Consumer debt hit an all-time high last year

Discussion

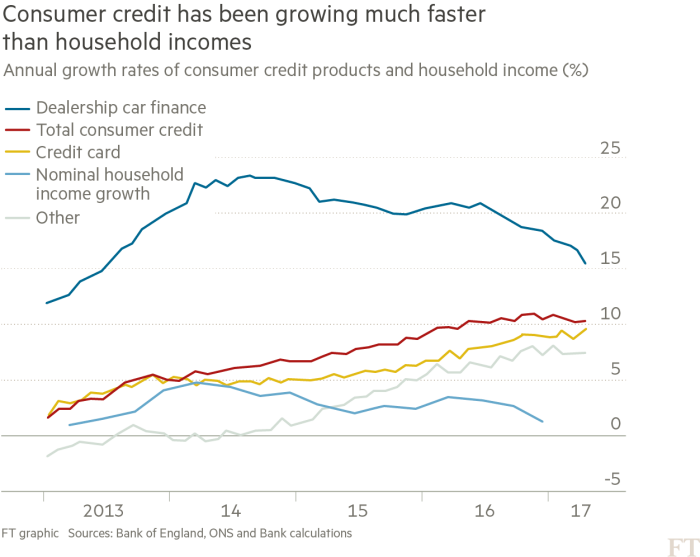

Even though we've hardly had rampant growth it does seem that there has been something of a credit bubble brewing out there.

My humble opinion is that the end of this economic cycle is likely to coincide with brexit, which will pricipitate a downturn, that likely would have happened sooner or later anyhow. Politically I can see brexit and "Tory austerity" being blamed even though the credit cycle and global economic factors will play a large part....

My humble opinion is that the end of this economic cycle is likely to coincide with brexit, which will pricipitate a downturn, that likely would have happened sooner or later anyhow. Politically I can see brexit and "Tory austerity" being blamed even though the credit cycle and global economic factors will play a large part....

Ridgemont said:

skahigh said:

crankedup said:

As a 'baby boomer' in my younger days we had no such thing as debt, other than a mortgage perhaps. If you wanted a new tele it was down to Radio Rentals to hire one! Or maybe put down a deposit and take on HP (hire purchase). New cars were few and far between for young people back in the 60s and 70's, most were old bangers held together with fibreglass patches or pudding. No such thing as credit cards or monster loans because you just had to have something NOW,

Better days? Well better than the 40s and 50s.

Eh?Better days? Well better than the 40s and 50s.

Living on Tick

Living on the never never

Hire Purchase

Ignore the source: http://www.worldsocialism.org/spgb/socialist-stand...

the key quote is valid:

article said:

Robert Roberts’ The Classic Slum describes life in Salford in the first part of last century. The pawnshop was an essential part of the local community; many people were dependent on the short-term loans offered, with women often pawning the family’s ‘best’ clothes on Monday until the following Saturday. There was a social hierarchy among the working class, with skilled workers at the top, and various ‘disreputable’ individuals at the bottom; and position ‘was judged not only by what one possessed but also by what one pawned’. True destitution meant pawning not just clothes but also pots and rugs, and finally not being able to redeem what had been left with the broker. The interest charged was usually a penny in the shilling per week; sky-high, but less than the moneylender, who charged threepence in the shilling per week.

Debt and loan financing was endemic. It didn't resemble the whizzy world of PAYG loans but was essentially the same dynamic. Ironically the things that were largely responsible for that world gradually fading away, was the Council House Right to Buy schemes, and the massive explosion in credit cards from the early eighties. The Boomers weren't therefore fiscally more prudent: they were able to tap entirely new lines of credit, and equity that previous generations were unable to.

Now it seems to be OK to have huge debts and a multitude of credit cards, this is obviously driving the debt mountain which is of concern to the BOE. Carney suggesting that a tightening of the loan criteria could be required to rein in consumerism.

Personally I did not hold a credit card until about 1990, but a very useful tool it is to this day.

Have to agree that consumerism has been on the rise since the 1980,s it would be interesting to see how much debt is broken down into respective generations, I suspect that the baby boomers would come out fairly debt free, very broad brush remark, owing to the retirement on good pensions, house equity and kids flown off the nest alongside household furniture / goods now all paid for.

JagLover said:

BOE "cracks down" on excessive personal debt....which they have caused with their own policies.

Price money properly and you would be far less likely to see such rapid growth in consumer credit.

Trouble is, as we know, if the BOE raised the rate untold people would go bankrupt and lose thier home. Just how many people are living on the edge? Price money properly and you would be far less likely to see such rapid growth in consumer credit.

sidicks said:

youngsyr said:

Obviously only a problem if your circumstances unexpectedly change within the next 30 months and even then you still have the value of the asset to sell.

But as you're arguing against with a specific scenario, let me counter with another: it's currently more than possible to borrow at 0% to extend your house and then see the value of your house increase above and the value of your debt, so in fact you earn money on your debt.

The fact is, the current economic situation is vastly different to what we've seen before, so applying traditional criticisms to it is not particularly useful.

Borrowing to improve your house which is likely (but not guaranteed) to increase in value over the long term can make sense.But as you're arguing against with a specific scenario, let me counter with another: it's currently more than possible to borrow at 0% to extend your house and then see the value of your house increase above and the value of your debt, so in fact you earn money on your debt.

The fact is, the current economic situation is vastly different to what we've seen before, so applying traditional criticisms to it is not particularly useful.

Borrowing to purchase an asset which is likely to depreciate makes much less sense!

In this situation it often makes absolute logical sense to take on debt, as effectively you're being paid (in cash terms) to do so.

For example, you want to buy a £10k car to get to work in a neighboring town and have access to a credit card that will lend to you at 0% interest for 2 years. Inflation is at 3%. Savings accounts offer negligible interest.

You can buy the car now on credit for £10k in todays money or you can save up £10k, over 2 years, by which time the car has increased in price (in line with inflation) to £10,609! So waiting two years has actually cost you £609 in cash, plus the opportunity cost of not having the car for two years.

crankedup said:

JagLover said:

BOE "cracks down" on excessive personal debt....which they have caused with their own policies.

Price money properly and you would be far less likely to see such rapid growth in consumer credit.

Trouble is, as we know, if the BOE raised the rate untold people would go bankrupt and lose thier home. Just how many people are living on the edge? Price money properly and you would be far less likely to see such rapid growth in consumer credit.

youngsyr said:

crankedup said:

JagLover said:

BOE "cracks down" on excessive personal debt....which they have caused with their own policies.

Price money properly and you would be far less likely to see such rapid growth in consumer credit.

Trouble is, as we know, if the BOE raised the rate untold people would go bankrupt and lose thier home. Just how many people are living on the edge? Price money properly and you would be far less likely to see such rapid growth in consumer credit.

BlueHave said:

Can't say i'm at all surprised, plenty of millennials think money grows on trees and are up to their necks in debt.

Car from parents, rent from parents or house from parents so they have never really had to work hard for anything in their life so far.

If they miss a credit card payment it's ok because mummy and daddy will pick up the tab.

Not a great way to live as the safety net won't always be there.

Oh good it's all young people's fault again. Glad we cleared that up.Car from parents, rent from parents or house from parents so they have never really had to work hard for anything in their life so far.

If they miss a credit card payment it's ok because mummy and daddy will pick up the tab.

Not a great way to live as the safety net won't always be there.

zarjaz1991 said:

BlueHave said:

Can't say i'm at all surprised, plenty of millennials think money grows on trees and are up to their necks in debt.

Car from parents, rent from parents or house from parents so they have never really had to work hard for anything in their life so far.

If they miss a credit card payment it's ok because mummy and daddy will pick up the tab.

Not a great way to live as the safety net won't always be there.

Oh good it's all young people's fault again. Glad we cleared that up.Car from parents, rent from parents or house from parents so they have never really had to work hard for anything in their life so far.

If they miss a credit card payment it's ok because mummy and daddy will pick up the tab.

Not a great way to live as the safety net won't always be there.

superkartracer said:

youngsyr said:

crankedup said:

JagLover said:

BOE "cracks down" on excessive personal debt....which they have caused with their own policies.

Price money properly and you would be far less likely to see such rapid growth in consumer credit.

Trouble is, as we know, if the BOE raised the rate untold people would go bankrupt and lose thier home. Just how many people are living on the edge? Price money properly and you would be far less likely to see such rapid growth in consumer credit.

So, I'll ask again: how many people will go under given say a 1% or even 2% increase in interest rates?

I suspect people's exposure to the BoE base rate is significantly lower than many people believe.

BlackLabel said:

Sorry to get back to the topic of discussion here but unless I (and menousername) is much mistaken that that graph shows the annual increase in debt. So dealership car finance is increasing by about 16% per year. Credit card debt is going up by nearly 10% a year and Total Consumer Credit increasing by more than 10% a year. So if the average family owes £10,000 this year then by next summer it will be £11,000. I agree that it would be very interesting to see the figure of average household debt for households that have debt. This amount is probably owed by less than half the households in the country (and possibly less than 30%).

youngsyr said:

superkartracer said:

youngsyr said:

crankedup said:

JagLover said:

BOE "cracks down" on excessive personal debt....which they have caused with their own policies.

Price money properly and you would be far less likely to see such rapid growth in consumer credit.

Trouble is, as we know, if the BOE raised the rate untold people would go bankrupt and lose thier home. Just how many people are living on the edge? Price money properly and you would be far less likely to see such rapid growth in consumer credit.

So, I'll ask again: how many people will go under given say a 1% or even 2% increase in interest rates?

I suspect people's exposure to the BoE base rate is significantly lower than many people believe.

superkartracer said:

youngsyr said:

superkartracer said:

youngsyr said:

crankedup said:

JagLover said:

BOE "cracks down" on excessive personal debt....which they have caused with their own policies.

Price money properly and you would be far less likely to see such rapid growth in consumer credit.

Trouble is, as we know, if the BOE raised the rate untold people would go bankrupt and lose thier home. Just how many people are living on the edge? Price money properly and you would be far less likely to see such rapid growth in consumer credit.

So, I'll ask again: how many people will go under given say a 1% or even 2% increase in interest rates?

I suspect people's exposure to the BoE base rate is significantly lower than many people believe.

As above, I suspect it is massively overplayed and that's before we even discuss the likelihood of interest rates going up anytime soon.

youngsyr said:

The youth of today, eh?

Tell me: what difference does it make if you buy something now on interest free credit and pay it off over 30 months or you save up over 30 months, earning negligible interest, and buy it at the end of that time - apart from the obvious that you get to use that item 2 and a half years earlier?!

Because being able to pay off the stuff you bought on credit relies on you making a gamble that you will maintain your current income. These companies actually factor in profit they will make from the percentage that will fail to make the payments and so lose the interest free status.

Tell me: what difference does it make if you buy something now on interest free credit and pay it off over 30 months or you save up over 30 months, earning negligible interest, and buy it at the end of that time - apart from the obvious that you get to use that item 2 and a half years earlier?!

Take todays news 1,200 people cut by Tesco. How many of them will currently have monthly financial commitments that they could have gone without, and are now be panicking about.

These 1200 are in Head office jobs, so will have iPhones, leased cars, credit card debts. And a dfs interest free sofa.

Just a week before 1,100 people in Cardiff were also sacked by Tesco - total since 2014 is 7000+ people. There is no guaranteed job security.

Edited by hyphen on Wednesday 28th June 14:52

hyphen said:

Because being able to pay off the stuff you bought on credit relies on you making a gamble that you will maintain your current income. These companies actually factor in profit they will make from the percentage that will fail to make the payments and so lose the interest free status.

Take todays news 1,200 people cut by Tesco. How many of them will currently have monthly financial commitments that they could have gone without, and are now be panicking about.

These 1200 are in Head office jobs, so will have iPhones, leased cars, credit card debts. And a dfs interest free sofa.

Are you arguing that all 1200 of those people will now be bankrupted from their debt?Take todays news 1,200 people cut by Tesco. How many of them will currently have monthly financial commitments that they could have gone without, and are now be panicking about.

These 1200 are in Head office jobs, so will have iPhones, leased cars, credit card debts. And a dfs interest free sofa.

If not, what is your point?

What I am saying is, many people don't see further than the end of their nose. Taking on debt for todays happiness can be tomorrows nightmares.

Over 10,000 committed suicide during the crash of 2008-2010, job losses and debt being primary reason.

Many of the current people are not intelligent consumers making a decision, it is the low iq, low educated plebs who are being sold a dream and falling for it.

Over 10,000 committed suicide during the crash of 2008-2010, job losses and debt being primary reason.

Many of the current people are not intelligent consumers making a decision, it is the low iq, low educated plebs who are being sold a dream and falling for it.

hyphen said:

What I am saying is, many people don't see further than the end of their nose. Taking on debt for todays happiness can be tomorrows nightmares.

Over 10,000 committed suicide during the crash of 2008-2010, job losses and debt being primary reason.

Many of the current people are not intelligent consumers making a decision, it is the low iq, low educated plebs who are being sold a dream and falling for it.

This isn't going to change while money is cheap it's only going to get worse. The only way to slow it down is to slowly increase interest rates. Over 10,000 committed suicide during the crash of 2008-2010, job losses and debt being primary reason.

Many of the current people are not intelligent consumers making a decision, it is the low iq, low educated plebs who are being sold a dream and falling for it.

youngsyr said:

crankedup said:

JagLover said:

BOE "cracks down" on excessive personal debt....which they have caused with their own policies.

Price money properly and you would be far less likely to see such rapid growth in consumer credit.

Trouble is, as we know, if the BOE raised the rate untold people would go bankrupt and lose thier home. Just how many people are living on the edge? Price money properly and you would be far less likely to see such rapid growth in consumer credit.

youngsyr said:

superkartracer said:

youngsyr said:

superkartracer said:

youngsyr said:

crankedup said:

JagLover said:

BOE "cracks down" on excessive personal debt....which they have caused with their own policies.

Price money properly and you would be far less likely to see such rapid growth in consumer credit.

Trouble is, as we know, if the BOE raised the rate untold people would go bankrupt and lose thier home. Just how many people are living on the edge? Price money properly and you would be far less likely to see such rapid growth in consumer credit.

So, I'll ask again: how many people will go under given say a 1% or even 2% increase in interest rates?

I suspect people's exposure to the BoE base rate is significantly lower than many people believe.

As above, I suspect it is massively overplayed and that's before we even discuss the likelihood of interest rates going up anytime soon.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff