of an oncoming train.

Rovinghawk said:

edh said:

I'm glad you have seen the light (not sure how it helps with adult social care though..)

It's a bloody stupid idea that will cause massive upheaval & will be pretty much guaranteed to supplement rather than replace other taxation.

The light at the end of the tunnel is in this case the front of an oncoming train.

Its a ludicrous idea which would bankrupt half the country.

Jobbo said:

edh said:

No, by definition it is a tax on the unimproved value of land, separate from any structures on that land. By gaining planning consent you have not "improved" the land as you haven't built anything, but you have changed the value by changing its permitted use.

You and I have different definitions of 'improved' then. By definition, it will tax land which has been improved in value, whether because the area as a whole has gone up or because planning consent has been granted (for the land itself, or a development nearby) or whatever other sentiment affects it.The effect of this is to force people out of property where they did nothing to increase the value of the land. That is iniquitous.

You write "They did nothing to increase the value of the land" - I'm glad you recognise this. Why should "they" benefit from huge unearned gains?

It will "force people out of property" how so? All they are doing is paying over a proportion of their unearned windfall gain when land prices rise.

Anyway, they have a choice, stay and pay, or move.

The libertarian right likes LVT

https://iea.org.uk/blog/the-case-for-a-land-value-...

https://iea.org.uk/would-a-land-value-tax-lvt-get-...

even the Mail is getting in on it..

http://www.dailymail.co.uk/wires/reuters/article-5...

edh said:

It will "force people out of property" how so?

Anyway, they have a choice, stay and pay, or move.

Your two statements here seem to contradict each other.Anyway, they have a choice, stay and pay, or move.

edh said:

All they are doing is paying over a proportion of their unearned windfall gain when land prices rise.

So pay money they might not actually have? Or be forced out?edh said:

The libertarian right likes LVT

https://iea.org.uk/blog/the-case-for-a-land-value-...

https://iea.org.uk/would-a-land-value-tax-lvt-get-...

even the Mail is getting in on it..

http://www.dailymail.co.uk/wires/reuters/article-5...

I don't care who likes it- stupidity is stupidity. We need to tax & spend less, not more.https://iea.org.uk/blog/the-case-for-a-land-value-...

https://iea.org.uk/would-a-land-value-tax-lvt-get-...

even the Mail is getting in on it..

http://www.dailymail.co.uk/wires/reuters/article-5...

98elise said:

How does the average owner occupier optimise the use of their land (aka garden) to pay for the extra tax?

If you want to target empty homes or undeveloped land then do just that.

The "average owner occupier" may not pay more under LVT as they would benefit from reductions in other taxes. If you want to target empty homes or undeveloped land then do just that.

Gardens aren't an issue really, they have limited value given their permitted use so don't really contribute to the LVT liability. (Different if they have planning permission to build a house on it obviously). The "garden tax" is a complete misnomer.

I see no issue with targeting underutilised homes (oh no! not the "poor widow in a mansion" - how could he be so heartless..). Obviously requires concerted action so that people have suitable places that they can move to.

Rovinghawk said:

edh said:

It will "force people out of property" how so?

Anyway, they have a choice, stay and pay, or move.

Your two statements here seem to contradict each other.Anyway, they have a choice, stay and pay, or move.

Rovinghawk said:

edh said:

All they are doing is paying over a proportion of their unearned windfall gain when land prices rise.

So pay money they might not actually have? Or be forced out?Rovinghawk said:

edh said:

The libertarian right likes LVT

https://iea.org.uk/blog/the-case-for-a-land-value-...

https://iea.org.uk/would-a-land-value-tax-lvt-get-...

even the Mail is getting in on it..

http://www.dailymail.co.uk/wires/reuters/article-5...

I don't care who likes it- stupidity is stupidity. We need to tax & spend less, not more.https://iea.org.uk/blog/the-case-for-a-land-value-...

https://iea.org.uk/would-a-land-value-tax-lvt-get-...

even the Mail is getting in on it..

http://www.dailymail.co.uk/wires/reuters/article-5...

Timmy40 said:

edh said:

The "average owner occupier" may not pay more under LVT as they would benefit from reductions in other taxes.

Forgive me for viewing that line with more than a little skepticism.

edh said:

Timmy40 said:

edh said:

The "average owner occupier" may not pay more under LVT as they would benefit from reductions in other taxes.

Forgive me for viewing that line with more than a little skepticism.

Look since when has a new tax being imposed resulted in other taxes being lowered. As far as I can tell the new tax comes in and the reductions are quietly forgotten about.

Would it not simply be more sensible to cap CGT relief on homes at say £50k, and tax the rest across the board. The huge gains being made when personal homes are evetually sold are going untaxed because of the CGT relief. It would only be paid when people moved/sold so no one would be forced out of their home.

Edited to add, and yes for once this is all Maggies fault because without her reforms the UK would still be an economic basket case and property would be cheap.

Edited by Timmy40 on Wednesday 9th May 13:37

edh said:

The libertarian right likes LVT

... whilst proposing that it is effectively revenue-neutral, just replacing business rates, SDLT, council tax. Obviously, that will never happen (and good luck replacing all those evil, grasping private landlords who will no longer provide the needed accommodation when rent controls stop them passing the extra burden on to tenants, good luck growing any food post-CAP etc.).I would oppose in the strongest terms any further attempts to tax me simply for owning land or property.

edh said:

Almost anything will sell in a flash at the right price... You can restrict supply by your pricing, which affects sales rates. (Btw a drop of 2% gross margin ain't really going to cut it...).

Other constraints on supply like labour and materials mean we are not going to see massive increases in new build unless we radically change our building methods.

Land is too expensive. That's at the heart of it.

Re being sales led (and I was being a little facetious about the 2%), it's no different from business planning buying x number of widgets and reckoning on past experience and market conditions that you'll sell y of them per month. Housing is exactly the same, it's just that the upfront costs are usually substantially higher (land, planning, fees, build) before you get to sell. People also don't buy houses like widgets, it takes time to complete, depends on their and other people's chain etc etc. All in, it is a lot riskier and front loaded than a lot of sectors, which is why the returns are higher (at say 20%) but also why the industry is so incredibly risk averse and generally lacks innovation. Other constraints on supply like labour and materials mean we are not going to see massive increases in new build unless we radically change our building methods.

Land is too expensive. That's at the heart of it.

You are right that land being too expensive is at the heart of it.

That Twain quote about not make more of it is obviously right in a literal sense, but we don't actually need to make more of it. There's actually loads of land and more than enough of it to go around. It's just that the supply of it is artificially constrained by the planning system.

Free up land, the cost of it will come down and so will the house prices. It'll reduce the entry point for new housing developers which will encourage more badly needed competition in the sector. The net result will be more houses being built and prices at least stabilising.

Taxing planning gain was mooted on a thread a few months ago and I remember saying that I couldn't think of a more effective way of killing the housebuilding industry stone dead. If you remove the incentive for people to sell land, then they simply won't as it is a ball ache. Besides, people like owning land.

Why would a house builder spend an extraordinary amount of time trying to find a site in a now reduced market, risk a boat load of cash on fees, surveys and a planning application which is subject to the vagaries of the the shopkeepers etc sitting on a Planning Committee, only to have the uplift in the value of the land taxed away from them? Why would you take the risk?

edh said:

You write "They did nothing to increase the value of the land" - I'm glad you recognise this. Why should "they" benefit from huge unearned gains?

It will "force people out of property" how so? All they are doing is paying over a proportion of their unearned windfall gain when land prices rise.

Anyway, they have a choice, stay and pay, or move.

In what way does someone who bought a house in London in the 1970s benefit from your asserted 'windfall gain' when they continue to live in the house? LVT means they are paying money that they have not received. You say yourself that they have a choice: stay and pay or move. That is exactly the 'forcing people out of the property' I refer to.It will "force people out of property" how so? All they are doing is paying over a proportion of their unearned windfall gain when land prices rise.

Anyway, they have a choice, stay and pay, or move.

And your definition of 'improvement' fails to recognise the fact that improvements happen without the owner doing anything - in exactly the example I give above, for instance. You clearly recognise that LVT would catch such a scenario so you're accepting my definition while arguing about it. Futile.

Jobbo said:

edh said:

You write "They did nothing to increase the value of the land" - I'm glad you recognise this. Why should "they" benefit from huge unearned gains?

It will "force people out of property" how so? All they are doing is paying over a proportion of their unearned windfall gain when land prices rise.

Anyway, they have a choice, stay and pay, or move.

In what way does someone who bought a house in London in the 1970s benefit from your asserted 'windfall gain' when they continue to live in the house? LVT means they are paying money that they have not received. You say yourself that they have a choice: stay and pay or move. That is exactly the 'forcing people out of the property' I refer to.It will "force people out of property" how so? All they are doing is paying over a proportion of their unearned windfall gain when land prices rise.

Anyway, they have a choice, stay and pay, or move.

And your definition of 'improvement' fails to recognise the fact that improvements happen without the owner doing anything - in exactly the example I give above, for instance. You clearly recognise that LVT would catch such a scenario so you're accepting my definition while arguing about it. Futile.

Jobbo said:

edh said:

It's very difficult to increase the supply of land

Housebuilders have an understandable need to maximise profit per plot and to restrict the supply of new houses in order to do this.

UK house prices took off about the time mortgage lending was de-restricted - correlation or causation?

It would be very easy to increase the supply of land - relax the planning system.Housebuilders have an understandable need to maximise profit per plot and to restrict the supply of new houses in order to do this.

UK house prices took off about the time mortgage lending was de-restricted - correlation or causation?

SKWD, your house price/income graph starts in 1995 which was close to the bottom of the slump. A friend of mine bought a 2-bed flat in Balham for £65k not long after (1997ish, IIRC). If you extend the graph backwards I think the overall trend would be far less clearly upward, but that’s just supposition unless we see the graph over a longer term.

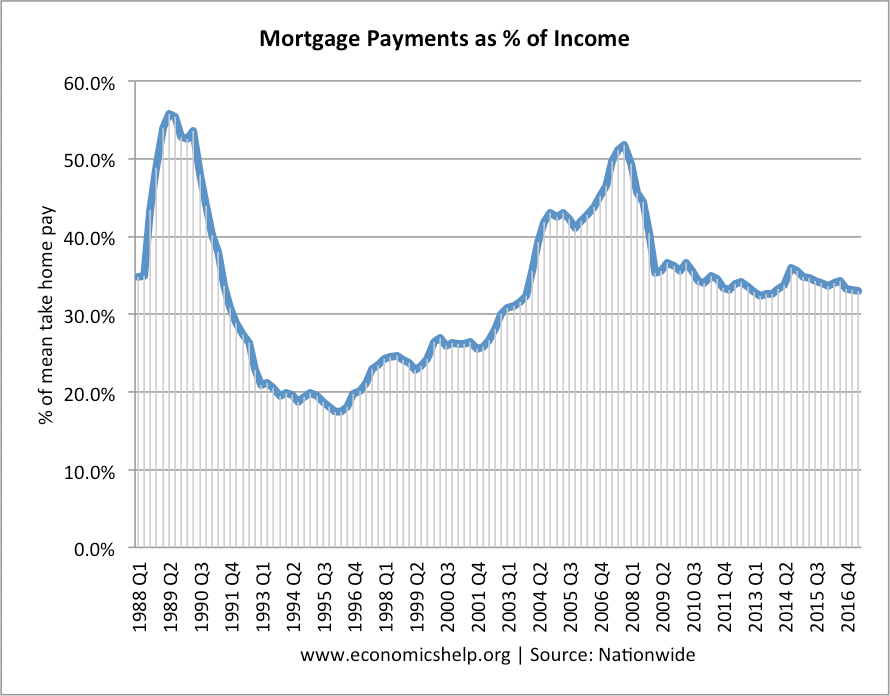

I didn't put up a graph of house prices vs incomes. I put up a graph of mortgage payments as % of take home pay for first-time buyers. Not quite the same thing. I will see if I can find data going further back.

But I don't believe the past is the best guide. We have made many changes to the "market" since pre-95. However, since you asked, here are some quick additional points:

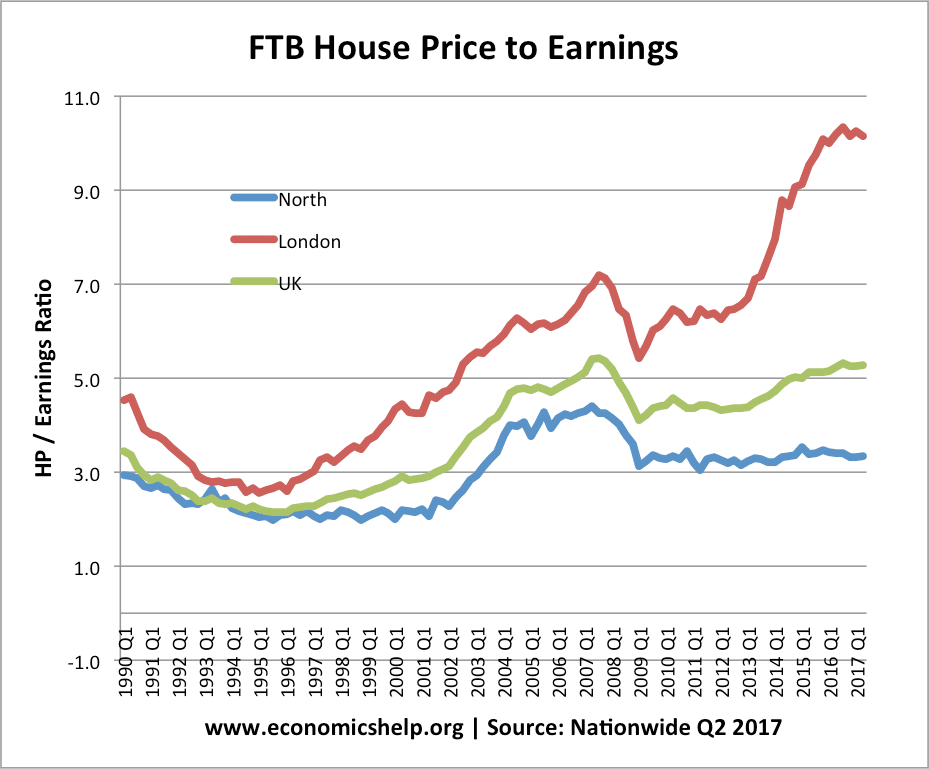

The graph you thought I'd put up (FTB house price to earnings, but of course skewed by LTV ratio changes etc.):

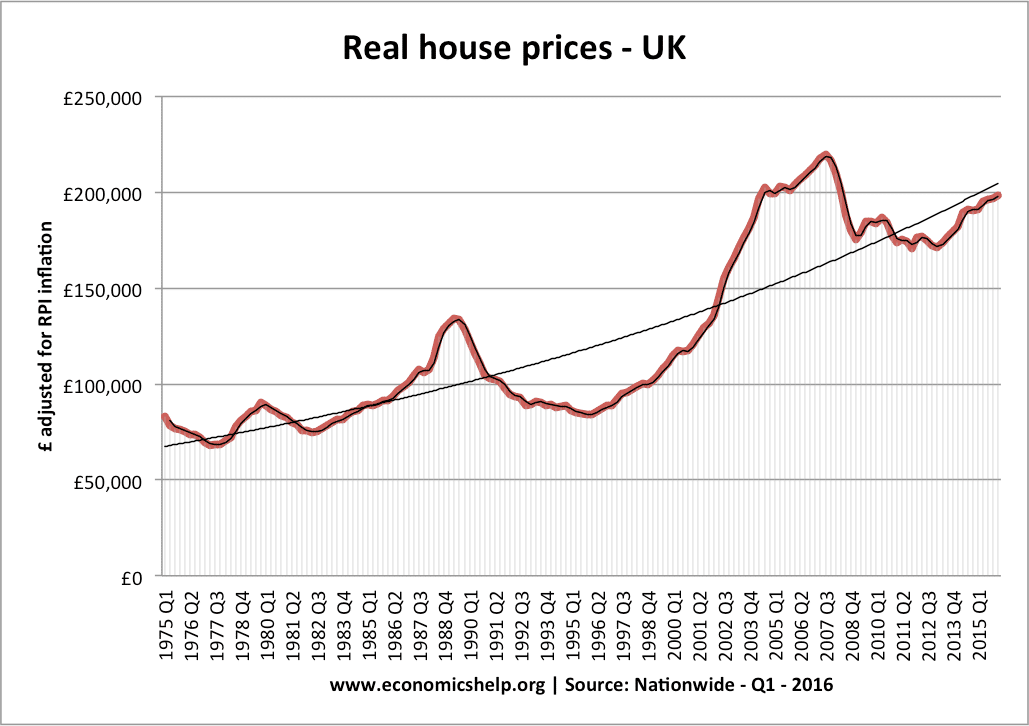

This one is inflation-adjusted, showing a near-tripling of the real-terms cost of a house:

An extension of the previous graph:

Feel free to correlate the 2 graphs above to show a slump in house prices each time mortgage payments reached a peak.

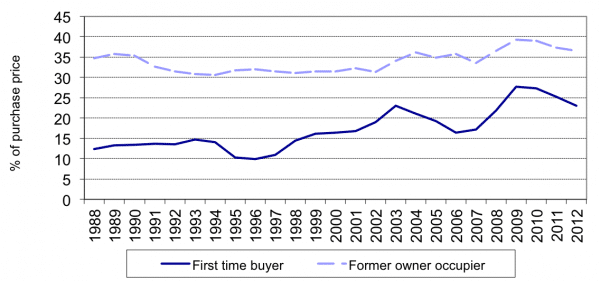

A look at deposits is also interesting:

There isn't a clear "go/no go" trend in all of this. The market doesn't operate that way. Since 2008, we've introduced very stringent new constraints on mortgages, which have clearly had an impact. Every few years there is some "fiddling" in the "market" by government. I don't believe it is possible to strip all of those things out with ease, nor is it possible to predict what politicians will do next.

The deposit curve is possibly the most startling, however, and graphically illustrates the problems at the bottom of the market.

Rovinghawk said:

skwdenyer said:

There is little doubt but that this is a situation born solely of rising housing costs compared to incomes.

Please show your evidence for this statement.At 2014 (the numbers I have to hand), 40% of working families received tax credits.

More recent ONS data I have shows:

The terms are defined thus:

So for the median group, benefits almost completely negate the effects of direct taxation. Since affordability of housing has gone down, it follows that without this intervention housing would be unaffordable.

Pensioner incomes in the period of study above rose about 3.1%, vis working families' incomes staying roughly flat. Meanwhile housing costs continued to rise for most.

The graphs are quite startling; in terms of direct taxation, only the top quintile are in effect paying for anything much at all...

If one thinks about how much machinery there is granting benefits, running direct taxation, and so on, it would seem surprising if one couldn't scrap the lot of it in favour of something else and save a very large amount of money (or spend that one something else, like schools)...

p1stonhead said:

Jobbo said:

edh said:

You write "They did nothing to increase the value of the land" - I'm glad you recognise this. Why should "they" benefit from huge unearned gains?

It will "force people out of property" how so? All they are doing is paying over a proportion of their unearned windfall gain when land prices rise.

Anyway, they have a choice, stay and pay, or move.

In what way does someone who bought a house in London in the 1970s benefit from your asserted 'windfall gain' when they continue to live in the house? LVT means they are paying money that they have not received. You say yourself that they have a choice: stay and pay or move. That is exactly the 'forcing people out of the property' I refer to.It will "force people out of property" how so? All they are doing is paying over a proportion of their unearned windfall gain when land prices rise.

Anyway, they have a choice, stay and pay, or move.

And your definition of 'improvement' fails to recognise the fact that improvements happen without the owner doing anything - in exactly the example I give above, for instance. You clearly recognise that LVT would catch such a scenario so you're accepting my definition while arguing about it. Futile.

No-one is forced to do anything. Blimey, if you were sitting on £1m of unearned windfall gain and had "let's say" a £5k annual tax to pay, i wonder if it would be possible to somehow draw down the money against some sort of security? Ooh, how about a £1m windfall housing gain?

edh said:

p1stonhead said:

Jobbo said:

edh said:

You write "They did nothing to increase the value of the land" - I'm glad you recognise this. Why should "they" benefit from huge unearned gains?

It will "force people out of property" how so? All they are doing is paying over a proportion of their unearned windfall gain when land prices rise.

Anyway, they have a choice, stay and pay, or move.

In what way does someone who bought a house in London in the 1970s benefit from your asserted 'windfall gain' when they continue to live in the house? LVT means they are paying money that they have not received. You say yourself that they have a choice: stay and pay or move. That is exactly the 'forcing people out of the property' I refer to.It will "force people out of property" how so? All they are doing is paying over a proportion of their unearned windfall gain when land prices rise.

Anyway, they have a choice, stay and pay, or move.

And your definition of 'improvement' fails to recognise the fact that improvements happen without the owner doing anything - in exactly the example I give above, for instance. You clearly recognise that LVT would catch such a scenario so you're accepting my definition while arguing about it. Futile.

No-one is forced to do anything. Blimey, if you were sitting on £1m of unearned windfall gain and had "let's say" a £5k annual tax to pay, i wonder if it would be possible to somehow draw down the money against some sort of security? Ooh, how about a £1m windfall housing gain?

Your very obvious bitterness at presumably not being able to afford a property is blinding you to the ludicrousness of your ideas.

Edited by p1stonhead on Wednesday 9th May 16:17

ben5575 said:

edh said:

Almost anything will sell in a flash at the right price... You can restrict supply by your pricing, which affects sales rates. (Btw a drop of 2% gross margin ain't really going to cut it...).

Other constraints on supply like labour and materials mean we are not going to see massive increases in new build unless we radically change our building methods.

Land is too expensive. That's at the heart of it.

Re being sales led (and I was being a little facetious about the 2%), it's no different from business planning buying x number of widgets and reckoning on past experience and market conditions that you'll sell y of them per month. Housing is exactly the same, it's just that the upfront costs are usually substantially higher (land, planning, fees, build) before you get to sell. People also don't buy houses like widgets, it takes time to complete, depends on their and other people's chain etc etc. All in, it is a lot riskier and front loaded than a lot of sectors, which is why the returns are higher (at say 20%) but also why the industry is so incredibly risk averse and generally lacks innovation. Other constraints on supply like labour and materials mean we are not going to see massive increases in new build unless we radically change our building methods.

Land is too expensive. That's at the heart of it.

You are right that land being too expensive is at the heart of it.

That Twain quote about not make more of it is obviously right in a literal sense, but we don't actually need to make more of it. There's actually loads of land and more than enough of it to go around. It's just that the supply of it is artificially constrained by the planning system.

Free up land, the cost of it will come down and so will the house prices. It'll reduce the entry point for new housing developers which will encourage more badly needed competition in the sector. The net result will be more houses being built and prices at least stabilising.

Taxing planning gain was mooted on a thread a few months ago and I remember saying that I couldn't think of a more effective way of killing the housebuilding industry stone dead. If you remove the incentive for people to sell land, then they simply won't as it is a ball ache. Besides, people like owning land.

Why would a house builder spend an extraordinary amount of time trying to find a site in a now reduced market, risk a boat load of cash on fees, surveys and a planning application which is subject to the vagaries of the the shopkeepers etc sitting on a Planning Committee, only to have the uplift in the value of the land taxed away from them? Why would you take the risk?

a. the carrying cost was higher and

b. the potential speculative gain was much lower?

I really don't think that building houses is like making widgets. Your supply constraints are very different.

Housebuilders would benefit from lower land costs - what % of upfront costs does land represent for you?

As for the risk you refer to in your last para..are you a housebuilder or a land speculator or both? I'd like to support you making profits from the former but not the latter.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff