Share tips thread (Vol 2)

Discussion

And if you think I just laugh at other people here is what my Airbus shares are doing currently

https://www.youtube.com/watch?v=DkGR65CXaNA

They are currently at flight level minus 17. That was my safe bet as well ! Boeing being hopeless....

The problem with buying a French share is that they get spooked by the Asian markets when they get into work, then the price goes up a bit, and then rather than spending all afternoon having lunch like the good old days with cheese and wine they watch the americans go down, so follow suite as well.

Who would have thought the French could be so proactive in the afternoons? Not me !

https://www.youtube.com/watch?v=DkGR65CXaNA

They are currently at flight level minus 17. That was my safe bet as well ! Boeing being hopeless....

The problem with buying a French share is that they get spooked by the Asian markets when they get into work, then the price goes up a bit, and then rather than spending all afternoon having lunch like the good old days with cheese and wine they watch the americans go down, so follow suite as well.

Who would have thought the French could be so proactive in the afternoons? Not me !

p1stonhead said:

Gandahar said:

clubsport said:

One of the most important aspect of trading is to manage your cognitive & emotional bias, we have many posting on here about how they sold moments before the sell off and a few who bought just before.

Overconfidence on one hand, hindsight & traders regret on the other.

Bear that in mind when investing, seasoned traders do not have the definitive answers here, only reacting to the way the market behaves based on experience and the trading metric tools available. Even to the largest players, the sum of market flows are only evident ex post.

After such an agressive sell off this week, the expectation would be for a slight recovery from todays low prices before the closing bell.

In part as a squaring up off postions ahead of the weekend (reducing exposure) until trading resumes Sunday night in Tokyo/ Singapore.

In regards to that, a slight recovery does not mean this is over, markets are at the mercy of any weekend news reports on the effect of the virus.

Today may be the greatest buying opportunity in a decade, but you may have thought that yesterday?

When Tesla went up to $900+ I was watching the twitter as they all celebrated and somebody postedOverconfidence on one hand, hindsight & traders regret on the other.

Bear that in mind when investing, seasoned traders do not have the definitive answers here, only reacting to the way the market behaves based on experience and the trading metric tools available. Even to the largest players, the sum of market flows are only evident ex post.

After such an agressive sell off this week, the expectation would be for a slight recovery from todays low prices before the closing bell.

In part as a squaring up off postions ahead of the weekend (reducing exposure) until trading resumes Sunday night in Tokyo/ Singapore.

In regards to that, a slight recovery does not mean this is over, markets are at the mercy of any weekend news reports on the effect of the virus.

Today may be the greatest buying opportunity in a decade, but you may have thought that yesterday?

"i want to buy some shares, what time does the stock market open ?"

Er .... if you have to ask that, then you shouldn't be buying Tesla shares on this short selling megabubble. Sadly they didn't do him a favour and say no don't do it due to inexperience, but instead told him the actual time.

I sold immediately

It got to the stage that if you went for a crap on the bog and didn't have good wifi for your phone you would worry what was happening. If it gets to that stage, where you can't live your life, then it has gone too far.

Shoirtly after I sold NVDA at $305 and AMD a $56 after I went for a bath and when I got out they had triggered my 4% rule on quick order reduction from max. My mate in the USA said I had not got sturdy loins. True, but I did have shiny hair and also some money profit ! Looking back that bath saved my bacon. That was before the massive dip too.

EUREKA ! As the greeks say.

Edited by Gandahar on Friday 28th February 11:52

Gandahar said:

"Today may be the greatest buying opportunity in a decade, but you may have thought that yesterday?  "

"

Exactly. Two examples from Tesla. Tesla fans have always said buy on the dip, so come last Monday some tesla fan lady said again, buy on the dip. Not sure what financial background she has, probably none but likes Elon. So we get this on Tuesday

https://twitter.com/TasserMatthias/status/12322850...

He sold his car to get more Tesla shares, so now has less money and has to pay for the bus on Friday. Donkey Apple would call that high risk leveraging and fall about laughing at the stupidity. The ironic thing is now he is going to work on the bus / train full of people with sneezes and has less money ...

Come later in the week another Tesla person called ValueAnalyst , another Tesla fanboy who thinks the shares will goit to $10 000 each and no Tesla car ever depreciated ( graph to prove ) said buy on the dip. Someone listened

https://twitter.com/TeslaDiehardFan/status/1233055...

He bought $70k worth and now worth a lot less. And we still don't know where the bottom is. The kicker he spent $70k of his own cash due to reading someone with followers on twitter rather than a good old financial adviser who has seen it all before and if still in business is either lucky or clever and probably both.

People are saying " I'll buy again today, and if it goes down again tomorrow, I'll buy more". This is just saying you bought the first lot overpriced. There is also an expression "throwing money after bad".

I know Tesla investors are insane compared to the average, but even so. It shows that greed and a gravy train is not a happy long term marriage.

When Tesla went up to $900+ I was watching the twitter as they all celebrated and somebody posted

"i want to buy some shares, what time does the stock market open ?"

Er .... if you have to ask that, then you shouldn't be buying Tesla shares on this short selling megabubble. Sadly they didn't do him a favour and say no don't do it due to inexperience, but instead told him the actual time.

That is fear in the USA of failing to being a hobo on the gravy train in 2020. They will all end up like the Cassandra Crossing......

This is why I’ve always referred to TSLA as a penny share. It attracts the same dishonesty and stupidity.  "

"Exactly. Two examples from Tesla. Tesla fans have always said buy on the dip, so come last Monday some tesla fan lady said again, buy on the dip. Not sure what financial background she has, probably none but likes Elon. So we get this on Tuesday

https://twitter.com/TasserMatthias/status/12322850...

He sold his car to get more Tesla shares, so now has less money and has to pay for the bus on Friday. Donkey Apple would call that high risk leveraging and fall about laughing at the stupidity. The ironic thing is now he is going to work on the bus / train full of people with sneezes and has less money ...

Come later in the week another Tesla person called ValueAnalyst , another Tesla fanboy who thinks the shares will goit to $10 000 each and no Tesla car ever depreciated ( graph to prove ) said buy on the dip. Someone listened

https://twitter.com/TeslaDiehardFan/status/1233055...

He bought $70k worth and now worth a lot less. And we still don't know where the bottom is. The kicker he spent $70k of his own cash due to reading someone with followers on twitter rather than a good old financial adviser who has seen it all before and if still in business is either lucky or clever and probably both.

People are saying " I'll buy again today, and if it goes down again tomorrow, I'll buy more". This is just saying you bought the first lot overpriced. There is also an expression "throwing money after bad".

I know Tesla investors are insane compared to the average, but even so. It shows that greed and a gravy train is not a happy long term marriage.

When Tesla went up to $900+ I was watching the twitter as they all celebrated and somebody posted

"i want to buy some shares, what time does the stock market open ?"

Er .... if you have to ask that, then you shouldn't be buying Tesla shares on this short selling megabubble. Sadly they didn't do him a favour and say no don't do it due to inexperience, but instead told him the actual time.

That is fear in the USA of failing to being a hobo on the gravy train in 2020. They will all end up like the Cassandra Crossing......

Right now the exact same is happening on AIM and all small cap markets. Lunatics will be putting their wife on the game to get more stock today and margined our tomorrow. Some will then be moving into sheltered accommodation next week and start posting on specialists INCEL and MGTOW websites. Lots will be posting about how they’ve timed everything perfectly and made a fortune when in reality they’ve lost the £6.23 lunch money they punted blindly on something they knew absolutely nothing about.

Gandahar said:

People are saying " I'll buy again today, and if it goes down again tomorrow, I'll buy more". This is just saying you bought the first lot overpriced. There is also an expression "throwing money after bad".

I don't think so. Correct me though. I can understand the insanity of buying when shares are flying high. BUT i don't understand why it's bad to buy fundamentally sound shares / blue chip etc when overall market sentiment is bad? Which is what you and a few seem to be saying. If trading then yes, perhaps. But investing for long term? Well surely buying is best done when stocks are low (er) than they were provided the company is not about to vanish. Laugh at me if you like, just please educate me in the process.bmwmike said:

Gandahar said:

People are saying " I'll buy again today, and if it goes down again tomorrow, I'll buy more". This is just saying you bought the first lot overpriced. There is also an expression "throwing money after bad".

I don't think so. Correct me though. I can understand the insanity of buying when shares are flying high. BUT i don't understand why it's bad to buy fundamentally sound shares / blue chip etc when overall market sentiment is bad? Which is what you and a few seem to be saying. If trading then yes, perhaps. But investing for long term? Well surely buying is best done when stocks are low (er) than they were provided the company is not about to vanish. Laugh at me if you like, just please educate me in the process.I'm a bit of a joker, and time for black humour at the moment, but correctly one always needs to sell at the very top and buy at the very bottom, a professional would be more advised to be listened to than me, but I can give some general thoughts on things from 30 years .

I need to get an historical graph though first.

bmwmike said:

Gandahar said:

People are saying " I'll buy again today, and if it goes down again tomorrow, I'll buy more". This is just saying you bought the first lot overpriced. There is also an expression "throwing money after bad".

I don't think so. Correct me though. I can understand the insanity of buying when shares are flying high. BUT i don't understand why it's bad to buy fundamentally sound shares / blue chip etc when overall market sentiment is bad? Which is what you and a few seem to be saying. If trading then yes, perhaps. But investing for long term? Well surely buying is best done when stocks are low (er) than they were provided the company is not about to vanish. Laugh at me if you like, just please educate me in the process.

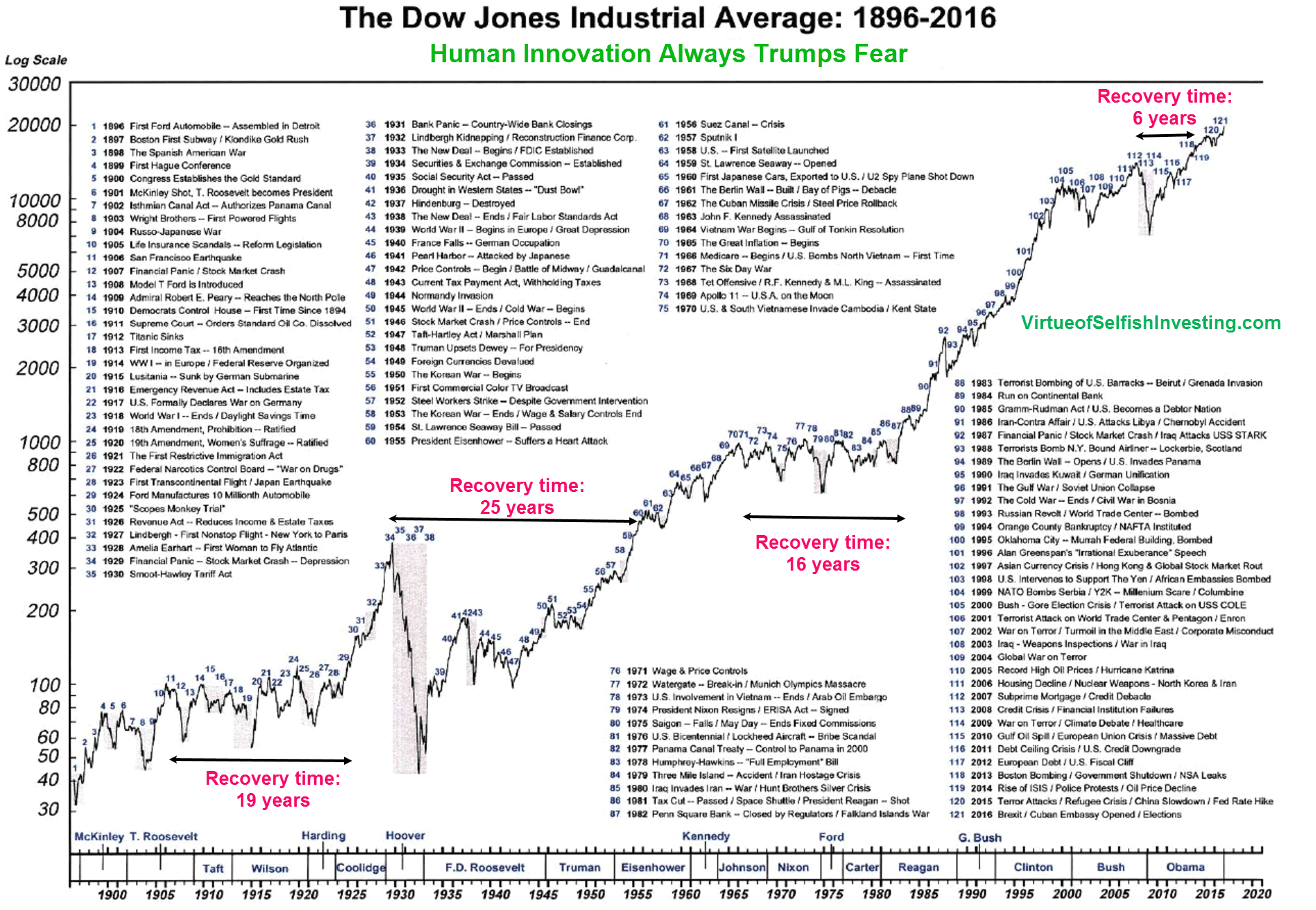

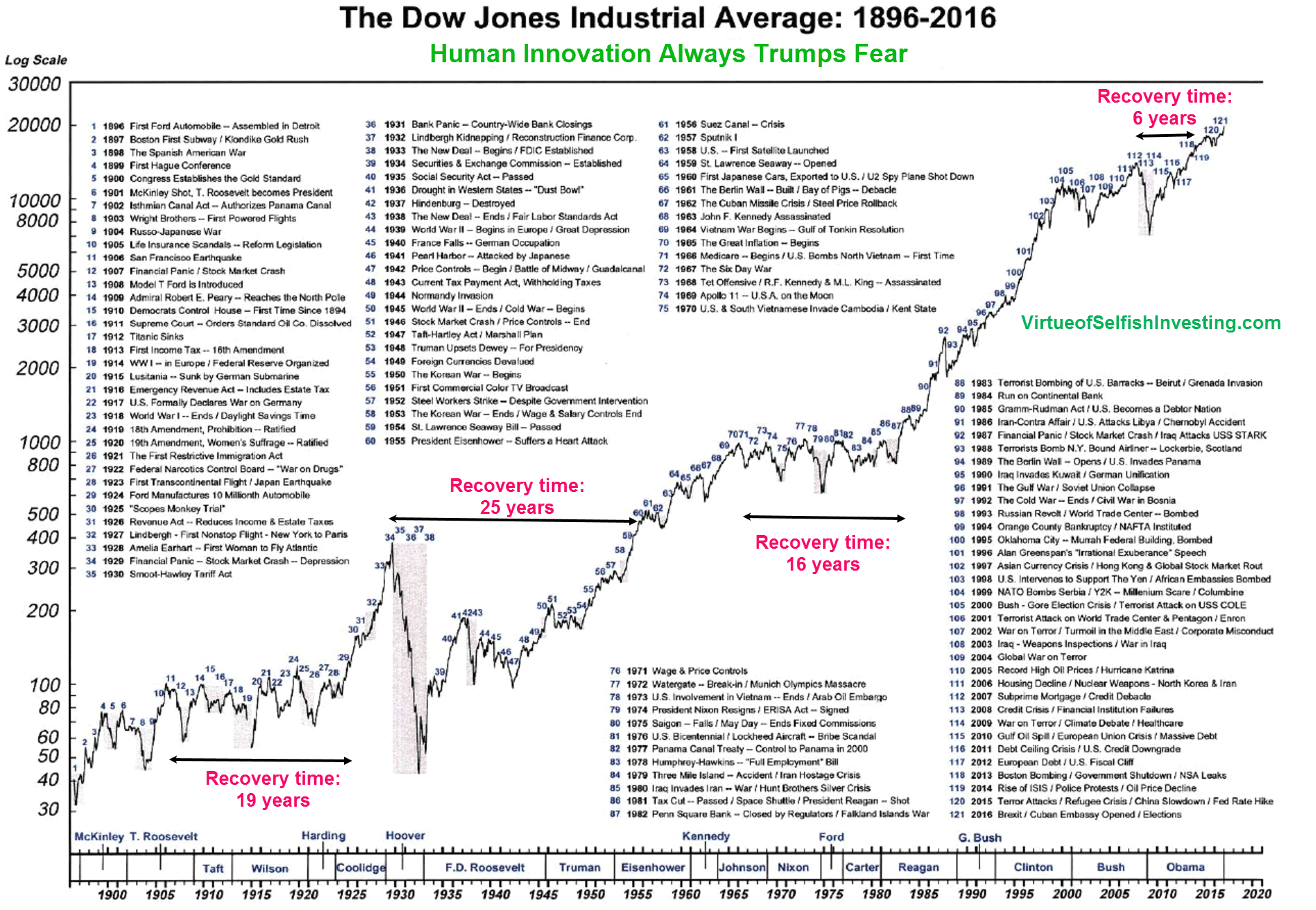

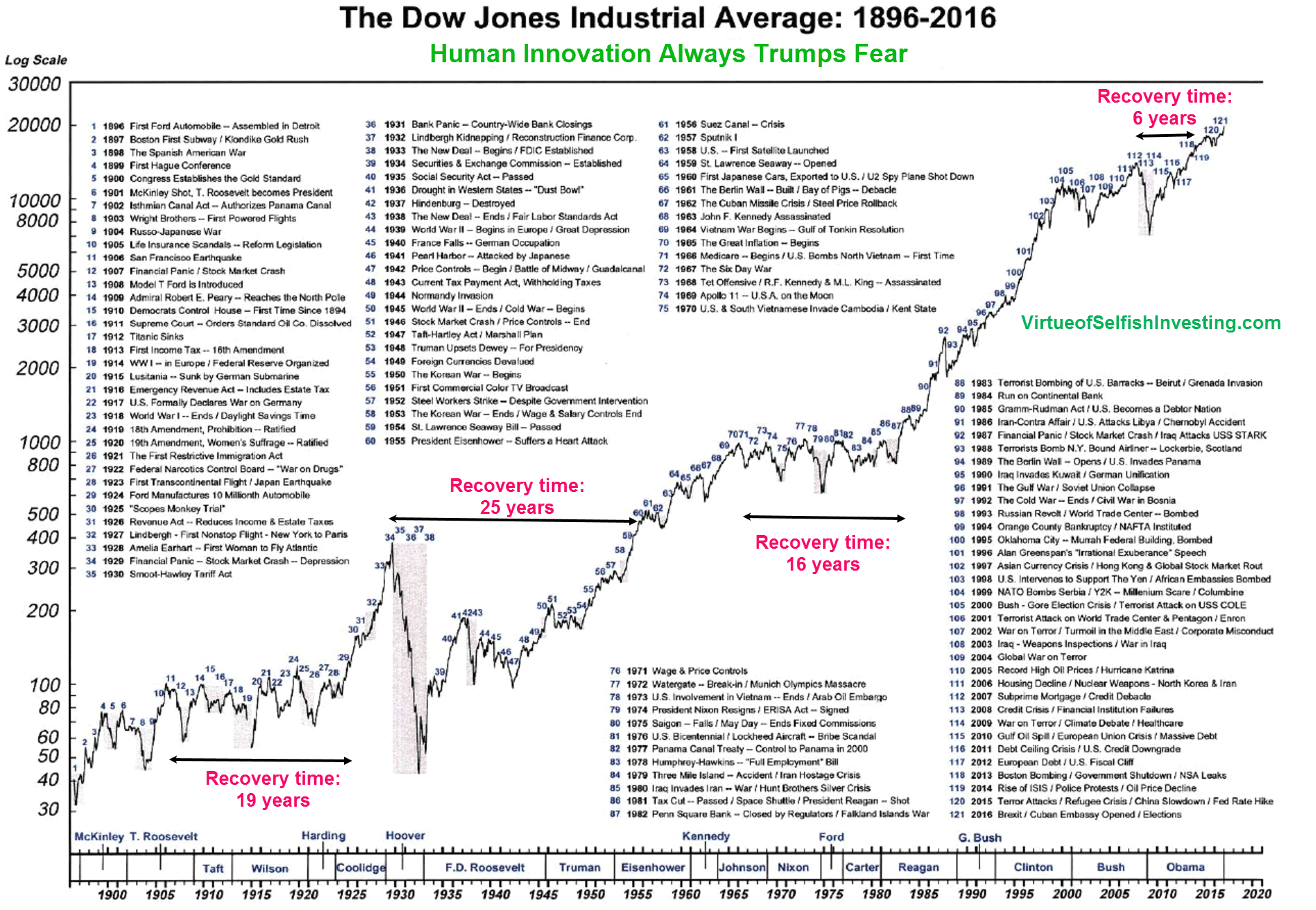

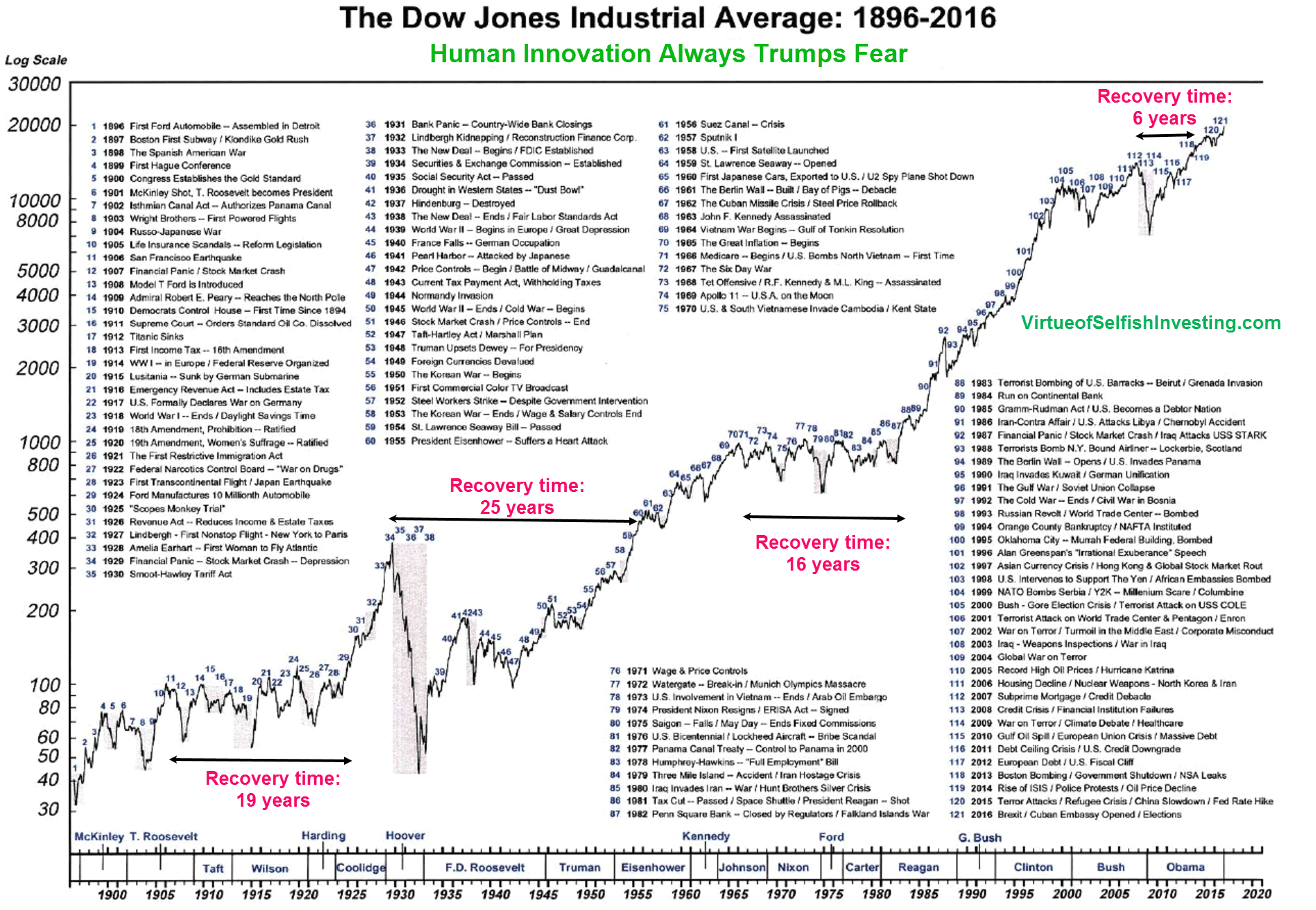

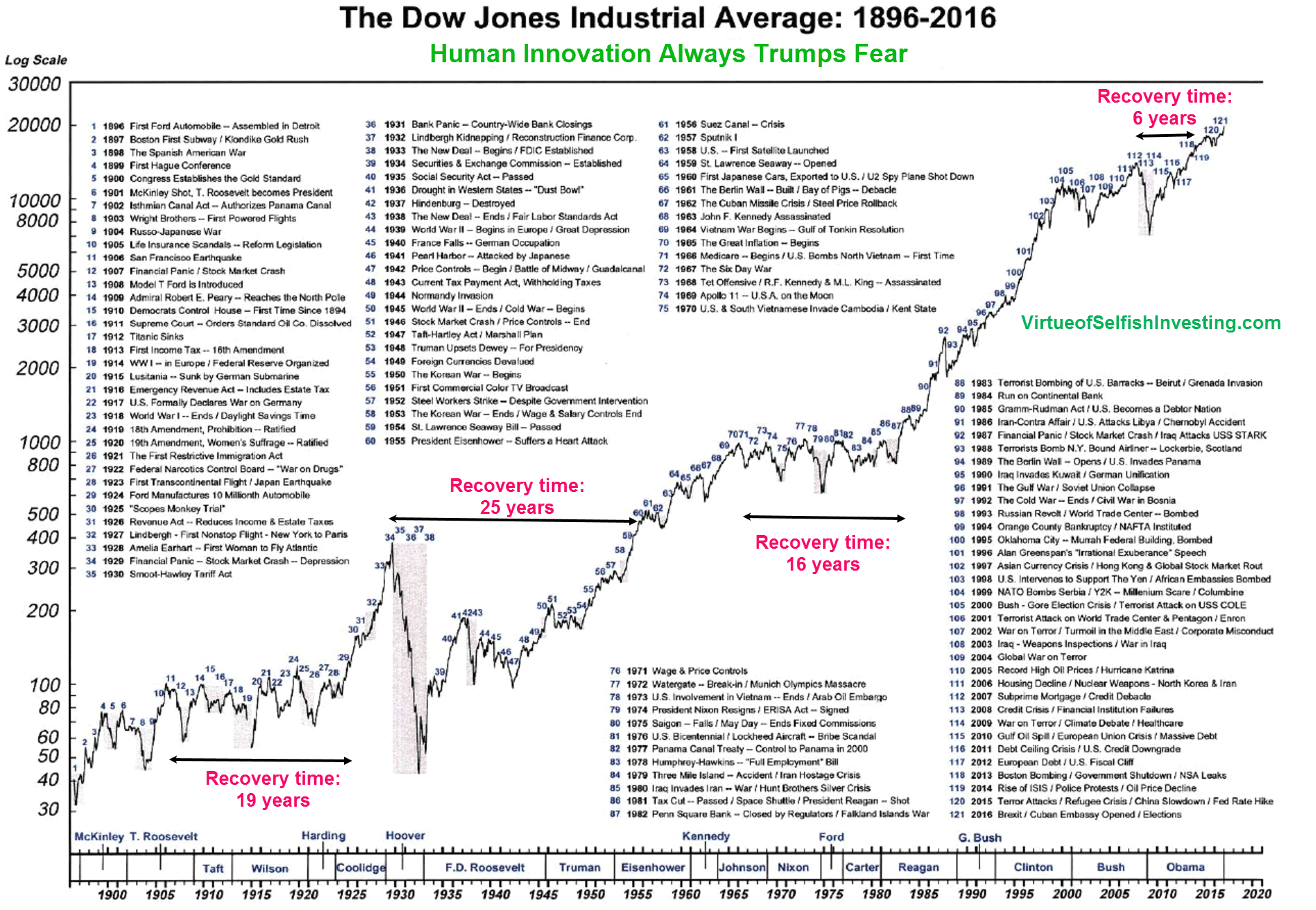

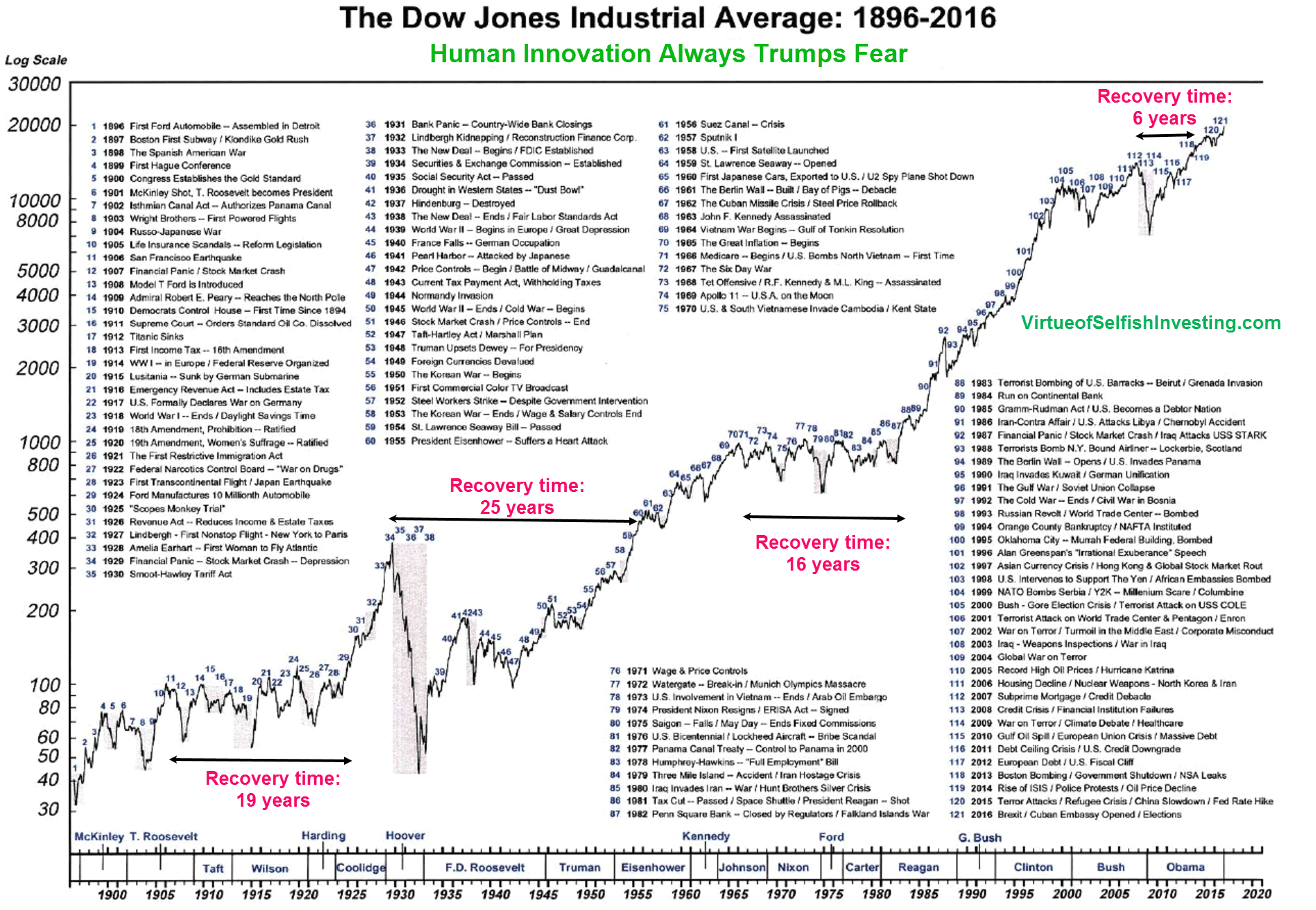

In this graph you can compare the great depression loss to the dot com loss and 2008 leveraged loans borrowing loss from the banks, not as pure $ or points because the collapse that started in 1928 was not any of those. They use a logarithmic scale though to show the massive change. It's not called the great depression for nothing !

This downside is very different from then, I can say why in another post, but the thing to notice is how many dead cat bounces there were in the great depression collapse, you can see the small spikes.

When do you know when the drop has finally finished? Terminology such as catching a falling knife and dead cat bounces don't come from the ether ! Use past experience to be cautious. It's a statistical exercise.

Don't fear missing the very bottom.

DonkeyApple said:

Gandahar said:

"Today may be the greatest buying opportunity in a decade, but you may have thought that yesterday?  "

"

Exactly. Two examples from Tesla. Tesla fans have always said buy on the dip, so come last Monday some tesla fan lady said again, buy on the dip. Not sure what financial background she has, probably none but likes Elon. So we get this on Tuesday

https://twitter.com/TasserMatthias/status/12322850...

He sold his car to get more Tesla shares, so now has less money and has to pay for the bus on Friday. Donkey Apple would call that high risk leveraging and fall about laughing at the stupidity. The ironic thing is now he is going to work on the bus / train full of people with sneezes and has less money ...

Come later in the week another Tesla person called ValueAnalyst , another Tesla fanboy who thinks the shares will goit to $10 000 each and no Tesla car ever depreciated ( graph to prove ) said buy on the dip. Someone listened

https://twitter.com/TeslaDiehardFan/status/1233055...

He bought $70k worth and now worth a lot less. And we still don't know where the bottom is. The kicker he spent $70k of his own cash due to reading someone with followers on twitter rather than a good old financial adviser who has seen it all before and if still in business is either lucky or clever and probably both.

People are saying " I'll buy again today, and if it goes down again tomorrow, I'll buy more". This is just saying you bought the first lot overpriced. There is also an expression "throwing money after bad".

I know Tesla investors are insane compared to the average, but even so. It shows that greed and a gravy train is not a happy long term marriage.

When Tesla went up to $900+ I was watching the twitter as they all celebrated and somebody posted

"i want to buy some shares, what time does the stock market open ?"

Er .... if you have to ask that, then you shouldn't be buying Tesla shares on this short selling megabubble. Sadly they didn't do him a favour and say no don't do it due to inexperience, but instead told him the actual time.

That is fear in the USA of failing to being a hobo on the gravy train in 2020. They will all end up like the Cassandra Crossing......

This is why I’ve always referred to TSLA as a penny share. It attracts the same dishonesty and stupidity.  "

"Exactly. Two examples from Tesla. Tesla fans have always said buy on the dip, so come last Monday some tesla fan lady said again, buy on the dip. Not sure what financial background she has, probably none but likes Elon. So we get this on Tuesday

https://twitter.com/TasserMatthias/status/12322850...

He sold his car to get more Tesla shares, so now has less money and has to pay for the bus on Friday. Donkey Apple would call that high risk leveraging and fall about laughing at the stupidity. The ironic thing is now he is going to work on the bus / train full of people with sneezes and has less money ...

Come later in the week another Tesla person called ValueAnalyst , another Tesla fanboy who thinks the shares will goit to $10 000 each and no Tesla car ever depreciated ( graph to prove ) said buy on the dip. Someone listened

https://twitter.com/TeslaDiehardFan/status/1233055...

He bought $70k worth and now worth a lot less. And we still don't know where the bottom is. The kicker he spent $70k of his own cash due to reading someone with followers on twitter rather than a good old financial adviser who has seen it all before and if still in business is either lucky or clever and probably both.

People are saying " I'll buy again today, and if it goes down again tomorrow, I'll buy more". This is just saying you bought the first lot overpriced. There is also an expression "throwing money after bad".

I know Tesla investors are insane compared to the average, but even so. It shows that greed and a gravy train is not a happy long term marriage.

When Tesla went up to $900+ I was watching the twitter as they all celebrated and somebody posted

"i want to buy some shares, what time does the stock market open ?"

Er .... if you have to ask that, then you shouldn't be buying Tesla shares on this short selling megabubble. Sadly they didn't do him a favour and say no don't do it due to inexperience, but instead told him the actual time.

That is fear in the USA of failing to being a hobo on the gravy train in 2020. They will all end up like the Cassandra Crossing......

Right now the exact same is happening on AIM and all small cap markets. Lunatics will be putting their wife on the game to get more stock today and margined our tomorrow. Some will then be moving into sheltered accommodation next week and start posting on specialists INCEL and MGTOW websites. Lots will be posting about how they’ve timed everything perfectly and made a fortune when in reality they’ve lost the £6.23 lunch money they punted blindly on something they knew absolutely nothing about.

You know what my summary is at the moment is?

We have a huge financial empire based on the best AI Cyberdyne 2000 / Hal 9000 computers doing high frequency trading

against

A small humble micro organism. That might mutate at any given moment.

Being British I think I might put the kettle on ....

FIGHT !

Gandahar said:

bmwmike said:

Gandahar said:

People are saying " I'll buy again today, and if it goes down again tomorrow, I'll buy more". This is just saying you bought the first lot overpriced. There is also an expression "throwing money after bad".

I don't think so. Correct me though. I can understand the insanity of buying when shares are flying high. BUT i don't understand why it's bad to buy fundamentally sound shares / blue chip etc when overall market sentiment is bad? Which is what you and a few seem to be saying. If trading then yes, perhaps. But investing for long term? Well surely buying is best done when stocks are low (er) than they were provided the company is not about to vanish. Laugh at me if you like, just please educate me in the process.

In this graph you can compare the great depression loss to the dot com loss and 2008 leveraged loans borrowing loss from the banks, not as pure $ or points because the collapse that started in 1928 was not any of those. They use a logarithmic scale though to show the massive change. It's not called the great depression for nothing !

This downside is very different from then, I can say why in another post, but the thing to notice is how many dead cat bounces there were in the great depression collapse, you can see the small spikes.

When do you know when the drop has finally finished? Terminology such as catching a falling knife and dead cat bounces don't come from the ether ! Use past experience to be cautious. It's a statistical exercise.

Don't fear missing the very bottom.

Gandahar said:

True.

You know what my summary is at the moment is?

We have a huge financial empire based on the best AI Cyberdyne 2000 / Hal 9000 computers doing high frequency trading

against

A small humble micro organism. That might mutate at any given moment.

Being British I think I might put the kettle on ....

FIGHT !

Panic level 1: put kettle on. You know what my summary is at the moment is?

We have a huge financial empire based on the best AI Cyberdyne 2000 / Hal 9000 computers doing high frequency trading

against

A small humble micro organism. That might mutate at any given moment.

Being British I think I might put the kettle on ....

FIGHT !

Panic level 2: check you’ve got some digestives.

Panic level 3: check where the keys are to the gun cabinet.

DonkeyApple said:

Gandahar said:

True.

You know what my summary is at the moment is?

We have a huge financial empire based on the best AI Cyberdyne 2000 / Hal 9000 computers doing high frequency trading

against

A small humble micro organism. That might mutate at any given moment.

Being British I think I might put the kettle on ....

FIGHT !

Panic level 1: put kettle on. You know what my summary is at the moment is?

We have a huge financial empire based on the best AI Cyberdyne 2000 / Hal 9000 computers doing high frequency trading

against

A small humble micro organism. That might mutate at any given moment.

Being British I think I might put the kettle on ....

FIGHT !

Panic level 2: check you’ve got some digestives.

Panic level 3: check where the keys are to the gun cabinet.

Maybe I am overthinking it but my wife did say her money was not making enough money in her Natwest account.

One weekend later I am a full on "home" financial advisor for her spondulies . Aston all the way,

Wife "Ponzi scheme ?"

Me "No, just me !

Stay tuned.

Gandahar said:

Take a look at this graph

In this graph you can compare the great depression loss to the dot com loss and 2008 leveraged loans borrowing loss from the banks, not as pure $ or points because the collapse that started in 1928 was not any of those. They use a logarithmic scale though to show the massive change. It's not called the great depression for nothing !

This downside is very different from then, I can say why in another post, but the thing to notice is how many dead cat bounces there were in the great depression collapse, you can see the small spikes.

When do you know when the drop has finally finished? Terminology such as catching a falling knife and dead cat bounces don't come from the ether ! Use past experience to be cautious. It's a statistical exercise.

Don't fear missing the very bottom.

Graphs not working..

In this graph you can compare the great depression loss to the dot com loss and 2008 leveraged loans borrowing loss from the banks, not as pure $ or points because the collapse that started in 1928 was not any of those. They use a logarithmic scale though to show the massive change. It's not called the great depression for nothing !

This downside is very different from then, I can say why in another post, but the thing to notice is how many dead cat bounces there were in the great depression collapse, you can see the small spikes.

When do you know when the drop has finally finished? Terminology such as catching a falling knife and dead cat bounces don't come from the ether ! Use past experience to be cautious. It's a statistical exercise.

Don't fear missing the very bottom.

DonkeyApple said:

Gandahar said:

True.

You know what my summary is at the moment is?

We have a huge financial empire based on the best AI Cyberdyne 2000 / Hal 9000 computers doing high frequency trading

against

A small humble micro organism. That might mutate at any given moment.

Being British I think I might put the kettle on ....

FIGHT !

Panic level 1: put kettle on. You know what my summary is at the moment is?

We have a huge financial empire based on the best AI Cyberdyne 2000 / Hal 9000 computers doing high frequency trading

against

A small humble micro organism. That might mutate at any given moment.

Being British I think I might put the kettle on ....

FIGHT !

Panic level 2: check you’ve got some digestives.

Panic level 3: check where the keys are to the gun cabinet.

bmwmike said:

Gandahar said:

Take a look at this graph

In this graph you can compare the great depression loss to the dot com loss and 2008 leveraged loans borrowing loss from the banks, not as pure $ or points because the collapse that started in 1928 was not any of those. They use a logarithmic scale though to show the massive change. It's not called the great depression for nothing !

This downside is very different from then, I can say why in another post, but the thing to notice is how many dead cat bounces there were in the great depression collapse, you can see the small spikes.

When do you know when the drop has finally finished? Terminology such as catching a falling knife and dead cat bounces don't come from the ether ! Use past experience to be cautious. It's a statistical exercise.

Don't fear missing the very bottom.

Graphs not working..

In this graph you can compare the great depression loss to the dot com loss and 2008 leveraged loans borrowing loss from the banks, not as pure $ or points because the collapse that started in 1928 was not any of those. They use a logarithmic scale though to show the massive change. It's not called the great depression for nothing !

This downside is very different from then, I can say why in another post, but the thing to notice is how many dead cat bounces there were in the great depression collapse, you can see the small spikes.

When do you know when the drop has finally finished? Terminology such as catching a falling knife and dead cat bounces don't come from the ether ! Use past experience to be cautious. It's a statistical exercise.

Don't fear missing the very bottom.

Gandahar said:

Yes,thank you.Looks like it's difficult to pick the bottom but easy to make a return given enough time. Kind of what I was saying isn't it? Buying off peak, wherever in the cycle so long as it's not whilst the stock is rallying. Part of the reason for that growth over very long term is not just stock growth but devaluation of currency through inflation, I think?. But I take your point that if this turns out to be a great depression we are still at the peak? Let me know if you just did a massive facepalm.

bmwmike said:

Yes,thank you.

Looks like it's difficult to pick the bottom but easy to make a return given enough time. Kind of what I was saying isn't it? Buying off peak, wherever in the cycle so long as it's not whilst the stock is rallying. Part of the reason for that growth over very long term is not just stock growth but devaluation of currency through inflation, I think?. But I take your point that if this turns out to be a great depression we are still at the peak? Let me know if you just did a massive facepalm.

Do you still think i'm a brave man for moving everything into GBP the other month Looks like it's difficult to pick the bottom but easy to make a return given enough time. Kind of what I was saying isn't it? Buying off peak, wherever in the cycle so long as it's not whilst the stock is rallying. Part of the reason for that growth over very long term is not just stock growth but devaluation of currency through inflation, I think?. But I take your point that if this turns out to be a great depression we are still at the peak? Let me know if you just did a massive facepalm.

bmwmike said:

Gandahar said:

Yes,thank you.Looks like it's difficult to pick the bottom but easy to make a return given enough time. Kind of what I was saying isn't it? Buying off peak, wherever in the cycle so long as it's not whilst the stock is rallying. Part of the reason for that growth over very long term is not just stock growth but devaluation of currency through inflation, I think?. But I take your point that if this turns out to be a great depression we are still at the peak? Let me know if you just did a massive facepalm.

I'm just a bloke on the internet like you. What the f

k do I know more than the rest ?

k do I know more than the rest ? I would say that Donald Rumsfeld one had this pithy comment about the Iraq war which could be moved over to share dealing.

"Reports that say that something hasn't happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don't know we don't know. And if one looks throughout the history of our country and other free countries, it is the latter category that tend to be the difficult ones"

I think he just summed up how to try and share deal in a sensible manner but still might get a wedgie.

To be perfectly honest the best we can do is get light entertainment out of it today and in 30 years time, if still alive, advise your son / daughter who refuses to listen to advice based on those days

It should be so, never blow out the candle !

It should be so, never blow out the candle ! 5 mins to market opening in the USA. Let's get ready to crumble !

Edited by Gandahar on Friday 28th February 14:33

Gandahar said:

Take a look at this graph...

In this graph you can compare the great depression loss to the dot com loss and 2008 leveraged loans borrowing loss from the banks, not as pure $ or points because the collapse that started in 1928 was not any of those. They use a logarithmic scale though to show the massive change. It's not called the great depression for nothing !

This downside is very different from then, I can say why in another post, but the thing to notice is how many dead cat bounces there were in the great depression collapse, you can see the small spikes.

When do you know when the drop has finally finished? Terminology such as catching a falling knife and dead cat bounces don't come from the ether ! Use past experience to be cautious. It's a statistical exercise.

Don't fear missing the very bottom.

How do you avoid the flip side though? If you are selling at each "crisis" it will be say a 5-10% drop, and so you'll not have any time to sell/see the bottom/buy the recovery as the average person. You'd then likely have lost money - which is what the stats show by people trading too much/panic selling etc. If you update the graph then of course you want to sell out for the great recession/yellow arrow. But I assume the red arrows were all some kind of problem situation, but if you sold them you'd probably have lost money as it climbs shortly after again. It's crazy to just throw money you can't afford into buying the dip, but as a long term investor who is wanting to avoid timing the market how is it best to avoid overselling on each crisis, but make sure you get out (and stay out) for the big one? Corona virus is not a huge problem in itself now - it's trying to stop it that is doing the economic damage. If governments just said go back to normal life tomorrow and people did, then in theory the markets would surely rebound a lot as the economy would return to normal after a relatively short time.In this graph you can compare the great depression loss to the dot com loss and 2008 leveraged loans borrowing loss from the banks, not as pure $ or points because the collapse that started in 1928 was not any of those. They use a logarithmic scale though to show the massive change. It's not called the great depression for nothing !

This downside is very different from then, I can say why in another post, but the thing to notice is how many dead cat bounces there were in the great depression collapse, you can see the small spikes.

When do you know when the drop has finally finished? Terminology such as catching a falling knife and dead cat bounces don't come from the ether ! Use past experience to be cautious. It's a statistical exercise.

Don't fear missing the very bottom.

Gassing Station | Finance | Top of Page | What's New | My Stuff