"Safe" investment, maybe gold?

Discussion

ATM said:

pingu393 said:

Hosenbugler said:

Not a good time to buy gold at the moment, prices being so high. My holdings are showing currently, a 24% return, which is pleasing, but I want to buy , not sell.

I use Atkinson bullion in Brum, their spread seems to be very competetive, and give an efficient service.

As a customer, and only that , I can , from my experience recomend them.

Much better than BullionByPost...I use Atkinson bullion in Brum, their spread seems to be very competetive, and give an efficient service.

As a customer, and only that , I can , from my experience recomend them.

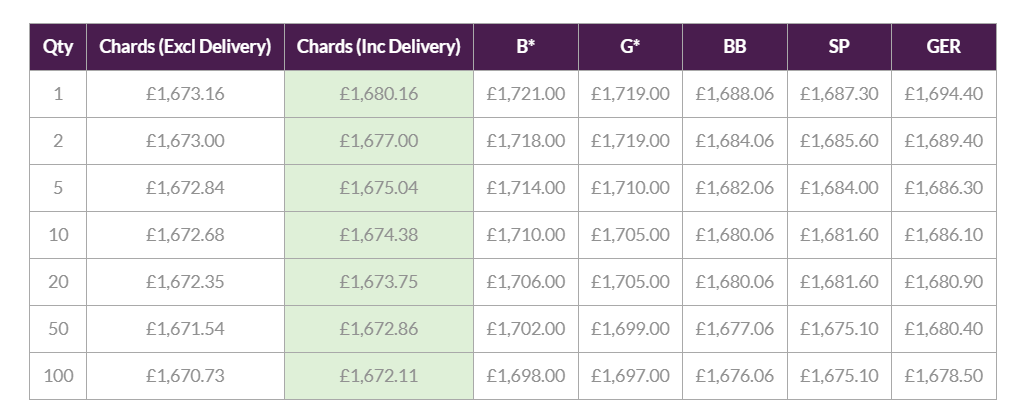

2024 Britannia prices Buy / Sell...

Atkinson £1679 / £1609

BullionByPost £1722 / £1560

Chards £1,674.66 if you are buying from them

Not sure if you guys are adding postage on top?

They charge £7 for one Brit

They have a price comparison table too

Spot price spiked and got close to hitting 2150 in the Asian session this morning. Thats almost 5% in a few hours. I think that's significant. I think that's a clear marker that we have cleared the long standing resistance just above or around 2000. I know we didn't stay over it but surely that will come along soon. However you look at the chart everything is pointing upwards.

Anyone who thinks Gold is a hedge against the USD needs to either reassess or assume this is a prediction the USD is going down a lot and soon. Personally I think Gold is a hedge against all Fiat. And I remain on the bull side.

Anyone who thinks Gold is a hedge against the USD needs to either reassess or assume this is a prediction the USD is going down a lot and soon. Personally I think Gold is a hedge against all Fiat. And I remain on the bull side.

r3g said:

Monkey hammered by JPM with paper contracts back down to the price it was a month ago.

It will go up and down. That is the way. I think it started coming back down way before the Western world was out of bed. Or maybe the extreme west were still awake on Sunday night. Any big spike up like that will always correct some whatever the market. The question now is where it settles and then if it will blow past this new high. Surely more of the world is watching now. Even though this thread is quieter than ever?

Even the Beeb noticed https://www.bbc.co.uk/news/business-67617540

pingu393 said:

ATM said:

pingu393 said:

Hosenbugler said:

Not a good time to buy gold at the moment, prices being so high. My holdings are showing currently, a 24% return, which is pleasing, but I want to buy , not sell.

I use Atkinson bullion in Brum, their spread seems to be very competetive, and give an efficient service.

As a customer, and only that , I can , from my experience recomend them.

Much better than BullionByPost...I use Atkinson bullion in Brum, their spread seems to be very competetive, and give an efficient service.

As a customer, and only that , I can , from my experience recomend them.

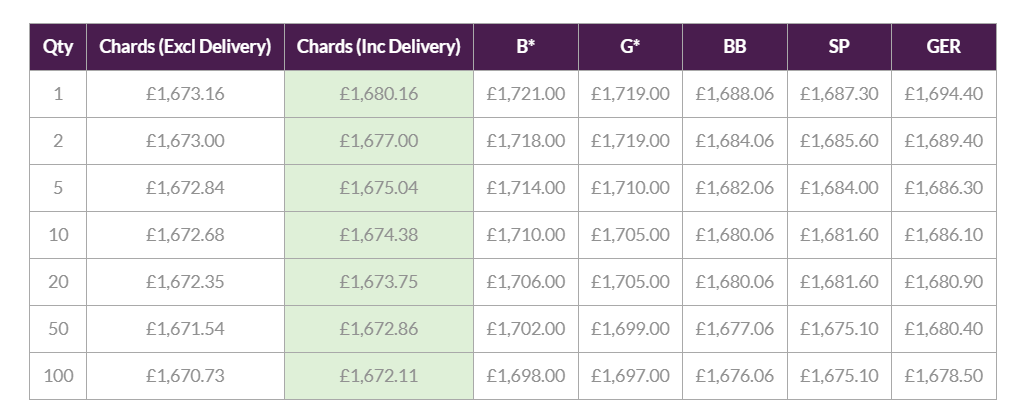

2024 Britannia prices Buy / Sell...

Atkinson £1679 / £1609

BullionByPost £1722 / £1560

Chards £1,674.66 if you are buying from them

Not sure if you guys are adding postage on top?

They charge £7 for one Brit

They have a price comparison table too

RSTurboPaul said:

pingu393 said:

ATM said:

pingu393 said:

Hosenbugler said:

Not a good time to buy gold at the moment, prices being so high. My holdings are showing currently, a 24% return, which is pleasing, but I want to buy , not sell.

I use Atkinson bullion in Brum, their spread seems to be very competetive, and give an efficient service.

As a customer, and only that , I can , from my experience recomend them.

Much better than BullionByPost...I use Atkinson bullion in Brum, their spread seems to be very competetive, and give an efficient service.

As a customer, and only that , I can , from my experience recomend them.

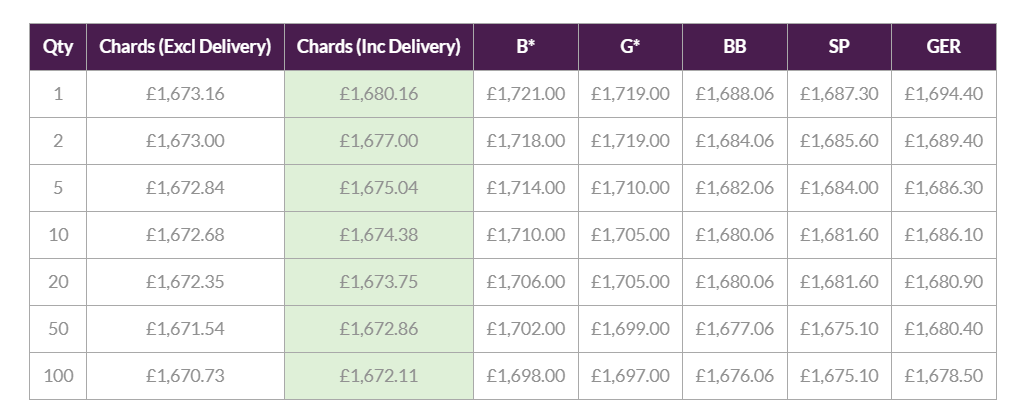

2024 Britannia prices Buy / Sell...

Atkinson £1679 / £1609

BullionByPost £1722 / £1560

Chards £1,674.66 if you are buying from them

Not sure if you guys are adding postage on top?

They charge £7 for one Brit

They have a price comparison table too

I'd say avoid. Which is a pity, as they were always cheapest for bullion and coins. For a while their double Sovereigns were almost literally at spot price!

Trustpilot ratings were plummeting last time I looked.

jshell said:

I've had endless nightmares with them. Placed an order which disappeared in their systems - eventually cancelled and refunded my deposit after badgering them. Received gold coins with red tarnishing on them and when queried, they replied: 'they'e still worth bullion value'. That was a fight for replacement.

I'd say avoid. Which is a pity, as they were always cheapest for bullion and coins. For a while their double Sovereigns were almost literally at spot price!

Trustpilot ratings were plummeting last time I looked.

Thanks for the comments on Bairds - it seems the website is back up and running again!I'd say avoid. Which is a pity, as they were always cheapest for bullion and coins. For a while their double Sovereigns were almost literally at spot price!

Trustpilot ratings were plummeting last time I looked.

RSTurboPaul said:

jshell said:

I've had endless nightmares with them. Placed an order which disappeared in their systems - eventually cancelled and refunded my deposit after badgering them. Received gold coins with red tarnishing on them and when queried, they replied: 'they'e still worth bullion value'. That was a fight for replacement.

I'd say avoid. Which is a pity, as they were always cheapest for bullion and coins. For a while their double Sovereigns were almost literally at spot price!

Trustpilot ratings were plummeting last time I looked.

Thanks for the comments on Bairds - it seems the website is back up and running again!I'd say avoid. Which is a pity, as they were always cheapest for bullion and coins. For a while their double Sovereigns were almost literally at spot price!

Trustpilot ratings were plummeting last time I looked.

I was going to start this question with ... one of my friends was asking... but I know no one believes there openers so I'll keep it simpler.

If I did have a pot of gold, no rainbow, and I needed some short term cash. Can I lend against it or use it as security for a loan but without using dodgy pawn brokers and paying 25% per month?

If I did have a pot of gold, no rainbow, and I needed some short term cash. Can I lend against it or use it as security for a loan but without using dodgy pawn brokers and paying 25% per month?

TheRainMaker said:

Why would you?

Just sell it and hope the price doesn't go up too much before you buy it back.

The buy price for a Gold Sovereign is £391.00, sell price is £377.99 at Atkinsons Bullion

You might be lucky and the price drops.

Yeah I was hoping if the interest rate isn't ridiculous, like for argument sake and simple maths 12% annual [as its totally risk free] then if you settle early say after 2 months you have only been charged 2%.Just sell it and hope the price doesn't go up too much before you buy it back.

The buy price for a Gold Sovereign is £391.00, sell price is £377.99 at Atkinsons Bullion

You might be lucky and the price drops.

ATM said:

Yeah I was hoping if the interest rate isn't ridiculous, like for argument sake and simple maths 12% annual [as its totally risk free] then if you settle early say after 2 months you have only been charged 2%.

Simplest solution after just selling would be to sell the physical and open the same sized position as a spreadbet simultaneously. That way you maintain market exposure. Spreadbet transaction costs will be low if you use someone like IG and funding is 3 over typically. You'd need quite a bit of physical gold and for it to be held in a recognised deposit for someone to be willing to collateralise it for you at sensible rates.

r3g said:

You'll need to price to go up about 10% or so to cover the selling and buying premiums, not to mentiom the insured postage costs which would be significant if you're looking at 4 or 5 figures worth.

Yup. Trans costs are what make physical gold such a s t investment to be overweight in. People generally only realise that the asset doesn't do what they believed it would do when they come to have to sell. But look back on this thread and all others about gold and the huge trans costs are always denied as being any kind of issue.

t investment to be overweight in. People generally only realise that the asset doesn't do what they believed it would do when they come to have to sell. But look back on this thread and all others about gold and the huge trans costs are always denied as being any kind of issue. But if someone really does need to collateralise then unless it is a large enough holding the only feasible way is to simulate the collateralisation via crossing the physical into an OTC contract for the period required.

DonkeyApple said:

r3g said:

You'll need to price to go up about 10% or so to cover the selling and buying premiums, not to mentiom the insured postage costs which would be significant if you're looking at 4 or 5 figures worth.

Yup. Trans costs are what make physical gold such a s t investment to be overweight in. People generally only realise that the asset doesn't do what they believed it would do when they come to have to sell. But look back on this thread and all others about gold and the huge trans costs are always denied as being any kind of issue.

t investment to be overweight in. People generally only realise that the asset doesn't do what they believed it would do when they come to have to sell. But look back on this thread and all others about gold and the huge trans costs are always denied as being any kind of issue. But if someone really does need to collateralise then unless it is a large enough holding the only feasible way is to simulate the collateralisation via crossing the physical into an OTC contract for the period required.

More than a single sovereign is probably not insured on a normal household insurance policy.

I'd suggest that most people just take the insurance risk without even knowing the risk they are taking.

Transport and security cost can be reduced by delivering yourself to a local dealer, but you will probably have to take the hit on not achieving the best sell price. My local dealer matches the Bullionbypost price, which is about £25 less on a Britannia than Atkinson, so it's about £15 less than special delivery.

DonkeyApple said:

Yup. Trans costs are what make physical gold such a s t investment to be overweight in. People generally only realise that the asset doesn't do what they believed it would do when they come to have to sell. But look back on this thread and all others about gold and the huge trans costs are always denied as being any kind of issue.

t investment to be overweight in. People generally only realise that the asset doesn't do what they believed it would do when they come to have to sell. But look back on this thread and all others about gold and the huge trans costs are always denied as being any kind of issue.

It is rubbish for frequent in and outs, longer term holds it can be like a property investment, they have huge transaction costs too, but it doesn't stop people as the see it as rising much more over the long run. Will they always, well if you wait long enough it's always been a yes, same with Gold so far.  t investment to be overweight in. People generally only realise that the asset doesn't do what they believed it would do when they come to have to sell. But look back on this thread and all others about gold and the huge trans costs are always denied as being any kind of issue.

t investment to be overweight in. People generally only realise that the asset doesn't do what they believed it would do when they come to have to sell. But look back on this thread and all others about gold and the huge trans costs are always denied as being any kind of issue. NB I'm not pitching Gold directly vs property I'm merely pointing out the transaction cost being high is not always a barrier to the longer term holder.

Scootersp said:

It is rubbish for frequent in and outs, longer term holds it can be like a property investment, they have huge transaction costs too, but it doesn't stop people as the see it as rising much more over the long run. Will they always, well if you wait long enough it's always been a yes, same with Gold so far.

NB I'm not pitching Gold directly vs property I'm merely pointing out the transaction cost being high is not always a barrier to the longer term holder.

Absolutely. The difference in this particular instance is just that a property asset would be easier to borrow against as there is a massive industry to cater specifically for that. NB I'm not pitching Gold directly vs property I'm merely pointing out the transaction cost being high is not always a barrier to the longer term holder.

Gassing Station | Finance | Top of Page | What's New | My Stuff