Jeremy Corbyn Vol. 2

Discussion

drainbrain said:

Socialism beckoning. Maybe not very soon and maybe not Corbyn, but on the horizon. There's a growing demand for it and it won't be long till someone works out how to supply it acceptably.

Socialism comes around in the cycle of politics. It doesn't last two full terms before the voters realise it's not all milk and honey. The exception was New Labour - not surprising as they were really Tory Lite.Labour is the "Let's have a party" party. And the Nasty Party are the ones who have to spoil the fun and find the money to pay for the mess.

pingu393 said:

drainbrain said:

Socialism beckoning. Maybe not very soon and maybe not Corbyn, but on the horizon. There's a growing demand for it and it won't be long till someone works out how to supply it acceptably.

Socialism comes around in the cycle of politics. It doesn't last two full terms before the voters realise it's not all milk and honey. The exception was New Labour - not surprising as they were really Tory Lite.Labour is the "Let's have a party" party. And the Nasty Party are the ones who have to spoil the fun and find the money to pay for the mess.

When are we expecting this Nasty Party along to sort the 2007 mess? Soon I hope.

Then because we're stupid we'll get rid of them so we can get another mess made by Mr Corbyn et al.

And this is all a cyclical inevitability, is it?

Okay. When's the next BOOM due?

edh said:

Yet the 2017 manifesto policies are pretty much mainstream European social democratic so appear to be ok in Scandinavia or Germany.

It is highly debatable how much a manifesto promising £50bn a year in extra taxes, nationalizations, and substantial extra borrowing on top of the money raised from tax rises, is mainstream social democratic.JagLover said:

edh said:

Yet the 2017 manifesto policies are pretty much mainstream European social democratic so appear to be ok in Scandinavia or Germany.

Germany doesn't have a debt burden, nor does it have an ongoing balance of trade issue, IE it can afford a wider social policy. Also - Healthcare in Germany is an additional cost, above an already high taxation rate. I would also argue Corbyn didn't present a social democratic policy. His version was considerably further to the left. (I don't see Germany threatening to nationalise the banking, construction and utility companies) It is highly debatable how much a manifesto promising £50bn a year in extra taxes, nationalizations, and substantial extra borrowing on top of the money raised from tax rises, is mainstream social democratic.

John McDonnell’s borrowing plans would cost the taxpayer £270 billion in debt interest alone over the course of just one five-year parliament, new research suggests.

The shadow chancellor’s extra spending proposals would mean a Labour government borrowing £330 billion, adding to the £1.8 trillion of current national debt.

Debt interest payments would add up to more than £270 billion, according to the analysis undertaken by the TaxPayers’ Alliance. It calculated the figures based on the interest rate on government debt forecast over the period.

It comes after Mr McDonnell said any increase to the national debt would “pay for itself” and refused to answer questions about figures for his borrowing plans in a radio interview last week because MPs had “iPads and advisers” for that.

Gargamel said:

From the papers today.

John McDonnell’s borrowing plans would cost the taxpayer £270?billion in debt interest alone over the course of just one five-year parliament, new research suggests.

The shadow chancellor’s extra spending proposals would mean a Labour government borrowing £330?billion, adding to the £1.8?trillion of current national debt.

Debt interest payments would add up to more than £270?billion, according to the analysis undertaken by the TaxPayers’ Alliance. It calculated the figures based on the interest rate on government debt forecast over the period.

It comes after Mr McDonnell said any increase to the national debt would “pay for itself” and refused to answer questions about figures for his borrowing plans in a radio interview last week because MPs had “iPads and advisers” for that.

"Says the tax payers alliance"John McDonnell’s borrowing plans would cost the taxpayer £270?billion in debt interest alone over the course of just one five-year parliament, new research suggests.

The shadow chancellor’s extra spending proposals would mean a Labour government borrowing £330?billion, adding to the £1.8?trillion of current national debt.

Debt interest payments would add up to more than £270?billion, according to the analysis undertaken by the TaxPayers’ Alliance. It calculated the figures based on the interest rate on government debt forecast over the period.

It comes after Mr McDonnell said any increase to the national debt would “pay for itself” and refused to answer questions about figures for his borrowing plans in a radio interview last week because MPs had “iPads and advisers” for that.

At that point I lose interest ... I might as well quote the canary as an equally unreliabke response.

JagLover said:

edh said:

Yet the 2017 manifesto policies are pretty much mainstream European social democratic so appear to be ok in Scandinavia or Germany.

It is highly debatable how much a manifesto promising £50bn a year in extra taxes, nationalizations, and substantial extra borrowing on top of the money raised from tax rises, is mainstream social democratic.Part of the frothing hysteria is on the assumption that it all happens in day 1. For example the £250bn capital programme is spread over 10 years.

Separate the manifesto policies from the claims made by the tories or media and it looks different. Or are you still worried by the "garden tax"?

edh said:

Taxation levels still below those European countries, borrowing for investment not current spending, state ownership of rail, all unremarkable.

Part of the frothing hysteria is on the assumption that it all happens in day 1. For example the £250bn capital programme is spread over 10 years.

Separate the manifesto policies from the claims made by the tories or media and it looks different. Or are you still worried by the "garden tax"?

Do those countries have £7 trillion of debts to deal with?Part of the frothing hysteria is on the assumption that it all happens in day 1. For example the £250bn capital programme is spread over 10 years.

Separate the manifesto policies from the claims made by the tories or media and it looks different. Or are you still worried by the "garden tax"?

Were they running large structural deficits during a boom?

sidicks said:

edh said:

Taxation levels still below those European countries, borrowing for investment not current spending, state ownership of rail, all unremarkable.

Part of the frothing hysteria is on the assumption that it all happens in day 1. For example the £250bn capital programme is spread over 10 years.

Separate the manifesto policies from the claims made by the tories or media and it looks different. Or are you still worried by the "garden tax"?

Do those countries have £7 trillion of debts to deal with?Part of the frothing hysteria is on the assumption that it all happens in day 1. For example the £250bn capital programme is spread over 10 years.

Separate the manifesto policies from the claims made by the tories or media and it looks different. Or are you still worried by the "garden tax"?

Were they running large structural deficits during a boom?

Maybe if our tax levels had been more like our European counterparts it would have been better? Can't have European levels of provision on US levels of taxation..

I think ee will only deal with our debt by either growth or inflation. I prefer the former.

Anyway, here's a counterpoint to the debt / deficit fetishists

http://www.primeeconomics.org/articles/the-shadow-...

Germany has a sizeable national debt

https://www.nationaldebtclocks.org/debtclock/germa...

There are arguments that a national debt can be a good thing. Repaying debt destroys money and can reduce demand / growth.

edh said:

7tn? That's a new figure...this tory govt must be even more incompetent than I realised.. .

Circa £7 trillion = £1.8 trillion balance sheet debt, £1.5+ trillion for public sector pensions and £4 trillion for state pensions.

edh said:

Maybe if our tax levels had been more like our European counterparts it would have been better? Can't have European levels of provision on US levels of taxation..

I think ee will only deal with our debt by either growth or inflation. I prefer the former.

And higher taxes are conducive to growth?I think ee will only deal with our debt by either growth or inflation. I prefer the former.

edh said:

Anyway, here's a counterpoint to the debt / deficit fetishists

http://www.primeeconomics.org/articles/the-shadow-...

For economists the article is very political:http://www.primeeconomics.org/articles/the-shadow-...

“This is remarkably low, given the costs (debt) incurred by the government to bail out the private financial system after the 2007-9 global financial crisis”

Outstanding borrowing to bail out the banks is negligible in comparison to overall debt

“the dismantling and defunding of vital public services”

Do they actually mean increased spending each and every year since the crisis?!

“Should not be deterred from borrowing for productive investment”

Borrowing to pay fund ‘productive investment’ makes perfect sense. Borrowing to pay the daily bills, as we are still doing, does not. And Mcdonnell / Corbyn have a strange definition of ‘productive investment’!

Finally, interests are low because the market is broadly comfortable with the current economic plan - if massive increases in borrowing are expected then the interest rates demanded for that borrowing will be adjusted upwards significantly, massively increasing the cost of that debt.

edh said:

Germany has a sizeable national debt

https://www.nationaldebtclocks.org/debtclock/germa...

There are arguments that a national debt can be a good thing. Repaying debt destroys money and can reduce demand / growth.

Germany also runs a surplus:https://www.nationaldebtclocks.org/debtclock/germa...

There are arguments that a national debt can be a good thing. Repaying debt destroys money and can reduce demand / growth.

https://www.ft.com/content/7a06d15e-f9db-11e6-9516...

Edited by sidicks on Monday 27th November 10:12

edh said:

Gargamel said:

From the papers today.

John McDonnell’s borrowing plans would cost the taxpayer £270?billion in debt interest alone over the course of just one five-year parliament, new research suggests.

The shadow chancellor’s extra spending proposals would mean a Labour government borrowing £330?billion, adding to the £1.8?trillion of current national debt.

Debt interest payments would add up to more than £270?billion, according to the analysis undertaken by the TaxPayers’ Alliance. It calculated the figures based on the interest rate on government debt forecast over the period.

It comes after Mr McDonnell said any increase to the national debt would “pay for itself” and refused to answer questions about figures for his borrowing plans in a radio interview last week because MPs had “iPads and advisers” for that.

"Says the tax payers alliance"John McDonnell’s borrowing plans would cost the taxpayer £270?billion in debt interest alone over the course of just one five-year parliament, new research suggests.

The shadow chancellor’s extra spending proposals would mean a Labour government borrowing £330?billion, adding to the £1.8?trillion of current national debt.

Debt interest payments would add up to more than £270?billion, according to the analysis undertaken by the TaxPayers’ Alliance. It calculated the figures based on the interest rate on government debt forecast over the period.

It comes after Mr McDonnell said any increase to the national debt would “pay for itself” and refused to answer questions about figures for his borrowing plans in a radio interview last week because MPs had “iPads and advisers” for that.

At that point I lose interest ... I might as well quote the canary as an equally unreliabke response.

You mention Debt fetishists and bang on about why a nation is not a household but tell me this, if you had a credit card with a balance on it that was 80% of your annual salary, and every month you added another 0.75% of the balance to it. Would you then think it sensible to add a further 20% on top, provided you "invested it" in something which currently costs you nothing at all.

Gargamel said:

Well its a hard forecast to make, when the Shadow Chancellor himself won't release any information on figures for borrowing plans, and doesn't seem to thing issuing bonds counts a debt....

You mention Debt fetishists and bang on about why a nation is not a household but tell me this, if you had a credit card with a balance on it that was 80% of your annual salary, and every month you added another 0.75% of the balance to it. Would you then think it sensible to add a further 20% on top, provided you "invested it" in something which currently costs you nothing at all.

I am not a government with its own currency. You mention Debt fetishists and bang on about why a nation is not a household but tell me this, if you had a credit card with a balance on it that was 80% of your annual salary, and every month you added another 0.75% of the balance to it. Would you then think it sensible to add a further 20% on top, provided you "invested it" in something which currently costs you nothing at all.

Btw why are companies encouraged to load up on debt? Is that a good or a bad thing?

Wouldn't it be a good idea to have a national balance sheet? Then we could have a more informed discussion about "investment"

edh said:

I am not a government with its own currency.

Btw why are companies encouraged to load up on debt? Is that a good or a bad thing?

They aren’t. They are encouraged to consider whether borrowing might allow them to fund projects which have a sufficiently high risk-adjusted return to compensate them for the costs, taking into account numerous other factors around liquidity, ratings etc.Btw why are companies encouraged to load up on debt? Is that a good or a bad thing?

edh said:

Wouldn't it be a good idea to have a national balance sheet? Then we could have a more informed discussion about "investment"

Indeed, at the moment we have massive liabilities and minimal assets!sidicks said:

edh said:

I am not a government with its own currency.

Btw why are companies encouraged to load up on debt? Is that a good or a bad thing?

They aren’t. They are encouraged to consider whether borrowing might allow them to fund projects which have a sufficiently high risk-adjusted return to compensate them for the costs, taking into account numerous other factors around liquidity, ratings etc.Btw why are companies encouraged to load up on debt? Is that a good or a bad thing?

sidicks said:

edh said:

Wouldn't it be a good idea to have a national balance sheet? Then we could have a more informed discussion about "investment"

Indeed, at the moment we have massive liabilities and minimal assets!I'm old enough to remember several waves of obsession over a single financial measure, whether it's inflation, money supply, balance of trade, exchange rate, deficit or debt. Each time, the other measures seem to shrink from view. Maybe a longer view is required?

We currently owe ~25% of our debt to ourselves, so a make an income on debt repayments.

drainbrain said:

pingu393 said:

drainbrain said:

Socialism beckoning. Maybe not very soon and maybe not Corbyn, but on the horizon. There's a growing demand for it and it won't be long till someone works out how to supply it acceptably.

Socialism comes around in the cycle of politics. It doesn't last two full terms before the voters realise it's not all milk and honey. The exception was New Labour - not surprising as they were really Tory Lite.Labour is the "Let's have a party" party. And the Nasty Party are the ones who have to spoil the fun and find the money to pay for the mess.

When are we expecting this Nasty Party along to sort the 2007 mess? Soon I hope.

Then because we're stupid we'll get rid of them so we can get another mess made by Mr Corbyn et al.

And this is all a cyclical inevitability, is it?

Okay. When's the next BOOM due?

You can abstain and watch the fun from the edge of the room, or you can indulge to the max, spend a small fortune on drink. The money is only left in two places - the pockets of the onlookers or behind the bar. You will never see the money behind the bar ever again, but your sober mates can always pay for your taxi.

In your drunken stupor, you are totally unaware that it was the sober onlookers who cleaned you up, put you in the recovery position and called the ambulance, or paid for your taxi home. On Monday morning, you give the sober ones a ribbing for being boring - then you look outside at the carpark and realise that being boring has it's benefits

.

.I've been on both sides of the scenario, and I know which one is sustainable.

Edited by pingu393 on Monday 27th November 12:35

Edited by pingu393 on Monday 27th November 12:37

edh said:

Well we don't know really... Anyway, buying utilities wouldn't add to the national debt as we'd be acquiring assets of equal value.

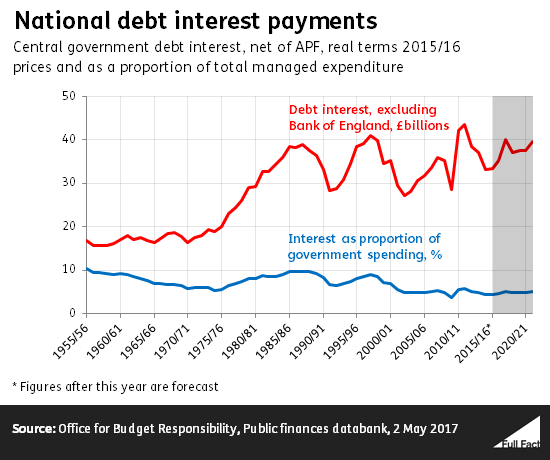

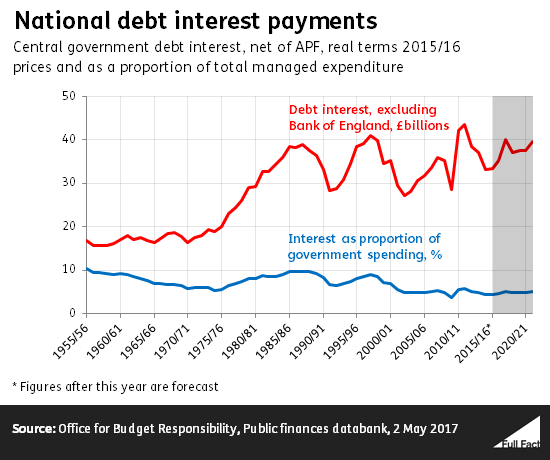

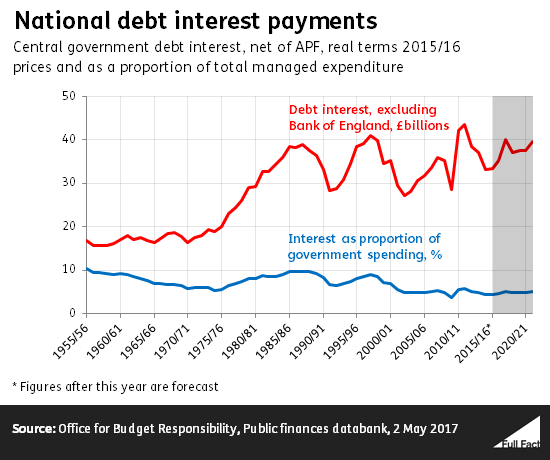

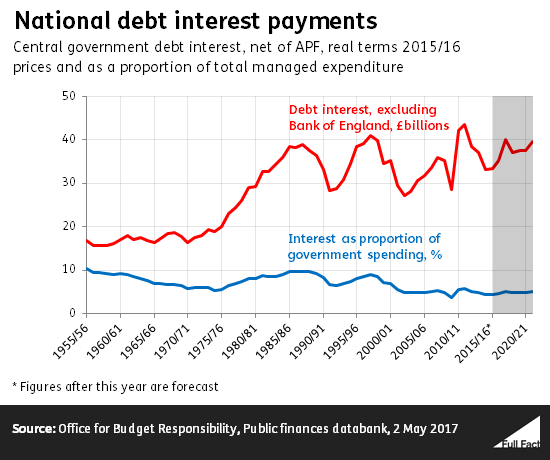

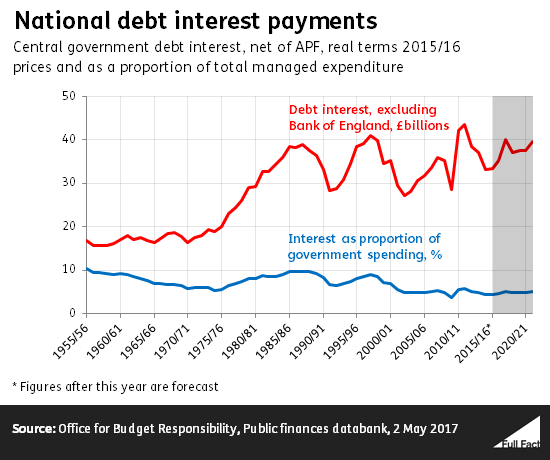

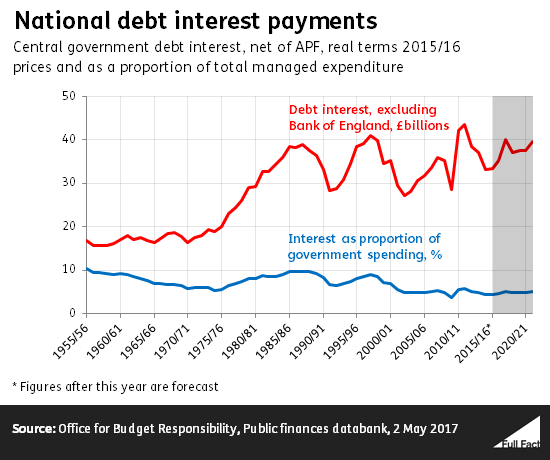

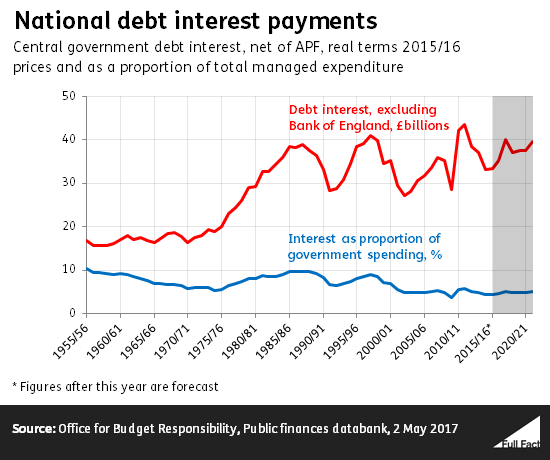

I'm old enough to remember several waves of obsession over a single financial measure, whether it's inflation, money supply, balance of trade, exchange rate, deficit or debt. Each time, the other measures seem to shrink from view. Maybe a longer view is required?

We currently owe ~25% of our debt to ourselves, so a make an income on debt repayments.

Just because you acquire an asset of equal value, doesn't mean you don't add to your debt... the prevailing conditions for each part of the transaction are somewhat independent from that point onwards. We are in an era of favourable interest rates, which allows us to manage the debt level as your graph shows - my fear is when the wind starts blowing the other way...I'm old enough to remember several waves of obsession over a single financial measure, whether it's inflation, money supply, balance of trade, exchange rate, deficit or debt. Each time, the other measures seem to shrink from view. Maybe a longer view is required?

We currently owe ~25% of our debt to ourselves, so a make an income on debt repayments.

egomeister said:

edh said:

Well we don't know really... Anyway, buying utilities wouldn't add to the national debt as we'd be acquiring assets of equal value.

I'm old enough to remember several waves of obsession over a single financial measure, whether it's inflation, money supply, balance of trade, exchange rate, deficit or debt. Each time, the other measures seem to shrink from view. Maybe a longer view is required?

We currently owe ~25% of our debt to ourselves, so a make an income on debt repayments.

Just because you acquire an asset of equal value, doesn't mean you don't add to your debt... the prevailing conditions for each part of the transaction are somewhat independent from that point onwards. We are in an era of favourable interest rates, which allows us to manage the debt level as your graph shows - my fear is when the wind starts blowing the other way...I'm old enough to remember several waves of obsession over a single financial measure, whether it's inflation, money supply, balance of trade, exchange rate, deficit or debt. Each time, the other measures seem to shrink from view. Maybe a longer view is required?

We currently owe ~25% of our debt to ourselves, so a make an income on debt repayments.

Companies borrow money, it is often cheap to do so, and sometimes it will be highly necessary to invest in long term projects or to buy a competitor

So lets consider the example - Company A borrow £10m to buy Company B. Company B then needs to be run in such a way as to pay off the £10m debt. You can say you have an asset of equal value to the liability and balance your book, but that does not repay the loan.

If Labour borrow £300bn to acquire assets those assets CANNOT be used to repay the debt, they are "worth" £300bn but they have to be managed in a way to produce returns to repay the capital outlay. In the future they may be worth £1000bn but it is the revenue they generate that repays the loan.

So in my earlier post, I asked, given the government currently has a UK water company that delivers water at negligible cost, why risk borrowing to acquire it and then be liable for the loan and he ongoing investment and cost to run? Would it pay back ? maybe at 3% interest rate, but how about at 7% ? Maybe at 1bn in net profit per year, but what about at £200m ?

Secondly

You mention we owe 25% of debt to ourselves, well that's true, but it also means 75% of debt isn't ours. If we increase our risk to repay by borrowing a third to a half more money - then that 75% of debt holders may want more than 3% ...

I do agree though that a "national balance sheet" is a good idea, there is one of course, but they tend to fudge it by including "assets" that realistically you can never sell. (Eg Royal Parks)

egomeister said:

Just because you acquire an asset of equal value, doesn't mean you don't add to your debt... the prevailing conditions for each part of the transaction are somewhat independent from that point onwards. We are in an era of favourable interest rates, which allows us to manage the debt level as your graph shows - my fear is when the wind starts blowing the other way...

Whatever the rights and wrongs of it, I have read several opinions (not labour party ones) that state that we will not add to the national debt by nationalising utilities. An accounting convention I think.Graph is long term, very long term. Trying to illustrate my point about getting fixated on one measure.

Tycho said:

egomeister said:

edh said:

Well we don't know really... Anyway, buying utilities wouldn't add to the national debt as we'd be acquiring assets of equal value.

I'm old enough to remember several waves of obsession over a single financial measure, whether it's inflation, money supply, balance of trade, exchange rate, deficit or debt. Each time, the other measures seem to shrink from view. Maybe a longer view is required?

We currently owe ~25% of our debt to ourselves, so a make an income on debt repayments.

Just because you acquire an asset of equal value, doesn't mean you don't add to your debt... the prevailing conditions for each part of the transaction are somewhat independent from that point onwards. We are in an era of favourable interest rates, which allows us to manage the debt level as your graph shows - my fear is when the wind starts blowing the other way...I'm old enough to remember several waves of obsession over a single financial measure, whether it's inflation, money supply, balance of trade, exchange rate, deficit or debt. Each time, the other measures seem to shrink from view. Maybe a longer view is required?

We currently owe ~25% of our debt to ourselves, so a make an income on debt repayments.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff