BoE Base Rate, What if...

Discussion

Adam Ansel said:

fblm said:

Uk rates arnt going up any time soon and if they did the BoE would be forced to cut em again pretty quick. The over borrowed have safety in numbers! In any event why would they go up?

Inflation?Asset bubbles?

Exchange rate competitiveness?

Market forcing government to pay higher rates?

etc etc etc

Murph7355 said:

sidicks said:

...

More likely the need for higher margins is a result of the massive amount of additional regulation and capital requirements that have been foisted on banks since the crisis.

...!

This.More likely the need for higher margins is a result of the massive amount of additional regulation and capital requirements that have been foisted on banks since the crisis.

...!

Plus a dose of "because they can".

they have to make back the billions paid out, so high mortgage rates and low interest rates will foot the bill.

Efbe said:

Murph7355 said:

sidicks said:

...

More likely the need for higher margins is a result of the massive amount of additional regulation and capital requirements that have been foisted on banks since the crisis.

...!

This.More likely the need for higher margins is a result of the massive amount of additional regulation and capital requirements that have been foisted on banks since the crisis.

...!

Plus a dose of "because they can".

they have to make back the billions paid out, so high mortgage rates and low interest rates will foot the bill.

Jockman said:

Efbe said:

Murph7355 said:

sidicks said:

...

More likely the need for higher margins is a result of the massive amount of additional regulation and capital requirements that have been foisted on banks since the crisis.

...!

This.More likely the need for higher margins is a result of the massive amount of additional regulation and capital requirements that have been foisted on banks since the crisis.

...!

Plus a dose of "because they can".

they have to make back the billions paid out, so high mortgage rates and low interest rates will foot the bill.

just a bit of fag packet maths here;

-£14bn for Lloyds PPI

-1/3 people mortgages with LBG

-24mn houses with mortgages in uk, so 8mn with LBG

-If limited to Mortgages only, then £1750 to make back from each customer

That is if they only tried to gain money back through mortgages though, so...

-30mn total customers with LBG,

-spread across all these, would be £466 per customer.

so somewhere around that is what the additional fees will be for customers that LBG needs to reclaim from PPI.

LBG mortgage book is xxxbn (I actually know the number but decided not to say). The issue is when we look at LTV certain subbooks were over 100% and far more than would be helpful were above 75%. So rates have been higher than you might expect to mitigate this risk. In addition regulatory changes mean increase need for tier 1 capital like cash. Finally risks to the bank as a whole need to be covered ppi was one but it was not the top risk (can't say what it was other than it passed and now will be replaced by similar risk)

So to summaries banks lent to people who had little money lost money now need to recover it an more while also dealing with new threats.

So to summaries banks lent to people who had little money lost money now need to recover it an more while also dealing with new threats.

Re the figures above it would not be right to confirm or deny them an of you do.know the exact figure you should not really say (I worked there 12 months ago). End of day banks need to cover higher risk and regulatory demands bit still make a profit. So rates or spreads of you will are higher wider than before.

If rates went to 5% in a short space many would fave hardship and defaults would rise. It's amazing how short memories people have when it comes to piling on the debt to get the latest X or y

If rates went to 5% in a short space many would fave hardship and defaults would rise. It's amazing how short memories people have when it comes to piling on the debt to get the latest X or y

Gecko1978 said:

LBG mortgage book is xxxbn (I actually know the number but decided not to say). The issue is when we look at LTV certain subbooks were over 100% and far more than would be helpful were above 75%. So rates have been higher than you might expect to mitigate this risk. In addition regulatory changes mean increase need for tier 1 capital like cash. Finally risks to the bank as a whole need to be covered ppi was one but it was not the top risk (can't say what it was other than it passed and now will be replaced by similar risk)

So to summaries banks lent to people who had little money lost money now need to recover it an more while also dealing with new threats.

Not sure why you are being so secretive about this - there is plenty of information in their annual report and analyst / shareholder communications...So to summaries banks lent to people who had little money lost money now need to recover it an more while also dealing with new threats.

