"Safe" investment, maybe gold?

Discussion

ATM said:

If we do get a reasonable crash in markets then will Gold [and other PM] crash too. Should you wait for the crash and then buy?

I think the theory is that everyone dumps everything to cover shorts and other positions, so the market price drops and it becomes 'a good time to buy' - but AIUI stocks are already low and demand is already high from retail customers, so the theory is good in principle but the reality would be that PMs would effectively become 'unobtanium' or be low in spot price but very high in price when supply/demand premiums are added on top, and that's without the potential for a whale with 8+ figures and a tin foil hat running into the market and placing an order for literally everything available.Andy Schectman (spelling?) of the PMs seller Miles Franklin (he who has strongly cautioned of the impending destruction of the USD and a move to dominance by 'the East' with an asset-backed currency created in the BRICS arrangements) was speaking to Arcadia Economics in a video recently, and he was saying he's gained 12,000 new customers in 4 weeks, something that is unprecedented in a 30+ year career and a struggle to cope with, with premiums increasing in the market due to him and other vendors chasing limited supply capacity.

https://www.youtube.com/watch?v=SboFigZYRQ8

RSTurboPaul said:

Never heard of this Arcadia guy. Andy has been all over recently. He must spend so much of his time doing these interviews. Ed Morse of Citibank who can be bearish but generally has made good calls on oil reckons gold is an ok bet but has a target of $2100

Gold like oil has two markets, paper and physical, I don’t trade gold but to use oil as an example, the paper is 28 times the size of the physical, gold may not be that much but it is a multiple of the physical

Again understanding the game here is important, although there is only probably 5 or 10% upside, some psychotic trader leveraging 20 times (5% margin) might do well.

All this bs about the death of the dollar or the BRICS and oil means nothing because the dollar is and will continue to be the worlds reserve currency for at least a generation, the stories of its demise are promoted by Gold bugs and doom merchants.

Since 1996 gold has offered the same return as the S&P , 6.6% and that’s fine but it hasn’t massively outperformed

People often quote Ray Dalio and his views but they leave out the critical part that he, in this instance he is taking a generational view of the world.

Every gold ad I see makes clear that these arrangements are outside of any deposit guarantee scheme and there is no recourse

So you either go all in and buy all gold and let a person or company you know nothing about control it or you buy so little that losing it doesn’t matter which sort of defeats the purpose

The world is not ending so if someone wants exposure to gold then find one of the larger ETF providers or buy individual producing miners are research

People always quote Buffett when it suits them but when expressed his views on gold, these same types dismissed it.

For anyone who thinks the US ( as it happens I don’t particularly like them ) is done is absolutely fooling themselves. There will be a U.S. recession and the market will correct but this is not the end .

I have positions in small producing miners and they really have gone nowhere but if things get rougher, they will move more than gold itself

Gold like oil has two markets, paper and physical, I don’t trade gold but to use oil as an example, the paper is 28 times the size of the physical, gold may not be that much but it is a multiple of the physical

Again understanding the game here is important, although there is only probably 5 or 10% upside, some psychotic trader leveraging 20 times (5% margin) might do well.

All this bs about the death of the dollar or the BRICS and oil means nothing because the dollar is and will continue to be the worlds reserve currency for at least a generation, the stories of its demise are promoted by Gold bugs and doom merchants.

Since 1996 gold has offered the same return as the S&P , 6.6% and that’s fine but it hasn’t massively outperformed

People often quote Ray Dalio and his views but they leave out the critical part that he, in this instance he is taking a generational view of the world.

Every gold ad I see makes clear that these arrangements are outside of any deposit guarantee scheme and there is no recourse

So you either go all in and buy all gold and let a person or company you know nothing about control it or you buy so little that losing it doesn’t matter which sort of defeats the purpose

The world is not ending so if someone wants exposure to gold then find one of the larger ETF providers or buy individual producing miners are research

People always quote Buffett when it suits them but when expressed his views on gold, these same types dismissed it.

For anyone who thinks the US ( as it happens I don’t particularly like them ) is done is absolutely fooling themselves. There will be a U.S. recession and the market will correct but this is not the end .

I have positions in small producing miners and they really have gone nowhere but if things get rougher, they will move more than gold itself

Interesting to watch 'value stocks' the last 6 months

Sainsbury went from 170 to 280 up 64%

Tesco 195 to 270 up 38%

Walmart USA 127 to 150 up 18%

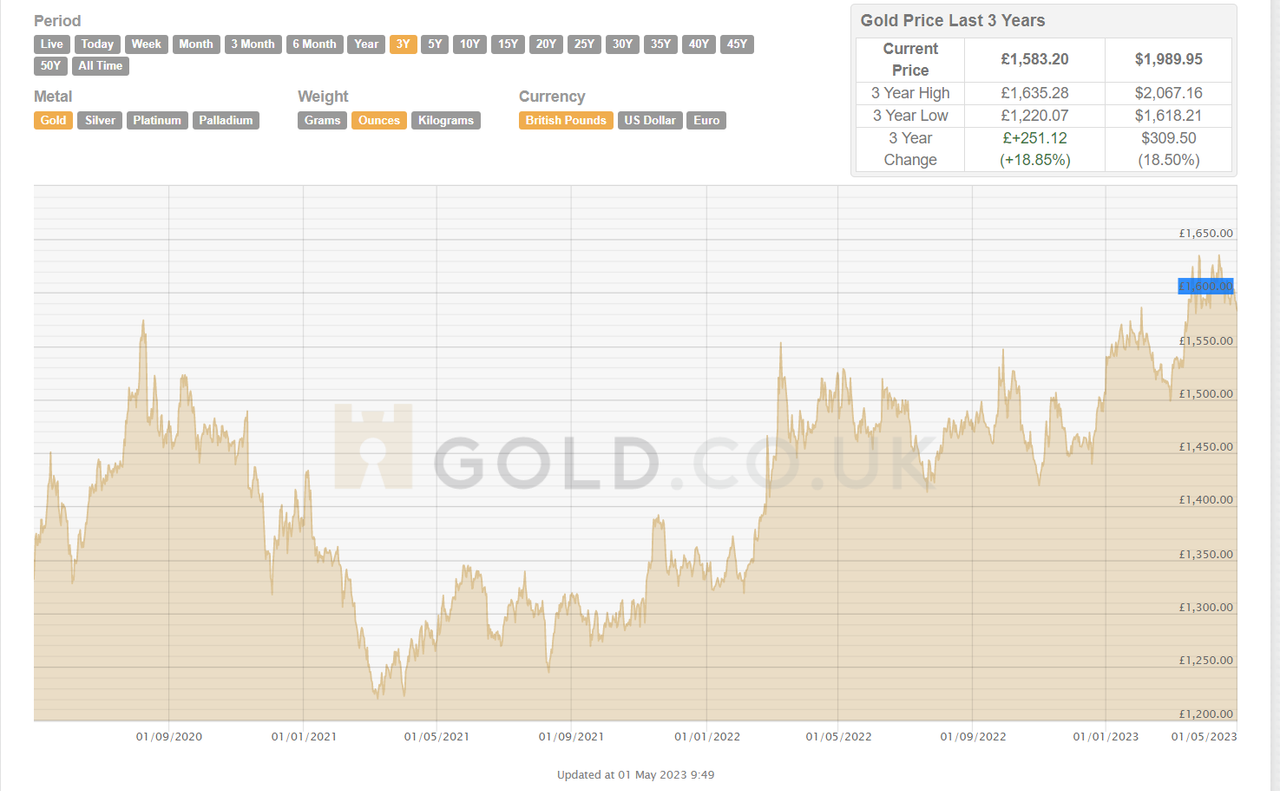

Gold 1620 to 2025 up 25%

I haven't cherry picked these stocks to prove a point, I own them and have for a while (except Wallmart)

As someone mentioned earlier, hard to beat a basket of equities and as shown, nothing wrong with some metal exposure either

Metals will logically go up in an inflationary environment, as the energy, man power etc required to dig it out of the ground gets more expensive. If the price doesn't go up to reflect this, it won't get mined. If it doesn't get mined, then the price will increase meaning the mining can recommence

A very basic view of course but from a logical point of view, these inflationary impacts will of course make a difference to the spot price.

Sainsbury went from 170 to 280 up 64%

Tesco 195 to 270 up 38%

Walmart USA 127 to 150 up 18%

Gold 1620 to 2025 up 25%

I haven't cherry picked these stocks to prove a point, I own them and have for a while (except Wallmart)

As someone mentioned earlier, hard to beat a basket of equities and as shown, nothing wrong with some metal exposure either

Metals will logically go up in an inflationary environment, as the energy, man power etc required to dig it out of the ground gets more expensive. If the price doesn't go up to reflect this, it won't get mined. If it doesn't get mined, then the price will increase meaning the mining can recommence

A very basic view of course but from a logical point of view, these inflationary impacts will of course make a difference to the spot price.

DaveA8 said:

I don’t trade gold but to use oil as an example, the paper is 28 times the size of the physical, gold may not be that much but it is a multiple of the physical

All this bs about the death of the dollar or the BRICS and oil means nothing because the dollar is and will continue to be the worlds reserve currency for at least a generation, the stories of its demise are promoted by Gold bugs and doom merchants.

Since 1996 gold has offered the same return as the S&P , 6.6% and that’s fine but it hasn’t massively outperformed

The system feels like it's fragile (again). Most have your opinion or perhaps even more confidence all is/will be ok. You say for at least a generation but that does actually suggest you think it might/will end at some point? If that's true then it will be for the same reasons as others think, it's just the timeline that's disputed? As for the 'paper' aspect of trading/markets well it's hard to see how this isn't a deception of sorts, like a fractional reserve system of things, a system that lets you buy items and trade the price movements but if everyone wanted what they 'own' then it would be exposed for the largely empty promise system it is? Almost everything is based around promises that will be made good in the future, and enough promises can be kept as everyone has been convinced that their money/wealth can be safely stored in the various promise formats. I can't fully decided if that's a very good, user friendly and flexible trust based system or a full on ponzi type deception!? All this bs about the death of the dollar or the BRICS and oil means nothing because the dollar is and will continue to be the worlds reserve currency for at least a generation, the stories of its demise are promoted by Gold bugs and doom merchants.

Since 1996 gold has offered the same return as the S&P , 6.6% and that’s fine but it hasn’t massively outperformed

The gold bug/doom merchants and the talk of system/dollar collapse are a bit chicken and egg, and I'd argue they are gold and doom people because if you study the system as it is, you conclude that it can't continue indefinitely, and when it doesn't there will be little good news? Everytime the USD debt ceiling issue comes around the level is raised because otherwise government workers don't get paid, social security doesn't get paid etc etc, it would be carnage?

So debt goes up and all is fine, but can debt go up forever, logical head says no, so then you are back to the doom and gloom scenarios.

Scootersp said:

DaveA8 said:

I don’t trade gold but to use oil as an example, the paper is 28 times the size of the physical, gold may not be that much but it is a multiple of the physical

All this bs about the death of the dollar or the BRICS and oil means nothing because the dollar is and will continue to be the worlds reserve currency for at least a generation, the stories of its demise are promoted by Gold bugs and doom merchants.

Since 1996 gold has offered the same return as the S&P , 6.6% and that’s fine but it hasn’t massively outperformed

The system feels like it's fragile (again). Most have your opinion or perhaps even more confidence all is/will be ok. You say for at least a generation but that does actually suggest you think it might/will end at some point? If that's true then it will be for the same reasons as others think, it's just the timeline that's disputed? As for the 'paper' aspect of trading/markets well it's hard to see how this isn't a deception of sorts, like a fractional reserve system of things, a system that lets you buy items and trade the price movements but if everyone wanted what they 'own' then it would be exposed for the largely empty promise system it is? Almost everything is based around promises that will be made good in the future, and enough promises can be kept as everyone has been convinced that their money/wealth can be safely stored in the various promise formats. I can't fully decided if that's a very good, user friendly and flexible trust based system or a full on ponzi type deception!? All this bs about the death of the dollar or the BRICS and oil means nothing because the dollar is and will continue to be the worlds reserve currency for at least a generation, the stories of its demise are promoted by Gold bugs and doom merchants.

Since 1996 gold has offered the same return as the S&P , 6.6% and that’s fine but it hasn’t massively outperformed

The gold bug/doom merchants and the talk of system/dollar collapse are a bit chicken and egg, and I'd argue they are gold and doom people because if you study the system as it is, you conclude that it can't continue indefinitely, and when it doesn't there will be little good news? Everytime the USD debt ceiling issue comes around the level is raised because otherwise government workers don't get paid, social security doesn't get paid etc etc, it would be carnage?

So debt goes up and all is fine, but can debt go up forever, logical head says no, so then you are back to the doom and gloom scenarios.

Based on history and probability, the dollar must at some point be replaced by something, no empire or reserve currency has had an indefinite run but for now what are the alternatives, China, Euro, the pound (greatest comeback since Lazarus) or Japan.

None of these really offer anything, I think it will be a slow demise for the dollar where buyers of US debt will demand more and more premium for that debt or the US government will mandate that Pension Co’s etc hold more US debt because that’s a nice way of keeping it in the family.I still think the US has enough sway that all they need to do is ensure global instability and everyone will run to the dollar, it is a matter of fact this happened on the invasion of Ukraine, raising interest rates turbocharged the effect.

The issue I have with gold is that it’s too stable in a way and takes a lot of leverage to make any money especially if at where it is now, small miners who are producing are a play I prefer as there’s always the chance of a home run.

The risk here is that even assuming that in the chaos of a complete breakdown in society that Loomis or whoever is holding your gold won’t be told to stop withdrawals so that means holding physical gold at home.

I wonder is being a gold bug the financial equivalent of being a doomsday prepper

Good luck if that’s somebody’s thing but I don’t think it’s a high probability event so worry about other things

Also a rock is just as good as a gold bar for dispatching zombies

DaveA8 said:

I wonder is being a gold bug the financial equivalent of being a doomsday prepper

Good luck if that’s somebody’s thing but I don’t think it’s a high probability event so worry about other things

I think it probably is seen as such today yes, certainly in the 'west'. What I find interesting is that it wasn't that long ago that silver/Gold was money, it had the backing and redeemability. That we can go from it being the, accepted by all norm, to it being a bit crackpot/prepper is interesting to me. Good luck if that’s somebody’s thing but I don’t think it’s a high probability event so worry about other things

Like humanities thousands of years of having something (not necessarily gold but something tangible) to represent money is not relevant? we should have realised far earlier that we can just create trust in paper or digital readouts and that's better?

In many languages the word for silver is the same as money, we have old sayings like "the family silver"

Since the 2008 crisis Gold has increased substantially but the general sentiment/view of it in a;; that time is not dissimilar to today? so how/why has it gone up, something is supporting underpinning it's general trend up, it's costing more to mine but still finding buyers at the higher prices, and it can't all be preppers in their bunkers doing the buying!?

1945 US dimes (10cents) were 90% silver, 2.25g of silver per dime, so approx 13 dimes = 1oz of silver.

Annual production now is approx 1 Billion ounces and so with the total global production you could make 13 billion dimes or $1.3 Billion (which these days is nothing)

If you wanted to create a trillion dollars worth of 90% silver dimes now you'd need over 750 years of current silver production to make them.

It highlights the money supply expansion that's happened, perhaps it doesn't matter.

Annual production now is approx 1 Billion ounces and so with the total global production you could make 13 billion dimes or $1.3 Billion (which these days is nothing)

If you wanted to create a trillion dollars worth of 90% silver dimes now you'd need over 750 years of current silver production to make them.

It highlights the money supply expansion that's happened, perhaps it doesn't matter.

DaveA8 said:

I wonder is being a gold bug the financial equivalent of being a doomsday prepper

Good luck if that’s somebody’s thing but I don’t think it’s a high probability event so worry about other things

It’s a guaranteed event. I’m thinking a big solar flare might be what catches our current civilisation out.Good luck if that’s somebody’s thing but I don’t think it’s a high probability event so worry about other things

But like I said, in the event the world goes tits up, gold will be useless any way.

There is in my view a fine between failure and normalcy where somehow gold goes crazy and some people make out like bandits… if they sell.

Imo they’d hold in their infinite greed and miss the boat

It’s fine as a bit in your portfolio though.

Mr Whippy said:

DaveA8 said:

I wonder is being a gold bug the financial equivalent of being a doomsday prepper

Good luck if that’s somebody’s thing but I don’t think it’s a high probability event so worry about other things

It’s a guaranteed event. I’m thinking a big solar flare might be what catches our current civilisation out.Good luck if that’s somebody’s thing but I don’t think it’s a high probability event so worry about other things

[b]But like I said, in the event the world goes tits up, gold will be useless any way.

There is in my view a fine between failure and normalcy where somehow gold goes crazy and some people make out like bandits… if they sell.[/b]

Imo they’d hold in their infinite greed and miss the boat

It’s fine as a bit in your portfolio though.

(ref: Weimar hyperinflation and buying houses for an ounce of gold etc. etc.)

RSTurboPaul said:

Mr Whippy said:

DaveA8 said:

I wonder is being a gold bug the financial equivalent of being a doomsday prepper

Good luck if that’s somebody’s thing but I don’t think it’s a high probability event so worry about other things

It’s a guaranteed event. I’m thinking a big solar flare might be what catches our current civilisation out.Good luck if that’s somebody’s thing but I don’t think it’s a high probability event so worry about other things

[b]But like I said, in the event the world goes tits up, gold will be useless any way.

There is in my view a fine between failure and normalcy where somehow gold goes crazy and some people make out like bandits… if they sell.[/b]

Imo they’d hold in their infinite greed and miss the boat

It’s fine as a bit in your portfolio though.

(ref: Weimar hyperinflation and buying houses for an ounce of gold etc. etc.)

Chances are you already had one. Who needs two when the economy is tanking?

Vs say, food. Or escaping the country?

This is the point, when gold is amazing, it isn’t truly valuable for much imo.

But as a cash-like inflation stable long-term saving you can hold quite discretely it’s nice.

Mr Whippy said:

RSTurboPaul said:

Mr Whippy said:

DaveA8 said:

I wonder is being a gold bug the financial equivalent of being a doomsday prepper

Good luck if that’s somebody’s thing but I don’t think it’s a high probability event so worry about other things

It’s a guaranteed event. I’m thinking a big solar flare might be what catches our current civilisation out.Good luck if that’s somebody’s thing but I don’t think it’s a high probability event so worry about other things

[b]But like I said, in the event the world goes tits up, gold will be useless any way.

There is in my view a fine between failure and normalcy where somehow gold goes crazy and some people make out like bandits… if they sell.[/b]

Imo they’d hold in their infinite greed and miss the boat

It’s fine as a bit in your portfolio though.

(ref: Weimar hyperinflation and buying houses for an ounce of gold etc. etc.)

Chances are you already had one. Who needs two when the economy is tanking?

Vs say, food. Or escaping the country?

This is the point, when gold is amazing, it isn’t truly valuable for much imo.

But as a cash-like inflation stable long-term saving you can hold quite discretely it’s nice.

Isn't that what the (predatory?) investment types say, so they can accumulate assets when very 'cheap' and then enjoy the benefits of them and the usual rise in fiat price when things settle down again?

It seems like 'buy and hold' is the approach one should take to physical assets if one is thinking long-term

Fair points of course re: survival situations - I guess the one key benefit of PMs is their portability and 'known valuable' status, enabling discreet transit and exchange across the world rather than being bricks-and-mortar or similar stuck in a difficult/declining geographic location/situation.

Mind you - if the choice is swapping one's shiny for either food or assets, isn't the lesson that one should have stacked more shiny before 'TSHTF'?

lol

lolRSTurboPaul said:

Mr Whippy said:

RSTurboPaul said:

Mr Whippy said:

DaveA8 said:

I wonder is being a gold bug the financial equivalent of being a doomsday prepper

Good luck if that’s somebody’s thing but I don’t think it’s a high probability event so worry about other things

It’s a guaranteed event. I’m thinking a big solar flare might be what catches our current civilisation out.Good luck if that’s somebody’s thing but I don’t think it’s a high probability event so worry about other things

[b]But like I said, in the event the world goes tits up, gold will be useless any way.

There is in my view a fine between failure and normalcy where somehow gold goes crazy and some people make out like bandits… if they sell.[/b]

Imo they’d hold in their infinite greed and miss the boat

It’s fine as a bit in your portfolio though.

(ref: Weimar hyperinflation and buying houses for an ounce of gold etc. etc.)

Chances are you already had one. Who needs two when the economy is tanking?

Vs say, food. Or escaping the country?

This is the point, when gold is amazing, it isn’t truly valuable for much imo.

But as a cash-like inflation stable long-term saving you can hold quite discretely it’s nice.

Isn't that what the (predatory?) investment types say, so they can accumulate assets when very 'cheap' and then enjoy the benefits of them and the usual rise in fiat price when things settle down again?

It seems like 'buy and hold' is the approach one should take to physical assets if one is thinking long-term

Fair points of course re: survival situations - I guess the one key benefit of PMs is their portability and 'known valuable' status, enabling discreet transit and exchange across the world rather than being bricks-and-mortar or similar stuck in a difficult/declining geographic location/situation.

Mind you - if the choice is swapping one's shiny for either food or assets, isn't the lesson that one should have stacked more shiny before 'TSHTF'?

lol

lol15-20 years later it sort of was.

This is the issue with fear. It’s motivated and justified.

But we’ve enjoyed decades of bailouts and stability and moral hazard now reigns supreme. No one can see risks like these.

They just think the system will carry on as it has.

And the risks are such that gold could be just as impotent as anything else to protect wealth.

A move to socialism?

Banning it for 40 years or so again?

Who knows?

I’d be maybe 10% in it, but any more is just silly really as it’s just as risky as lots of other stuff.

I've just been looking at silver for getting rid.

I've been offered about £21/oz for silver for about 50 or so RM 1oz brits/lunar coins as best quote so far.

Despite 8 years I've made pretty much feck all on this. I'd have owned a Lambo or five had I put the same cash into bitcoin

Gold has done ok in comparison, helped further mainly by much tighter spreads and no VAT.

Why does anyone buy flipping silver? What a waste of time.

Plus it gets white spots, and buyers don't like white spots much either.

I'm balancing up the idea of just selling it and buying gold, or bitcoin, or putting it into an M3 or something.

Or is it about to 'go to the moon'?

I've been offered about £21/oz for silver for about 50 or so RM 1oz brits/lunar coins as best quote so far.

Despite 8 years I've made pretty much feck all on this. I'd have owned a Lambo or five had I put the same cash into bitcoin

Gold has done ok in comparison, helped further mainly by much tighter spreads and no VAT.

Why does anyone buy flipping silver? What a waste of time.

Plus it gets white spots, and buyers don't like white spots much either.

I'm balancing up the idea of just selling it and buying gold, or bitcoin, or putting it into an M3 or something.

Or is it about to 'go to the moon'?

Gassing Station | Finance | Top of Page | What's New | My Stuff