Mansion Tax and Raid on Pensions

Discussion

oyster said:

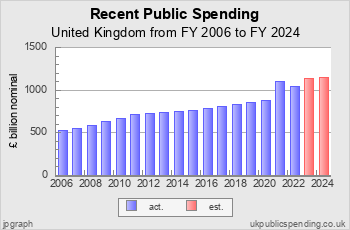

Be interesting to see the same graph if you stripped out the following:

1. Inflation

1. Inflation

oyster said:

2. Population growth

See above, also...

oyster said:

3. Debt repayments.

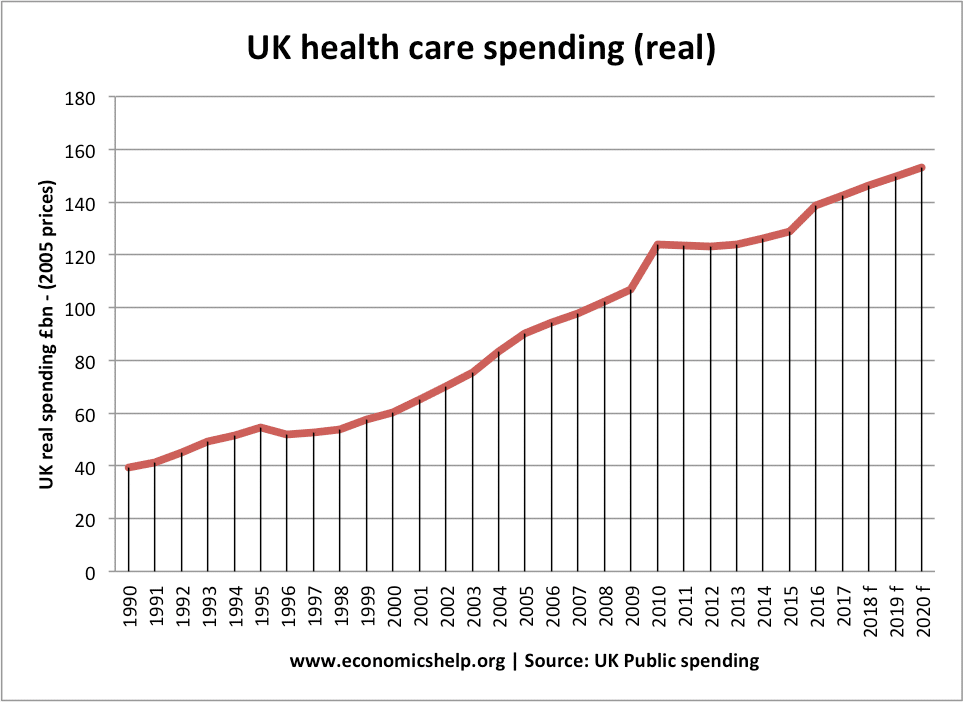

huh?Here's the deal; health care spending has increased, it has increased more than inflation, it has increased more than inflation AND the population. Real, per capita health care spending has increased over the last decade. In addition the population is aging and healthcare costs are increasing; there have been no funding cuts however you care to spin it but the costs are increasing even faster. In economic terms the NHS has become less productive faster than the increase in real per capita spending.

Edited by anonymous-user on Tuesday 11th February 15:01

Terminator X said:

"raise more tax from better-off homeowners"

I'll bet 99% of them live in the SE or London and 99% of that lot either worked f king hard or sacrificed a lot to earn their home vs 1% who inherited it. Tax the rich, always ends well.

king hard or sacrificed a lot to earn their home vs 1% who inherited it. Tax the rich, always ends well.

TX.

Which is why capital gains on principal private residence might be a way forward. You're not taxing hard work or effort - you are merely taxing the unearned gain.I'll bet 99% of them live in the SE or London and 99% of that lot either worked f

king hard or sacrificed a lot to earn their home vs 1% who inherited it. Tax the rich, always ends well.

king hard or sacrificed a lot to earn their home vs 1% who inherited it. Tax the rich, always ends well.TX.

oyster said:

Which is why capital gains on principal private residence might be a way forward. You're not taxing hard work or effort - you are merely taxing the unearned gain.

Which, like stamp duty, immobilises your workforce and decreases economic productivity. It's a bad tax. I don't like it one bit but annual wealth tax makes more sense.fblm said:

oyster said:

Be interesting to see the same graph if you stripped out the following:

1. Inflation

1. Inflation

oyster said:

2. Population growth

See above, also...

oyster said:

3. Debt repayments.

huh?Here's the deal; health care spending has increased, it has increased more than inflation, it has increased more than inflation AND the population. Real, per capita health care spending has increased over the last decade. In addition the population is aging and healthcare costs are increasing; there have been no funding cuts however you care to spin it but the costs are increasing even faster. In economic terms the NHS has become less productive faster than the increase in real per capita spending.

Edited by fblm on Tuesday 11th February 15:01

Notwithstanding, surely the light green line is the only relevant line, as it reflects demand, only reached back up to 100% 2015-2016.

Where are the figures from the start of 2000 so we can see a sensible period trend?

Nickgnome said:

As I read that the graph takes absolutely no cognisance of the year on year increased cost due to the advancement of and technology medicine as I said before it used to be 3%. We can do more so we do.

Notwithstanding, surely the light green line is the only relevant line, as it reflects demand, only reached back up to 100% 2015-2016.

Where are the figures from the start of 2000 so we can see a sensible period trend?

I'm saying funding has gone up and costs have gone up even more. You're telling me costs have gone up more. I know. You can tell I know by reading what I wrote.Notwithstanding, surely the light green line is the only relevant line, as it reflects demand, only reached back up to 100% 2015-2016.

Where are the figures from the start of 2000 so we can see a sensible period trend?

fesuvious said:

Property over £1.5m is proving difficult to shift already, andd over £2m exceptionally difficult. Estate Agents at this end will be crying out 'FFS!' when they wake up to this today.

Oh dear. Property in this bracket is clearly over priced then and would be shifted more easily if it was reduced and made more affordable to more people. I honestly have no sympathy for anyone who feels shafted if they are not achieving this sort of value for their property. Asset prices (including housing and property) can go up or down, we've over the recent past fooled ourselves into thinking property can only ever be a one way bet, with those at the bottom feeling the pain for it. About time there was some reversal and if people loose their shirt as a result of being over-borrowed to be in one of those properties, well, doesn't feel nice does it. fblm said:

Nickgnome said:

As I read that the graph takes absolutely no cognisance of the year on year increased cost due to the advancement of and technology medicine as I said before it used to be 3%. We can do more so we do.

Notwithstanding, surely the light green line is the only relevant line, as it reflects demand, only reached back up to 100% 2015-2016.

Where are the figures from the start of 2000 so we can see a sensible period trend?

I'm saying funding has gone up and costs have gone up even more. You're telling me costs have gone up more. I know. You can tell I know by reading what I wrote.Notwithstanding, surely the light green line is the only relevant line, as it reflects demand, only reached back up to 100% 2015-2016.

Where are the figures from the start of 2000 so we can see a sensible period trend?

We may agree but the government has not kept pace. I make no comment on whether they were able, just that as an individual patient the service you are likely receive has unfortunately slipped back and the attrition rate of staff due to pressure is worryingly high.

oyster said:

Terminator X said:

"raise more tax from better-off homeowners"

I'll bet 99% of them live in the SE or London and 99% of that lot either worked f king hard or sacrificed a lot to earn their home vs 1% who inherited it. Tax the rich, always ends well.

king hard or sacrificed a lot to earn their home vs 1% who inherited it. Tax the rich, always ends well.

TX.

Which is why capital gains on principal private residence might be a way forward. You're not taxing hard work or effort - you are merely taxing the unearned gain.I'll bet 99% of them live in the SE or London and 99% of that lot either worked f

king hard or sacrificed a lot to earn their home vs 1% who inherited it. Tax the rich, always ends well.

king hard or sacrificed a lot to earn their home vs 1% who inherited it. Tax the rich, always ends well.TX.

Presumably if houses come under attack people will just switch to renting instead?

TX.

fesuvious said:

biggles330d said:

fesuvious said:

Property over £1.5m is proving difficult to shift already, andd over £2m exceptionally difficult. Estate Agents at this end will be crying out 'FFS!' when they wake up to this today.

Oh dear. Property in this bracket is clearly over priced then and would be shifted more easily if it was reduced and made more affordable to more people. I honestly have no sympathy for anyone who feels shafted if they are not achieving this sort of value for their property. Asset prices (including housing and property) can go up or down, we've over the recent past fooled ourselves into thinking property can only ever be a one way bet, with those at the bottom feeling the pain for it. About time there was some reversal and if people loose their shirt as a result of being over-borrowed to be in one of those properties, well, doesn't feel nice does it. I suggest you do proper research. Start with Liam Halligans book 'Home Truths'.

And to address my post in context, if you suppress the top it will hold down property below. Stated as a fact, I unlike you don't have the bitterness so be personally angry at people in houses more expensive than my own.

Long term it will benefit the U.K.

fblm said:

oyster said:

Which is why capital gains on principal private residence might be a way forward. You're not taxing hard work or effort - you are merely taxing the unearned gain.

Which, like stamp duty, immobilises your workforce and decreases economic productivity. It's a bad tax. I don't like it one bit but annual wealth tax makes more sense.Nickgnome said:

fesuvious said:

biggles330d said:

fesuvious said:

Property over £1.5m is proving difficult to shift already, andd over £2m exceptionally difficult. Estate Agents at this end will be crying out 'FFS!' when they wake up to this today.

Oh dear. Property in this bracket is clearly over priced then and would be shifted more easily if it was reduced and made more affordable to more people. I honestly have no sympathy for anyone who feels shafted if they are not achieving this sort of value for their property. Asset prices (including housing and property) can go up or down, we've over the recent past fooled ourselves into thinking property can only ever be a one way bet, with those at the bottom feeling the pain for it. About time there was some reversal and if people loose their shirt as a result of being over-borrowed to be in one of those properties, well, doesn't feel nice does it. I suggest you do proper research. Start with Liam Halligans book 'Home Truths'.

And to address my post in context, if you suppress the top it will hold down property below. Stated as a fact, I unlike you don't have the bitterness so be personally angry at people in houses more expensive than my own.

Long term it will benefit the U.K.

Of course you do...…..you'll be pretending you own a fancy boat next!

Of course you do...…..you'll be pretending you own a fancy boat next!fblm said:

oyster said:

Be interesting to see the same graph if you stripped out the following:

1. Inflation

1. Inflation

oyster said:

2. Population growth

See above, also...

oyster said:

3. Debt repayments.

huh?Here's the deal; health care spending has increased, it has increased more than inflation, it has increased more than inflation AND the population. Real, per capita health care spending has increased over the last decade. In addition the population is aging and healthcare costs are increasing; there have been no funding cuts however you care to spin it but the costs are increasing even faster. In economic terms the NHS has become less productive faster than the increase in real per capita spending.

Edited by fblm on Tuesday 11th February 15:01

And I actually agree with the points you’re making.

The problem is I was responding to a post with a graph of total public spending - you then focussed on health spending only.

My original point stands:

If you stripped out debt repayments and inflation, how would UK public service spending per capita compare now with 2010?

Nickgnome said:

I am saying the demand through population increase and the ageing of that population combined with the advancement cost has exceeded the increase in funds.

We may agree but the government has not kept pace. I make no comment on whether they were able, just that as an individual patient the service you are likely receive has unfortunately slipped back and the attrition rate of staff due to pressure is worryingly high.

Every interaction I've had with the NHS has been decent.We may agree but the government has not kept pace. I make no comment on whether they were able, just that as an individual patient the service you are likely receive has unfortunately slipped back and the attrition rate of staff due to pressure is worryingly high.

A fundamental shift in what it tries to achieve is needed. Not more and more money being thrown into the pit. That is not the answer.

The same goes for all public spending.

But this is a matter of philosophy. Big versus Small government.

Personally I think Big government hurts most those it purports to want to look after most.

As for house price cuts helping the country long term, I'm not sure I'm convinced. Not really bothered either way as our primary residence is our home, not an investment. I'm not convinced house prices across the UK are universally a problem. In some areas, definitely. But think that could well sort itself out if allowed to.

wisbech said:

Mr Whippy said:

It won’t go imo. It’ll be adjusted so that the owner needs to farm it, claim the subsidy, have it as his occupation, not have it under an FBTA etc.

Ie. A farmer passing on the farm will get relief, sensible.

Stuff like contractors working like full time employees to avoid NI, now checked using a ‘sniff test’ type system.

All we need is sensible tweaks to reliefs and incentives to avoid them being abused.

You don’t need to raise taxes, or ‘cut’ reliefs etc, you just need to cut out the billions £££ of abuse.

Already covered by IHT gift rules though. Farmer passes on farm when they retire, as long as they live 7 years, no IHT. Why treat it any differently to, say a garage owner passing on a petrol station?Ie. A farmer passing on the farm will get relief, sensible.

Stuff like contractors working like full time employees to avoid NI, now checked using a ‘sniff test’ type system.

All we need is sensible tweaks to reliefs and incentives to avoid them being abused.

You don’t need to raise taxes, or ‘cut’ reliefs etc, you just need to cut out the billions £££ of abuse.

Plus quite often the farm is their home.

Passing it on effectively could be complicated.

I do get and appreciate your point though.

We probably need to end up there... but as a starting point APR needs to be made to reflect it’s original intended purpose, then if it’s still an issue remove it altogether.

Mr Whippy said:

Farmers who are the type to pass on their farms don’t retire though.

Plus quite often the farm is their home.

Passing it on effectively could be complicated.

I do get and appreciate your point though.

We probably need to end up there... but as a starting point APR needs to be made to reflect it’s original intended purpose, then if it’s still an issue remove it altogether.

True. But in this case, their heir is probably already in their 50s and has had to had a career in something other than farming. Unlikely that they would then want to move to rural area and start farming vs sell up and take the cash. Plus quite often the farm is their home.

Passing it on effectively could be complicated.

I do get and appreciate your point though.

We probably need to end up there... but as a starting point APR needs to be made to reflect it’s original intended purpose, then if it’s still an issue remove it altogether.

wisbech said:

True. But in this case, their heir is probably already in their 50s and has had to had a career in something other than farming. Unlikely that they would then want to move to rural area and start farming vs sell up and take the cash.

Not necessarily.I know of some who worked on the farm with their parents. If one of the offspring want to go into the vocation I suspect that will be the case more often than not.

Becoming less dependent on food imports is something I would support in this country. But I suspect that ship sailed a long time ago.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff