Another Bank of England warning on debt- Are we doomed?

Discussion

markcoznottz said:

f k patriotic people want roi, and old, exotic, collectable items produced in low numbers have given great yields. Dino in 2009 I understand £35k. Zirp doesn't force a 'better' use of cash, are you a Marxist? Do you talk for other people's money? I'm sure some folks do think it's a game. Inflation forces people to dip into savings, but zirp might not affect older cash and asset rich people who live prudently, and have low debt. They will just but up assets and sit it out, then sell stuff just before the market peaks if they are smart. Money fir old rope.

k patriotic people want roi, and old, exotic, collectable items produced in low numbers have given great yields. Dino in 2009 I understand £35k. Zirp doesn't force a 'better' use of cash, are you a Marxist? Do you talk for other people's money? I'm sure some folks do think it's a game. Inflation forces people to dip into savings, but zirp might not affect older cash and asset rich people who live prudently, and have low debt. They will just but up assets and sit it out, then sell stuff just before the market peaks if they are smart. Money fir old rope.

Er. Ok k patriotic people want roi, and old, exotic, collectable items produced in low numbers have given great yields. Dino in 2009 I understand £35k. Zirp doesn't force a 'better' use of cash, are you a Marxist? Do you talk for other people's money? I'm sure some folks do think it's a game. Inflation forces people to dip into savings, but zirp might not affect older cash and asset rich people who live prudently, and have low debt. They will just but up assets and sit it out, then sell stuff just before the market peaks if they are smart. Money fir old rope.

k patriotic people want roi, and old, exotic, collectable items produced in low numbers have given great yields. Dino in 2009 I understand £35k. Zirp doesn't force a 'better' use of cash, are you a Marxist? Do you talk for other people's money? I'm sure some folks do think it's a game. Inflation forces people to dip into savings, but zirp might not affect older cash and asset rich people who live prudently, and have low debt. They will just but up assets and sit it out, then sell stuff just before the market peaks if they are smart. Money fir old rope. stongle said:

eldar said:

Isn't that what Northern Rock did?

Well they borrowed open, lent at term. But those lending them cash only received a few bps and were wholesale not retail investors. Northern Rock run the maturity transformation risk - which is now regulatory not possible. Those asking for near 2 or even 5% yield on cash depots either need to take significantly more risk or deposit it for matched maturity - 25years. The level of financial acumen and understanding of risk versus return of some here is a joke.

fblm said:

ATG said:

Risk of a bit of pot/kettle here given that most UK mortgages are floating rate loans so the term to maturity is not the determinant of the rate.

Do you think 3m LIBOR compounded with 3m LIBOR starting in 3 months will give you 6m LIBOR?Unless I mis-read it, Strongle said it's silly to think you'll get a rate on a deposit that is comparable to the rate you'll pay on a mortgage because the mtge has, say, a 25yr term while the deposit is going to be overnight to a few months. But most mortgages are floating rate, so the 25 yr term is irrelevant. The reset frequency determines the interest rate risk of the mtge to the lender, not the term. If there's a term mismatch between the reset period and the reference rate used to calculate the refix then the lender is going to charge you for the curve risk in the spread over the reference rate, but BoE repo + the cost of the hedge is going to be a damn sight closer to the reset term's LIBOR than it is to 25 yr fixed.

If your mtge resets annually it is perfectly reasonable to compare your mtge rate to a 12mth fixed deposit rate. That'd make a lot more sense than comparing the mtge rate to the YTM offered by a 25yr fixed coupon bond or a 25yr deposit, if you could find one.

mike74 said:

Loving all the over leveraged, feckless, debt junkies on this thread making predictions of what will happen based on what they hope will happen.

10 year uk money is at 1.23%. That's factual not hopeful. It can of course change, but I would not be betting it in the short term.ATG said:

fblm said:

ATG said:

Risk of a bit of pot/kettle here given that most UK mortgages are floating rate loans so the term to maturity is not the determinant of the rate.

Do you think 3m LIBOR compounded with 3m LIBOR starting in 3 months will give you 6m LIBOR?ATG said:

If your mtge resets annually it is perfectly reasonable to compare your mtge rate to a 12mth fixed deposit rate.

Of course you can compare it but it would still have to be a healthy premium over it. As a lender what would you rather do: lend for 12 months and decide again in 12 months if you want to make the loan again or lend for 25 years. Which loan would you charge more for; a loan with an annual break clause or a straight 25 year loan? Stongle was absolutely right that to receive safe mortgage rate returns for cash you'd have to look for a fixed term investment of similar duration, obviously; that's exactly what a mortgage is in reverse. (Don't get hung up on fixed vs floating; the 2 cash flows are interchangable with a swap of zero NPV). The long and short of it is you're very unlikely to get 5% returns for cash any time soon. >10 years IMO. I do hope I'm wrong though, I've got more cash that I know how to invest.ATG said:

Digga said:

I think there were factors a year or so back - not least the referendum - which would almost definitely have caused consumer activity, and theerefore the accrual of consumer debt, to be subdued. It is not, therefore, totally surprising to see the year-on-year increase as people decide the sky is not actually (despite what project fear said) going to fall in.

I'm afraid you've got that exactly the wrong way round.The reason why economists thought a Leave vote would trigger an economic slowdown in the next few months after the referendum was because they expected consumers would immediately become more cautious. That didn't happen. Consumers continued spending. That unsustainable debt-financed consumer spending is what has propped the economy up in spite of the Leave vote.

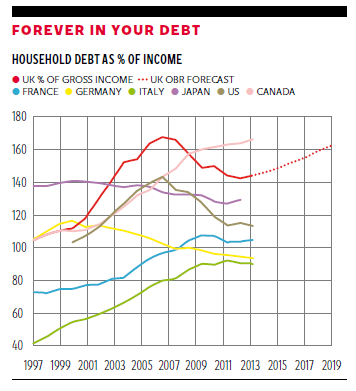

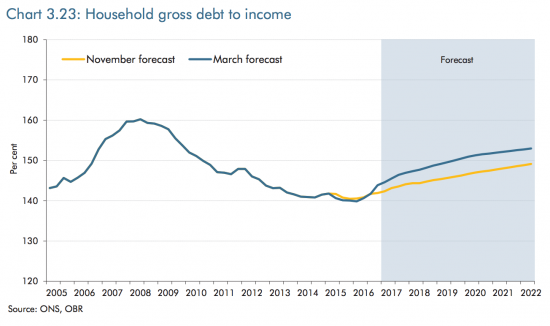

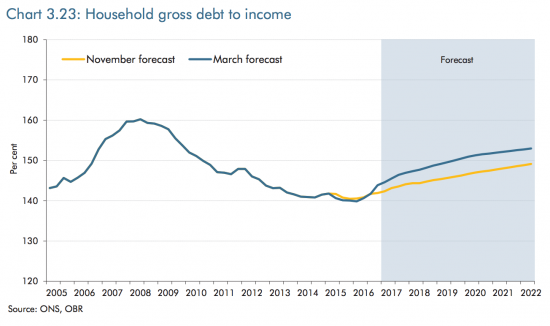

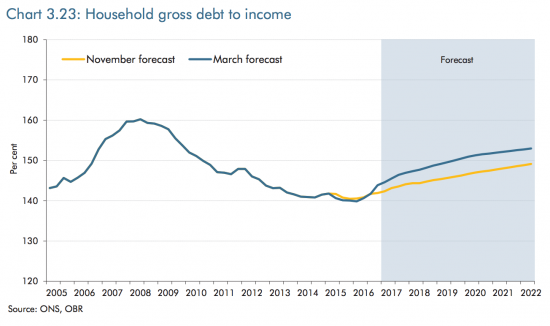

They're still off their pre-crunch peak though:

Digga said:

Looking at the charts, you're right, consumer debt increase barely checked - I must have succumbed to Project Fear to assume it had - throughout Brexit.

They're still off their pre-crunch peak though:

On what basis is the OBR forecasting its dotted line?They're still off their pre-crunch peak though:

It would be interesting to see what it's forecasts were in the previous years to see how good their modellers are...

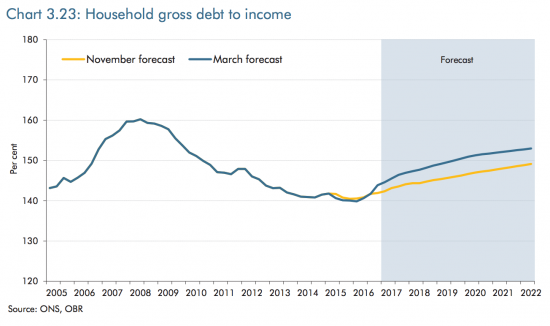

More charts / OBR forecasts and analysis here, including the latest - March 2017 forecast

http://www.taxresearch.org.uk/Blog/2017/07/26/the-...

http://www.taxresearch.org.uk/Blog/2017/07/26/the-...

edh said:

More charts / OBR forecasts and analysis here, including the latest - March 2017 forecast

http://www.taxresearch.org.uk/Blog/2017/07/26/the-...

Just looking at the left hand side of those charts, especially when you take a longer period, makes me think their modelling is nowhere near sophisticated enough. Possibly as it can't be modelled with any degree of accuracy. http://www.taxresearch.org.uk/Blog/2017/07/26/the-...

Makes you wonder why they bother (at least with trying to forecast long range).

fblm said:

tannhauser said:

crankedup said:

Wait Here Until Green Light Shows said:

I really hope interest rates start climbing soon - it's about time those of us who have been sensible with money start seeing some benefit.

5% would be nice please.

That would be nice, make a change from seeing cash savings devalue.5% would be nice please.

king overdue

king overdue

crankedup said:

Currently that is the situation. However, cash is always. handy for when the plumbing goes wrong, or the car. Cash is king, save 20% at a stroke, not that I would ever dream of such a thing

It only ever produces a derisory real return at the best of times (the return above inflation). Otherwise I agree cash savings are their own reward. There's no right answer, it's partly philosophical as to how you view 'money' as a store of value or a convenient medium for exchange. Personally I lean toward the latter.If Britain is sitting on a debt timebomb, we must be buggered down here https://www.finder.com.au/australias-personal-debt...

BlackLabel said:

the thing is they all know it is going on, debt is not the issue it is the growth in the economy that is the issue, growth is not as good as it should be so they are angling to increase interest rates as way to simulate growth in a roundabout way. Basically make it more profitable for banks to make money lending, more in mortgages and try and move the debt sideways from leases to houses..The Spruce goose said:

.... growth is not as good as it should be so they are angling to increase interest rates as way to simulate growth in a roundabout way. Basically make it more profitable for banks to make money lending....

This is confused. Higher rates lead to less borrowing, more saving and lower growth. Secondly banks don't make money from higher rates as such, they make considerably more money from a steep yield curve ie low short rates higher term rates. Raising rates causes the curve to flatten.fblm said:

The Spruce goose said:

.... growth is not as good as it should be so they are angling to increase interest rates as way to simulate growth in a roundabout way. Basically make it more profitable for banks to make money lending....

This is confused. Higher rates lead to less borrowing, more saving and lower growth. Secondly banks don't make money from higher rates as such, they make considerably more money from a steep yield curve ie low short rates higher term rates. Raising rates causes the curve to flatten.Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff