Brexit - 35% House Prices Crash

Discussion

donkmeister said:

A drop of that magnitude would be brilliant for many people and for many reasons but only if it isn't accompanied by a huge increase in people defaulting on mortgages as a result.

It would however upset a lot of friends and colleagues who have remortgaged to pay for holidays and toys, and also those who are mortgaged to the hilt to get the absolute maximum house they can stretch to.

The one who have mortgaged to the hilt are unaffected by falling house prices; what they will be affected by are rising interest rates. It would however upset a lot of friends and colleagues who have remortgaged to pay for holidays and toys, and also those who are mortgaged to the hilt to get the absolute maximum house they can stretch to.

oyster said:

Which people would it be brilliant for?

If you have a house you lose a ton of money.

If you have a job you might well lose it, or have your income fall or flatline.

...

Don't forget for those wanting to "climb the ladder" who need to sell their current home; they need no one else in the chain to suffer from the wider financial fall out either. Such a large drop and the inevitable recession is good for very few people except patient cash rich investors and those who don't need to sell their current home to trade up. Most of those wishing it are likely to be disappointed. If you have a house you lose a ton of money.

If you have a job you might well lose it, or have your income fall or flatline.

...

Jimboka said:

Is now a good time to sell my house, for say 600K

Rent

Then buy a house priced currently at around 900K for 600K in a year or two?

I wonder what the chances are

Isn’t the bank capital stress calibrated to a 99.9% downside scenario?Rent

Then buy a house priced currently at around 900K for 600K in a year or two?

I wonder what the chances are

Edited by sidicks on Monday 17th September 21:19

Jimboka said:

Is now a good time to sell my house, for say 600K

Rent

Then buy a house priced currently at around 900K for 600K in a year or two?

I wonder what the chances are

Much better to sell your 600k house now buy a 200k one and sell that in two years time to buy a 1000k one in two years...Rent

Then buy a house priced currently at around 900K for 600K in a year or two?

I wonder what the chances are

Atomic12C said:

budgie smuggler said:

Define 'quickly'.

We bought for £183k in 2007 and sold for £152k in 2014.

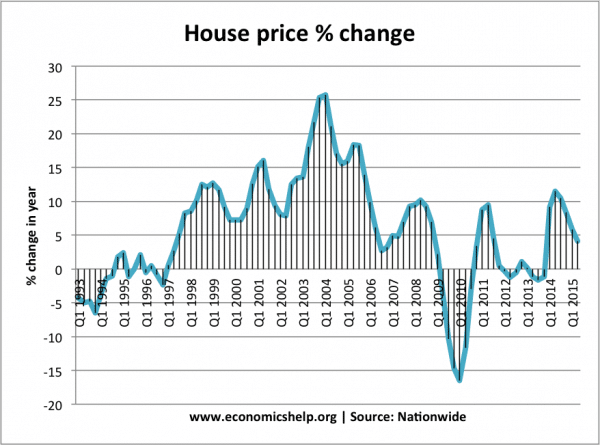

Well this was linked in another thread regarding this issue.... which suggests the worst of it lasted only about about 1 year.We bought for £183k in 2007 and sold for £152k in 2014.

Sure, "quickly" is a subjective term.

I did all the balance sheet and P&L modelling for a mortgage lender from 2011 to 2013, some parts of the UK fell close to 40% in 2008 and hadn't improved much by the end of 2013...probably still haven't.

eta

Edited by CaptainSlow on Monday 17th September 21:45

untakenname said:

I think you would have to be completely moronic to buy a house in this current climate, would need to wait until at least 2020 to see how hard the break with the EU is going to be.

Section 24 is also finally starting to bite, there's now lots of ex BTL coming to market which only held it's perceived value due to other BTL landlords.

I recall perusing the truly tragic housepricecrash.co.uk in the mid 2000s or so. One little fella piped up about being offered a right to buy in London for about 90 grand. Section 24 is also finally starting to bite, there's now lots of ex BTL coming to market which only held it's perceived value due to other BTL landlords.

Poster after poster poured in with 'forget it son, the ponzi is coming to an end'.

Didn't really pan out like that, though this would be a vastly healthier country if it had.

I have recently purchased a property - reckon I would lose 10% at least if I had to sell it now, before even SDLT. That's more a state of the market I think - huge spreads and illiquidity. 35% - maybe on overpriced HelpToSell new builds but I can't see it happening with sought after properties. E.g. take your average semi-detached near a station in Greater London for £600k. it's not going to lose £200k - just won't happen - dream on.

I personally wouldn't mind a slow reduction in house prices, or a long period of stagnation/slow growth. If it makes it easier for my kids to get on the ladder, I'll be happy enough. Don't think a complete crash is much good for anyone though.

But Carney must have known that his words, thinly disguised as worst case scenario, would have created a moment of alarm. Personally, I think Carney is the modern day joker

But Carney must have known that his words, thinly disguised as worst case scenario, would have created a moment of alarm. Personally, I think Carney is the modern day joker

kambites said:

Healthcare is expensive, especially if you want it to work. The UK's overall expenditure on healthcare per capita is about average for Europe (which makes it on the low side for western Europe) and massively lower than the USA.

Healthcare is expensive, especially if you want it to work. The UK's overall expenditure on healthcare per capita is about average for Europe (which makes it on the low side for western Europe) and massively lower than the USA. People love to claim the NHS is poor value for money but the figures don't really back that up.

Edited by kambites on Monday 17th September 11:48

Acute is, overall, superb; the rest

leaving people unable to work for a year, or allowing their condition to become CHRONIC is nothing more than short term failure that WILL cost the NHS more in the long term....but that is the issue with the NHS-lack of LONG TERM sustainable management policies.

leaving people unable to work for a year, or allowing their condition to become CHRONIC is nothing more than short term failure that WILL cost the NHS more in the long term....but that is the issue with the NHS-lack of LONG TERM sustainable management policies.35% house crash...

Is this because the supply exceeds demand all of a sudden and we are now building 100k new houses in London to accommodate?

No... Oh...

Was told there would be a crash last time when I bought just before the crash in 2007, in reality my house took 3 years to go up 10% but it didnt lose any money at all.

Might be different in the surrounding areas, but I cant see if ever dropping by 35% and if it does Im still up, plus have cash ready for the next on in Mrach if it does

Is this because the supply exceeds demand all of a sudden and we are now building 100k new houses in London to accommodate?

No... Oh...

Was told there would be a crash last time when I bought just before the crash in 2007, in reality my house took 3 years to go up 10% but it didnt lose any money at all.

Might be different in the surrounding areas, but I cant see if ever dropping by 35% and if it does Im still up, plus have cash ready for the next on in Mrach if it does

Christmassss said:

Hitch said:

People see those as essential expenditure. They'll just eat and drink out less as they watch 'made to binge' s te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.

te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.

I watched a program on Channel 4 about people on the 'breadline' - food vouchers and all - They had 2 massive tv's on opposite sides of the living room. One with a sky subscription and one with a virgin subscription. te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.

te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.I bet your praying house prices don’t fall too far or one of us poor people might be able to afford one!

I’ll crawl back to my council house now as I’m clearly not welcome here.

Nick1876 said:

Christmassss said:

Hitch said:

People see those as essential expenditure. They'll just eat and drink out less as they watch 'made to binge' s te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.

te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.

I watched a program on Channel 4 about people on the 'breadline' - food vouchers and all - They had 2 massive tv's on opposite sides of the living room. One with a sky subscription and one with a virgin subscription. te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.

te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.I bet your praying house prices don’t fall too far or one of us poor people might be able to afford one!

I’ll crawl back to my council house now as I’m clearly not welcome here.

There's probably something worth watching on the tellys

amusingduck said:

Nick1876 said:

Christmassss said:

Hitch said:

People see those as essential expenditure. They'll just eat and drink out less as they watch 'made to binge' s te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.

te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.

I watched a program on Channel 4 about people on the 'breadline' - food vouchers and all - They had 2 massive tv's on opposite sides of the living room. One with a sky subscription and one with a virgin subscription. te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.

te on their massive BrightHouse TVs whilst burning their furniture on their financed log burner and slowly pickling themselves on gin flavoured prosecco from Aldi.I bet your praying house prices don’t fall too far or one of us poor people might be able to afford one!

I’ll crawl back to my council house now as I’m clearly not welcome here.

There's probably something worth watching on the tellys

Must be different where I live (central Scotland).

I've paid my mortgage off, looking to move into a larger property, checking sites 10-20 times a day and stuff is going in 24 hours. Properties I am going to see have 5-7 viewers the next day.

That said the market is very, very sparse up here just now, I must check sites 20 times a day and very few people are selling just now, meaning people on the link are holding off as well. If i was an estate agent I'd be tarting up the CV.

I've paid my mortgage off, looking to move into a larger property, checking sites 10-20 times a day and stuff is going in 24 hours. Properties I am going to see have 5-7 viewers the next day.

That said the market is very, very sparse up here just now, I must check sites 20 times a day and very few people are selling just now, meaning people on the link are holding off as well. If i was an estate agent I'd be tarting up the CV.

Nick1876 said:

You mean you watched a programme about poor people, don’t worry I’m sure you’ll never have to meet one in real life.

I bet your* praying house prices don’t fall too far or one of us poor people might be able to afford one!

I’ll crawl back to my council house now as I’m clearly not welcome here.

you'reI bet your* praying house prices don’t fall too far or one of us poor people might be able to afford one!

I’ll crawl back to my council house now as I’m clearly not welcome here.

I spent the majority of my youth on a council estate (Hesters way in Cheltenham for any of you local people).

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff