Crypto Currency Thread

Discussion

Behemoth said:

No idea. That said, I certainly wouldn't want to run a business or a household reliant on cashflow that TSB broke, insured or otherwise. I wouldn't dismiss catastrophic failures like the TSB IT upgrade just because customers will get their money back, eventually.

Equally you may not want to run your business off a Trezor/Nano dongle that you can lose/have stolen or lose the password to. In fact there are no cold wallets for a lot of Cryptos so then you'll have to rely on third party websites or your hard drive. ATM I'd say a bank is the safer bet. That may change.

Mousem40 said:

Equally you may not want to run your business off a Trezor/Nano dongle that you can lose/have stolen or lose the password to. In fact there are no cold wallets for a lot of Cryptos so then you'll have to rely on third party websites or your hard drive.

ATM I'd say a bank is the safer bet. That may change.

I think most people will still use banks, even if Bitcoin takes off, as they will evolve to accommodate custodial needs. My comment on TSB was just a quip & to point out they're not as rock solid as many think.ATM I'd say a bank is the safer bet. That may change.

Behemoth said:

I think most people will still use banks, even if Bitcoin takes off, as they will evolve to accommodate custodial needs. My comment on TSB was just a quip & to point out they're not as rock solid as many think.

I know  My point, and I think an inflection point will be, when custodial services really take off (they are starting to now) which will allow institutional investors to pile in, and make life a whole lot easier for the average person too. Transactions won't be so cumbersome or risky.

My point, and I think an inflection point will be, when custodial services really take off (they are starting to now) which will allow institutional investors to pile in, and make life a whole lot easier for the average person too. Transactions won't be so cumbersome or risky. coyft said:

I can't see it ever competing with Visa, direct debit, cash or online banking. Not unless their is a run on a currency or the banking institutions are under threat. Which of course I wouldn't rule out, perhaps that is where the value lies, a hedge against financial collapse.

Even then though, are people going to run and try and get to safety by choosing a speculative instrument that is the wild west? Even the proven safety of gold dips when a crash happens, before generally recovering more quickly than other stuff.Behemoth said:

NickCQ said:

What was the magnitude of TSB depositors' uninsured losses?

No idea. That said, I certainly wouldn't want to run a business or a household reliant on cashflow that TSB broke, insured or otherwise. I wouldn't dismiss catastrophic failures like the TSB IT upgrade just because customers will get their money back, eventually.This wouldnt happen with money in the bank, now would it? (FYI dated yesterday)

https://www.theguardian.com/technology/2018/jun/11...

Mousem40 said:

I know  My point, and I think an inflection point will be, when custodial services really take off (they are starting to now) which will allow institutional investors to pile in, and make life a whole lot easier for the average person too. Transactions won't be so cumbersome or risky.

My point, and I think an inflection point will be, when custodial services really take off (they are starting to now) which will allow institutional investors to pile in, and make life a whole lot easier for the average person too. Transactions won't be so cumbersome or risky.

A custodial service? You mean, like a bricks and mortar shop where you can deposit your money, for free? In fact, the custodial service will even pay you for giving them your money! In return for giving you money they will also insure it is safe, up to £85k, and you can be sure its safe because the government inspects and regulates the entity?  My point, and I think an inflection point will be, when custodial services really take off (they are starting to now) which will allow institutional investors to pile in, and make life a whole lot easier for the average person too. Transactions won't be so cumbersome or risky.

My point, and I think an inflection point will be, when custodial services really take off (they are starting to now) which will allow institutional investors to pile in, and make life a whole lot easier for the average person too. Transactions won't be so cumbersome or risky. Sounds a lot like a bank to me.

But I bet no bitcoin custodian is going to pay you to leave your bitcoins there.....

But I bet no bitcoin custodian is going to pay you to leave your bitcoins there.....See - I honestly dont understand it. And as for Dimonts, who suggested I go and read a paper written by the developers of bitcoin about how its going to change the world 'for gods sake think for yourself before believing what you read'. You might be right (or rather, he might be right) and its going to be the future. But a market is made of people with differing opinions. How about we do a swop? Say today's price is $6700, in 6 months time whatever the price is we'll pay the difference. If it goes up, I'll pay you the extra, if it goes down, you pay me the difference?

Condi said:

A custodial service? You mean, like a bricks and mortar shop where you can deposit your money, for free? In fact, the custodial service will even pay you for giving them your money! In return for giving you money they will also insure it is safe, up to £85k, and you can be sure its safe because the government inspects and regulates the entity?

Sounds a lot like a bank to me. But I bet no bitcoin custodian is going to pay you to leave your bitcoins there.....

But I bet no bitcoin custodian is going to pay you to leave your bitcoins there.....

Yes, well done, a bank (I've already said this directly at least a couple of times in this thread, by the way). Some Bitcoin custodians already pay you to leave it there & I've already benefited from the service.Sounds a lot like a bank to me.

But I bet no bitcoin custodian is going to pay you to leave your bitcoins there.....

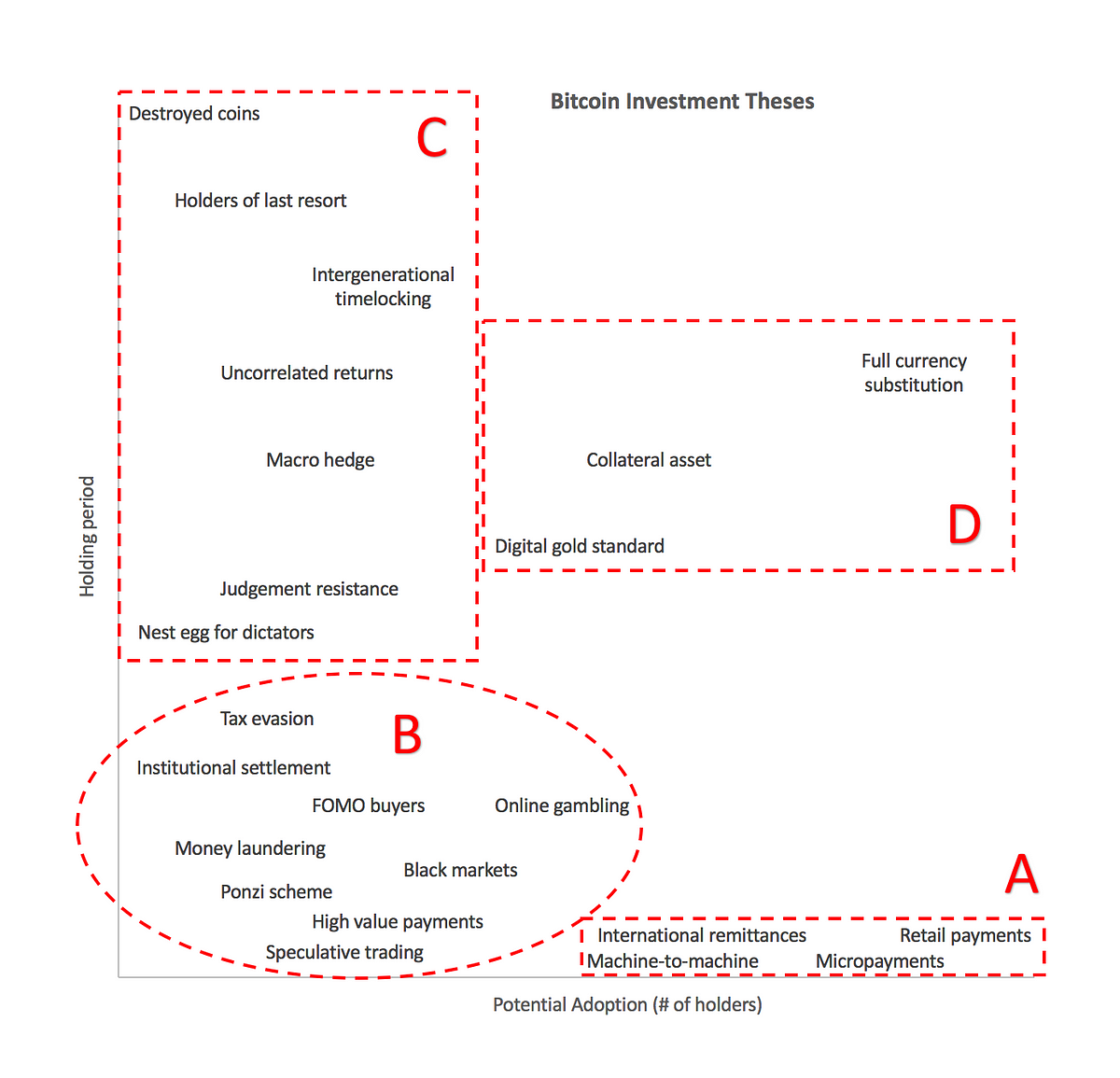

But I bet no bitcoin custodian is going to pay you to leave your bitcoins there..... This illustrates the full spectrum of beliefs about what Bitcoin is for and where it might go:

It comes from this useful summary published a few days ago: https://medium.com/@pierre_rochard/bitcoin-investm...

Condi said:

See - I honestly dont understand it. And as for Dimonts, who suggested I go and read a paper written by the developers of bitcoin about how its going to change the world 'for gods sake think for yourself before believing what you read'. You might be right (or rather, he might be right) and its going to be the future. But a market is made of people with differing opinions. How about we do a swop? Say today's price is $6700, in 6 months time whatever the price is we'll pay the difference. If it goes up, I'll pay you the extra, if it goes down, you pay me the difference?

Sure we can do that. See you in six months.Fun way to try out bitcoin micro payments! Requires a lightning wallet - EDIT: try https://htlc.me

https://www.reddit.com/r/Bitcoin/comments/8pm96j/p...

https://satoshis.place

https://www.reddit.com/r/Bitcoin/comments/8pm96j/p...

https://satoshis.place

Edited by dimots on Tuesday 12th June 23:28

Here's a good illustration of why it's stupid to think a blockchain can be used for anything involving authenticity or identity (which rules out a lot of use cases being bandied about boardrooms) https://shkspr.mobi/blog/2018/06/how-i-became-leon...

Behemoth said:

Here's a good illustration of why it's stupid to think a blockchain can be used for anything involving authenticity or identity (which rules out a lot of use cases being bandied about boardrooms) https://shkspr.mobi/blog/2018/06/how-i-became-leon...

No, that is possible in certain circumstances from reading it. For example wine/whisky etc you have the QR code seal stuck over the cork. If you see the QR code is damaged, then it makes it a lot more suspicious.Maybe there is ways around that, but it's better than the nothing we have now.

(Of course some people will be on the bandwagon to rip people off, but you are usually one of the first to point out possibilities of some of this as it could develop further).

coyft said:

I can see uses for smart contracts in the insurance industry.

Take flight delay insurance for example. There are databases that track whether a flight is delayed or not, if it's delayed over x hours, it could automatically trigger a claim and pay the insured directly, within a minute or two of the insured event occurring.

Insurance companies work by not paying money out. I can't see them using this technique this way.Take flight delay insurance for example. There are databases that track whether a flight is delayed or not, if it's delayed over x hours, it could automatically trigger a claim and pay the insured directly, within a minute or two of the insured event occurring.

coyft said:

I can see uses for smart contracts in the insurance industry.

Take flight delay insurance for example. There are databases that track whether a flight is delayed or not, if it's delayed over x hours, it could automatically trigger a claim and pay the insured directly, within a minute or two of the insured event occurring.

A normal database would work just fine. Smart contracts don't need blockchains.Take flight delay insurance for example. There are databases that track whether a flight is delayed or not, if it's delayed over x hours, it could automatically trigger a claim and pay the insured directly, within a minute or two of the insured event occurring.

coyft said:

Would work for fine wine that is in a bonded warehouse. The warehouse could guarantee authenticity of the wine, attach a smart contract, the owner could then transfer ownership and automatically notify warehouse of new owner.

A normal database would work just fine. Smart contracts don't need blockchains. See https://medium.com/@jimmysong/the-truth-about-smar...coyft said:

They work by pooling risk. Claims management is a big cost for the insurance industry. With the smart contract I outlined, claims management can be reduced to zero.

Smart contracts are only suitable for bearer instruments, digital ones at that. You will not be able to programme a smart contract to do what you intend. Who is in charge of the smart contract in your insurance situation? Who adjudicates disputed claims? Who has final say on payout?coyft said:

They work by pooling risk. Claims management is a big cost for the insurance industry. With the smart contract I outlined, claims management can be reduced to zero.

I honestly do not see it. Any payouts in any industry are made as difficult to complete as possible. Pooling risk etc hasn't nothing to do with the smart contracts as you outlined.Gassing Station | Finance | Top of Page | What's New | My Stuff