Discussion

okgo said:

Driven I’d guess by two stocks.

Driven by the majority of the top 10 holdings. Major start to the year across equities.Will 2024 be the year this stat fails?:

Every time since 1944 that a U.S. president was running for reelection, stocks posted gains for the year. It hasn’t mattered whether the incumbent won—just that there was an incumbent on the ballot. The worst of those years was 1948, when the S&P performance was 5.4% The best, 1980 with 32.5%

Nicked that from here:

https://www.morganstanley.com/ideas/global-equity-...

ukwill said:

Driven by the majority of the top 10 holdings. Major start to the year across equities.

Will 2024 be the year this stat fails?:

Every time since 1944 that a U.S. president was running for reelection, stocks posted gains for the year. It hasn’t mattered whether the incumbent won—just that there was an incumbent on the ballot. The worst of those years was 1948, when the S&P performance was 5.4% The best, 1980 with 32.5%

Nicked that from here:

https://www.morganstanley.com/ideas/global-equity-...

It's mostly the tech stocks, Novo, Meta, Microsoft. Fair bit of the top 10 is down YTD.Will 2024 be the year this stat fails?:

Every time since 1944 that a U.S. president was running for reelection, stocks posted gains for the year. It hasn’t mattered whether the incumbent won—just that there was an incumbent on the ballot. The worst of those years was 1948, when the S&P performance was 5.4% The best, 1980 with 32.5%

Nicked that from here:

https://www.morganstanley.com/ideas/global-equity-...

FS hardly has any tech now to be fair, hence earlier comment about the portfolio being more attractive now than it was say 2021/2022.

At one point it was about 30% tech, now just 10-11%.

It "feels" as if the portfolio is back to being more defensive perhaps - PE of 23 which had crept up to 30 odd at one point, and over 55% in Consumer Staples & Healthcare.

Novo Nordisk isn't tech btw, they are health/pharma and their stock has rocketed off the back of some breakthrough obesity drugs amongst other things. Up 384% in 5 years!

At one point it was about 30% tech, now just 10-11%.

It "feels" as if the portfolio is back to being more defensive perhaps - PE of 23 which had crept up to 30 odd at one point, and over 55% in Consumer Staples & Healthcare.

Novo Nordisk isn't tech btw, they are health/pharma and their stock has rocketed off the back of some breakthrough obesity drugs amongst other things. Up 384% in 5 years!

Looking at a return attribution, there's very little in the red but META and MSFT do look to be responsible for about half of the YTD performance. It's not precisely knowable, as they only seem to publish the full holdings every 6 months or so and the latest is June 2023, but the top 10 is same as the latest monthly factsheet so doubt it's far off.

ETA re the industry breakdown: the factsheets may be slightly misleading, as they appear to use GICS sectors and there are a few in there - e.g. Meta and Alphabet as "Communication Services", Automatic Data Processing as "Industrials" and Amadeus as "Consumer Discretionary" - which you might arguably label "tech" more generally.

ETA re the industry breakdown: the factsheets may be slightly misleading, as they appear to use GICS sectors and there are a few in there - e.g. Meta and Alphabet as "Communication Services", Automatic Data Processing as "Industrials" and Amadeus as "Consumer Discretionary" - which you might arguably label "tech" more generally.

Edited by NowWatchThisDrive on Friday 9th February 17:08

croyde said:

I've finally pulled almost all of my money in Fundsmith now.

Did well over the years prior to COVID but now better sitting in an account for the offset mortgage effectively paying me 6.25% and covering half the monthly payments.

So the rest of you had better pile in as I almost always make the wrong decision investment wise

And I was so right Did well over the years prior to COVID but now better sitting in an account for the offset mortgage effectively paying me 6.25% and covering half the monthly payments.

So the rest of you had better pile in as I almost always make the wrong decision investment wise

I sold at 690 and today it's 709.

croyde said:

croyde said:

I've finally pulled almost all of my money in Fundsmith now.

Did well over the years prior to COVID but now better sitting in an account for the offset mortgage effectively paying me 6.25% and covering half the monthly payments.

So the rest of you had better pile in as I almost always make the wrong decision investment wise

And I was so right Did well over the years prior to COVID but now better sitting in an account for the offset mortgage effectively paying me 6.25% and covering half the monthly payments.

So the rest of you had better pile in as I almost always make the wrong decision investment wise

I sold at 690 and today it's 709.

What are you selling next

98elise said:

croyde said:

croyde said:

I've finally pulled almost all of my money in Fundsmith now.

Did well over the years prior to COVID but now better sitting in an account for the offset mortgage effectively paying me 6.25% and covering half the monthly payments.

So the rest of you had better pile in as I almost always make the wrong decision investment wise

And I was so right Did well over the years prior to COVID but now better sitting in an account for the offset mortgage effectively paying me 6.25% and covering half the monthly payments.

So the rest of you had better pile in as I almost always make the wrong decision investment wise

I sold at 690 and today it's 709.

What are you selling next

croyde said:

The shirt off my back by the looks of things

This shirt of yours, you didn't by chance find it in a box in the attic left by previous owner or something?

If you ever get fed up of it and give it to a charity shop, can you let me know. It's probably one of John Lennon's or Elvis' or someone's?

A couple of recent videos with an interview with AJ Bell, worth a watch and reminded me that Smith is 71 this year....not sure where he finds the energy.

https://www.youtube.com/watch?v=QDEfMk7Axvo

https://www.youtube.com/watch?v=1lOvUfWlgV4

https://www.youtube.com/watch?v=QDEfMk7Axvo

https://www.youtube.com/watch?v=1lOvUfWlgV4

Edited by mark seeker on Sunday 3rd March 07:26

The Annual Shareholders' Meeting from last month is now uploaded to Youtube for those interested...

https://youtu.be/PYXtFKFsI0U?si=Fpqb8ojH_q2yxxI7

https://youtu.be/PYXtFKFsI0U?si=Fpqb8ojH_q2yxxI7

Sheepshanks said:

James6112 said:

Sheepshanks said:

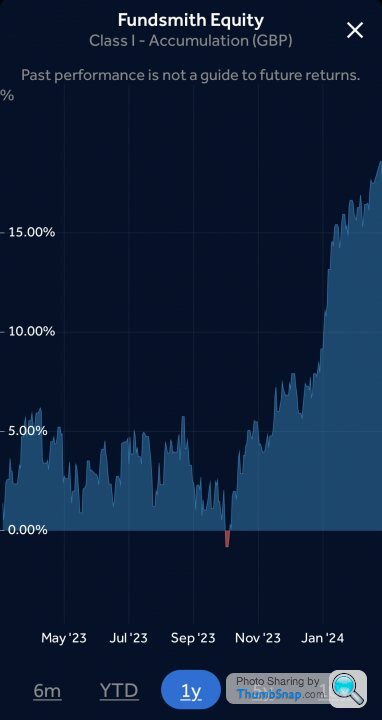

Fundsmith’s issue is that it just didn’t recover enough in 23 from the losses in 22 that everyone suffered.

Not an issue now though..

Hurrah / it’s just about overtaken the

MSCI World Index.

Gassing Station | Finance | Top of Page | What's New | My Stuff