"Safe" investment, maybe gold?

Discussion

clio007 said:

Looking at the price. The time to buy was the day before the Hamas attack

But in 3 years time you could argue the time to buy was Today. Some people get scared of buying when price is going up fast. So instead wait on the side lines for a dip to buy. If you are of a mind to buy then dont let price going up fast scare you away. Get involved. Price going up fast should not be scary. The opposite is true.DonkeyApple said:

jshell said:

With so many countries talking of returning to a so-called 'gold standard', and so many economies showing signs of stress, surely we are in a buy market!

Or at least more so than in earlier history. jshell said:

DonkeyApple said:

jshell said:

With so many countries talking of returning to a so-called 'gold standard', and so many economies showing signs of stress, surely we are in a buy market!

Or at least more so than in earlier history. So many reasons for Gold to do well right now:

1. US treasuries going or moving down - as in already

2. Gold going or moving Up - as in already

3. Bonds and debt markets going or moving down - as in already

Maybes or predictions or guesses

4. Big Tech stocks looking like they have topped and could start dropping

5. AI stocks looking like they have topped and could start dropping

6. US Stock markets in general held up by big tech and AI could all start dropping

7. Interest rates keep going higher leading to even more bad news.....

8. More countries or people getting out of the US Dollar if they start to believe they cant afford to pay their bills / the costs of their current escalating wars / their debt already or in future

9. Stocks looking even less worth buying because bonds paying more

10. More and more wars breaking out while [war minded] people think the US is stretched with 2 wars already so think F it lets get our conflict started now too while we can

Leading to a further spiral of all of the above etc etc etc

If anyone sees any good news at the moment I would like to hear it because I see absolutely none

1. US treasuries going or moving down - as in already

2. Gold going or moving Up - as in already

3. Bonds and debt markets going or moving down - as in already

Maybes or predictions or guesses

4. Big Tech stocks looking like they have topped and could start dropping

5. AI stocks looking like they have topped and could start dropping

6. US Stock markets in general held up by big tech and AI could all start dropping

7. Interest rates keep going higher leading to even more bad news.....

8. More countries or people getting out of the US Dollar if they start to believe they cant afford to pay their bills / the costs of their current escalating wars / their debt already or in future

9. Stocks looking even less worth buying because bonds paying more

10. More and more wars breaking out while [war minded] people think the US is stretched with 2 wars already so think F it lets get our conflict started now too while we can

Leading to a further spiral of all of the above etc etc etc

If anyone sees any good news at the moment I would like to hear it because I see absolutely none

DonkeyApple said:

jshell said:

DonkeyApple said:

jshell said:

With so many countries talking of returning to a so-called 'gold standard', and so many economies showing signs of stress, surely we are in a buy market!

Or at least more so than in earlier history. But, and here's a question for you perhaps; given that the US bullion reserve booked value is $42/Oz, with gold now having hit $2k/Oz only this week, could the US re-value and issue gold backed bonds to help alleviate their debts and allow gold to float ever higher? Lot's of wishful thinking there, of course.

Some in the metals space talk about the current metals ownership as a percentage of all asset classes and then talks about "reversion to mean".

Essentially saying that there are factors like the above which start to perhaps move more people to the metals, but that currently the % of the total investments (in the US I think he was saying) in precious metals was approx 0.5% (which goes with the fringe/play/safety portion DA mentions) but that the mean is about 2% and so essentially the argument is there is more chance of migration going to the metals than away from it?

I mean if you have some before all this turmoil, why would you sell now, you've had to have been a bit 'out there' /cautious/tin foil hat or whatever you get labelled to dabble before, most people don't even consider it.

DA's point about buying USD is relevant to varying degrees across the globe, having Gold that's valued in dollars over the last year or two would have been quite positive compared to their domestic currency and possibly better than other investments if they too are designated in the domestic currency.

It's largely tracked with inflation for us in the UK but will have preserved wealth across the globe for some, where currency issues have historically wiped out life savings. It's a global asset and many countries have far more reasons to buy it, it's on more people radar elsewhere but they have limited resource to buy it? To be fair the US paper dollar is often king in the places of currency devaluation, so there is arguably even more future metal potential if the dollar starts to waiver, that is not likely anytime soon (you have the technically insolvent argument vs the reserve currency argument)

A shift in western attitudes could start a trickle effect, and a reversion to mean could see quite a demand spike.

It's all could's and maybe's.....

Essentially saying that there are factors like the above which start to perhaps move more people to the metals, but that currently the % of the total investments (in the US I think he was saying) in precious metals was approx 0.5% (which goes with the fringe/play/safety portion DA mentions) but that the mean is about 2% and so essentially the argument is there is more chance of migration going to the metals than away from it?

I mean if you have some before all this turmoil, why would you sell now, you've had to have been a bit 'out there' /cautious/tin foil hat or whatever you get labelled to dabble before, most people don't even consider it.

DA's point about buying USD is relevant to varying degrees across the globe, having Gold that's valued in dollars over the last year or two would have been quite positive compared to their domestic currency and possibly better than other investments if they too are designated in the domestic currency.

It's largely tracked with inflation for us in the UK but will have preserved wealth across the globe for some, where currency issues have historically wiped out life savings. It's a global asset and many countries have far more reasons to buy it, it's on more people radar elsewhere but they have limited resource to buy it? To be fair the US paper dollar is often king in the places of currency devaluation, so there is arguably even more future metal potential if the dollar starts to waiver, that is not likely anytime soon (you have the technically insolvent argument vs the reserve currency argument)

A shift in western attitudes could start a trickle effect, and a reversion to mean could see quite a demand spike.

It's all could's and maybe's.....

jshell said:

Oh, yeah, I love doing a Gollum act occasionally, it's nice just having some shiny stuff that may or may not appreciate!

But, and here's a question for you perhaps; given that the US bullion reserve booked value is $42/Oz, with gold now having hit $2k/Oz only this week, could the US re-value and issue gold backed bonds to help alleviate their debts and allow gold to float ever higher? Lot's of wishful thinking there, of course.

I think the age old issue is that since departing from any gold links in 1971 the price of Gold has been seen to be a contra indicator, ie it doing well indicates the economy is not. This has led to the inference of the price being held down ie to ensure the dollar dominance continues. This price control is not purely tin foil hat, there have been documented times where the price has genuinely been suppressed.But, and here's a question for you perhaps; given that the US bullion reserve booked value is $42/Oz, with gold now having hit $2k/Oz only this week, could the US re-value and issue gold backed bonds to help alleviate their debts and allow gold to float ever higher? Lot's of wishful thinking there, of course.

So I don't see the US ever raising Golds profile? Gold is an oddity in that it is never ever promoted anywhere in the mainstream, seems more irrelevant than ever in many ways, yet no one wants to get rid of, exchange it for anything else? in fact its reported that central banks are buying more of it than ever. Is the reason they don't sell it the reason we should all generationally have some?

Scootersp said:

Some in the metals space talk about the current metals ownership as a percentage of all asset classes and then talks about "reversion to mean".

Essentially saying that there are factors like the above which start to perhaps move more people to the metals, but that currently the % of the total investments (in the US I think he was saying) in precious metals was approx 0.5% (which goes with the fringe/play/safety portion DA mentions) but that the mean is about 2% and so essentially the argument is there is more chance of migration going to the metals than away from it?

I mean if you have some before all this turmoil, why would you sell now, you've had to have been a bit 'out there' /cautious/tin foil hat or whatever you get labelled to dabble before, most people don't even consider it.

DA's point about buying USD is relevant to varying degrees across the globe, having Gold that's valued in dollars over the last year or two would have been quite positive compared to their domestic currency and possibly better than other investments if they too are designated in the domestic currency.

It's largely tracked with inflation for us in the UK but will have preserved wealth across the globe for some, where currency issues have historically wiped out life savings. It's a global asset and many countries have far more reasons to buy it, it's on more people radar elsewhere but they have limited resource to buy it? To be fair the US paper dollar is often king in the places of currency devaluation, so there is arguably even more future metal potential if the dollar starts to waiver, that is not likely anytime soon (you have the technically insolvent argument vs the reserve currency argument)

A shift in western attitudes could start a trickle effect, and a reversion to mean could see quite a demand spike.

It's all could's and maybe's.....

The BRICS proposals for an asset-backed currency and apparent reduction in use of USD / the Petrodollar may indicate a shift is coming...??Essentially saying that there are factors like the above which start to perhaps move more people to the metals, but that currently the % of the total investments (in the US I think he was saying) in precious metals was approx 0.5% (which goes with the fringe/play/safety portion DA mentions) but that the mean is about 2% and so essentially the argument is there is more chance of migration going to the metals than away from it?

I mean if you have some before all this turmoil, why would you sell now, you've had to have been a bit 'out there' /cautious/tin foil hat or whatever you get labelled to dabble before, most people don't even consider it.

DA's point about buying USD is relevant to varying degrees across the globe, having Gold that's valued in dollars over the last year or two would have been quite positive compared to their domestic currency and possibly better than other investments if they too are designated in the domestic currency.

It's largely tracked with inflation for us in the UK but will have preserved wealth across the globe for some, where currency issues have historically wiped out life savings. It's a global asset and many countries have far more reasons to buy it, it's on more people radar elsewhere but they have limited resource to buy it? To be fair the US paper dollar is often king in the places of currency devaluation, so there is arguably even more future metal potential if the dollar starts to waiver, that is not likely anytime soon (you have the technically insolvent argument vs the reserve currency argument)

A shift in western attitudes could start a trickle effect, and a reversion to mean could see quite a demand spike.

It's all could's and maybe's.....

Plus, IIRC, Janet Yellon or that Federal Reserve bloke have already said 'there is room for more than one world reserve currency' (to paraphrase).

I'm pro Gold, but I know it's currently the underdog, I agree there is an uncurrent around the world that the US is abusing it's reserve currency status but I'm not sure we are close to a major change? I've always like the underdog though and besides in this instance I don't see Gold as a potential total loss, it might be a "It didn't do as well as 'X'" thing but it'll never be a worthless thing and it has a speculative aspect to it in the past.

It 'feels' like a balance gamble where if you win, you could win big, if you lose you stay still. I personally don't see a huge long term downside and am happy if there is never a huge upside. You could argue it's like having a stable/boring asset with a chance of a blip up, like being in premium bonds but instead of an individual having the 1 in a Million chance of going x20 (from a max holding), the global outlook could change or your currency get devalued and all holders win perhasp x2 not just one out of a million?

Plenty of people have maxed out premium bonds, I wonder how many people have the same in Gold, a handful?

It 'feels' like a balance gamble where if you win, you could win big, if you lose you stay still. I personally don't see a huge long term downside and am happy if there is never a huge upside. You could argue it's like having a stable/boring asset with a chance of a blip up, like being in premium bonds but instead of an individual having the 1 in a Million chance of going x20 (from a max holding), the global outlook could change or your currency get devalued and all holders win perhasp x2 not just one out of a million?

Plenty of people have maxed out premium bonds, I wonder how many people have the same in Gold, a handful?

I've just crunched some numbers..............

Premium bonds Max limit was 20K before May 2003, then 30K to June 2014 and then 40K to June 2015 and 50K thereafter.

If you had £20K and bought £10K of Gold with every limit change you'd have, your original £20K, then £72K, £21K and £20K so £133K (20K cash and £113K of Gold at today price) vs the £50K plus whatever 'winnings' you may have had. (NB if you had really gone full on Gold Bug 1st June 2003 and moved the original £20K into Gold at that time too, you'd have over £250K's worth of Gold today.)

So ok your premium bonds never go down nominally, Gold will have dipped and frustrated at times, but the difference is significant and yet no way do over 900K uk people have £50k in Gold, when that many do have it in premium bonds. One is viewed as very safe by the general populace (mind you probably as hugely wasteful/inefficient by the index funder types) compare to the fringe/lunatic/"you're not quite right in the head are you" Gold.

Premium bonds Max limit was 20K before May 2003, then 30K to June 2014 and then 40K to June 2015 and 50K thereafter.

If you had £20K and bought £10K of Gold with every limit change you'd have, your original £20K, then £72K, £21K and £20K so £133K (20K cash and £113K of Gold at today price) vs the £50K plus whatever 'winnings' you may have had. (NB if you had really gone full on Gold Bug 1st June 2003 and moved the original £20K into Gold at that time too, you'd have over £250K's worth of Gold today.)

So ok your premium bonds never go down nominally, Gold will have dipped and frustrated at times, but the difference is significant and yet no way do over 900K uk people have £50k in Gold, when that many do have it in premium bonds. One is viewed as very safe by the general populace (mind you probably as hugely wasteful/inefficient by the index funder types) compare to the fringe/lunatic/"you're not quite right in the head are you" Gold.

Scootersp said:

I've just crunched some numbers..............

Premium bonds Max limit was 20K before May 2003, then 30K to June 2014 and then 40K to June 2015 and 50K thereafter.

If you had £20K and bought £10K of Gold with every limit change you'd have, your original £20K, then £72K, £21K and £20K so £133K (20K cash and £113K of Gold at today price) vs the £50K plus whatever 'winnings' you may have had. (NB if you had really gone full on Gold Bug 1st June 2003 and moved the original £20K into Gold at that time too, you'd have over £250K's worth of Gold today.)

So ok your premium bonds never go down nominally, Gold will have dipped and frustrated at times, but the difference is significant and yet no way do over 900K uk people have £50k in Gold, when that many do have it in premium bonds. One is viewed as very safe by the general populace (mind you probably as hugely wasteful/inefficient by the index funder types) compare to the fringe/lunatic/"you're not quite right in the head are you" Gold.

As I’ve said a few times.Premium bonds Max limit was 20K before May 2003, then 30K to June 2014 and then 40K to June 2015 and 50K thereafter.

If you had £20K and bought £10K of Gold with every limit change you'd have, your original £20K, then £72K, £21K and £20K so £133K (20K cash and £113K of Gold at today price) vs the £50K plus whatever 'winnings' you may have had. (NB if you had really gone full on Gold Bug 1st June 2003 and moved the original £20K into Gold at that time too, you'd have over £250K's worth of Gold today.)

So ok your premium bonds never go down nominally, Gold will have dipped and frustrated at times, but the difference is significant and yet no way do over 900K uk people have £50k in Gold, when that many do have it in premium bonds. One is viewed as very safe by the general populace (mind you probably as hugely wasteful/inefficient by the index funder types) compare to the fringe/lunatic/"you're not quite right in the head are you" Gold.

Gold as a Lambo-buying strategy, nope.

But as a solid long-term beats inflation, and at least matches interest of cash in the bank, but is in your hands and is CGT free, and outside ‘the system’… it’s actually a much better bet than cash in bank/savings accounts long term.

So yes those PB holders, really can only celebrate if they’ve won a big price.

If not arguably been in an S&S ISA with a global tracker would be a better bet.

From the conclusion of the link which is very balanced "And that’s the point about gold – you buy it for its diversification potential. If everything else is going swimmingly then you’ll probably end up loathing your gold. But if it’s not…"

I accept a lot of what that link says, Gold doesn't make sense in many ways, but it (and silver - which does have more industrial uses) did used to back all our money, back when everyone demanded it actually had some backing, when even the powerful couldn't get away with just paper/promissory money?

It lingers around, even in the current higher interest rate environment it seems to be holding up, you can get 5% on your money or have Gold and get nothing extra and yet nearly 300K ounces costing approx £450M are bought by someone a day.

I'm not sure if that's "telling" in any way but it's quite a lot of demand who buys the stuff and why! "Tinfoil hat" Gold bug enthusiasts aren't multi billionaires generally!?

Perhaps the last statement is the reason, is everything going swimmingly? I'd say not and it 'could' get worse, in some areas monetarily we are in unchartered terroritory?

I accept a lot of what that link says, Gold doesn't make sense in many ways, but it (and silver - which does have more industrial uses) did used to back all our money, back when everyone demanded it actually had some backing, when even the powerful couldn't get away with just paper/promissory money?

It lingers around, even in the current higher interest rate environment it seems to be holding up, you can get 5% on your money or have Gold and get nothing extra and yet nearly 300K ounces costing approx £450M are bought by someone a day.

I'm not sure if that's "telling" in any way but it's quite a lot of demand who buys the stuff and why! "Tinfoil hat" Gold bug enthusiasts aren't multi billionaires generally!?

Perhaps the last statement is the reason, is everything going swimmingly? I'd say not and it 'could' get worse, in some areas monetarily we are in unchartered terroritory?

For me its simple.

For years while bonds and debt based stuff like Treasuries were in a bull market countries like China or the Saudis were happy to hold them. Thats now changed as they are in a bear market. China has not been increasing its holding for many years.

Then ridiculous inflation for Covid or the secret US treasury market crisis in 2019

Then War with Russia where the US weaponised the USD

Now more war and more countries thinking the USD is going down down down - if they dont believe it is now then they believe it will soon as USA gets involved in more and more wars it cant afford - for now they can print money for war but for how long will this work?

More Gold buying by Central Banks now than ever before because they need a store of value which isnt USD so what else is there?

You cant store Wheat or Grain or Copper or Oil easily so what do you do. You buy and store Gold.

China is now out spending all over the world on stuff like ports and roads and rail. They are spending down their Treasuries / USD holdings and instead investing in stuff. Saudi also are spending like drunken sailors because they dont want to sit on Treasuries / USD too.

China exports loads of stuff and are now making friends with lots of countries bringing with them the stuff mentioned above.

The USA only exports War, Dollars and Debt. That's all. Ok they also have Amazon, Apple and Tesla which pay no tax.

I think the USD is looking weaker and weaker by the day.

For years while bonds and debt based stuff like Treasuries were in a bull market countries like China or the Saudis were happy to hold them. Thats now changed as they are in a bear market. China has not been increasing its holding for many years.

Then ridiculous inflation for Covid or the secret US treasury market crisis in 2019

Then War with Russia where the US weaponised the USD

Now more war and more countries thinking the USD is going down down down - if they dont believe it is now then they believe it will soon as USA gets involved in more and more wars it cant afford - for now they can print money for war but for how long will this work?

More Gold buying by Central Banks now than ever before because they need a store of value which isnt USD so what else is there?

You cant store Wheat or Grain or Copper or Oil easily so what do you do. You buy and store Gold.

China is now out spending all over the world on stuff like ports and roads and rail. They are spending down their Treasuries / USD holdings and instead investing in stuff. Saudi also are spending like drunken sailors because they dont want to sit on Treasuries / USD too.

China exports loads of stuff and are now making friends with lots of countries bringing with them the stuff mentioned above.

The USA only exports War, Dollars and Debt. That's all. Ok they also have Amazon, Apple and Tesla which pay no tax.

I think the USD is looking weaker and weaker by the day.

Not a good time to buy gold at the moment, prices being so high. My holdings are showing currently, a 24% return, which is pleasing, but I want to buy , not sell.

I use Atkinson bullion in Brum, their spread seems to be very competetive, and give an efficient service.

As a customer, and only that , I can , from my experience recomend them.

I use Atkinson bullion in Brum, their spread seems to be very competetive, and give an efficient service.

As a customer, and only that , I can , from my experience recomend them.

Hosenbugler said:

Not a good time to buy gold at the moment, prices being so high. My holdings are showing currently, a 24% return, which is pleasing, but I want to buy , not sell.

I use Atkinson bullion in Brum, their spread seems to be very competetive, and give an efficient service.

As a customer, and only that , I can , from my experience recomend them.

Much better than BullionByPost...I use Atkinson bullion in Brum, their spread seems to be very competetive, and give an efficient service.

As a customer, and only that , I can , from my experience recomend them.

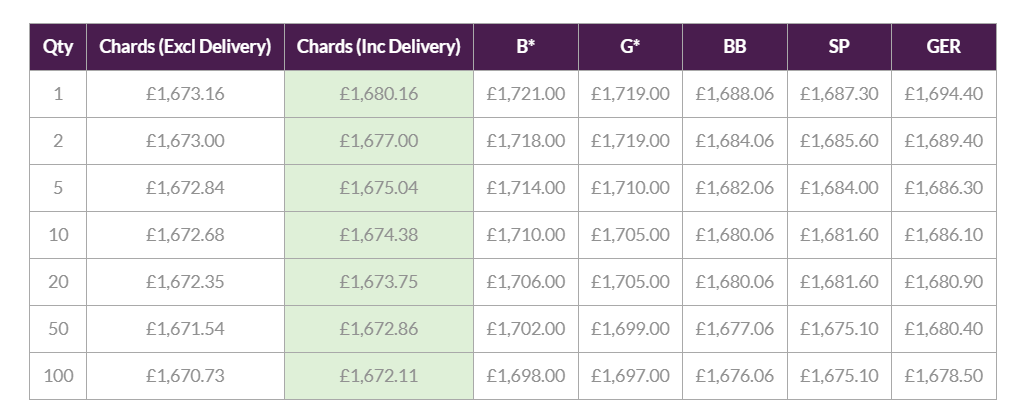

2024 Britannia prices Buy / Sell...

Atkinson £1679 / £1609

BullionByPost £1722 / £1560

pingu393 said:

Hosenbugler said:

Not a good time to buy gold at the moment, prices being so high. My holdings are showing currently, a 24% return, which is pleasing, but I want to buy , not sell.

I use Atkinson bullion in Brum, their spread seems to be very competetive, and give an efficient service.

As a customer, and only that , I can , from my experience recomend them.

Much better than BullionByPost...I use Atkinson bullion in Brum, their spread seems to be very competetive, and give an efficient service.

As a customer, and only that , I can , from my experience recomend them.

2024 Britannia prices Buy / Sell...

Atkinson £1679 / £1609

BullionByPost £1722 / £1560

Chards £1,674.66 if you are buying from them

Not sure if you guys are adding postage on top?

They charge £7 for one Brit

They have a price comparison table too

Gassing Station | Finance | Top of Page | What's New | My Stuff