Vanguard LifeStrategy

Discussion

Derek Chevalier said:

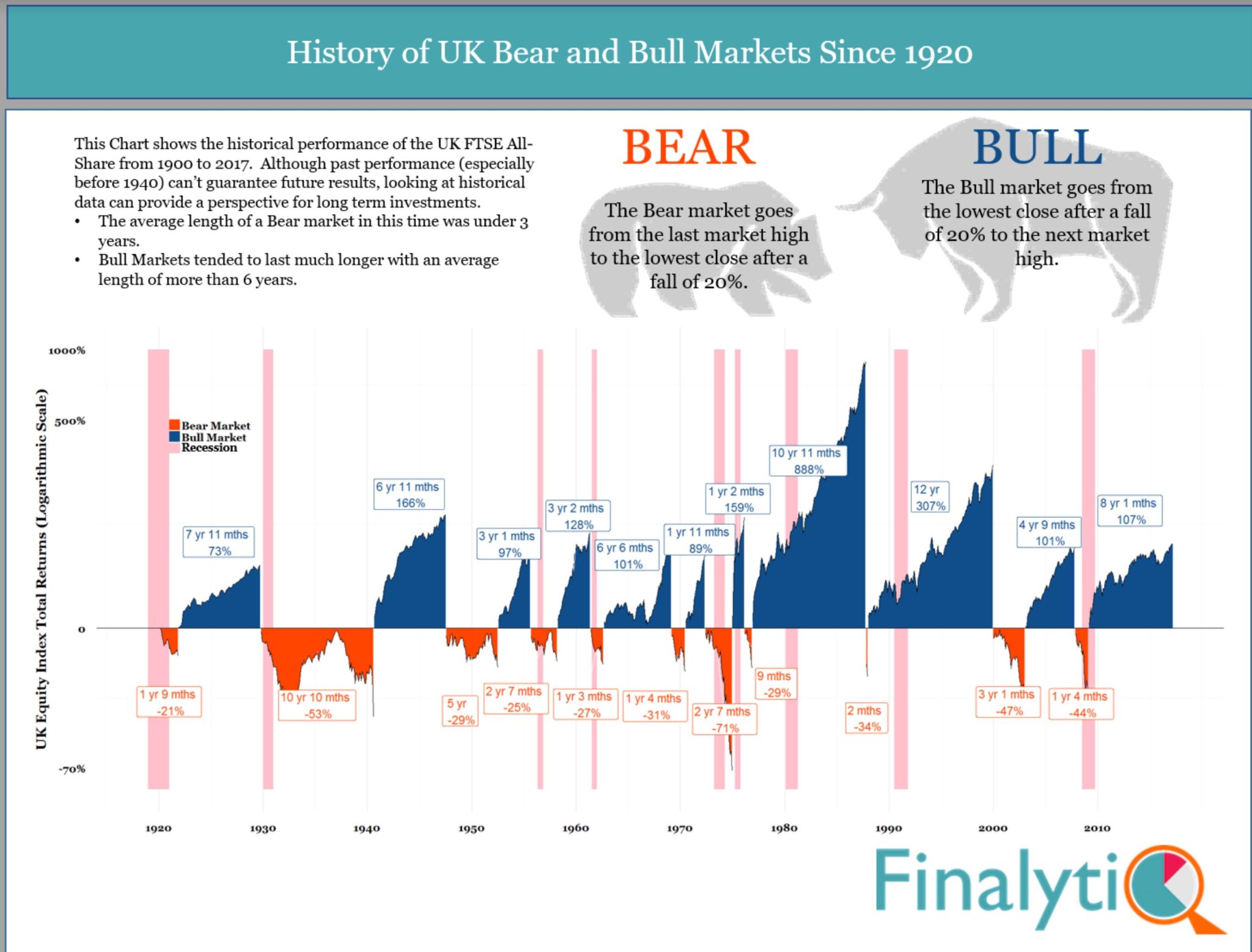

Thing is Groak we have tools that let us look at a century of market returns which obviously included times of terrible market returns (Great Depression etc). If we are happy to accept that the future (for our given life expectancy) is going to be no worse than the worst time over that last century, barring massive outliers (on a par with Scotland winning the RWC this autumn  ) we have a reasonable starting point for building a retirement portfolio.

) we have a reasonable starting point for building a retirement portfolio.

For Mrs BTL Miggins that has 3 flats in the same town for her pension, I just don't know how you could construct a robust retirement portfolio that you could rely on.

Trying hard not to be biased on this but struggling to see how it would work.

Well Im sure there are people who understand wtf you are on about, but...well...there may also be a sizeable minority who, erm.... don't  ) we have a reasonable starting point for building a retirement portfolio.

) we have a reasonable starting point for building a retirement portfolio.For Mrs BTL Miggins that has 3 flats in the same town for her pension, I just don't know how you could construct a robust retirement portfolio that you could rely on.

Trying hard not to be biased on this but struggling to see how it would work.

Keeping it simple, and reducing it to concrete terms, if a codger has £100k invested in equities and needs to liquidate £6k a year from

the investment to supplement income, and the returns aren't good....say minus 2%.....am I right in saying that the codger's 100 is now worth 98 which then has to provide another 6 for income leaving 92. Thus the minus 2 return turns into a minus 8..... leaving the 92 to not only make up 8 to get back to the original 100 but also provide another 6 for next years income.

Originally the 100 had to return £6k/6% over the year.

Now the 92 has to return £14k/15% over the next year just to get back to where it began.

And of course no certainty the next year will be better than the previous one......

And we haven't even built in the even greater deficit caused by the claws of the parasites who advised and supervised this mess.....

I take it the fear of this very possible scenario is why saddos get themselves involved in the Great Annuity Con.

Edited by selmahoose on Friday 19th July 23:51

selmahoose said:

Keeping it simple, and reducing it to concrete terms, if a codger has £100k invested in equities and needs to liquidate £6k a year from

the investment to supplement income, and the returns aren't good....say minus 2%.....am I right in saying that the codger's 100 is now worth 98 which then has to provide another 6 for income leaving 92

Agreedthe investment to supplement income, and the returns aren't good....say minus 2%.....am I right in saying that the codger's 100 is now worth 98 which then has to provide another 6 for income leaving 92

selmahoose said:

Now the 92 has to return £14k/15% over the next year just to get back to where it began.

Why does it need to get back to where it began? Surely the goal (unless you have gifting planned) is to die with £1 remaining?selmahoose said:

And of course no certainty the next year will be better than the previous one......

Goes back to my point of having historical data where we have had a string of very, very bad years, and we can show that codger's portfolio would have/would not have survived this. This gives us a starting point to base planning for our future (on the understanding that the future is not going to worse than the very worst period of the last century).

selmahoose said:

And we haven't even built in the even greater deficit caused by the claws of the parasites who advised and supervised this mess.....

You are seemingly implying that the parasites have any influence over the future direction of the global markets?  No need to pay anyone if you don't want to - the majority of the information is available. For example

No need to pay anyone if you don't want to - the majority of the information is available. For examplehttps://www.pistonheads.com/gassing/topic.asp?h=0&...

selmahoose said:

I take it the fear of this very possible scenario is why saddos get themselves involved in the Great Annuity Con.

Why do you say that?selmahoose said:

'pension' and 'simples' don't really fit in the same sentence given that no-one in the world appears to know just exactly how they work (when they DO work which seems a gatheringly rare event).

Pensions actually are very simple, it is just that many people confuse them with products historically sold by insurance companies (which is not surprising, to be honest).

At its basic level a pension is a tax allowance. It is as simple as that.

You can set aside up to 100% of your net relevant earnings (capped at £40,000 a year for most people) and not pay a penny of income tax on this money.

It then grows free of income tax and capital gains tax.

Once you are 55 (currently) you can then access this money with a quarter of it being completely free of tax and the rest taxed at your marginal rate.

There is no rule whatsoever that says you have to invest this money in equities (though most people do given they have always outperformed other asset classes over the long term).

If you want to use this money to buy property then you can do (just not residential property).

Commercial property has the benefit of long term leases with repair clauses. Also, if converted into residential use the value is likely to rise considerably and you have no tax on this when your pension sells it. All rent also goes into your pension tax free.

Let's use some round numbers for a comparison:

BTL

- You buy a property for £100,000. Assuming you are a higher rate taxpayer you would have needed to earn £166,666 to have the £100,000 after tax

- Tax cost of purchase = £66,666

- You receive a rental yield of 5% (£5,000 a year)

- Tax cost in income = £2,000 a year

- You sell it 10 years later for twice what you paid for it.

- Tax cost on sale = £28,000

Commercial property in a SIPP

- Fund your SIPP with £100,000 to buy the property

- Tax saving = £66,000

- Receive a 5% rental yield (£5,000 a year)

- Tax saving = £2,000 a year

- Sell it 10 years later for twice what you paid for it

- Tax saving = £28,000

Or more likely

- Fund your SIPP with the same gross £166,666 you would have needed to buy the £100,000 BTL

- This gives you an income tax saving of £111,111

- Your 5% rental yield is now £8,333 a year

- Income tax saving = £3,333 a year

- Sell in 10 years for twice what you paid for it

- CGT saving = £46,666

Even if you took all this money out of your SIPP at the 40% rate you would still have £175,000 profit in your hands after tax (£73,000 more than your BTL profit) and in the more likely scenario of taking it out at the 20% rate of tax you would have £212,500 in your hands (£110,500 more than your BTL profit).

JulianPH said:

Normal Reality: After decades of sacrifice and scrimp hard working Dave has managed to pay all his rates and taxes and bills and mortgages and insurances and kiddies costs and occasional emergencies and contingencies too. And now Dave's 65 he's retiring with his.....100 grand pension pot.

Oh well, at least he's avoided cancer, sepsis, heart attack, serious injury and (so far) dementia!! So barring any of those happening and a whole heap of other health dramas and also assuming none of his other dependent nearest and dearest succumb to them either, Dave can look forward to starting that Silver Fox dream on his 3 grand per annum index-linked annuity!!

Hmmm. Poor old Normal Dave. All that austerity for less than £60 a week payback!

Meanwhile his younger brother Fred has been even more prudent! His pot's looking like £500k!! A nifty 15kpa annuity PLUS the state pension! WOW!! Almost the average wage!! Okay, maybe not enough for Silver Fox lifestyles, but certainly enough to pay basic bills, plus an annual fortnight (well, 10 days anyway) in Marmaris or Fuengirols, PLUS enough left over to run a Ford Gremlin (albeit a highish mileage 2nd hand one). Not quite grim, but not quite un-grim either. And that's a half-million pot.

Hmmm

So what size of pot DOES buy that Silver Fox dream? £5M? Naaaaa. A poxy £150kpa pre-tax doesn't cut it. What's that? About £100kpa post tax? Less than £2k per week? That won't support much paradise lifestyle, will it?

£50M? Yep, probably. Now what percentage of pension investors accumulate a £50M pot? .1? .01? .0001? ANY???

And that, gents, is why no Silver Fox and partner you will ever come across are funding that serviced clifftop villa with maserati parked outside, plus decent yacht in the local marina plus plus plus on pension savings.

https://www.123rf.com/photo_36747442_stock-vector-...

Pension = "this time next year/decade/century we'll all be millionaires, Rodders" !!

selmahoose said:

To the comfortably retired, every day's the weekend

Ye old goat.

On a serious note, I know the point you’re making above. That’s said, I appreciate that in the weegie swamplands in which you operate your BTL business, it may be possible to get (on the face of it) great yields.

However, to pretend that such yields are prevalent in the wider BTL market for the passive investor is just b

ks.

ks.Net of taxes and expenses, the vast, vast majority of U.K. rental properties rent in the low single digits. That is a fact.

Testaburger said:

However, to pretend that such yields are prevalent in the wider BTL market for the passive investor is just b ks.

ks.

Net of taxes and expenses, the vast, vast majority of U.K. rental properties rent in the low single digits. That is a fact.

This is nonsense. Seriously. It's nonsense.  ks.

ks.Net of taxes and expenses, the vast, vast majority of U.K. rental properties rent in the low single digits. That is a fact.

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

Those took less than 5 minutes to find on a public marketing site. Imagine what the pros in those areas can dig up esp in the off-market BMV arena....

Edited by selmahoose on Saturday 20th July 16:19

selmahoose said:

JulianPH said:

I completely agree about the crappy lifestyle adverts. No investment is going to magically make your 'considerably richer' in retirement than you were before retirement. Investment can, however, maintain your lifestyle in retirement, to any degree.

This reminds me of a girl in the office who once commentated on another saying "I wish I could have a body like you after having two kids" at which point someone else said "well it would help if you had a body like her before having any kids"!

It is entirely up to you if you don't want to use your tax allowances and give the government more money than you receive from your endevours (using my examples above), but don't deny these actually exist an benefit millions of people.

Next time you look at an investment I would ask yourself if you could achieve far greater tax efficiency using your allowances. You don't. I presume, inform HMRC that you don't want to take advantage of your nil rate tax bands...

Cheers Groat!

Pension tax allowances are theoretical money. The closest you can get to them before some apparently ever-changing future age number is by seeing numbers on a screen.

Which is fine for people who like to chase a carrot, but it's not a spendy-spendy tax allowance like the bird-in-the-hand people like.

And the thing with a bird in the hand is that it comes with a 50% rebate over its bushy equivalent.

Which is fine for people who like to chase a carrot, but it's not a spendy-spendy tax allowance like the bird-in-the-hand people like.

And the thing with a bird in the hand is that it comes with a 50% rebate over its bushy equivalent.

selmahoose said:

This is nonsense. Seriously. It's nonsense.

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

Those took less than 5 minutes to find on a public marketing site. Imagine what the pros in those areas can dig up esp in the off-market BMV arena....

You can post links for properties I wouldn’t use as a fly-tip, but there is a reason they’re cheap. If there wasn’t, then, well, they wouldn’t be cheap. https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

Those took less than 5 minutes to find on a public marketing site. Imagine what the pros in those areas can dig up esp in the off-market BMV arena....

Edited by selmahoose on Saturday 20th July 16:19

You’ve carved out a - let’s call it - specialisation - as a professional. That’s akin to professional investors who specialise in their sub-section of the financial markets, be that biotech, semiconductor, oil, etc. There are fortunes to be made. That doesn’t apply to the passive investor saving for retirement. They don’t have the knowledge, tools nor contacts to exploit it.

If I were to go and experiment with three such dumps you posted, I guarantee I’d lose my shirt. I’ve many friends who’ve dabbled with slumlordship, ranging from Detroit to Darlington. All have lost. Some lost big. Every one of them lamented it hasn’t been worth their while.

I’d consider BTL if the right opportunity came along. I’m not anti-property in the least. However, I know a) my limits, and b) my embuggerance threshold.

Oh, and those properties you posted up aren’t representative of the vast majority of rental property. They represent the very lowest percentiles.

Edited by Testaburger on Saturday 20th July 16:49

BTL has many downsides; including

1. Highly illiquid, it could take years to dismantle a portfolio.

2. It's an easy target for the taxman.

3. There is no IHT protection.

4. Who wants the responsibility when you are retired, I would rather be in the garden.

And I used to have a number of BTL but they are no longer the investment they used to be and the best yielding properties are properties with least prospect of capital growth. If you are interested in property you would probably make more money trading or developing.

Sure some will make a good return but I suspect the average BTL owner only has one or two and the returns are pretty average.

1. Highly illiquid, it could take years to dismantle a portfolio.

2. It's an easy target for the taxman.

3. There is no IHT protection.

4. Who wants the responsibility when you are retired, I would rather be in the garden.

And I used to have a number of BTL but they are no longer the investment they used to be and the best yielding properties are properties with least prospect of capital growth. If you are interested in property you would probably make more money trading or developing.

Sure some will make a good return but I suspect the average BTL owner only has one or two and the returns are pretty average.

selmahoose said:

This is nonsense. Seriously. It's nonsense.

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

Those took less than 5 minutes to find on a public marketing site. Imagine what the pros in those areas can dig up esp in the off-market BMV arena....

Realistically a person on an average salary will find it very difficult to save £500k (on current values) into a pension. But many of those people probably also don't have the wherewithal, attitude to risk or commercial nous to setup large scale BTL business either.https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

Those took less than 5 minutes to find on a public marketing site. Imagine what the pros in those areas can dig up esp in the off-market BMV arena....

Edited by selmahoose on Saturday 20th July 16:19

One downside I would mention of large BTL portfolios is how they are treated from an IHT perspective. The government regards them in a similar way to shares and so don't offer any relief. The reality though is large scale BTLs are often proper businesses requiring a lot of care and effort to ensure they achieve the expected returns on a long term basis. So in this regard, there are some IHT benefits to pension savings.

EddieSteadyGo said:

Realistically a person on an average salary will find it very difficult to save £500k (on current values) into a pension. But many of those people probably also don't have the wherewithal, attitude to risk or commercial nous to setup large scale BTL business either.

One downside I would mention of large BTL portfolios is how they are treated from an IHT perspective. The government regards them in a similar way to shares and so don't offer any relief. The reality though is large scale BTLs are often proper businesses requiring a lot of care and effort to ensure they achieve the expected returns on a long term basis.

Correct. One downside I would mention of large BTL portfolios is how they are treated from an IHT perspective. The government regards them in a similar way to shares and so don't offer any relief. The reality though is large scale BTLs are often proper businesses requiring a lot of care and effort to ensure they achieve the expected returns on a long term basis.

I don’t want to be a business owner. If I did, I would have gone into business. Suggesting large-scale portfolios of slums as a viable investment avenue for someone to get into with savings from their full-time profession is farcical.

ETA on your first point - I’m not sure it is difficult. 200 a month at 7% gives you 500k after 40 years. That’s 150 a month when topped up by the govt. same cost as a lease one a very average eurobox. It seems like a no-brainer, however the trick is to educate.

Edited by Testaburger on Saturday 20th July 17:31

selmahoose said:

This is nonsense. Seriously. It's nonsense.

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

Those took less than 5 minutes to find on a public marketing site. Imagine what the pros in those areas can dig up esp in the off-market BMV arena....

Let me turn a question you once put to me back on you.https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

https://www.rightmove.co.uk/property-for-sale/prop...

Those took less than 5 minutes to find on a public marketing site. Imagine what the pros in those areas can dig up esp in the off-market BMV arena....

Edited by selmahoose on Saturday 20th July 16:19

If I were to invest in one of these properties with you, how much income would I receive each year and how quickly could I get my money back if I wanted it?

On another note, my wife has just walked past this and expressed an interest in me buying it:

https://www.zoopla.co.uk/for-sale/details/45308142

What are your thoughts? I think the conversion costs (and ongoing heating/maintenance would wipe out any profit.

I do like that it is is a town/village called t

tt though!

tt though!

Testaburger said:

You can post links for properties I wouldn’t use as a fly-tip, but there is a reason they’re cheap. If there wasn’t, then, well, they wouldn’t be cheap.

You’ve carved out a - let’s call it - specialisation - as a professional. That’s akin to professional investors who specialise in their sub-section of the financial markets, be that biotech, semiconductor, oil, etc. There are fortunes to be made. That doesn’t apply to the passive investor saving for retirement. They don’t have the knowledge, tools nor contacts to exploit it.

If I were to go and experiment with three such dumps you posted, I guarantee I’d lose my shirt. I’ve many friends who’ve dabbled with slumlordship, ranging from Detroit to Darlington. All have lost. Some lost big. Every one of them lamented it hasn’t been worth their while.

I’d consider BTL if the right opportunity came along. I’m not anti-property in the least. However, I know a) my limits, and b) my embuggerance threshold.

Oh, and those properties you posted up aren’t representative of the vast majority of rental property. They represent the very lowest percentiles.

Adding more nonsense to previous nonsense doesn't make any of it less nonsensical. You’ve carved out a - let’s call it - specialisation - as a professional. That’s akin to professional investors who specialise in their sub-section of the financial markets, be that biotech, semiconductor, oil, etc. There are fortunes to be made. That doesn’t apply to the passive investor saving for retirement. They don’t have the knowledge, tools nor contacts to exploit it.

If I were to go and experiment with three such dumps you posted, I guarantee I’d lose my shirt. I’ve many friends who’ve dabbled with slumlordship, ranging from Detroit to Darlington. All have lost. Some lost big. Every one of them lamented it hasn’t been worth their while.

I’d consider BTL if the right opportunity came along. I’m not anti-property in the least. However, I know a) my limits, and b) my embuggerance threshold.

Oh, and those properties you posted up aren’t representative of the vast majority of rental property. They represent the very lowest percentiles.

Edited by Testaburger on Saturday 20th July 16:49

The properties I posted are all properties which show your idea of UK rental yields to be nonsensical. None of those should be lower single digit returns. And there are MANY of these all around the UK.

The lower end of the rental market is MASSIVE. This is because, as Jesus said, the poor are always with us. And as you may have noticed in your travels round the world, there are rather more humble dwellings than impressive ones. And that's because there is hugely more demand for cheaper property than there is for expensive.

It might dawn on you that there's a great deal of sense in offering a product for which there is huge demand as opposed to, say, a product only available to a very much smaller pool.

One of the hardest parts to understand is the difference between cheap and slum, or bad. But of course there are many more stupid people than bright ones. The stupid always stumble at the bird/sparrow hurdle. For example, there are many landlords who will not accept DSS tenants. What they can't get their heads round - just can't - is that whilst ALL the scummy people without exception are on benefits, not all the people on benefits are scummy. To them, benefits = scum = not acceptable as tenants. And not all cheap properties are slums. Actually a chunky number of expensive properties are slums. And a chunky number of well padded tenants are scum.

The other really hard thing to understand for the hard of thinking is what I came in business to call the "endless doctrine of self-replacement". Which is why you see the day to day management of property and tenancy as some time-consuming chore. It isn't. You replace yourself as landlord with a managing agent. Then, if you wish, your only connection to the property is as a name on a title deed and a bank account.

So, the stupid equate cheap property with slum property and then believe that somehow their desire to succeed at renting it profitably somehow provides them with the ability to do so. And that's when the common-or-garden lower end of renting comes unstuck. Of course, it dawns on SOME people that their cheap properties might be best operated by agents with a lengthy provable history of having the ability to operate such property very profitably. So they replace themselves as landlords with such agents and of course the agent just adds their properties to a roster of already successfully operating properties which is exactly what the newcomers properties become.

None of this is really much more than common sense. No special tools or knowhow or ability or acumen. Just common sense. Which, of course, is not something most people have.

springfan62 said:

BTL has many downsides; including

1. Highly illiquid, it could take years to dismantle a portfolio.

2. It's an easy target for the taxman.

3. There is no IHT protection.

4. Who wants the responsibility when you are retired, I would rather be in the garden.

And I used to have a number of BTL but they are no longer the investment they used to be and the best yielding properties are properties with least prospect of capital growth. If you are interested in property you would probably make more money trading or developing.

Sure some will make a good return but I suspect the average BTL owner only has one or two and the returns are pretty average.

The last sentence is probably right. The rest of it is just more abject nonsense, apart from point 4 which makes me wonder if you wouldn't prefer to be a tree rather than a human. 1. Highly illiquid, it could take years to dismantle a portfolio.

2. It's an easy target for the taxman.

3. There is no IHT protection.

4. Who wants the responsibility when you are retired, I would rather be in the garden.

And I used to have a number of BTL but they are no longer the investment they used to be and the best yielding properties are properties with least prospect of capital growth. If you are interested in property you would probably make more money trading or developing.

Sure some will make a good return but I suspect the average BTL owner only has one or two and the returns are pretty average.

Gassing Station | Finance | Top of Page | What's New | My Stuff