Moonhawk said:

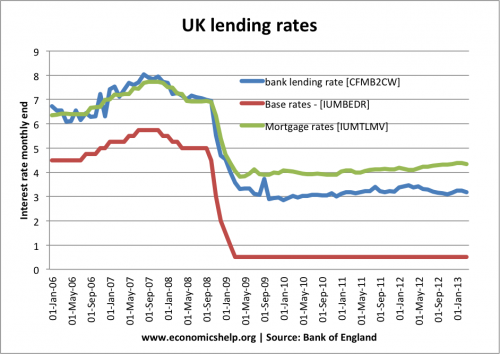

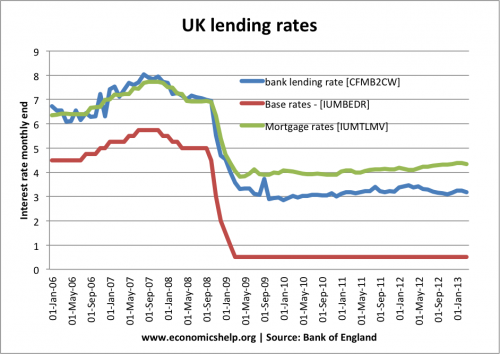

Mortgage rates shouldn't go up as fast as the base rate - afterall they didn't come down as quickly.

Between 2008 and 2009 the base rate dropped by a little under 5%, whereas the mortgage interest rates only dropped by around 3% over the same period.

Mortgage rates didn't come down as quickly as base because banks funding changed to represent something closer to reality. Between 2008 and 2009 the base rate dropped by a little under 5%, whereas the mortgage interest rates only dropped by around 3% over the same period.

Gecko1978 said:

LBG mortgage book is xxxbn (I actually know the number but decided not to say). The issue is when we look at LTV certain subbooks were over 100% and far more than would be helpful were above 75%. So rates have been higher than you might expect to mitigate this risk. In addition regulatory changes mean increase need for tier 1 capital like cash. Finally risks to the bank as a whole need to be covered ppi was one but it was not the top risk (can't say what it was other than it passed and now will be replaced by similar risk)

So to summaries banks lent to people who had little money lost money now need to recover it an more while also dealing with new threats.

If it was anything like my old employer the biggest risk was the mis-selling of commercial SWAPs, now somewhat resolved thankfully.So to summaries banks lent to people who had little money lost money now need to recover it an more while also dealing with new threats.

Can say as I'm no longer in that line of business and my ex-employer was liquidated...

BigLion said:

This thread just highlights the lack of financial understanding of the markets within this forum and also demonstrate peoples desperate attempt to pretend they have the knowledge and pass this of as fact.

Honestly some of the things posted are laughable !!!

I disagree strongly the question what would happen if base rate rose is one of conjecture. If I knew exactly then I could become very rich with my crystal ball like ability. Facts as you say are hard to state when talking about future events. My own knowledge when working at LBG showed many books were what was a considered internally risky though pre the crash acceptable. The reality is many people do not have spare income to cover a large shock like a 4% rise as suggested. It does not need to be majority etc just a large minority defaulting and you have another crisis. An for the record I have 15 years credit and market risk experience so am happy I understand this.Honestly some of the things posted are laughable !!!

Gecko1978 said:

BigLion said:

This thread just highlights the lack of financial understanding of the markets within this forum and also demonstrate peoples desperate attempt to pretend they have the knowledge and pass this of as fact.

Honestly some of the things posted are laughable !!!

I disagree strongly the question what would happen if base rate rose is one of conjecture. If I knew exactly then I could become very rich with my crystal ball like ability. Facts as you say are hard to state when talking about future events. My own knowledge when working at LBG showed many books were what was a considered internally risky though pre the crash acceptable. The reality is many people do not have spare income to cover a large shock like a 4% rise as suggested. It does not need to be majority etc just a large minority defaulting and you have another crisis. An for the record I have 15 years credit and market risk experience so am happy I understand this.Honestly some of the things posted are laughable !!!

BigLion said:

Gecko1978 said:

BigLion said:

This thread just highlights the lack of financial understanding of the markets within this forum and also demonstrate peoples desperate attempt to pretend they have the knowledge and pass this of as fact.

Honestly some of the things posted are laughable !!!

I disagree strongly the question what would happen if base rate rose is one of conjecture. If I knew exactly then I could become very rich with my crystal ball like ability. Facts as you say are hard to state when talking about future events. My own knowledge when working at LBG showed many books were what was a considered internally risky though pre the crash acceptable. The reality is many people do not have spare income to cover a large shock like a 4% rise as suggested. It does not need to be majority etc just a large minority defaulting and you have another crisis. An for the record I have 15 years credit and market risk experience so am happy I understand this.Honestly some of the things posted are laughable !!!

Jimboka said:

My Base rate + 0.59% IF mortgage taken out in 2008 was a lucky move. Not worth paying it off early, savings earn more.

As I'm costing them money, do mortgage companies cut a deal, lower settlement amount?

You are not costing them money. You can get a new fixed rate around that now.As I'm costing them money, do mortgage companies cut a deal, lower settlement amount?

No, they wont cut you a deal.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff